Ventia Services Bundle

Who Really Owns Ventia Services?

Understanding the ownership structure of a company like Ventia Services Group Limited is key to understanding its strategic direction and market influence. Ventia, a major player in the Australian and New Zealand infrastructure services market, has seen significant shifts in its ownership since its inception. This analysis delves into the intricate details of who owns Ventia Services, providing critical insights for investors and stakeholders alike.

Ventia Services' journey, marked by its 2021 IPO, offers a fascinating case study in corporate ownership. From its formation in 2015 through the merger of key divisions, to its current status as a publicly listed entity, the Ventia Services SWOT Analysis reveals the company's strategic positioning. This exploration will uncover the current owners, major shareholders, and the evolution of Ventia Services' parent company, providing a comprehensive overview of its ownership and control.

Who Founded Ventia Services?

The story of Ventia Services Group Limited's ownership begins in 2015, not with individual founders, but through the merger of established entities. This union brought together Leighton Contractors Services, Thiess Services, and Visionstream, all under the umbrella of a newly formed company. This strategic consolidation set the stage for Ventia Services' emergence as a major player in the infrastructure services sector.

At its inception, the ownership structure was a partnership between Apollo Global Management, holding a 50% share, and CIMIC Group, also with a 50% stake. This arrangement provided a strong financial and operational foundation from the start. The merger brought together the resources and client bases of the merging companies, creating a robust platform for growth in the Australasian market.

The entities that formed Ventia Services had their own histories. Thiess Services, for instance, had launched its environmental services business in 1987. Visionstream, a key part of the merger, was initially established in 1994 as a subsidiary of Telstra. The acquisition of Visionstream by Leighton Contractors in December 1996 further solidified the foundation upon which Ventia Services was built. The initial ownership structure, with Apollo Global Management and CIMIC Group, reflected a strategic vision to dominate the infrastructure services market in the Australasian region.

The initial ownership of Ventia Services was split between Apollo Global Management and CIMIC Group, each holding a 50% stake. This arrangement provided substantial financial backing and operational expertise from the outset. The merger that created Ventia Services brought together established companies with existing client bases and capabilities, setting the stage for significant market presence. To learn more about the company's background, you can read a Brief History of Ventia Services.

- Ventia Services ownership began with a 50:50 partnership between Apollo Global Management and CIMIC Group.

- This structure provided Ventia Services with significant financial resources and operational expertise from the start.

- The merger combined the resources of Leighton Contractors Services, Thiess Services, and Visionstream.

- The initial ownership reflected a strategic vision to become a leading infrastructure services provider.

