Best Buy Bundle

How Does Best Buy Thrive in Today's Retail World?

Best Buy, a titan in the Best Buy SWOT Analysis, has long been a cornerstone of the consumer electronics market. But how does this multinational retailer, specializing in consumer electronics, home office products, entertainment software, and appliances, continue to adapt and influence its sector amidst the rise of e-commerce? With a market capitalization of approximately $18.2 billion, understanding the Best Buy business model and its core operations is crucial for anyone interested in the retail industry.

This exploration will dissect the intricacies of Best Buy operations, examining its value proposition, revenue streams, and strategic maneuvers. We'll uncover how Best Buy navigates the competitive landscape, analyzing its strengths and weaknesses to understand its position in the tech industry. From Best Buy store layout explained to Best Buy's future plans and goals, we'll provide insights into how this retail giant aims to maintain profitability and growth in a dynamic market, covering aspects like How does Best Buy make money and How Best Buy manages inventory.

What Are the Key Operations Driving Best Buy’s Success?

The core operations of Best Buy revolve around offering a wide range of consumer electronics, home office products, and related services. The company's value proposition centers on providing innovative solutions through both in-store and online experiences, including product demonstrations, immediate product acquisition, and expert advice. This approach caters to a diverse customer base, including young adults (18-28) and families, understanding their varying income levels and tech interests.

Best Buy's business model is built on an omnichannel strategy that integrates physical stores with its e-commerce platform. This allows customers to explore products in-store and then make purchases online, or vice versa, with options for in-store pickup and returns. The company's operational processes are designed to support this integrated approach, ensuring a seamless customer experience across all touchpoints.

Best Buy's success in the retail industry is also dependent on its ability to adapt to changing consumer behaviors and technological advancements. By continuously investing in its digital experiences and supply chain efficiency, the company aims to maintain its competitive edge and meet the evolving needs of its customers. The company's focus on customer service and post-purchase support is a key differentiator.

Best Buy operates a large network of nearly 1,000 big-box stores in the U.S., providing convenient access for customers. Approximately 92% of Americans live within 15 miles of a Best Buy store, highlighting the accessibility of its physical locations. This extensive presence allows for hands-on product testing and immediate purchase options.

The company has significantly invested in its digital experiences, including its consumer app, to enhance product discovery and personalization. Best Buy's e-commerce platform enables services like in-store pickup and returns for online orders, creating an integrated shopping experience. This omnichannel strategy is crucial for meeting the demands of today's consumers.

Best Buy's supply chain includes over 40 regional U.S. distribution centers to replenish stores and support e-commerce fulfillment. Machine learning is used to rebalance inventory, reportedly reducing markdowns by 30% and saving $180 million annually. This efficient supply chain is critical for managing inventory.

Best Buy differentiates itself with services like Geek Squad for technical support and installation, and Best Buy Health, which focuses on enabling care at home. Strategic partnerships, such as the collaboration with Bell Canada, enhance its distribution and service offerings. These services add value to the customer experience.

Best Buy's success is built on a combination of physical presence, robust digital integration, and differentiated services. This approach sets it apart from purely online competitors and enhances the overall customer experience. The company's commitment to innovation and customer service has played a key role in its evolution, as explored in Brief History of Best Buy.

- Extensive store network offering hands-on product experiences.

- Integrated e-commerce platform with in-store pickup and return options.

- Expert services like Geek Squad and Best Buy Health for post-purchase support.

- Efficient supply chain and logistics leveraging machine learning for inventory management.

Best Buy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Best Buy Make Money?

Best Buy's financial success hinges on a multifaceted approach to revenue generation and monetization. The company leverages its extensive product offerings and service capabilities to drive sales and build customer loyalty. This strategy is further enhanced by innovative initiatives aimed at expanding revenue streams and improving profitability.

In fiscal year 2025, Best Buy reported total revenue of $41.528 billion, reflecting its significant presence in the retail industry. The company's ability to adapt to changing market dynamics and consumer preferences is crucial for sustaining its financial performance.

Understanding the Marketing Strategy of Best Buy provides insights into its revenue streams and monetization strategies.

Best Buy's revenue streams are diverse, encompassing product sales and service offerings. The company focuses on strategies such as membership programs and retail media to boost profitability. In Q1 FY26, services, including membership offerings, contributed to a higher domestic gross profit rate.

