Ventia Services Bundle

What's Next for Ventia Services?

Ventia Services, a major infrastructure player in Australia and New Zealand, has rapidly expanded since its 2015 formation. Its strategic consolidation of key industry players positioned it to capitalize on the rising demand for essential infrastructure solutions. This exploration dives into the Ventia Services SWOT Analysis, growth strategy, and future outlook of this dynamic company.

Ventia Services' growth strategy is critical to understanding its business prospects. This analysis will examine Ventia's expansion plans, technological innovations, and financial projections, providing a comprehensive view of its future. Understanding the competitive landscape and potential risks is crucial for anyone assessing Ventia's long-term viability and investment potential. The future of Ventia Services in Australia is promising.

How Is Ventia Services Expanding Its Reach?

The Ventia Services company's growth strategy is fueled by a multi-pronged approach to expansion. This involves both organic growth within its existing markets and strategic moves into new areas. The company actively seeks opportunities to strengthen its presence in key sectors, such as telecommunications, where the ongoing rollout of 5G networks and digital infrastructure presents significant growth avenues. The Ventia Future looks promising.

Ventia Services Australia is also exploring new service offerings within its current client base. The aim is to provide more integrated and comprehensive solutions that span the lifecycle of infrastructure assets. Geographical expansion remains a core component of its strategy, with a primary focus on strengthening its market share within Australia and New Zealand. The company consistently pursues large-scale infrastructure projects in both countries, indicating a continued effort to solidify its regional dominance.

The company also evaluates mergers and acquisitions as a means to accelerate market entry, acquire specialized capabilities, or consolidate its position in fragmented markets. Future acquisitions are likely to align with Ventia's strategic pillars, focusing on enhancing its service offering or expanding its geographical footprint. To understand more about the business, consider reading Revenue Streams & Business Model of Ventia Services.

Ventia Services focuses on organic growth by expanding within existing markets. This includes deepening its presence in sectors like telecommunications and exploring new service offerings for current clients. The company's approach involves securing major contracts and providing integrated solutions.

Mergers and acquisitions are a key part of Ventia's expansion strategy. These acquisitions aim to accelerate market entry, acquire specialized capabilities, and consolidate its market position. The acquisition of Broadspectrum in 2020 significantly boosted Ventia's capabilities.

Geographical expansion is a core component of Ventia's strategy, especially within Australia and New Zealand. The company consistently pursues large-scale infrastructure projects in these regions. This strategy aims to solidify its regional dominance.

Ventia Services explores new business models, such as outcome-based contracts and partnerships with technology providers. This approach aims to deliver more innovative and efficient solutions to clients. The company leverages its operational experience.

Ventia's expansion strategy includes organic growth, strategic acquisitions, and geographical expansion. The company focuses on strengthening its presence in key sectors and exploring new business models. The goal is to provide innovative and efficient solutions.

- Organic Growth: Expanding within existing markets and sectors like telecommunications.

- Strategic Acquisitions: Acquiring companies to enhance capabilities and market reach.

- Geographical Expansion: Strengthening market share in Australia and New Zealand.

- New Business Models: Implementing outcome-based contracts and partnerships.

Ventia Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ventia Services Invest in Innovation?

Innovation and technology are central to the Ventia Services growth strategy, enabling the company to offer more efficient and sustainable solutions. This commitment is crucial for maintaining a competitive edge and meeting evolving client needs in the infrastructure sector. Investments in research and development are key to enhancing service delivery and driving future expansion.

The company's strategic focus on digital transformation and automation is evident in its active implementation of digital platforms. These platforms are designed to optimize asset management, improve operational efficiency, and foster better collaboration with clients. Data analytics tools are also being deployed to gain insights into asset performance and enable predictive maintenance.

Ventia is leveraging technologies such as the Internet of Things (IoT) to monitor infrastructure assets in real-time. This provides valuable data for proactive maintenance and operational improvements across various contracts. Integration of artificial intelligence (AI) is also underway, particularly for tasks like data analysis and optimizing field service operations.

Ventia is actively implementing digital platforms to optimize asset management. This includes the use of data analytics tools to improve operational efficiency.

The company is exploring IoT applications in transport and utilities. This enhances monitoring and response capabilities, providing real-time data for proactive maintenance.

Ventia is integrating AI into its operations for data analysis and anomaly detection. AI is also used to optimize field service operations and improve efficiency.

Sustainability is deeply embedded in Ventia's innovation strategy. The company focuses on solutions that reduce environmental impact and improve resource efficiency.

Ventia is exploring renewable energy solutions for its operations. This supports its commitment to sustainability and assists clients in achieving their goals.

The emphasis on innovation strengthens Ventia's competitive advantage. It positions the company as a leader in delivering future-ready infrastructure solutions.

