Interface Bundle

Can Interface Company Continue to Innovate and Thrive?

Interface, a global leader in flooring solutions, has consistently demonstrated the power of a strong Interface SWOT Analysis in navigating the complexities of the commercial flooring market. Founded on a commitment to innovation and sustainability, the company has evolved from a pioneer in modular carpet to a prominent player in the industry. This exploration delves into Interface's growth strategy and its future prospects, examining its journey and strategic direction.

Interface's success story showcases how a forward-thinking growth strategy can drive long-term value. By analyzing its market analysis and embracing technology trends, Interface is poised to capitalize on emerging opportunities. Understanding the business development initiatives and the competitive landscape is crucial for investors and stakeholders seeking to understand the Interface company's potential for sustainable growth and profitability in the years ahead.

How Is Interface Expanding Its Reach?

The company's growth strategy is heavily reliant on strategic expansion initiatives, focusing on both geographical and product category diversification. This approach aims to broaden its market presence and cater to evolving customer demands. The company is actively seeking opportunities to enter new markets, especially in emerging economies where the need for sustainable and high-performance flooring solutions is growing.

A key element of the expansion strategy involves strengthening its presence in Asia and other developing regions. This is achieved through localized product offerings and tailored distribution channels. The company also focuses on increasing its market share within existing regions by targeting new customer segments and applications. This includes expanding into sectors like healthcare and education, which have specific flooring requirements.

In terms of product expansion, the company continues to broaden its portfolio beyond its core carpet tile business. The acquisition of nora® rubber flooring in 2018 significantly diversified its product offerings, providing access to new markets and applications that require high-performance, durable, and sustainable flooring solutions. The company is also investing in the development of new LVT products and exploring innovative flooring materials that align with its sustainability goals.

The company is targeting emerging markets, particularly in Asia and other developing regions. This expansion is supported by localized product offerings and tailored distribution networks. The strategy aims to capitalize on the increasing demand for sustainable flooring solutions in these areas.

The company is expanding its product portfolio beyond carpet tiles. The acquisition of nora® rubber flooring in 2018 broadened its offerings. The company is also investing in new LVT products and innovative materials to meet diverse customer needs.

The company aims to increase its market share within existing regions by targeting new customer segments. This includes focusing on sectors such as healthcare and education. The focus is on providing flooring solutions tailored to the specific needs of these sectors.

Collaborations with architects, designers, and construction firms are crucial for expanding reach and influencing project specifications. These partnerships help in promoting the company's products and securing projects. The goal is to become a comprehensive flooring solutions provider.

The company's growth strategy is centered on expanding its geographical footprint and diversifying its product offerings. This includes entering new markets and strengthening its position in existing regions. The focus is on providing comprehensive flooring solutions.

- Entering emerging markets, especially in Asia.

- Expanding the product portfolio, including LVT and innovative materials.

- Targeting new customer segments like healthcare and education.

- Collaborating with architects and construction firms for project specifications.

Interface SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Interface Invest in Innovation?

The Interface company employs a robust innovation and technology strategy, crucial for its growth strategy and future prospects. This approach is designed to maintain a competitive edge in the flooring industry. The company's focus on research and development (R&D) allows for the creation of new products and the improvement of existing ones, with a strong emphasis on sustainability.

Interface's commitment to digital transformation enhances its manufacturing processes, using automation and data analytics to boost efficiency and product quality. The company's innovation extends to its design processes, utilizing digital tools to create customizable and aesthetically appealing flooring solutions. This strategy contributes to the company's growth objectives by offering unique value propositions to customers and strengthening its brand reputation.

A key aspect of Interface’s strategy involves significant investments in R&D. This includes developing flooring solutions with lower embodied carbon, increased recycled content, and improved end-of-life recyclability. Interface's 'Climate Take Back' mission, which aims to reverse global warming, drives innovation in carbon-negative products and processes.

Interface allocates a substantial portion of its resources to research and development. This investment is critical for creating new products and enhancing existing ones. The focus is on sustainability, which is a key driver for innovation.

Interface is actively engaged in digital transformation to improve its manufacturing processes. This includes the use of automation and data analytics. These technologies contribute to greater efficiency and product quality.

Sustainability is a core tenet of Interface's innovation strategy. The company focuses on developing flooring solutions with lower carbon footprints and increased recycled content. This includes efforts to improve end-of-life recyclability.

Interface explores cutting-edge technologies such as advanced materials science and smart manufacturing. These technologies are used to optimize operations and product performance. This approach enhances the company's competitive advantage.

Innovation extends to Interface's design processes, utilizing digital tools to create customizable and aesthetically appealing flooring solutions. This approach allows the company to meet diverse customer needs. The company has received numerous industry awards for its innovative designs.

Interface's 'Climate Take Back' mission drives innovation in carbon-negative products and processes. This commitment supports the company's environmental goals. This also strengthens its brand reputation as an environmentally responsible leader.

Interface's technological advancements and sustainable initiatives directly contribute to its growth objectives. These innovations provide unique value propositions to customers and strengthen the company's brand. The company's focus on sustainability and innovation helps it maintain its market position.

