WestRock Bundle

Can WestRock Company Redefine the Packaging Industry?

In the ever-evolving world of packaging, WestRock Company is on the cusp of a monumental transformation. The merger with Smurfit Kappa, set to finalize in July 2024, promises to create a global packaging powerhouse. This strategic move raises critical questions about WestRock's future trajectory and its ability to capitalize on emerging WestRock SWOT Analysis opportunities.

This article delves into the core of WestRock's growth strategy, examining its future prospects within the dynamic packaging industry. We'll analyze the company's strategic acquisitions, innovation in packaging, and commitment to sustainable packaging solutions, all crucial for navigating the competitive landscape. Furthermore, we'll explore the potential impact of e-commerce on packaging and how WestRock aims to leverage its strengths to drive revenue growth and achieve its environmental sustainability goals, providing a comprehensive WestRock company growth strategy analysis.

How Is WestRock Expanding Its Reach?

The core of the WestRock Growth Strategy hinges on significant expansion initiatives, most notably the planned combination with Smurfit Kappa Group plc. This merger aims to establish a global leader in sustainable packaging, substantially broadening the combined entity's geographical presence and product offerings. The resulting company, Smurfit WestRock, is set to operate across 45 countries, employing approximately 67,000 individuals worldwide. This strategic move is designed to create a more resilient and diversified business model, capable of serving a wider customer base and capitalizing on enhanced operational efficiencies. This is a key aspect of understanding the WestRock Future Prospects.

Beyond the transformative merger, WestRock continues to pursue organic growth through strategic investments in its existing operations and targeted product development. For instance, the company has focused on expanding its corrugated packaging capabilities, particularly in the growing e-commerce sectors, by investing in new machinery and optimizing its supply chain. Furthermore, WestRock is committed to developing innovative packaging solutions that meet evolving consumer demands for sustainability and convenience. This includes advancements in recyclable and compostable materials, as well as smart packaging technologies. The company's expansion into new product categories is also evident in its focus on fiber-based packaging solutions that serve as alternatives to plastics, aligning with global sustainability trends and accessing new customer segments. For more information on the company's ownership, you can read about Owners & Shareholders of WestRock.

Partnership strategies are also a key component of WestRock's expansion. The company frequently collaborates with its customers to develop bespoke packaging solutions, fostering long-term relationships and securing new business. While specific timelines and milestones for individual initiatives are often part of ongoing operational plans, the overarching milestone of the Smurfit Kappa combination, expected to close in July 2024, represents the most significant near-term expansion target, fundamentally reshaping WestRock's market position and future trajectory.

The expansion strategy involves both inorganic and organic growth, with the Smurfit Kappa merger being the most significant inorganic initiative. Organic growth is driven by investments in existing operations and new product development.

- Merger with Smurfit Kappa: Expected to close in July 2024, creating a global leader.

- Corrugated Packaging Expansion: Investments in machinery and supply chain optimization, especially for e-commerce.

- Sustainable Packaging Solutions: Focus on recyclable, compostable materials, and smart packaging technologies.

- Fiber-Based Packaging: Development of alternatives to plastics to meet sustainability demands.

WestRock SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WestRock Invest in Innovation?

The company focuses on innovation and technology to drive growth. Their approach involves digital transformation, automation, and the development of sustainable packaging solutions. This strategy is crucial for adapting to evolving Packaging Industry Trends and maintaining a competitive edge.

A key aspect of the company's strategy is investing in research and development (R&D). These investments aim to enhance the product portfolio and improve operational efficiency. This includes a focus on fiber-based packaging alternatives. This is in response to the growing demand for Sustainable Packaging Solutions and a reduction in plastic use.

Digital transformation is another critical element of the company's innovation strategy. They are investing in automation across their manufacturing facilities to improve productivity, reduce costs, and enhance product quality. This includes implementing advanced robotics and automated systems in production lines. Furthermore, they are exploring the use of data analytics and artificial intelligence (AI) to optimize the supply chain, forecast market trends, and personalize customer experiences. These technological capabilities help bring new, high-value products to market more quickly and efficiently.

The company is actively developing recyclable, compostable, and renewable packaging materials. This aligns with the growing consumer and regulatory demand for environmentally friendly options. This focus is a key driver in the company's WestRock Growth Strategy.

Significant investments in automation, including robotics and AI, are being made. These technologies improve manufacturing productivity and reduce operational costs. This is crucial for maintaining a competitive edge in the Packaging Industry Trends.