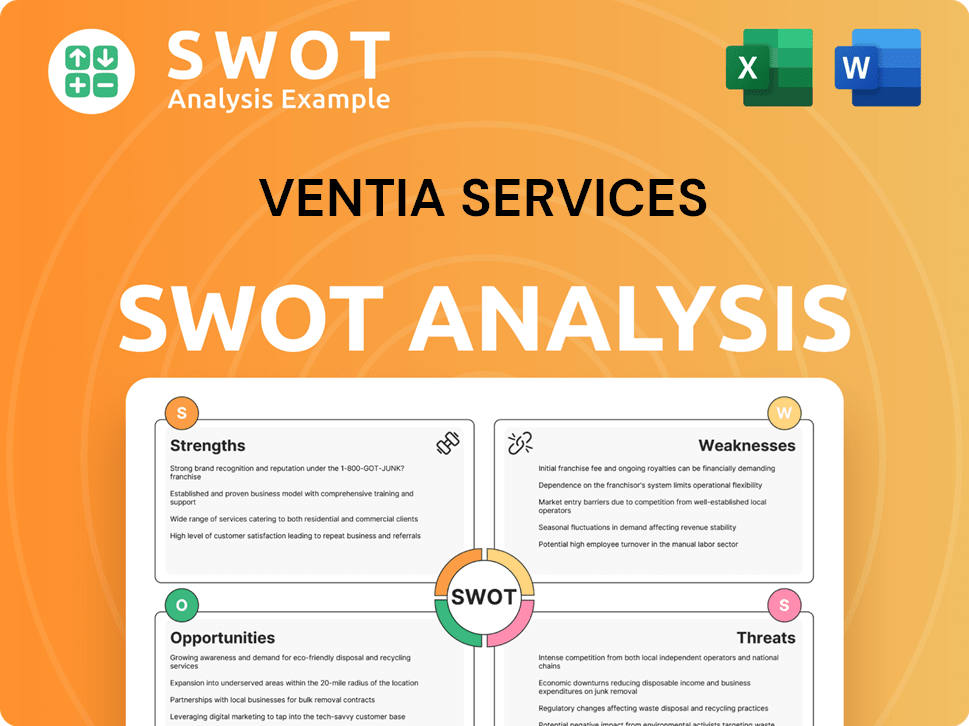

Ventia Services SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ventia Services’s Ownership Changed Over Time?

The evolution of Ventia Services' ownership has been marked by significant shifts since its inception in 2015. Initially, the company was a joint venture between Apollo Global Management and CIMIC Group Limited, each holding a 50% stake. This structure changed with the acquisition of Broadspectrum in June 2020, which strengthened Ventia's market presence. This period set the stage for further developments in the company's ownership structure.

A crucial turning point was the Initial Public Offering (IPO) on the Australian and New Zealand stock exchanges on November 18, 2021. The IPO, priced at $1.70 per share, raised A$438 million and valued the company at A$1,454 million. Following the IPO, both CIMIC and Apollo retained substantial shareholdings, but these were later reduced. By November 3, 2023, both CIMIC and Apollo had divested their remaining shares, transforming Ventia into a widely held public company.

| Date | Event | Impact on Ownership |

|---|---|---|

| 2015 | Formation of Ventia | 50:50 partnership between Apollo Global Management and CIMIC Group Limited |

| June 2020 | Acquisition of Broadspectrum | Consolidation of market position |

| November 18, 2021 | IPO on ASX and NZX | Raised A$438 million, CIMIC and Apollo retained significant stakes |

| May 2023 | Reduction of shareholdings by CIMIC and Apollo | Both companies lowered their stakes to 15% |

| November 3, 2023 | Complete divestment by CIMIC and Apollo | Ventia became a widely held public company |

As of June 5, 2025, Ventia Services has approximately 855,484,445 ordinary shares outstanding, with a free-float of around 93.99%. The major shareholders include institutional investors such as Insignia Financial Ltd., Regal Funds Management Pty Ltd., and Aware Super Pty Ltd. Vanguard Group Inc. and BlackRock, Inc. also hold significant stakes. This shift towards a public ownership model has broadened the investor base and influenced the company's strategy and governance to align with a diverse range of public shareholders, reflecting a significant change in the company's ownership and control.

Ventia Services' ownership has evolved from a joint venture to a publicly traded company. Key events include the IPO in 2021 and the subsequent divestment by founding shareholders.

- Initial ownership: 50:50 partnership.

- IPO in 2021: Transition to public ownership.

- Divestment by CIMIC and Apollo: Ventia became a widely held public company.

- Current structure: Diverse institutional and public shareholders.

