Best Buy Bundle

Can Best Buy Thrive in Tomorrow's Retail World?

Best Buy, a name synonymous with consumer electronics, is navigating a dynamic retail landscape. Founded in 1966, the company has evolved from a niche audio equipment seller to a multinational powerhouse. Understanding Best Buy's Best Buy SWOT Analysis is crucial to grasping its strategic shifts and future potential.

This in-depth analysis explores Best Buy's growth strategy, examining its ability to adapt to retail industry trends and the ever-changing consumer electronics market. We'll dissect its business model, scrutinize its expansion plans, and assess its competitive advantages to provide a comprehensive Best Buy company analysis. Furthermore, we will delve into Best Buy's future prospects, considering its long-term investment outlook and its innovative approaches to omnichannel retail.

How Is Best Buy Expanding Its Reach?

The expansion strategy of the company is centered on optimizing its existing footprint, enhancing its services, and exploring new avenues for customer engagement. This approach prioritizes deepening its presence in core markets rather than rapid expansion. The company focuses on evolving customer preferences, increasing convenience, and improving profitability.

A significant aspect of the company's growth strategy involves its 'Best Buy Health' segment. This segment uses technology to help seniors live independently at home. This includes services such as remote monitoring and personal emergency response systems. This represents a diversification beyond traditional retail products. This shift is driven by the desire to meet evolving customer preferences, increase convenience, and improve profitability per square foot.

The company is also refining its store formats, with an emphasis on smaller, more efficient locations and an enhanced omnichannel experience that seamlessly integrates online and in-store shopping. This strategy is driven by the desire to meet evolving customer preferences, increase convenience, and improve profitability per square foot. The company is also continuously evaluating its product and service offerings to align with emerging consumer trends, such as smart home technology and connected fitness.

The company is focusing on smaller, more efficient store locations. This includes an enhanced omnichannel experience. This integrates online and in-store shopping to improve customer convenience. The goal is to improve profitability per square foot.

The company is expanding its service offerings, including the 'Best Buy Health' segment. This segment provides services like remote monitoring and personal emergency response systems. The company is also focusing on strategic partnerships to enhance its service ecosystem.

The company's primary focus remains on deepening its presence in its core North American markets. This is achieved through strategic partnerships and continuous improvement of its service ecosystem. The aim is to capture a larger share of the services market.

The company is exploring new avenues for customer engagement. This includes aligning product and service offerings with emerging consumer trends. The company aims to adapt to changes in the consumer electronics market.

The company's expansion initiatives are primarily focused on enhancing its existing footprint and services. This approach is driven by the need to adapt to the dynamic retail industry trends. The company's business model is evolving to meet changing consumer demands.

- Refining store formats for efficiency and enhanced customer experience.

- Expanding the 'Best Buy Health' segment to cater to the aging population.

- Focusing on the North American market through strategic partnerships.

- Aligning product and service offerings with emerging consumer trends.

The company's strategic focus on omnichannel retail is evident in its efforts to integrate online and in-store shopping experiences. The company's commitment to sustainability is also a factor in its long-term strategy, with initiatives aimed at reducing its environmental impact. The company's financial performance review indicates a solid position in the consumer electronics market. For more details on the company's values and mission, you can read about the Mission, Vision & Core Values of Best Buy.

