Best Buy Bundle

Who Really Owns Best Buy?

Understanding the Best Buy SWOT Analysis is crucial, but who truly steers this consumer electronics giant? From its humble beginnings as Sound of Music to its current status, Best Buy's ownership structure has undergone a fascinating transformation. Unraveling the threads of its ownership reveals insights into its strategic direction and market influence.

The question of "Who owns Best Buy?" extends beyond simple stock ownership, encompassing the influence of Best Buy shareholders, the role of Best Buy executives, and the impact of its Best Buy history. Exploring Best Buy's Best Buy parent company and Best Buy ownership provides a deeper understanding of its Best Buy company structure and the forces shaping its future, including its Best Buy's largest shareholders and the dynamics of its Best Buy's current ownership structure. This analysis will also touch upon "Who is the CEO of Best Buy" and how Best Buy is managed.

Who Founded Best Buy?

The story of Best Buy's ownership begins in 1966 with its founding by Richard M. Schulze and James Wheeler. Initially, the company was known as Sound of Music, an audio specialty store. Schulze, an American businessman, played a pivotal role as chairman and CEO, shaping the company's early direction and growth.

While specific details about the initial equity split between Schulze and Wheeler are not widely available, Schulze's vision was central to the company's development. His innovative approach, including a non-commission and discount warehouse format, set the stage for Best Buy's expansion. This strategy helped the company grow rapidly.

The company rebranded to Best Buy in 1983, marking a significant milestone in its history. This change reflected the company's broader product offerings and its evolution in the consumer electronics market. The founders' influence has been a constant in the company's trajectory.

Richard Schulze remained a significant shareholder even after stepping down from leadership positions. In 2012, he held a 20% stake, even when he attempted a buyout. As of June 2025, Schulze, as Chairman Emeritus, held approximately 15,286,118 shares of Best Buy Co Inc (BBY) stock. This stake was valued at over $1.1 billion, making him the largest individual shareholder with a roughly 10% stake. This continued ownership highlights the enduring influence of the founders in the company's trajectory. To learn more about the company's history, you can read the Brief History of Best Buy.

- Best Buy was founded in 1966 by Richard M. Schulze and James Wheeler.

- The company was initially called Sound of Music.

- Richard Schulze was the chairman and CEO.

- Schulze's innovative strategies fueled the company's growth.