The company uses data analytics and AI to optimize its supply chain and predict market trends. This enhances decision-making and allows for more personalized customer experiences. This data-driven approach supports the company's WestRock Future Prospects.

Substantial R&D investments are made to enhance the product portfolio and operational efficiency. These investments are critical for developing innovative solutions and staying ahead of market demands. This is a core element of their WestRock Company strategy.

A strong emphasis is placed on developing fiber-based packaging alternatives to reduce reliance on plastics. This includes advancements in recyclable and compostable materials. This focus addresses the growing demand for Sustainable Packaging Solutions.

The company's innovation strategy is geared towards meeting customer needs and preferences. This includes personalized experiences and efficient solutions. Understanding the Target Market of WestRock is essential for this approach.

The company's technological initiatives are designed to drive efficiency and sustainability. These initiatives are crucial for long-term growth and competitive advantage.

- Digital Transformation: Implementing automation and AI across operations.

- Sustainable Packaging: Developing fiber-based and eco-friendly alternatives.

- Supply Chain Optimization: Using data analytics to improve efficiency.

- Product Innovation: Continuously improving the product portfolio.

WestRock PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is WestRock’s Growth Forecast?

The financial outlook for the combined entity, Smurfit WestRock, is promising, largely due to the strategic merger. This combination is poised to create a global leader in the packaging industry, with anticipated revenues of approximately $20 billion. This positions the company to capitalize on evolving Packaging Industry Trends and market opportunities.

The merger is expected to generate significant synergies. Pre-tax synergies are projected to reach approximately $200 million annually by the end of the first full year after the closing, and increase to about $400 million annually by the end of the second year. These improvements are expected to come from operational efficiencies, supply chain optimization, and procurement savings.

In the fiscal first quarter of 2024, WestRock reported net sales of $4.7 billion, a decrease from $5.0 billion in the prior year quarter. The adjusted earnings per diluted share from continuing operations were $0.20 for the first quarter of fiscal 2024. Despite these fluctuations, the long-term financial goals are supported by the enhanced scale and improved cost structure expected from the Smurfit WestRock combination. The company's investments are focused on integrating the two businesses, realizing synergies, and continuing capital expenditures in sustainable packaging solutions.

The merger is designed to create substantial value through synergies. The company aims to achieve approximately $200 million in annual pre-tax synergies by the end of the first year, increasing to $400 million annually by the end of the second year. This will be achieved through operational efficiencies and optimized supply chains.

The combined entity is expected to generate approximately $20 billion in revenue, establishing a strong market position. This enhanced scale enables the company to better serve customers and compete in the global packaging market. The company aims to capitalize on

Investment priorities include the integration of the two businesses and the realization of projected synergies. Capital expenditures will continue to focus on sustainable packaging solutions and operational improvements. This strategic allocation supports the company's

Analyst forecasts generally reflect a positive outlook for the combined entity. The focus is on robust cash flow generation and deleveraging, which supports the company's financial health. This positive sentiment underscores the potential for enhanced shareholder value.

The financial strategy centers on achieving sustainable growth and improving profitability. The company aims to deliver enhanced shareholder value through a stronger market position and operational excellence. This approach is critical for long-term success.

The company's commitment to

WestRock Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow WestRock’s Growth?

The growth strategy and future prospects of the company face several potential risks and obstacles. The packaging industry is highly competitive, and the company must navigate challenges like price sensitivity and overcapacity in certain segments. Successfully integrating with Smurfit Kappa also presents operational risks.

Regulatory changes and evolving environmental policies pose significant obstacles. Increased scrutiny on packaging waste and the demand for more sustainable materials could necessitate significant investments in R&D and manufacturing adjustments. Fluctuations in raw material costs and energy prices also represent ongoing supply chain vulnerabilities.

The company’s management assesses and prepares for these risks through various strategies. Diversifying its product portfolio and customer base helps mitigate dependence on any single market or segment. Risk management frameworks are employed to identify, assess, and mitigate potential operational and financial risks. The company’s strategic adjustments, such as the Smurfit Kappa merger, demonstrate a proactive approach to navigating industry challenges. For a broader understanding of the competitive environment, consider exploring the Competitors Landscape of WestRock.

The packaging industry is highly fragmented and competitive, with numerous global and regional players. Price sensitivity and overcapacity in certain segments can impact profitability. The company must continuously innovate to maintain a competitive edge within the corrugated packaging market.