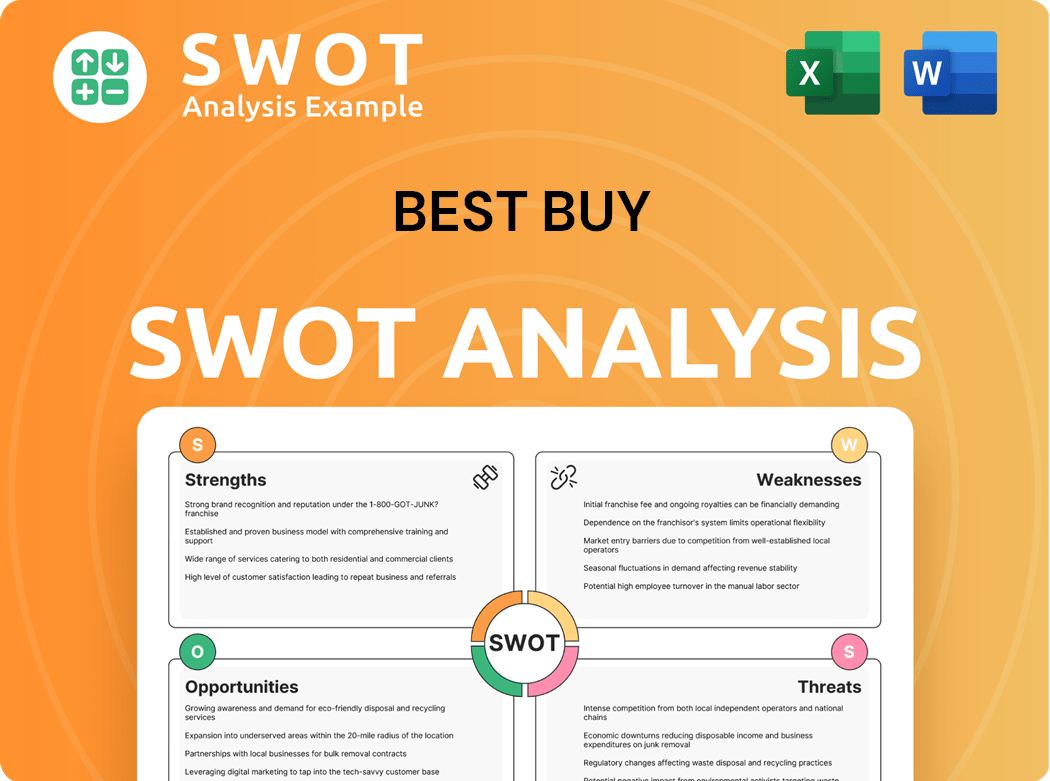

Best Buy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Best Buy Invest in Innovation?

The innovation and technology strategy of the company is central to its long-term growth, focusing on leveraging digital transformation and cutting-edge technologies. This approach aims to enhance customer experience and improve operational efficiency. Investments in research and development (R&D) are crucial for creating proprietary tools and platforms that support its services-led model.

A key element of this strategy involves integrating artificial intelligence (AI) to optimize inventory management, personalize marketing campaigns, and enhance customer support through AI-powered chatbots and virtual assistants. The company is also exploring the potential of Internet of Things (IoT) devices to create more interconnected home solutions, particularly within its health initiatives. Sustainability initiatives are increasingly integrated into its technology strategy, with efforts to promote energy-efficient products and responsible electronics recycling programs.

These technological advancements are vital for differentiating the company in a competitive market, contributing to growth by increasing customer loyalty, driving repeat business, and opening new revenue streams through innovative service offerings. This strategic direction is essential for navigating the evolving landscape of the retail industry and ensuring sustained success.

The company heavily invests in its e-commerce platform to enhance online sales and customer experience. This includes improving website functionality, mobile app features, and online customer service. The company's e-commerce strategy is crucial for adapting to the evolving consumer electronics market and retail industry trends.

The company utilizes AI and data analytics to personalize customer recommendations, optimize inventory management, and improve marketing campaigns. AI-powered chatbots and virtual assistants enhance customer support. This data-driven approach supports both Best Buy's business model and its efforts to improve the customer experience.

The company explores the potential of IoT devices to create interconnected home solutions, particularly within its Best Buy Health initiatives. This focus on smart home technology aligns with consumer demand for integrated and automated home systems. The company's expansion plans 2024 include further development in this area.

Sustainability is increasingly integrated into the company's technology strategy, with efforts to promote energy-efficient products and responsible electronics recycling programs. These initiatives are part of the company's broader commitment to environmental responsibility. The company's sustainability efforts are becoming increasingly important.

The company invests in research and development to create proprietary tools and platforms that support its services-led approach. This includes advanced logistics for product delivery and installation, and sophisticated data analytics. These tools help differentiate the company in the competitive consumer electronics market.

