WestRock Bundle

How Does WestRock Company Shape the Future of Packaging?

WestRock Company is a global powerhouse, providing essential paper and packaging solutions across numerous industries. From food and beverage to e-commerce, its impact is felt worldwide. The upcoming merger with Smurfit Kappa Group to form Smurfit WestRock signals a bold move, promising even greater influence in the sustainable packaging arena.

This deep dive explores the WestRock SWOT Analysis, revealing the intricacies of its WestRock business model and its strategic evolution. We'll examine how WestRock manufactures its diverse paper and packaging products, analyzing its financial performance and sustainability initiatives. Understanding WestRock Company's role in the packaging industry is crucial for anyone seeking to understand the current market dynamics and future trends in sustainable packaging.

What Are the Key Operations Driving WestRock’s Success?

The WestRock Company, a key player in the paper and packaging industry, operates by providing integrated paper and packaging solutions. Its business model focuses on serving a diverse range of customers, from consumer brands to industrial manufacturers. This approach allows it to offer comprehensive services, from sustainable forest management to advanced converting and finishing services.

WestRock's core operations are centered around the creation and delivery of value through its packaging solutions. This includes corrugated packaging, consumer packaging, and paperboard products. The company's vertical integration ensures control over the supply chain, which is crucial for maintaining quality and efficiency. This integrated strategy is designed to meet the evolving needs of its customers while promoting sustainability.

The value proposition of WestRock is based on its ability to deliver innovative, sustainable, and high-performance packaging solutions. This is achieved through a network of mills, converting plants, and design centers, allowing for localized service with a global reach. The company's commitment to sustainability is evident in its practices and offerings, reflecting its dedication to environmental responsibility and the circular economy. For further insights into their strategic growth, consider exploring Growth Strategy of WestRock.

WestRock's main product lines include corrugated packaging, consumer packaging, and paperboard products. Corrugated packaging provides custom boxes and displays. Consumer packaging offers folding cartons and specialty packaging. These offerings are designed to meet a wide range of packaging needs.

WestRock distinguishes itself through its extensive network of mills and converting plants, ensuring localized service. Its supply chain is optimized for efficiency and timely delivery. Partnerships with customers often involve collaborative design to develop tailored packaging solutions.

Customers benefit from reduced costs, improved product protection, and enhanced brand presentation. The company's approach also increases supply chain efficiency. These benefits are a direct result of WestRock's integrated and customer-focused strategy.

WestRock emphasizes sustainable packaging solutions and practices. This includes using responsibly sourced materials and designing packaging for recyclability. The company's environmental initiatives are integral to its business model.

WestRock's operations are characterized by vertical integration and a focus on customer needs. The company's supply chain is optimized for efficiency, ensuring timely delivery of high-quality packaging solutions. This approach supports its commitment to sustainability and the circular economy.

- Vertical Integration: From forest management to converting and finishing.

- Customer Collaboration: Working with customers to design tailored packaging.

- Sustainability: Emphasis on sustainable materials and practices.

- Global Network: Extensive network of mills and converting plants.