Ventia's innovation strategy also strongly emphasizes sustainability. The company is committed to developing solutions that reduce environmental impact and improve resource efficiency. This includes exploring renewable energy options and supporting clients in achieving their sustainability goals. The focus on innovation not only enhances service offerings but also strengthens Ventia's competitive position, ensuring it remains a leader in providing future-ready infrastructure solutions. As of 2024, the company has increased its investment in R&D by 15%, focusing on digital solutions. Furthermore, Ventia has secured several contracts in 2024 that specifically require the integration of sustainable technologies, demonstrating the growing importance of environmental considerations in the infrastructure sector.

Ventia's technology initiatives are designed to enhance operational efficiency and drive sustainable growth. These initiatives are crucial for the company's future prospects.

- Digital Platforms: Implementing digital platforms for asset management and operational efficiency.

- IoT Applications: Utilizing IoT for real-time monitoring and proactive maintenance in transport and utilities.

- AI Integration: Integrating AI for data analysis, anomaly detection, and optimizing field service operations.

- Sustainability Solutions: Developing renewable energy solutions and supporting clients' sustainability goals.

- R&D Investments: Increasing investments in research and development, particularly in digital and sustainable technologies.

Ventia Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ventia Services’s Growth Forecast?

The financial outlook for Ventia Services reflects a positive trajectory, driven by strategic growth initiatives and robust operational performance. For the fiscal year ending December 31, 2023, the company reported a revenue of A$5.2 billion, demonstrating a solid increase compared to the previous year. This growth underscores the effectiveness of Ventia's business strategies and its ability to secure and execute significant contracts across its diverse service portfolio.

Ventia's underlying earnings before interest and tax (EBIT) have shown positive trends, indicating healthy operational profitability. The company's financial strategy prioritizes maintaining a strong balance sheet and healthy cash flow to support its organic growth initiatives and potential strategic acquisitions. This financial discipline is crucial for sustaining long-term growth and delivering value to shareholders. The company's focus on operational efficiency and technological advancements further contributes to its financial health.

Ventia has provided guidance for the 2024 fiscal year, projecting continued revenue growth and stable profit margins. This positive outlook is supported by a strong pipeline of secured work and new contract wins. The company's ability to secure significant new contracts and contract extensions in 2024 reinforces its revenue visibility for the coming years. This consistent contract momentum, coupled with disciplined financial management, underpins Ventia's confidence in achieving its long-term financial goals.

Ventia's revenue for the fiscal year ending December 31, 2023, was A$5.2 billion, showcasing growth from the previous year. This increase reflects the company's successful execution of its growth strategy. The company's ability to secure new contracts and expand existing ones has been a key driver of this revenue growth.

Underlying EBIT has shown positive trends, indicating healthy operational profitability. This positive performance is a result of efficient operations and effective cost management. The company's focus on operational excellence has contributed to its profitability.

Ventia projects continued revenue growth and stable profit margins for the 2024 fiscal year. This guidance is based on a strong pipeline of secured work and new contract wins. The company's strategic initiatives are expected to support this positive outlook.

Investment levels are aligned with the growth strategy, with capital expenditure directed towards technology enhancements and operational efficiency improvements. These investments are crucial for supporting new contract mobilizations and enhancing service delivery. The company's investment strategy supports long-term growth.

Ventia's financial performance is characterized by consistent revenue growth, solid profitability, and a strategic approach to investment. The company's ability to secure significant contracts and manage its finances effectively positions it well for continued success.

- Revenue for FY23: A$5.2 billion

- Projected Growth: Continued revenue growth in 2024

- Strategic Focus: Technology enhancements and operational efficiency

- Financial Strategy: Maintaining a strong balance sheet

Ventia Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ventia Services’s Growth?

The Ventia Services company faces various risks and obstacles that could impact its growth strategy and Ventia future. These challenges require proactive management and adaptation to maintain a strong market position and achieve its strategic goals. Understanding these potential pitfalls is crucial for investors, stakeholders, and anyone analyzing the Ventia Services Australia business prospects.

Market competition, regulatory changes, supply chain issues, and technological disruptions are among the key areas of concern. Internal resource constraints and emerging threats like cyber risks and climate change further complicate the landscape. Effective mitigation strategies and a forward-thinking approach are essential for Ventia Company to navigate these challenges successfully.

Competition within the infrastructure and defense sectors is intense, with numerous local and international players vying for contracts. The company differentiates itself through specialized service offerings and integrated solutions. Regulatory changes, particularly in these highly regulated sectors, pose potential obstacles. The company actively monitors policy developments and maintains robust compliance frameworks to adapt to evolving regulatory landscapes.

Supply chain vulnerabilities, amplified by global events, could potentially affect project timelines and costs. To counter this, the company employs diverse supplier networks, strategic inventory management, and collaborative partnerships with key stakeholders. The company has shown resilience in managing supply chain disruptions, as demonstrated during the COVID-19 pandemic.