The company focuses on an omnichannel retail approach, integrating online and in-store experiences to provide a seamless customer journey. This strategy includes options like in-store pickup, curbside pickup, and home delivery. This approach is vital for the company's e-commerce growth and overall success.

The company's focus on innovation and technology is a key element of its Marketing Strategy of Best Buy. By leveraging these advancements, the company aims to enhance customer experience, improve operational efficiency, and drive sustainable growth. The company's strategic partnerships and long-term investment outlook are also influenced by these technology initiatives. The company's competitive advantages are strengthened through these technological advancements.

The company’s technology strategy includes several key initiatives aimed at enhancing customer experience and operational efficiency. These initiatives are crucial for maintaining and expanding the company's market share and ensuring its long-term success in the retail industry.

- E-commerce Enhancements: Continuous improvements to the online platform, including website functionality, mobile app features, and online customer service.

- AI and Data Analytics: Implementation of AI for personalized customer recommendations, optimized inventory management, and improved marketing campaigns.

- Smart Home Integration: Exploration of IoT devices to create interconnected home solutions, particularly within the Best Buy Health initiatives.

- Sustainability Programs: Promotion of energy-efficient products and responsible electronics recycling programs.

- R&D Investments: Development of proprietary tools and platforms to support the services-led approach, including advanced logistics and data analytics.

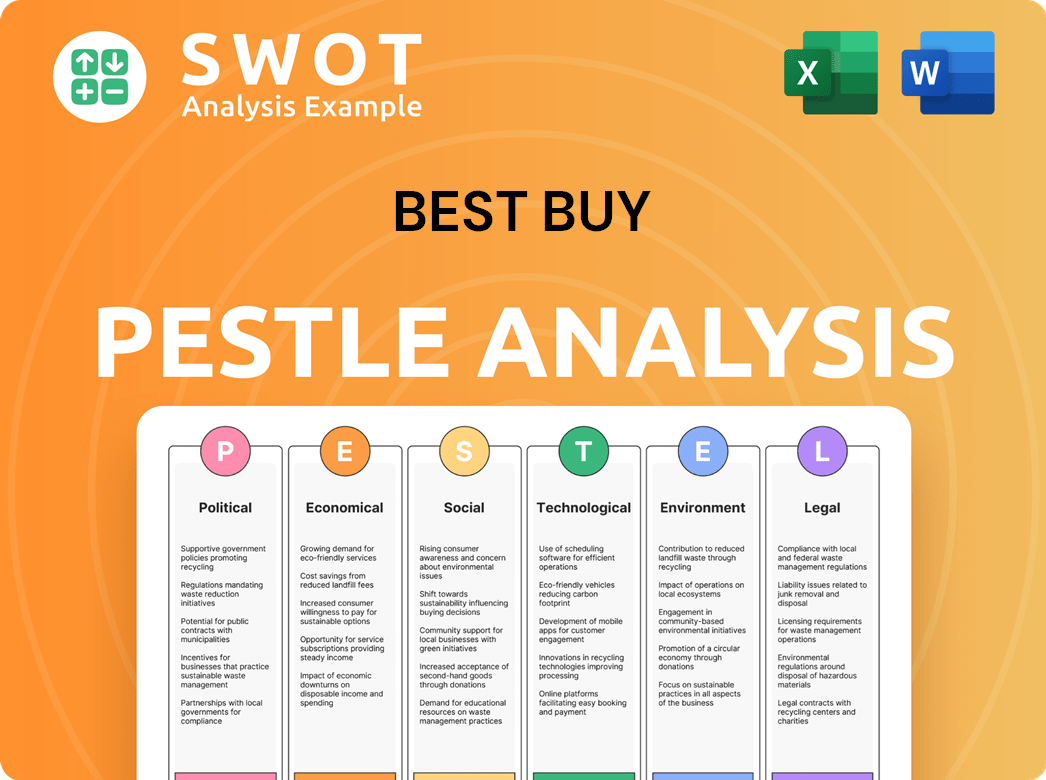

Best Buy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Best Buy’s Growth Forecast?