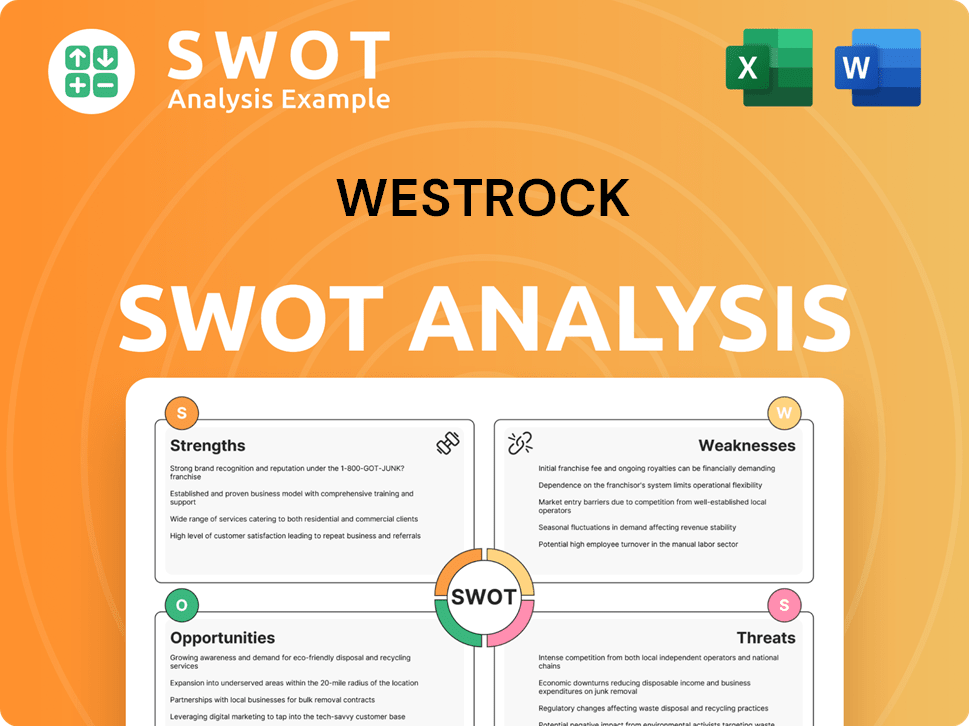

WestRock SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does WestRock Make Money?

The WestRock Company generates revenue through the sale of paper and packaging products and related services. Its main revenue streams include corrugated packaging, consumer packaging, and paperboard sales. The company's financial performance is heavily influenced by these core segments, which are key drivers of its income.

WestRock's monetization strategies involve long-term supply agreements with major companies. It also offers value-added services like specialized design and automation. The company's global footprint serves multinational clients, potentially differentiating its revenue mix by region. The merger with Smurfit Kappa Group is expected to expand revenue sources and geographic reach.

In fiscal year 2023, WestRock reported net sales of $20.3 billion. The merger with Smurfit Kappa Group is projected to result in a combined entity with approximately $34 billion in adjusted annual revenue as of June 30, 2024. This strategic move aims to diversify the revenue base and enhance cross-selling opportunities.

Corrugated packaging is a significant revenue stream for WestRock, serving various industries. This segment includes the production and sale of boxes, containers, and other packaging materials. Demand for corrugated packaging is driven by e-commerce, food and beverage, and industrial sectors.

Consumer packaging involves packaging solutions for a wide range of consumer goods. This includes folding cartons, labels, and flexible packaging. The consumer packaging segment benefits from trends in consumer behavior and product innovation.

The sale of paperboard and other paper products is another key revenue stream. This includes the production and sale of paperboard used in packaging and other applications. The paper products segment is influenced by demand from various industries.

WestRock often enters into long-term supply agreements with major companies. These agreements provide a stable and recurring revenue stream. They ensure a consistent demand for WestRock's products and services.

WestRock offers value-added services, including design, engineering, and automation. These services help optimize supply chain efficiency and reduce material usage. They also enhance product protection and cater to specific customer needs.

The company leverages its global footprint to serve multinational clients. This allows WestRock to cater to a diverse customer base. It also helps differentiate revenue mix by region, providing a competitive advantage.

WestRock's revenue is primarily driven by its packaging solutions and paper products. The company employs various strategies to maximize revenue, including long-term contracts and value-added services. The merger with Smurfit Kappa Group is a strategic move to expand revenue and geographic reach.

- Corrugated Packaging: Sales of boxes and containers for various industries.

- Consumer Packaging: Packaging solutions for consumer goods.

- Paperboard Sales: Revenue from the sale of paperboard and other paper products.

- Long-Term Agreements: Contracts providing stable revenue streams.

- Value-Added Services: Design, engineering, and automation services.

- Global Presence: Serving multinational clients across different regions.

For more insights, explore the Marketing Strategy of WestRock.