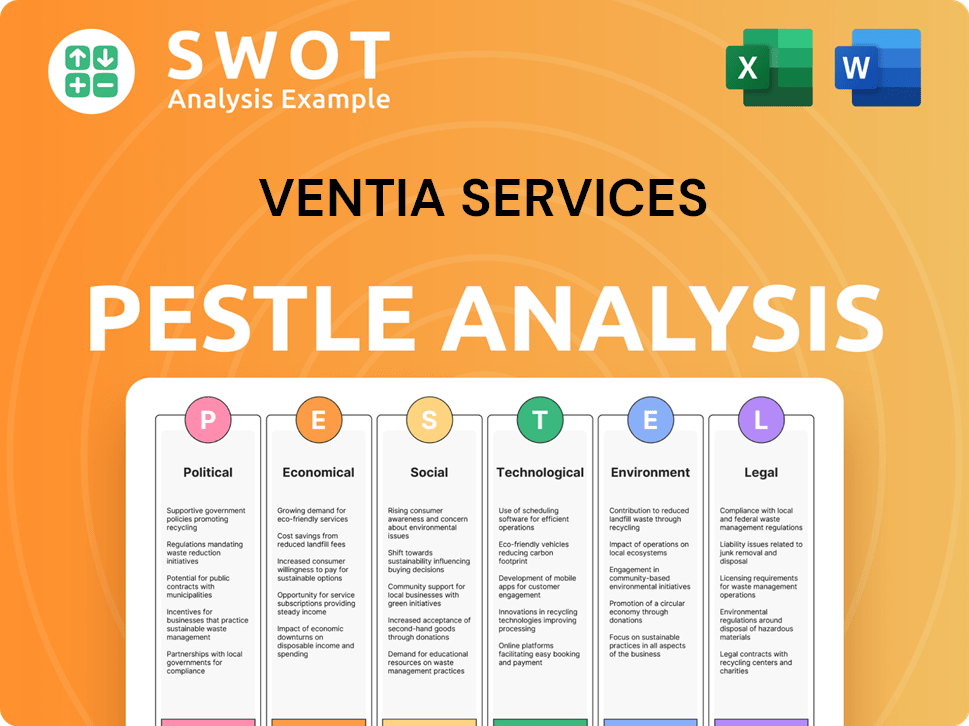

Ventia Services PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ventia Services’s Board?

The corporate governance of Ventia Services Group Limited is guided by its values and brand pillars, which aim to prioritize the interests of clients and employees while integrating sustainability. The company's Corporate Governance Statement, updated on February 19, 2025, reflects its adherence to the ASX Corporate Governance Council's recommendations. This framework is crucial for understanding Ventia Services ownership and how the company operates.

As of June 2025, the Board of Directors includes key figures who shape the strategic direction and oversight of the company. The current board members include David Moffatt as Chairman, Dean Banks as Chief Executive Officer, Mark Fleming as Chief Financial Officer, and several independent directors such as Damon Rees, Jeff Forbes, Sibylle Krieger, Lynne Saint, and Anne Urlwin. Jill Hardiman and Amy Jackson serve as Company Secretaries. This structure is vital for understanding Ventia Services company and its governance.

| Director | Title | Role |

|---|---|---|

| David Moffatt | Chairman and Non-Executive Director | Oversees the board and its activities. |

| Dean Banks | Chief Executive Officer, Managing Director, Group Chief Executive Officer | Leads the company's operations and strategy. |

| Mark Fleming | Chief Financial Officer | Manages the company's financial activities. |

| Damon Rees | Independent Director | Provides independent oversight. |

| Jeff Forbes | Independent Non-Executive Director, Lead Independent Director | Provides independent oversight and leads independent directors. |

| Sibylle Krieger | Independent Non-Executive Director | Provides independent oversight. |

| Lynne Saint | Independent Non-Executive Director | Provides independent oversight. |

| Anne Urlwin | Independent Non-Executive Director | Provides independent oversight. |

| Jill Hardiman | Company Secretary | Manages corporate governance and compliance. |

| Amy Jackson | Company Secretary | Manages corporate governance and compliance. |

The voting structure at Ventia Services generally follows a one-share-one-vote principle, typical for companies listed on the ASX and NZX. All resolutions at the 2025 Annual General Meeting (AGM) on May 22, 2025, were approved by a majority vote. The share registry is managed by Computershare Investor Services Limited. For a deeper understanding of how the company generates revenue, consider reading Revenue Streams & Business Model of Ventia Services.