The financial outlook for Best Buy reflects a strategic pivot towards enhancing profitability through services and operational efficiency. For fiscal year 2024, the company reported revenue of $43.45 billion. This figure represents a decrease from the previous year, with diluted earnings per share at $6.14. Despite the revenue dip, Best Buy is focused on improving its profitability and cash flow.

Best Buy's financial strategy includes effectively managing inventory levels, optimizing operating expenses, and returning capital to shareholders through dividends and share repurchases. The company is navigating the challenges in the consumer electronics market by emphasizing its services segment, which typically yields higher margins. This approach is expected to positively influence its overall profitability.

Looking ahead to fiscal year 2025, Best Buy anticipates comparable sales to be in the range of (0.5%) to 2.5%. Enterprise revenue is projected to be between $41.3 billion and $42.3 billion. The diluted earnings per share for fiscal year 2025 are expected to be between $5.95 and $6.55. These projections highlight the company's ongoing efforts to adapt to changing consumer behavior and maintain a strong omnichannel presence.

The company's growth strategy focuses on expanding its services offerings, enhancing its online sales strategy, and optimizing its omnichannel retail approach. These initiatives are designed to capture a larger share of the consumer electronics market. Best Buy's strategic partnerships also play a key role in driving growth.

The future prospects for Best Buy are tied to its ability to adapt to evolving retail industry trends and consumer preferences. The company is investing in innovation in retail technology to improve customer experience initiatives. Its commitment to sustainability efforts also enhances its long-term outlook.

Best Buy's business model is centered on providing a comprehensive range of consumer electronics and related services. This includes in-store sales, online sales strategy, and a growing services segment. The company's competitive advantages include its strong brand recognition and established customer base.

Best Buy's market share analysis reveals its position in the consumer electronics market. The company competes with both online and brick-and-mortar retailers. Its omnichannel retail approach and focus on customer experience initiatives help maintain its market share.

Best Buy’s financial performance review indicates a focus on adapting to the dynamic retail landscape. The company is actively managing its financial resources to navigate market challenges. For more insights, consider exploring the perspective of Owners & Shareholders of Best Buy.

Best Buy's expansion plans in 2024 include strategic investments in its services offerings and online sales channels. The company is also focusing on optimizing its physical store footprint. These efforts aim to enhance its market presence.

The future of brick and mortar retail for Best Buy involves integrating its physical stores with its online platform. The company is investing in creating a seamless omnichannel retail approach. This strategy aims to provide a consistent customer experience.

Best Buy's competitive advantages include its strong brand recognition, extensive product selection, and customer service. The company's focus on its services segment also differentiates it. These factors help it maintain a strong position in the market.

Best Buy's sustainability efforts involve initiatives to reduce its environmental impact. The company is focused on sustainable sourcing and reducing waste. These efforts enhance its brand image and appeal to environmentally conscious consumers.

Best Buy's international market strategies include evaluating opportunities for expansion in key markets. The company is carefully assessing the potential for growth in different regions. This approach supports its long-term investment outlook.

Best Buy's e-commerce growth is driven by investments in its online platform and customer experience initiatives. The company is focusing on enhancing its online sales strategy. This is a crucial component of its omnichannel retail approach.