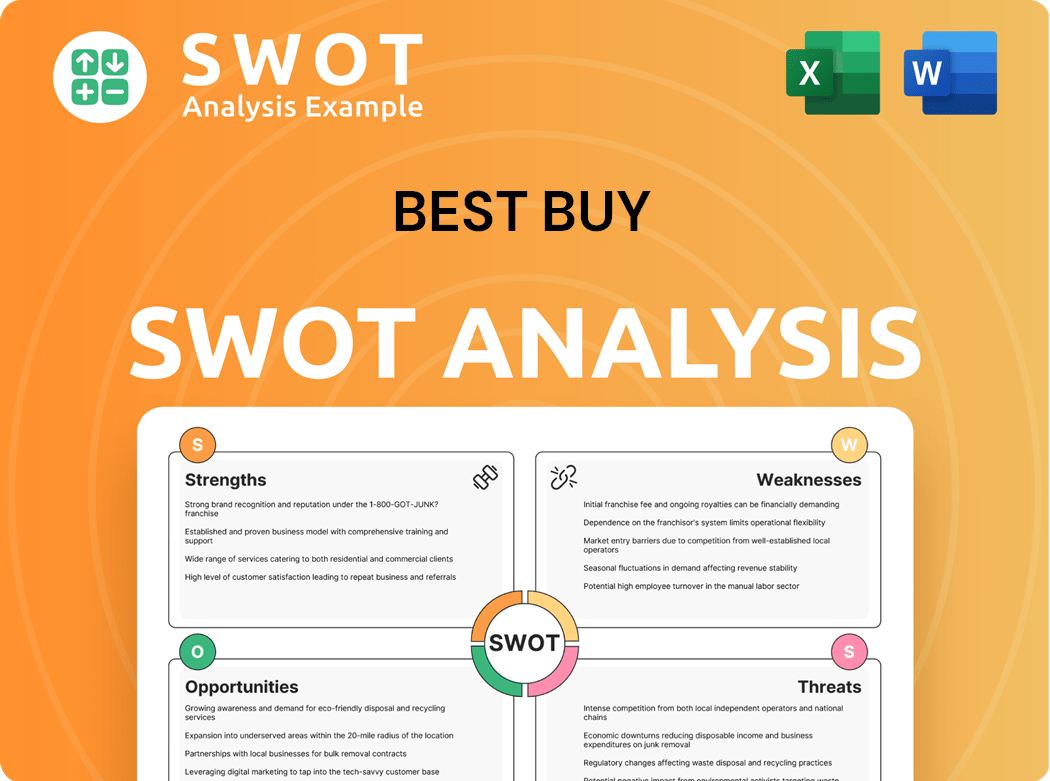

Best Buy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Best Buy’s Ownership Changed Over Time?

The journey of Best Buy, now a publicly traded company, began on April 18, 1985, with its initial public offering (IPO). As of May 16, 2025, the company's market capitalization stood at approximately $14.02 billion. This evolution highlights the transformation from a private entity to a publicly traded corporation, subject to the dynamics of the stock market and the influence of various stakeholders. Understanding the Best Buy ownership structure is key to grasping its operational and strategic direction.

The Best Buy parent company's ownership structure is primarily driven by institutional investors. As of May 2025, these investors collectively held 84.34% of the shares. Mutual funds have also increased their holdings, rising from 64.53% to 64.65% during the same period. Insider holdings remained stable at 0.41% in May 2025. This composition illustrates the significant influence of institutional investors in shaping the company's trajectory. The Best Buy shareholders include a diverse group of entities that collectively manage a substantial portion of the company's stock.

| Shareholder | Shares Held (as of March 30, 2025) | Percentage of Ownership |

|---|---|---|

| BlackRock, Inc. | 24,877,754 | 11.75% |

| The Vanguard Group, Inc. | 22,975,743 | 10.85% |

| State Street Global Advisors, Inc. | 13,135,214 | 6.21% |

| Charles Schwab Investment Management, Inc. | 6,968,973 | 3.29% |

| JPMorgan Asset Management | 6,039,073 | 2.85% |

The major institutional shareholders, as of March 30, 2025, include BlackRock, Inc. (11.75%), The Vanguard Group, Inc. (10.85%), and State Street Global Advisors, Inc. (6.21%), demonstrating the concentrated ownership among a few key players. Other significant shareholders include Charles Schwab Investment Management, Inc., and JPMorgan Asset Management. These entities, along with others like Raymond James Financial Inc., Geode Capital Management, LLC, and UBS Asset Management AG, collectively hold a significant portion of the company's stock. The aggregate institutional ownership percentage was 80.96% as of May 28, 2025. The shifts in shareholding, such as founder Richard M. Schulze's sale of stock in July 2024, underscore the dynamic nature of Best Buy's current ownership structure and its impact on the company's strategic decisions and Best Buy's corporate governance.

Best Buy ownership is primarily held by institutional investors, reflecting their significant influence.

- Institutional investors hold a substantial majority of shares.

- Major shareholders include BlackRock, Vanguard, and State Street.

- Founder Richard M. Schulze sold a large amount of stock in 2024.

- Changes in ownership can impact company strategy and governance.