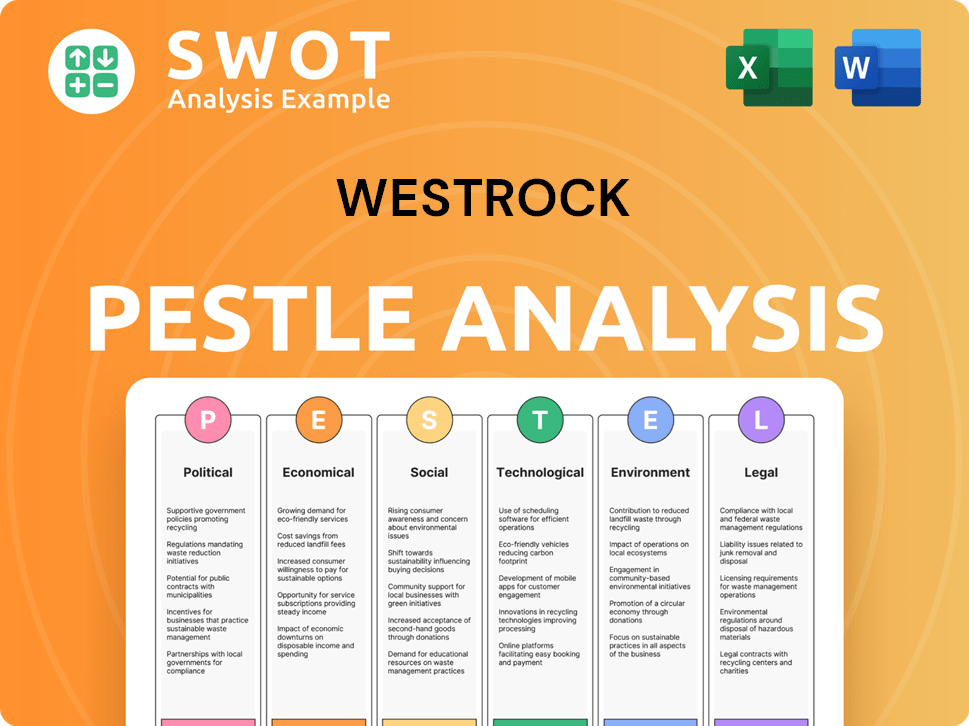

WestRock PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped WestRock’s Business Model?

The evolution of the WestRock Company has been marked by significant milestones, strategic shifts, and a focus on maintaining a competitive edge within the packaging industry. A key development is the pending merger with Smurfit Kappa Group, announced in September 2023, which aims to create a global leader in sustainable packaging. This merger is expected to close in early July 2024, representing a major strategic move to expand the company's geographic reach and product offerings.

WestRock's strategic initiatives have been shaped by the demand for sustainable packaging solutions and the need to navigate operational challenges. The company has invested in advanced manufacturing technologies, optimized its logistics, and expanded its portfolio of eco-friendly packaging options. These efforts are designed to meet evolving consumer preferences and maintain market competitiveness.

The company's competitive advantages stem from its integrated business model, spanning forest management to finished packaging products, providing cost efficiencies and quality control. WestRock also benefits from its strong brand reputation, extensive customer relationships, and a focus on innovation in sustainable packaging. Continuous adaptation to trends, such as the growth of e-commerce, is evident through specialized packaging solutions and investments in automation.

The definitive agreement to combine with Smurfit Kappa Group, announced in September 2023, is a pivotal milestone. The merger, expected to be finalized in early July 2024, will create a global leader in sustainable packaging. Recent financial data reveals that WestRock reported net sales of approximately $5.3 billion for the first quarter of fiscal year 2024.

WestRock has focused on expanding its sustainable packaging offerings and optimizing its manufacturing processes. Investments in advanced technologies and eco-friendly materials are key strategies. The company is also adapting to the e-commerce boom by developing specialized packaging solutions. The company's strategic moves are detailed in the Growth Strategy of WestRock.