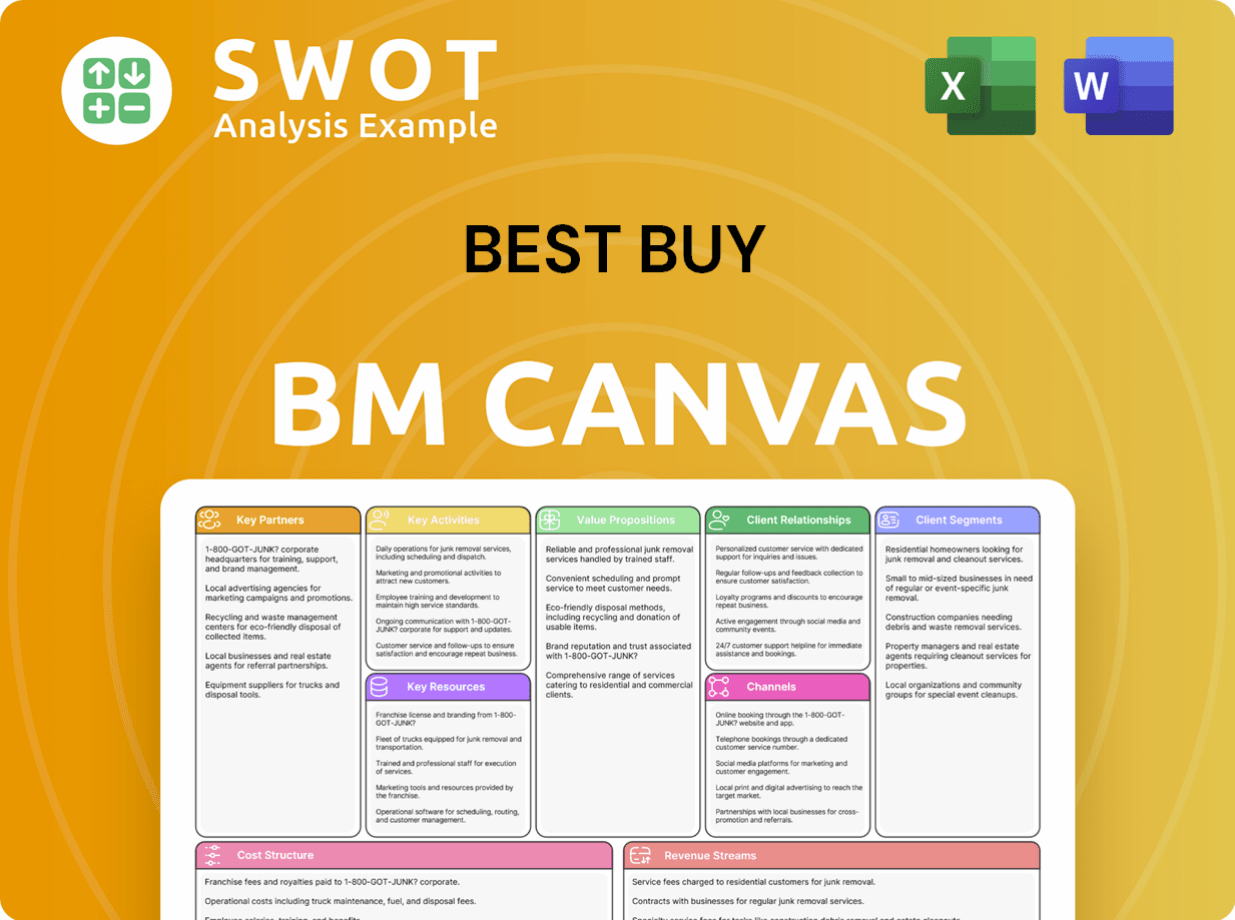

Best Buy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Best Buy’s Growth?

The path forward for the company, like any major retailer, is fraught with potential risks and obstacles. The Best Buy growth strategy must navigate a complex landscape of market competition, technological advancements, and evolving consumer behaviors. Understanding these challenges is critical for assessing the Best Buy future prospects and making informed decisions.

Intense competition from online retailers and other big-box stores continues to pressure margins. Adapting to rapid technological changes and maintaining supply chain efficiency are crucial for sustained success. The company's ability to manage these risks will significantly influence its financial performance and long-term viability.

The Best Buy company analysis reveals several key areas of potential vulnerability. These include the ability to adapt to changing retail industry trends, manage the consumer electronics market effectively, and maintain a robust Best Buy business model.

The company faces fierce competition from online giants like Amazon and other brick-and-mortar retailers. These competitors often offer lower prices and aggressive promotions, creating a challenging environment. Constant innovation in pricing strategies and service offerings is essential to stay competitive.

Rapid technological advancements pose a significant risk. The company must quickly adapt to emerging trends and anticipate the obsolescence of existing product categories. Failure to do so could lead to a decline in market share and relevance.

Supply chain disruptions, as seen in recent years, can severely impact product availability and delivery times. These disruptions can negatively affect customer satisfaction and sales. Diversifying suppliers and improving supply chain resilience are crucial for mitigating this risk.

