WestRock Bundle

Can Smurfit WestRock Dominate the Global Packaging Game?

The paper and packaging industry is undergoing a massive transformation, and at the heart of it lies Smurfit WestRock, born from the merger of two industry giants. This strategic consolidation reshaped the competitive landscape, creating a global powerhouse with a vast footprint and unparalleled capabilities. Understanding this new reality is crucial for anyone looking to navigate the complexities of this evolving market.

This article provides a comprehensive WestRock SWOT Analysis and market analysis, dissecting the WestRock competitive landscape and evaluating its position within the WestRock industry. We'll explore the WestRock competitors, analyze the company's strengths, and delve into the challenges and opportunities that will define its future. A deep dive into WestRock company profile and WestRock financial performance will provide actionable insights for investors and strategists alike, helping you understand the dynamics of the WestRock company market share analysis and how it stacks up against key players.

Where Does WestRock’ Stand in the Current Market?

Smurfit WestRock, following the merger of Smurfit Kappa and WestRock in July 2024, holds a leading position in the global sustainable paper and packaging solutions industry. The combined entity operates across 40 countries, supported by over 500 production facilities, showcasing a robust global footprint. This expansive presence allows the company to serve a wide range of markets and customers, solidifying its market position.

The company's core operations revolve around providing paper and packaging solutions for consumer and corrugated packaging markets. Additionally, Smurfit WestRock manages forests and produces pulp and paper products, ensuring a vertically integrated approach. This comprehensive strategy supports its value proposition of offering sustainable packaging solutions that meet the evolving demands of consumers and regulatory bodies, as highlighted in the Growth Strategy of WestRock.

In the first quarter of 2025, Smurfit WestRock reported net sales of $7.66 billion, demonstrating the significant scale of its post-merger operations and its financial performance. This financial performance reflects the company's ability to integrate operations and capitalize on market opportunities.

The global paper and paperboard packaging market was valued at $381.4 billion in 2024. The corrugated boxes segment held the largest revenue share within the paper packaging market in 2024, driven by their use in e-commerce and the food and beverage industries. The company's revenue breakdown is heavily influenced by its strong presence in these key sectors.

Smurfit WestRock operates in 40 countries with over 500 production facilities. The U.S. dominated the North American paper packaging market in 2024. This extensive geographic presence allows the company to serve diverse markets and leverage regional advantages.

The global paper and paperboard packaging market is projected to grow to $620.6 billion by 2034, with a CAGR of 5.1%. The flexible paper packaging market is expected to reach $200.02 billion by 2032, exhibiting a CAGR of 6.18%. These projections indicate significant growth opportunities for Smurfit WestRock.

Smurfit WestRock's focus on sustainable and recyclable packaging aligns with increasing consumer demand. The merger is expected to generate synergies of at least $400 million, enhancing profitability. This commitment to sustainability positions the company well in the evolving market.

Smurfit WestRock benefits from its expansive geographic presence, a wide range of product offerings, and a strong focus on sustainability. The merger of Smurfit Kappa and WestRock created a more competitive entity. The company's ability to provide sustainable packaging solutions positions it favorably in the market.

- Leading market position due to the merger.

- Strong focus on sustainable and recyclable packaging.

- Extensive global footprint with over 500 production facilities.

- Expected synergies of at least $400 million from the merger.

WestRock SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging WestRock?

The WestRock competitive landscape is characterized by a dynamic interplay of major players in the global paper and packaging industry. This landscape is shaped by factors such as market share, product innovation, and strategic acquisitions. Understanding the competitive dynamics is crucial for investors and stakeholders looking to assess the company's position and future prospects. Recent industry trends, including the increasing demand for sustainable packaging solutions, significantly influence the competitive strategies of WestRock competitors.

WestRock's market analysis reveals a competitive environment where companies constantly seek to differentiate themselves. This differentiation often involves advancements in technology, cost-efficiency, and environmental sustainability. The financial performance of WestRock and its rivals is a key indicator of their competitive strength, influencing decisions about investment and market positioning. The industry's consolidation through mergers and acquisitions further reshapes the competitive landscape.

Key competitors in the WestRock industry include both domestic and international companies. These competitors offer a range of products and services that overlap with WestRock's offerings, leading to direct competition in various market segments. The strategic moves of these companies, such as expansions, acquisitions, and technological innovations, directly impact WestRock's market position. Understanding these competitive dynamics is essential for evaluating WestRock's strategic decisions and overall performance.

International Paper is a leading global producer of renewable fiber-based packaging, pulp, and paper products. It competes directly with WestRock in several segments, including corrugated packaging and containerboard. In 2023, IP reported net sales of approximately $18.9 billion, demonstrating its significant market presence.

Smurfit Kappa is a major player in paper-based packaging solutions, with a strong presence in Europe and the Americas. The company offers a wide array of products, from corrugated cardboard to specialty papers. In 2023, Smurfit Kappa reported revenues of approximately €12.3 billion, highlighting its global reach.