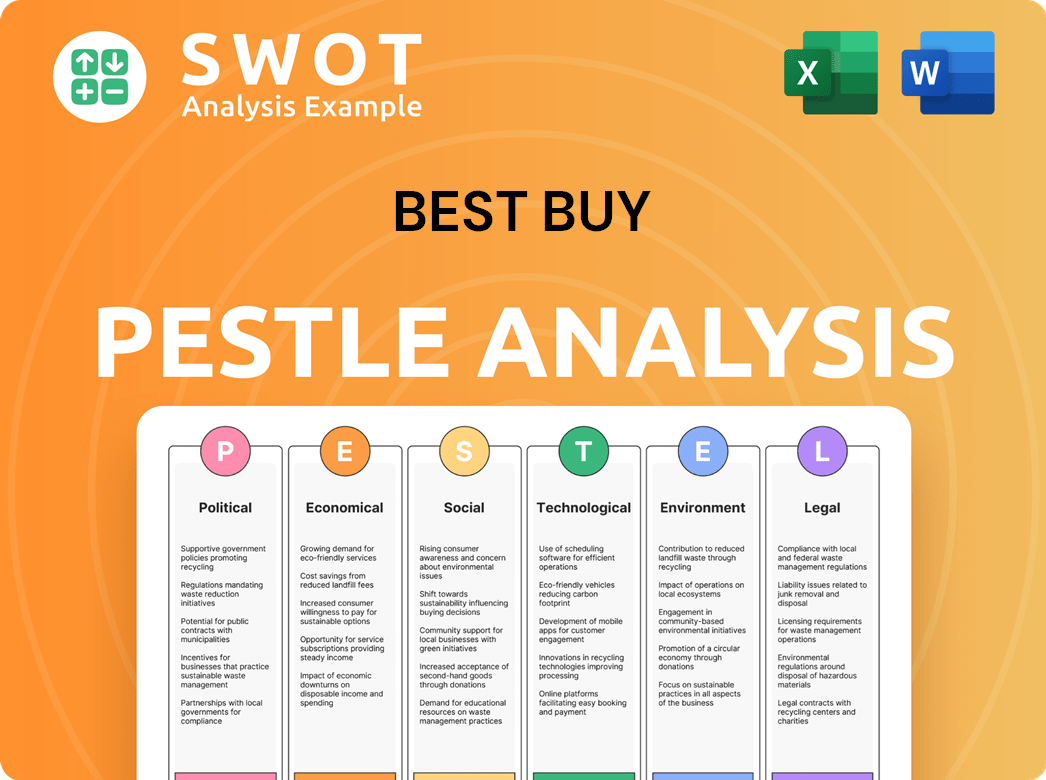

Best Buy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Best Buy’s Board?

The current Board of Directors at the company plays a vital role in its governance, overseeing strategic direction and operations. As of April 30, 2024, the Board is led by an independent Chair, ensuring independent oversight of management. All director nominees, with the exception of the CEO, are independent. The Board also emphasizes diverse representation among its members, with seven of the eleven director nominees being women. Understanding the dynamics of Best Buy ownership is key to grasping its corporate structure.

The presence of independent directors aims to balance the interests of various stakeholders. Recent SEC filings and annual reports for fiscal year 2025 provide insights into the company's governance. The company's governance structure is designed to provide oversight and accountability to its shareholders. For more context, you can explore the Competitors Landscape of Best Buy.

| Board Member | Role | Independence |

|---|---|---|

| Corie Barry | Chief Executive Officer | No |

| Cynthia B. Taylor | Independent Chair | Yes |

| Current Board Composition | 11 Members | 7 Women |

Best Buy operates with a one-share-one-vote structure, common for publicly traded companies. There is no indication of dual-class shares or special voting rights. In 2012, founder Richard Schulze resigned his chairmanship. While there haven't been recent high-profile proxy battles, the company's governance structure is designed to provide oversight and accountability to its shareholders. Analyzing Best Buy's current ownership structure is essential for investors.

The Board of Directors at the company oversees strategic direction and operations.

- Independent Chair ensures oversight.

- Diverse representation among members.

- One-share-one-vote structure.

- No dual-class shares.