Changes in regulations, particularly concerning data privacy and consumer protection, can increase operational costs. Compliance with these regulations is essential, but it may require significant investments in technology and processes. The company must also adapt to evolving environmental standards and sustainability requirements.

Attracting and retaining skilled talent in a competitive labor market is a constant challenge. Limited resources can hinder the execution of innovation and service-led strategies. Investing in employee training and development is crucial for maintaining a competitive edge.

Economic downturns can significantly impact consumer spending on discretionary items like electronics. The company must be prepared to navigate economic fluctuations and adjust its strategies accordingly. This includes managing inventory levels and controlling operational costs.

The company employs various strategies to mitigate these risks, including diversifying its product and service offerings. It also maintains robust risk management frameworks and utilizes scenario planning to prepare for potential disruptions. Leveraging its physical store network for fulfillment and customer support has proven effective in the past.

In fiscal year 2024, the company reported net sales of approximately $43.5 billion. The company's market share in the consumer electronics sector is a key indicator of its competitive position. Maintaining and growing market share is crucial for long-term success. The company’s ability to adapt to changing consumer behaviors and preferences is vital.

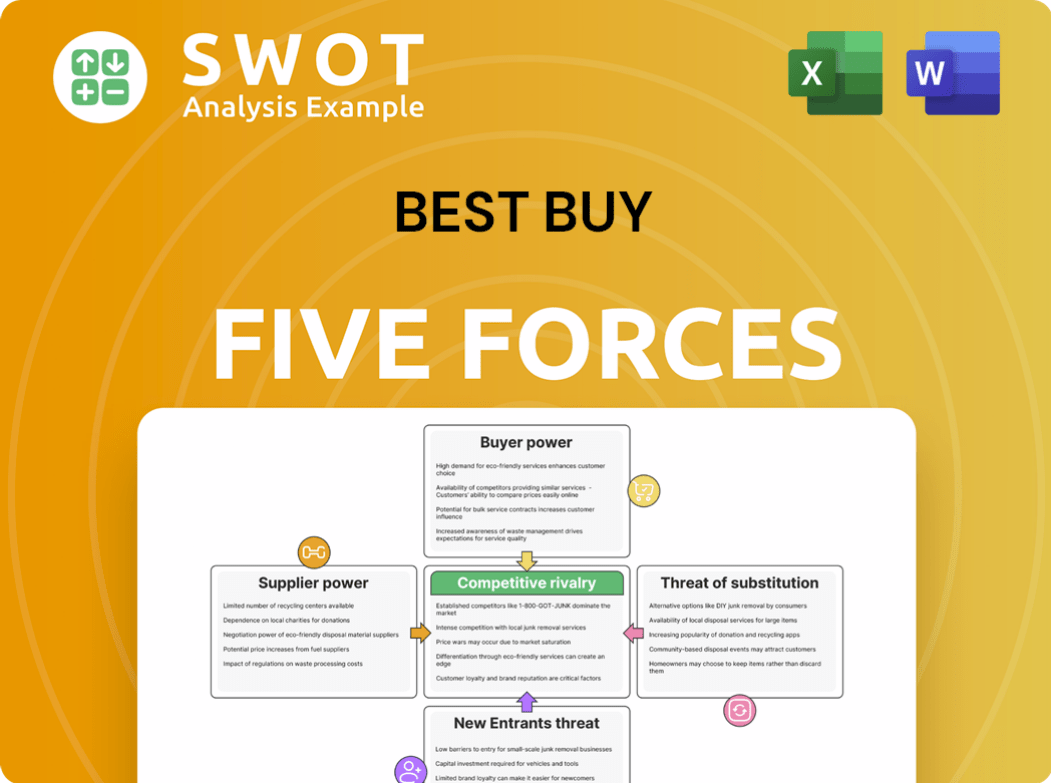

Best Buy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Best Buy Company?

- What is Competitive Landscape of Best Buy Company?

- How Does Best Buy Company Work?

- What is Sales and Marketing Strategy of Best Buy Company?

- What is Brief History of Best Buy Company?

- Who Owns Best Buy Company?

- What is Customer Demographics and Target Market of Best Buy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.