DS Smith is a leading provider of sustainable packaging solutions, specializing in corrugated packaging, plastics, and paper products. The company has a significant presence in Europe and North America. In 2023, DS Smith reported a revenue of £7.9 billion, reflecting its strong market position.

Sonoco Products Company offers a diverse range of packaging solutions, including paperboard, tubes and cores, and flexible packaging. Sonoco's net sales for 2023 were approximately $7.3 billion. Sonoco competes with WestRock in several packaging segments.

Sappi Limited is a global company focused on dissolving pulp, graphic paper, and packaging and specialty papers. Sappi's revenue for fiscal year 2023 was approximately $6.4 billion. Sappi competes with WestRock in the paper and packaging market.

Mondi PLC is a global leader in packaging and paper, offering a wide range of products, including corrugated packaging and flexible packaging. In 2023, Mondi reported revenue of €7.46 billion, competing with WestRock in several key markets.

The competition among these companies is intense, driven by factors such as pricing, innovation, and sustainability. Mergers and acquisitions, like the one discussed in Owners & Shareholders of WestRock, further reshape the competitive dynamics. WestRock's ability to maintain and improve its market share depends on its strategic responses to these competitive pressures, including investments in sustainable packaging and efficient operations. Understanding the strategies and performance of these key players is critical for assessing WestRock's future prospects.

Several factors drive competition within the WestRock competitive landscape. These include pricing strategies, product innovation, and the ability to offer sustainable packaging solutions. The WestRock company profile is often evaluated in comparison to these factors.

- Pricing: Competitive pricing is essential for attracting and retaining customers.

- Innovation: Developing new and improved packaging solutions, including sustainable materials, is crucial.

- Sustainability: Meeting the growing demand for eco-friendly packaging solutions is a key differentiator.

- Efficiency: Optimizing supply chains and production processes to reduce costs and improve delivery times.

- Customer Service: Providing excellent customer service and building strong relationships.

WestRock PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives WestRock a Competitive Edge Over Its Rivals?

The competitive advantages of the merged company, now operating as Smurfit WestRock, are rooted in its extensive scale, comprehensive product offerings, and a strong dedication to sustainability and innovation. The merger itself is a strategic move designed to generate significant synergies and enhance its competitive position within the WestRock competitive landscape. This expansion allows for greater operational efficiency and market reach, solidifying its position in the WestRock industry.

Smurfit WestRock's diverse portfolio of renewable and recyclable packaging solutions, including paper, packaging for consumer and corrugated markets, and pulp and paper products, provides a significant competitive edge. This wide range of offerings, combined with a focus on sustainable practices, aligns with the growing consumer and regulatory demand for eco-friendly packaging. This focus is a key aspect of its WestRock competitive strategy.

The company leverages its expertise in materials science, packaging design, and manufacturing to drive innovation, maintaining a consumer-centric approach. This collaborative problem-solving approach, along with its purpose of 'Innovate Boldly. Package Sustainably.', distinguishes it in the market. The merger is expected to yield at least $400 million in synergies through operational improvements and asset optimization, further enhancing profitability and competitive standing, according to recent reports on WestRock financial performance.

Smurfit WestRock operates in approximately 40 countries with over 500 production facilities, showcasing an unparalleled geographic footprint. This extensive network allows for economies of scale, optimizing both production and distribution processes. The company's vast reach enhances its ability to serve a global customer base efficiently, a critical factor in the WestRock market analysis.

The company offers a diverse range of packaging solutions, including paper, packaging for consumer and corrugated markets, and pulp and paper products. This breadth, combined with a focus on sustainable practices, aligns with growing consumer and regulatory demands. Smurfit WestRock actively works with major brands to reclaim packaging material, helping them meet recycling targets.

Smurfit WestRock is committed to sustainability, reflected in its focus on renewable and recyclable packaging solutions. The company emphasizes a consumer-centric approach, partnering with customers to develop solutions that promote, display, and protect their products. This collaborative approach fosters long-lasting connections, a key element in the WestRock company profile.

The merger is expected to yield at least $400 million in synergies through operational improvements and asset optimization. Smurfit WestRock prioritizes talent, recognizing that a diverse and engaged workforce is crucial for innovation and productivity. The company's focus on its employees is a significant advantage in the WestRock competitive landscape.

Smurfit WestRock's competitive advantages include its extensive global presence, comprehensive product offerings, and dedication to sustainability. The merger is expected to enhance these strengths, creating significant value. For a detailed look at the company's financial performance, consider reading a comprehensive analysis of the company's financial health.

- Extensive global footprint with over 500 production facilities.

- Diverse portfolio of packaging solutions, including renewable and recyclable options.

- Commitment to sustainability and a customer-centric approach.

- Expected synergies of at least $400 million from the merger.

WestRock Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping WestRock’s Competitive Landscape?