The Board of Directors is composed of a mix of executive and independent directors, ensuring balanced governance.

- The company adheres to the ASX Corporate Governance Council's recommendations.

- Voting rights are typically based on a one-share-one-vote system.

- The company's governance structure supports the interests of stakeholders.

- The company's financial backers are not publicly disclosed.

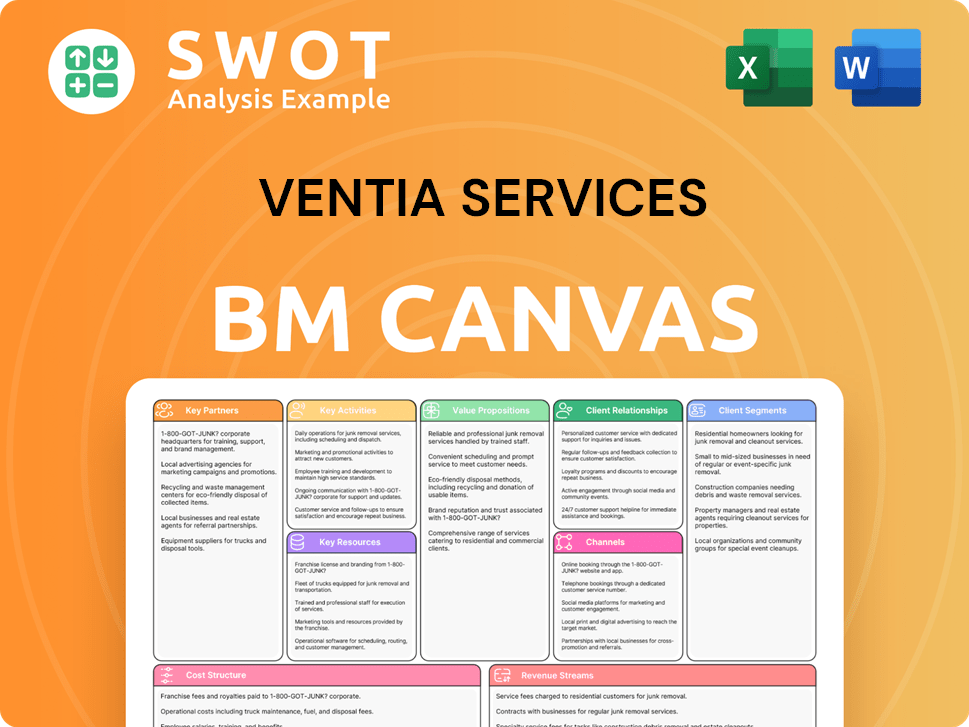

Ventia Services Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ventia Services’s Ownership Landscape?

Over the past few years, the ownership of the Ventia Services company has undergone significant changes. Following its initial public offering (IPO) on the ASX and NZX in November 2021, major shareholders CIMIC Group and Apollo Global Management, who initially held 32.8% each, gradually reduced their stakes. By November 3, 2023, both had completely divested their holdings through block trades, transitioning the company from primarily private ownership to a publicly traded structure.

This shift has led to a more dispersed shareholder base, with increased institutional ownership. Key institutional investors now include Insignia Financial Ltd., Regal Funds Management Pty Ltd., and Aware Super Pty Ltd., among others. The trend towards greater institutional involvement is typical for mature public companies and often results in closer scrutiny of corporate governance and financial performance. Understanding the Ventia Services ownership structure is essential for investors and stakeholders alike, as it influences strategic decisions and financial outcomes.

| Shareholder | Initial Stake (Post-IPO) | Exit Date |

|---|---|---|

| CIMIC Group | 32.8% | November 3, 2023 |

| Apollo Global Management | 32.8% | November 3, 2023 |

| Institutional Investors (Various) | Increased holdings post-IPO | Ongoing |

Financially, Ventia Services Australia has shown robust performance. The company reported a 10.6% increase in revenue to $3,082.5 million for the half-year ended June 30, 2024. For the full year ended December 31, 2024, total revenue reached $6,105.5 million, a 7.6% increase from the previous year. Further demonstrating its strong financial position, the company has announced an on-market buyback of up to $100 million of its ordinary shares. This, coupled with reaffirmed FY25 NPATA growth guidance of 7-10%, supported by recent contract extensions, highlights a focus on strategic growth and efficient capital management. If you want to learn more about their strategies, check out the Marketing Strategy of Ventia Services.