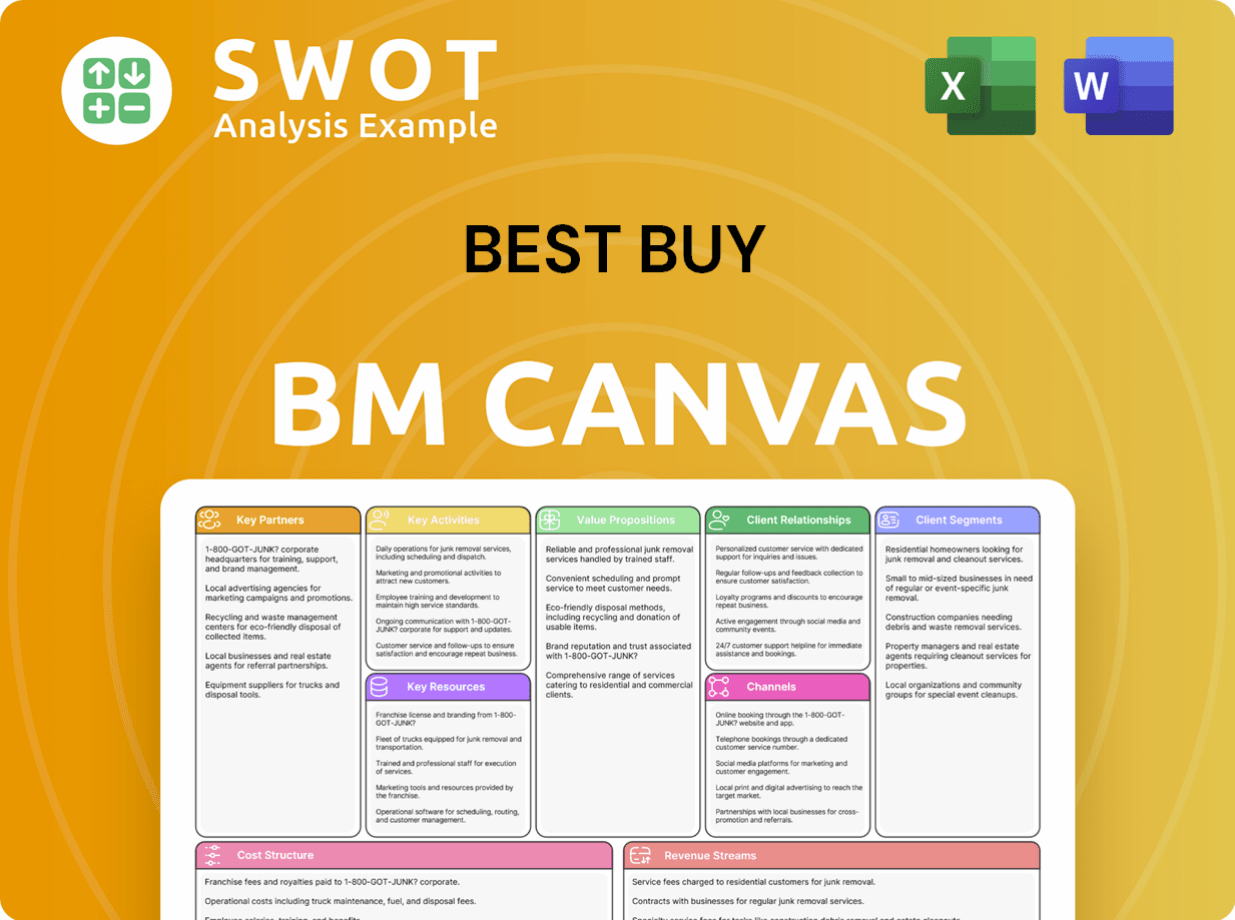

Best Buy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Best Buy’s Ownership Landscape?

Over the past few years, Best Buy's ownership has shown interesting trends. The company continues to prioritize shareholder returns, returning $1.1 billion to shareholders through dividends and share repurchases in fiscal year 2024. They also increased their quarterly dividend by 2% to $0.94 per share for fiscal year 2025, demonstrating a commitment to delivering value to its shareholders. This focus on shareholder value is a key aspect of the company's financial strategy.

Institutional investors remain a significant part of the ownership structure. As of May 2025, they hold a substantial 84.34% of Best Buy's shares. Major players like BlackRock, Inc., The Vanguard Group, Inc., and State Street Global Advisors, Inc. continue to be key holders, reflecting the confidence these large institutions have in the company. The aggregate market value of voting and non-voting common equity held by non-affiliates was approximately $15.8 billion as of August 2, 2024. This highlights the substantial market capitalization and investor interest in Best Buy.

| Ownership Category | Percentage (as of May 2025) | Key Holders (as of March 30, 2025) |

|---|---|---|

| Institutional Investors | 84.34% | BlackRock, Inc., The Vanguard Group, Inc., State Street Global Advisors, Inc. |

| Individual Investors | Remaining Percentage | Various |

Corie Barry has been leading the company as CEO since June 2019, overseeing strategic shifts in its operations, including significant investments in digital experiences and store overhauls. Best Buy is also focusing on employee development, including AI training. The company plans to reduce its Domestic segment store count by approximately 5 to 10 stores for fiscal year 2026. In January 2025, Best Buy announced plans to relaunch its online marketplace for third-party sellers by Summer 2025, partnering with Mirakl. These initiatives reflect the company's efforts to adapt to market changes and enhance shareholder value.