The paper and packaging industry is experiencing a transformative period, significantly impacting the competitive landscape of the company. Key trends such as sustainability, e-commerce growth, and technological advancements are reshaping the market. These factors present both opportunities and challenges, influencing the company's strategic direction and future performance. For a deeper understanding of the company's origins, you can explore a Brief History of WestRock.

The industry faces challenges like supply chain disruptions and raw material uncertainties, along with the need to balance costs and demand. However, there are also opportunities to capitalize on the growing demand for sustainable packaging and technological innovation. The company's ability to adapt to these changes will be crucial for maintaining its competitive position and achieving long-term growth.

The escalating demand for sustainable packaging solutions is a primary trend, driven by consumer environmental awareness and stricter regulations. The growth of e-commerce is also a major driver, increasing demand for durable and protective packaging. Technological advancements, including the Internet of Packaging (IoP) and AI, are revolutionizing the industry.

Navigating complex global supply chain disruptions and raw material uncertainties poses a significant challenge. Intense competition for talent, particularly in specialized roles, is anticipated. Balancing volumes, costs, and demand amidst industry consolidation remains a constant challenge.

Capitalizing on the growing demand for sustainable packaging by innovating in recyclable and biodegradable materials is a key opportunity. Expanding reach in emerging markets and leveraging advanced technologies to enhance operational efficiency and product innovation are also crucial. The ongoing integration of the Smurfit Kappa and WestRock merger offers further growth potential.

The global paper and paperboard packaging market, valued at $381.4 billion in 2024, is projected to reach $620.6 billion by 2034, with a CAGR of 5.1%. The EU's Packaging and Packaging Waste Regulation (PPWR), which entered into force in February 2025, is pushing for waste reduction and increased recyclability. The Smurfit Kappa and WestRock merger aims for at least $400 million in synergies.

The company's competitive strategy should focus on sustainable packaging, technological innovation, and operational efficiency. This includes investing in R&D for new materials and processes, expanding in emerging markets, and leveraging AI and automation. The company's actions must align with consumer preferences and regulatory mandates, particularly in the area of recyclability.

- Prioritize the development and adoption of recyclable and biodegradable materials.

- Invest in digital printing and smart packaging technologies for customized solutions.

- Enhance supply chain efficiency and operational excellence through AI and automation.

- Focus on integrating the Smurfit Kappa and WestRock merger to realize synergies.

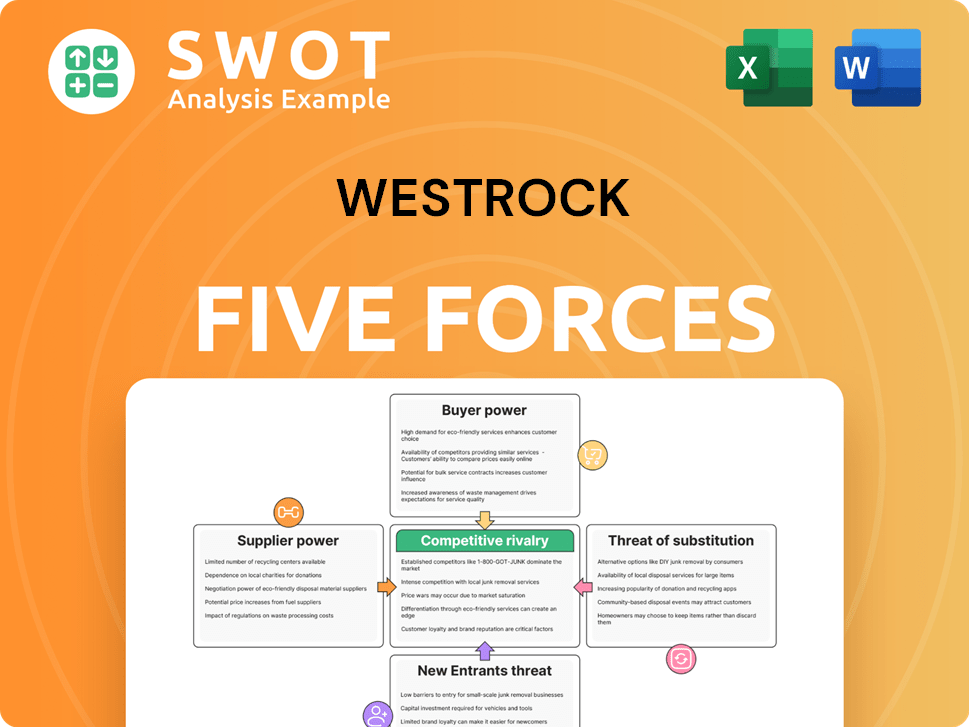

WestRock Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WestRock Company?

- What is Growth Strategy and Future Prospects of WestRock Company?

- How Does WestRock Company Work?

- What is Sales and Marketing Strategy of WestRock Company?

- What is Brief History of WestRock Company?

- Who Owns WestRock Company?

- What is Customer Demographics and Target Market of WestRock Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.