WestRock's integrated business model, strong brand reputation, and customer relationships contribute to its competitive edge. The company's focus on innovation in sustainable packaging and its ability to adapt to market trends differentiate it from competitors. The company's focus on sustainability is reflected in its environmental impact and practices.

In the first quarter of fiscal year 2024, WestRock demonstrated resilience with net sales of approximately $5.3 billion. The company's adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were approximately $775 million. These figures reflect the company's ability to navigate market challenges and maintain financial health.

WestRock's strategic moves, including the merger with Smurfit Kappa Group, are aimed at expanding its global footprint and product offerings. The company's commitment to sustainable packaging and innovation positions it well for future growth. The company's financial performance in early 2024 demonstrates its ability to adapt and thrive in a dynamic market.

- Merger with Smurfit Kappa Group to create a global leader.

- Focus on sustainable packaging solutions and eco-friendly materials.

- Strong financial performance with approximately $5.3 billion in net sales in Q1 2024.

- Integrated business model providing cost efficiencies and quality control.

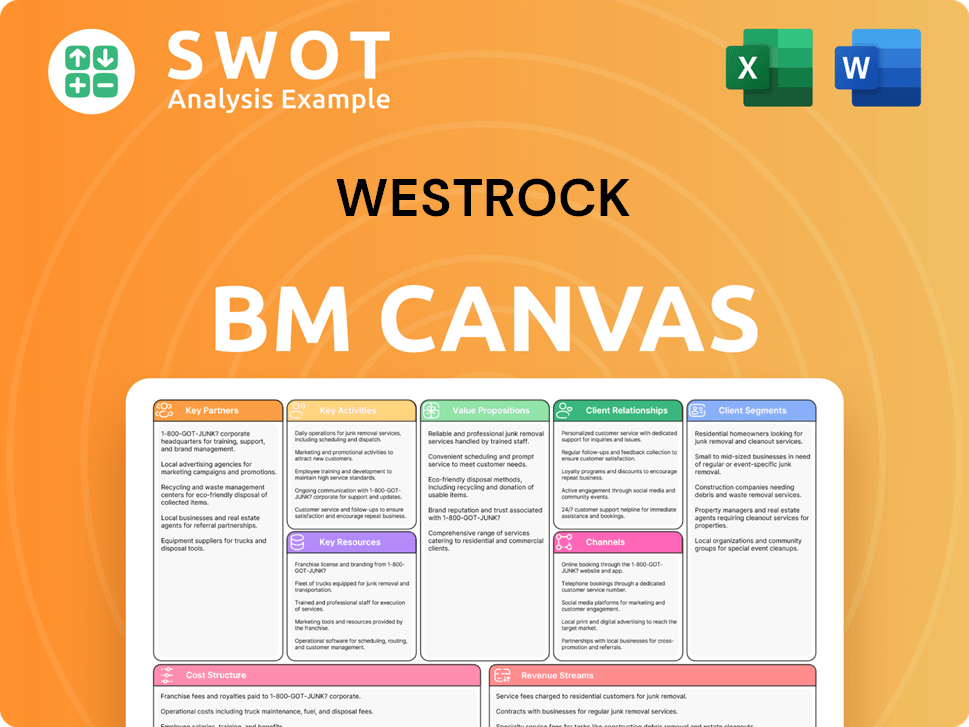

WestRock Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is WestRock Positioning Itself for Continued Success?

The WestRock Company holds a significant position in the global paper and packaging industry. The proposed merger with Smurfit Kappa Group aims to create Smurfit WestRock, which is projected to become a global leader in sustainable packaging. This consolidation will enhance its market share and expand its global reach across North and South America, Europe, and Asia.

However, the WestRock Company faces several risks, including fluctuations in raw material costs, particularly for wood fiber and recycled paper. Regulatory changes related to environmental standards and packaging waste also pose challenges. New competitors and changing consumer preferences towards even more sustainable packaging require continuous adaptation of product lines. For more information, check out this article about the Target Market of WestRock.