- Computing and Mobile Phones: This category accounted for 45% of the Domestic segment's revenue in fiscal 2025, with a 3.4% increase in comparable sales.

- Consumer Electronics: This remains a core product offering.

- Appliances: Best Buy offers a wide range of appliances. However, comparable appliance sales in the U.S. experienced an 11.4% year-over-year decline in Q4 FY25.

- Entertainment: This includes software and other entertainment products.

- Services: This is a crucial and growing revenue stream, including offerings like Geek Squad. The improved financial performance from services and membership offerings contributed to an increased gross profit rate of 22.6% in fiscal 2025, up from 22.1% in fiscal 2024.

- Other: This category encompasses various other product and service offerings.

- Membership Offerings: These are expected to boost gross profit rates.

- Best Buy Marketplace: Launching in mid-fiscal 2026 to expand product offerings through third-party sellers.

- Best Buy Ads: Enhancing its retail media network to drive new revenue streams.

- Bundled Services: Offering product installations alongside product purchases.

- Cross-selling: Leveraging in-store and online platforms to cross-sell complementary products and services.

- Private Label and Co-branded Credit Card Arrangement: Lower profit-sharing revenue from this arrangement was noted in Q1 FY26.

Best Buy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Best Buy’s Business Model?

Best Buy has navigated significant transformations to remain competitive in the dynamic retail landscape. A key strategic move has been the substantial investment in its digital experiences, particularly its consumer app, to enhance product discovery and customer understanding of technology. This digital transformation is complemented by a store experience overhaul, tailoring each store to its local market.

The company has also reconfigured its workforce management, assigning employees to a market rather than a specific store to meet evolving customer needs. These strategic shifts are crucial for Best Buy to adapt to the changing consumer electronics market and maintain its position in the retail industry.

Best Buy faces operational challenges, including macroeconomic pressures, fluctuating consumer demand, and intense competition from multi-channel retailers and e-commerce businesses. Supply chain interruptions and reliance on third-party vendors are also significant concerns. In response, Best Buy has focused on operational efficiency, cost reductions, and strategic pricing investments. The company has proactively enhanced its supply chain systems and processes, leveraging technologies like machine learning and generative AI for inventory management, which has led to significant savings.

Best Buy's competitive advantages are multifaceted, allowing it to maintain a strong position in the consumer electronics market. These advantages include a well-established brand image, an extensive physical store network, and a robust e-commerce platform. These factors contribute to Best Buy's ability to compete effectively in the retail industry.

- Established Brand Image and Equity: With over 50 years in operation, Best Buy enjoys high brand awareness, with an estimated 68% of U.S. consumers familiar with the brand.

- Expansive Brick-and-Mortar Network: Its nearly 1,000 physical store locations nationwide allow for product demonstrations and immediate product acquisition, a distinct advantage over purely e-commerce competitors.

- Seamless Omni-Channel E-commerce: Best Buy has effectively integrated its online and in-store experiences, offering services like fast store or curbside pickup and in-store returns for online purchases.

- Differentiated Services: Services like Geek Squad provide valuable technical support, installation, and repair, enhancing customer satisfaction and loyalty.

- Strategic Partnerships: Collaborations, such as with Bell Canada and various healthcare providers for Best Buy Health, expand its service offerings and market reach.

- Loyalty Programs: These programs drive customer engagement and repeat business.

Best Buy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Best Buy Positioning Itself for Continued Success?

As a leading multinational retailer, Best Buy holds a significant position in the consumer electronics market. The company is recognized for its strong brand awareness and high customer preference. Its operations span the United States and Canada, making it a key player in the retail industry.

However, the company faces challenges from macroeconomic pressures, intense competition, and rapid technological changes. The company's ability to adapt to shifting consumer preferences and manage operational efficiencies will be crucial for its continued success. Understanding the Growth Strategy of Best Buy is essential to assess its future potential.

Best Buy is a dominant player in the consumer electronics and home appliances retail sectors. With a high brand awareness of 93% among U.S. consumers, the company has a significant advantage. Its omnichannel approach, combining physical stores and e-commerce, allows it to reach a broad customer base.