Integrating two large companies like the company and Smurfit Kappa presents operational risks. These include potential supply chain disruptions, challenges in harmonizing corporate cultures, and complexities in combining IT systems. Successful integration is crucial for realizing anticipated synergies.

Increasing scrutiny on packaging waste and the demand for more sustainable materials require significant investments. Evolving environmental policies necessitate adjustments in R&D and manufacturing. The company must adapt to stricter regulations on packaging.

Fluctuations in raw material costs, particularly for pulp and paper, and energy prices impact production costs. These ongoing supply chain vulnerabilities can affect profit margins. Managing these costs effectively is essential for maintaining financial performance.

Economic downturns can reduce demand for packaging materials, affecting sales and profitability. The company’s financial performance is tied to overall economic conditions. Diversifying its customer base can help mitigate these risks.

The packaging industry is subject to technological advancements. Failing to adopt new technologies can lead to a loss of market share. Continuous innovation in packaging solutions is crucial for staying competitive.

The company diversifies its product portfolio and customer base to reduce reliance on any single market. This strategy aims to mitigate risks associated with economic downturns and market-specific challenges. Focusing on a diverse range of packaging solutions helps in adapting to changing market demands.

The company employs risk management frameworks to identify and mitigate potential operational and financial risks. These frameworks help in assessing and addressing vulnerabilities in the supply chain, market fluctuations, and regulatory changes. Proactive risk management enhances resilience.

The company makes strategic adjustments, such as the Smurfit Kappa merger, to navigate industry challenges. These adjustments demonstrate a proactive approach to positioning for future growth. Such actions are crucial for adapting to changing market dynamics and competitive pressures.

Emerging risks, such as the increasing global focus on a circular economy, require continuous innovation. The company must adapt to stricter regulations on packaging. Innovation and adaptation are crucial for long-term sustainability and growth in the packaging industry.

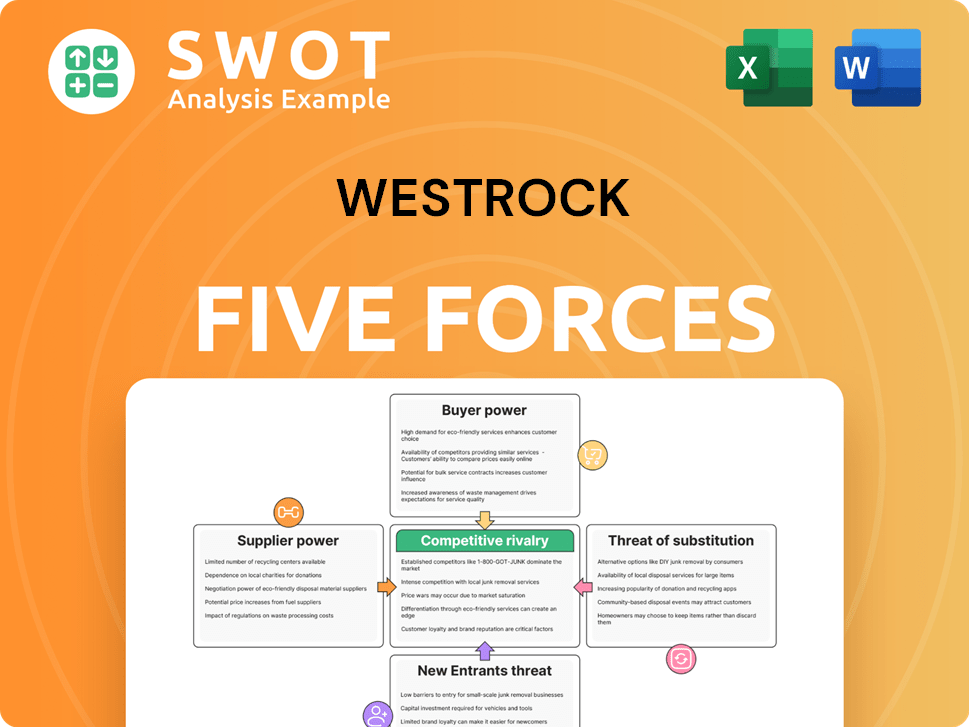

WestRock Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WestRock Company?

- What is Competitive Landscape of WestRock Company?

- How Does WestRock Company Work?

- What is Sales and Marketing Strategy of WestRock Company?

- What is Brief History of WestRock Company?

- Who Owns WestRock Company?

- What is Customer Demographics and Target Market of WestRock Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.