WestRock is currently one of the largest players in the global paper and packaging industry. The merger with Smurfit Kappa Group is expected to establish a leading global entity in sustainable packaging. This strategic move is designed to strengthen market share and expand global reach.

Key risks include fluctuating raw material costs and regulatory changes. New competitors and evolving consumer preferences towards sustainable packaging are also significant challenges. These factors can affect operations and profitability.

WestRock, now as Smurfit WestRock, is focused on strategic initiatives to sustain revenue growth. These include leveraging the merger's scale, driving operational efficiencies, and accelerating innovation in sustainable packaging. The company aims to capitalize on the growing demand for eco-friendly materials and circular economy principles.

The company is committed to creating value for shareholders through strong financial performance and continued investment in growth opportunities. This includes a strong emphasis on sustainable packaging solutions and environmental practices. The future outlook emphasizes global leadership in sustainable packaging.

WestRock's strategic initiatives focus on leveraging the merger, driving operational efficiencies, and accelerating innovation in sustainable packaging. The company aims to capitalize on the growing demand for eco-friendly materials and circular economy principles. Leadership emphasizes creating shareholder value through strong financial performance and continued investment in growth.

- Leveraging the scale and geographic diversification from the merger with Smurfit Kappa.

- Driving operational efficiencies across the combined entity.

- Accelerating innovation in sustainable packaging solutions.

- Capitalizing on the growing demand for eco-friendly materials.

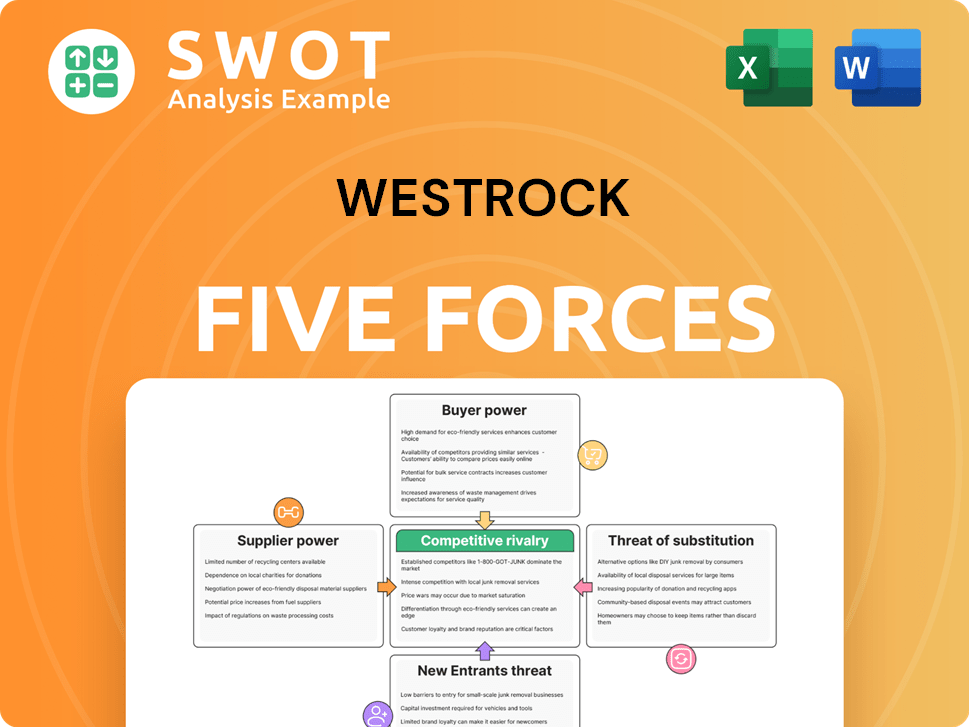

WestRock Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of WestRock Company?

- What is Competitive Landscape of WestRock Company?

- What is Growth Strategy and Future Prospects of WestRock Company?

- What is Sales and Marketing Strategy of WestRock Company?

- What is Brief History of WestRock Company?

- Who Owns WestRock Company?

- What is Customer Demographics and Target Market of WestRock Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.