Corie Barry has been the CEO since June 2019, guiding the company through significant changes and investments in technology and store experiences.

Major institutional investors include BlackRock, Inc., The Vanguard Group, Inc., and State Street Global Advisors, Inc., holding significant portions of the company's shares.

Best Buy is primarily owned by institutional investors, holding approximately 84.34% of the shares as of May 2025, with a significant portion held by mutual funds.

Best Buy is managed by a leadership team led by CEO Corie Barry, with a focus on digital transformation, store experience improvements, and strategic investments.

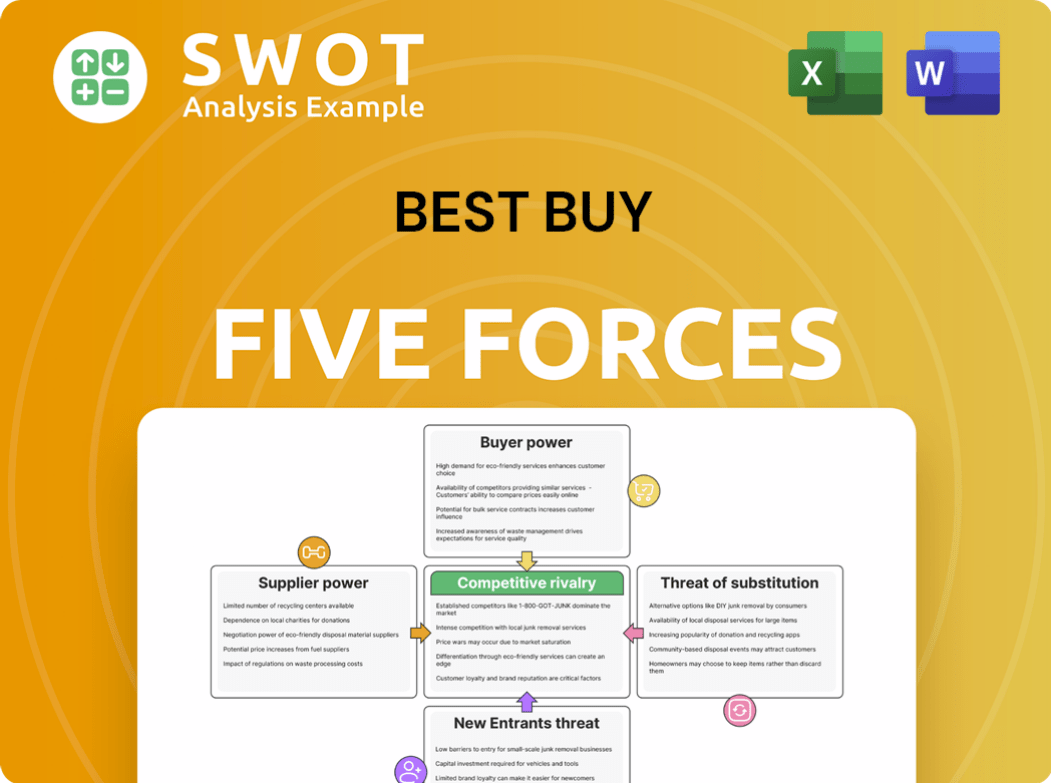

Best Buy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Best Buy Company?

- What is Competitive Landscape of Best Buy Company?

- What is Growth Strategy and Future Prospects of Best Buy Company?

- How Does Best Buy Company Work?

- What is Sales and Marketing Strategy of Best Buy Company?

- What is Brief History of Best Buy Company?

- What is Customer Demographics and Target Market of Best Buy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.