The company has moved from concentrated ownership to a more dispersed model. CIMIC Group and Apollo Global Management have exited their positions. Institutional investors now hold significant stakes in the company.

Ventia has shown strong revenue growth, with a 7.6% increase in 2024. The company is also implementing a share buyback program. Future growth is projected based on recent contract wins.

Key institutional investors include Insignia Financial Ltd., Regal Funds Management Pty Ltd., and Aware Super Pty Ltd. This trend often leads to greater scrutiny. The shift indicates a maturing public company.

Ventia is focused on strategic growth and efficient capital management. Contract extensions and new agreements support future revenue. These actions are designed to increase shareholder value.

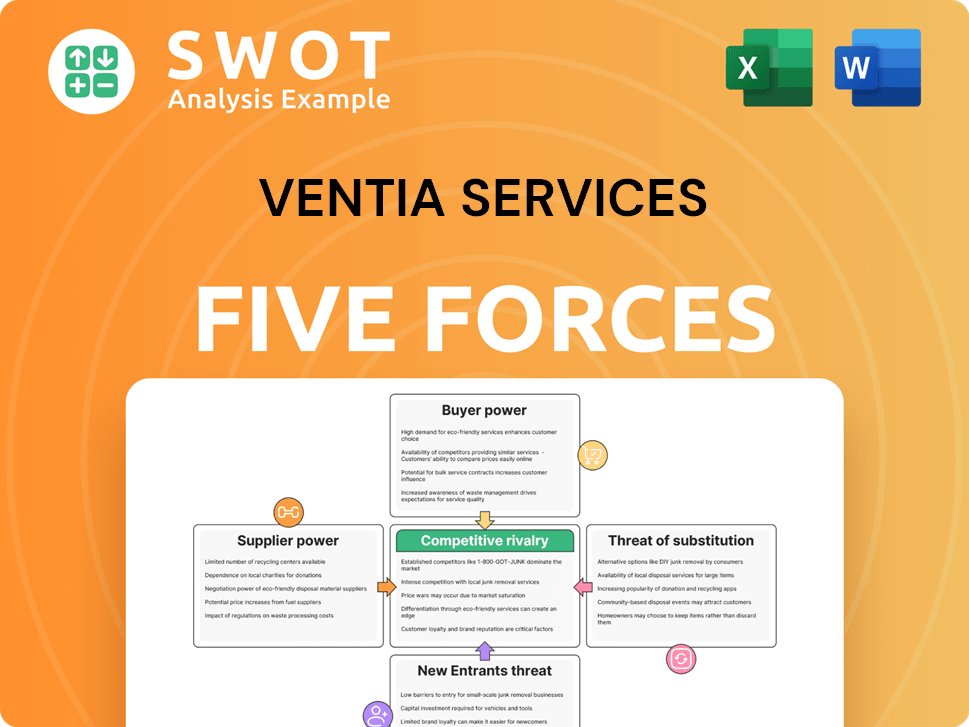

Ventia Services Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ventia Services Company?

- What is Competitive Landscape of Ventia Services Company?

- What is Growth Strategy and Future Prospects of Ventia Services Company?

- How Does Ventia Services Company Work?

- What is Sales and Marketing Strategy of Ventia Services Company?

- What is Brief History of Ventia Services Company?

- What is Customer Demographics and Target Market of Ventia Services Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.