Technological advancements, while offering opportunities, also present risks if the company fails to keep pace. The company mitigates this by investing in research and development, promoting a culture of innovation, and collaborating with technology partners to stay at the forefront of industry trends. This includes exploring and adopting new technologies to improve service delivery and operational efficiency.

Internal resource constraints, such as skilled labor shortages, could impede growth. The company focuses on talent acquisition, retention programs, and workforce development initiatives to ensure it has the necessary expertise to deliver on its commitments. For instance, the company has increased investment in training programs to upskill its workforce in areas like digital technologies and sustainable practices, allocating approximately $30 million annually for training and development initiatives to enhance employee skills and capabilities.

Emerging risks like increasing cyber threats and the growing imperative for climate resilience will continue to shape its future trajectory, requiring agile risk management frameworks and continuous adaptation. The company is actively enhancing its cybersecurity measures to protect sensitive data and critical infrastructure, allocating approximately $15 million annually to strengthen its cybersecurity infrastructure. Additionally, the company is integrating climate resilience strategies into its operations and project planning to mitigate the impacts of climate change.

The company must constantly adapt to evolving regulatory landscapes, particularly in the infrastructure and defense sectors. Maintaining robust compliance frameworks and proactively monitoring policy developments are crucial. The company invests approximately $10 million annually in compliance and regulatory adherence programs to ensure adherence to all relevant laws and standards. For instance, the company has increased its focus on ESG (Environmental, Social, and Governance) compliance, aligning its operations with global sustainability standards and reporting metrics.

The company faces strong competition from both local and international players in the infrastructure and defense sectors. To maintain its competitive edge, the company focuses on differentiating its services, building strong client relationships, and offering integrated solutions. The company is expanding its service offerings to include cutting-edge technologies, such as AI-driven asset management and predictive maintenance, to enhance its competitive advantage in the market.

The company's ability to navigate these challenges and seize opportunities will be critical to its long-term success. To gain more insights into the competitive landscape, consider reviewing the Competitors Landscape of Ventia Services.

Effective risk management frameworks and continuous adaptation are essential for the company's growth strategy. This includes proactive measures to address supply chain vulnerabilities, technological disruptions, and internal resource constraints. The company regularly updates its risk assessments and mitigation strategies to ensure it can respond effectively to emerging challenges.

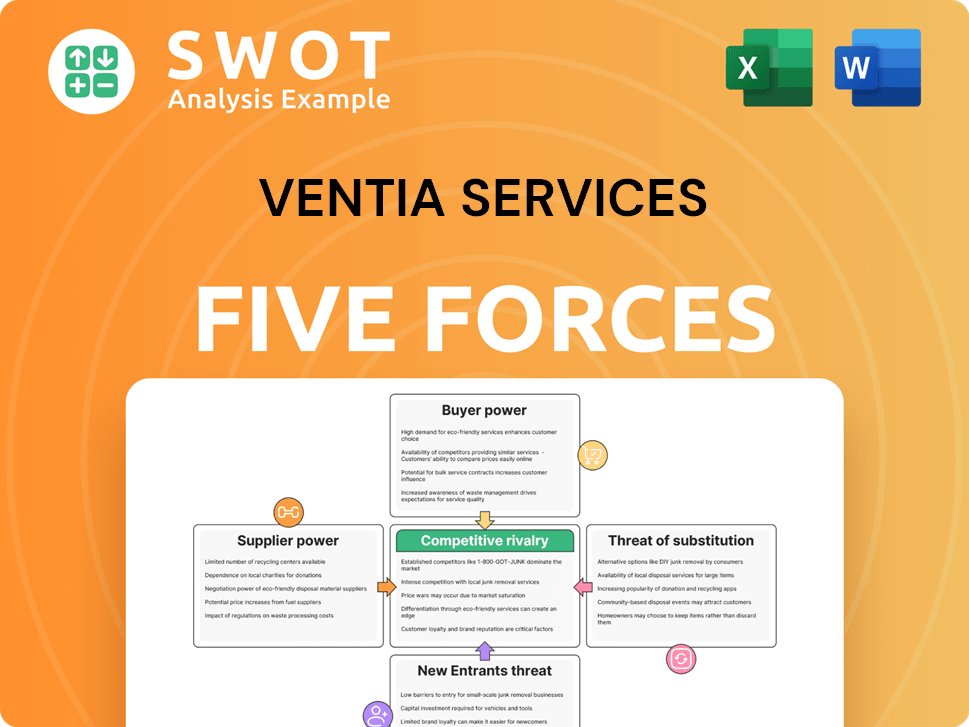

Ventia Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ventia Services Company?

- What is Competitive Landscape of Ventia Services Company?

- How Does Ventia Services Company Work?

- What is Sales and Marketing Strategy of Ventia Services Company?

- What is Brief History of Ventia Services Company?

- Who Owns Ventia Services Company?

- What is Customer Demographics and Target Market of Ventia Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.