Several factors pose risks to Best Buy's operations. These include macroeconomic pressures like inflation and potential recession, which can affect demand. Intense competition from both online and brick-and-mortar retailers also impacts revenue and profitability. Technological advancements and supply chain issues can further challenge the company.

Best Buy is focusing on strategic initiatives to sustain and expand its business. For fiscal year 2026, the company projects revenue between $41.4 billion and $42.2 billion. The company plans to enhance its omnichannel capabilities and introduce new growth initiatives, such as the Best Buy Marketplace.

Key initiatives include omnichannel enhancements, new growth ventures, and operational efficiency improvements. The company aims to boost margins and customer engagement through its services and membership offerings. Real estate optimization, including store closures and openings, is also a part of the strategy.

Best Buy's future success depends on several key factors. The company's ability to adapt to changing consumer behaviors and economic conditions is crucial. Strategic initiatives, such as enhancing its omnichannel presence and expanding service offerings, will play a significant role in driving growth.

- Omnichannel Strategy: Enhancing digital platforms and optimizing store operations.

- New Growth Initiatives: Launching a new Best Buy Marketplace to expand product offerings.

- Operational Efficiency: Focusing on cost reductions and savings.

- Services and Membership: Diversifying and enhancing services like Geek Squad.

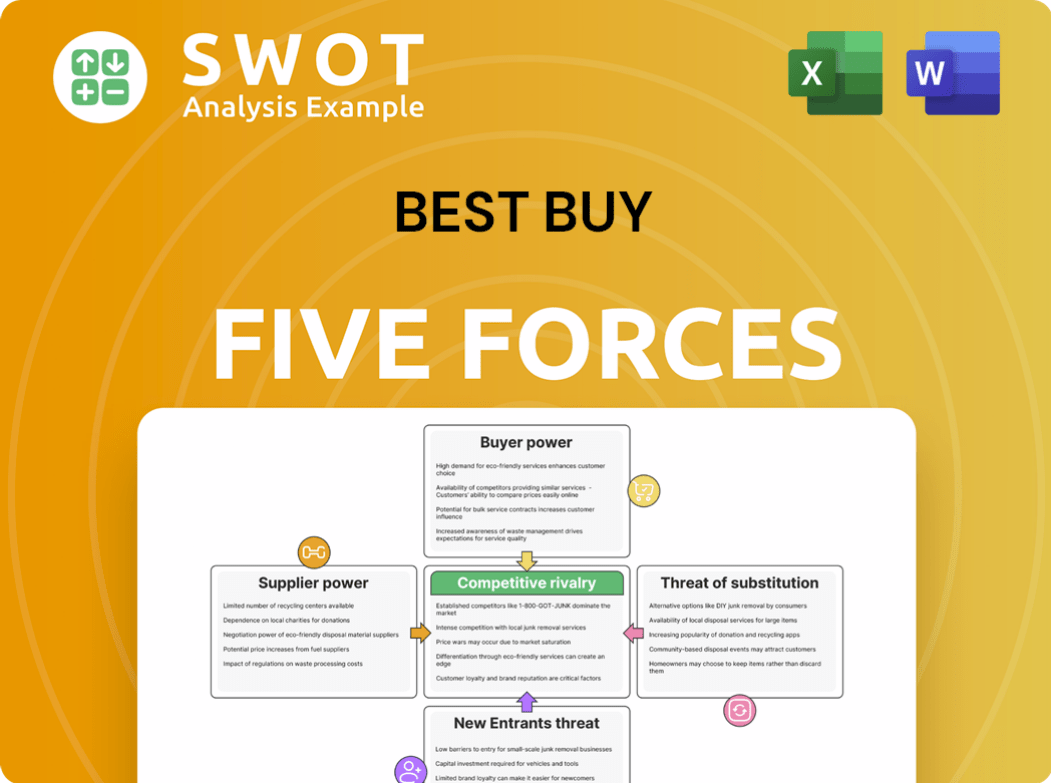

Best Buy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Best Buy Company?

- What is Competitive Landscape of Best Buy Company?

- What is Growth Strategy and Future Prospects of Best Buy Company?

- What is Sales and Marketing Strategy of Best Buy Company?

- What is Brief History of Best Buy Company?

- Who Owns Best Buy Company?

- What is Customer Demographics and Target Market of Best Buy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.