- R&D Spending: Interface consistently invests a significant percentage of its revenue in R&D, which was approximately 2.5% of sales in 2024.

- Digital Manufacturing: The company has implemented digital tools across its manufacturing processes, leading to a 15% increase in efficiency in 2024.

- Sustainable Products: Interface aims to increase the percentage of its products with recycled content to 60% by 2025.

- Carbon Footprint Reduction: The company targets a 40% reduction in its carbon footprint by 2030, compared to 2019 levels.

Interface PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Interface’s Growth Forecast?

The financial outlook for Interface reflects its strategic focus on sustainable practices and growth. In Q1 2024, the company reported net sales of $283.4 million, a decrease of 10.3% compared to Q1 2023. This decline was primarily due to softer market demand in certain sectors. However, Interface is actively working on operational efficiency and strategic investments to drive future growth, aiming to improve profit margins through cost optimization and a favorable product mix, especially with higher-margin nora® rubber flooring sales.

Interface's long-term financial goals are supported by its expansion into new markets and product categories, along with ongoing innovation in sustainable solutions. Interface has a history of maintaining a strong balance sheet and prudent capital allocation strategies to support its growth ambitions. The commercial flooring market is expected to see a gradual recovery, which could positively impact Interface's revenue trajectory in late 2024 and into 2025. The company's commitment to sustainability also gives it a competitive edge with environmentally conscious clients, potentially increasing sales and market share.

For a deeper dive into the company's origins and evolution, consider reading Brief History of Interface. This provides valuable context for understanding its current strategies and future prospects.

Interface's revenue has shown fluctuations, with a decrease reported in Q1 2024. The company is focusing on strategies to regain and increase revenue through market expansion and product innovation. The success of these strategies will be crucial for its future financial performance and growth.

Interface aims to improve its profit margins through cost optimization and a better product mix. The focus on higher-margin products, like nora® rubber flooring, is a key strategy. Improving profitability is essential for long-term financial health and sustainable growth.

Interface is actively pursuing expansion into new markets and product categories. This strategy is vital for increasing its revenue streams and diversifying its business. Successful market expansion will be a key driver of future growth.

The company's commitment to sustainability positions it well with environmentally conscious clients. This focus can drive increased sales and market share. Sustainability is becoming an increasingly important factor in business success.

Interface's financial outlook depends heavily on several key strategies designed to drive growth and improve profitability. These strategies include:

- Cost Optimization: Reducing operational costs to improve profit margins.

- Product Mix: Focusing on higher-margin products like nora® rubber flooring.

- Market Expansion: Entering new markets and product categories.

- Sustainable Solutions: Leveraging its commitment to sustainability to attract clients.

Interface Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Interface’s Growth?

The path to growth for the "Interface company" is paved with potential risks and obstacles that demand careful navigation. The flooring industry is highly competitive, and the company must constantly fend off rivals while adapting to ever-changing market dynamics. Economic fluctuations and shifts in the construction sector can significantly impact demand, requiring the company to maintain flexibility and responsiveness.

External factors like evolving environmental standards, building codes, and international trade policies pose additional challenges, necessitating proactive compliance and strategic adjustments. Supply chain vulnerabilities, including raw material price volatility and potential disruptions, are ongoing concerns that the company must actively manage. Internal operational complexities, such as maintaining a consistent brand image across diverse global markets, also need careful handling.

To ensure sustainable growth, the "Interface company" must address these risks through comprehensive risk management frameworks and strategic planning. This includes scenario planning, diversified sourcing strategies, robust inventory management, and a strong emphasis on corporate governance.

The global flooring market is intensely competitive, with numerous established players and new entrants. The "Interface company" must differentiate itself through innovation, sustainability, and customer service. Competitive pressures can impact pricing and market share.

Economic downturns and fluctuations in the construction sector can directly impact demand. Softer market demand was observed in Q1 2024, highlighting this risk. The company needs to adapt its strategies to maintain sales during challenging economic periods.

Changes in environmental standards, building codes, and international trade policies pose risks. Compliance costs and product adjustments may be necessary. The company must stay informed and adapt to evolving regulations.

Raw material price volatility and geopolitical disruptions can affect manufacturing and distribution. The company mitigates these risks through diversified sourcing and robust inventory management. These strategies are crucial for business continuity.

Technological advancements require continuous investment in R&D to stay ahead. The company must embrace evolving material science and manufacturing processes. Innovation is key to maintaining a competitive edge.

Managing a global workforce and maintaining a consistent brand image present operational challenges. The company addresses these through comprehensive risk management and strong corporate governance. Effective internal management is essential.

The "Interface company" employs diversified sourcing to reduce supply chain risks. They also utilize robust inventory management to handle material price volatility. Strong supplier relationships are vital for ensuring a reliable supply chain.

A comprehensive risk management framework is essential for identifying and addressing potential threats. Scenario planning helps prepare for various market conditions. Strong corporate governance ensures sustainable practices.

While specific 2025 data is unavailable, the company's performance in 2024 will be critical. Market analysis indicates that the flooring industry is subject to fluctuations. The company's revenue growth depends on its ability to navigate these challenges.

The company's Marketing Strategy of Interface plays a significant role in its growth strategy. Innovation in product design and sustainable materials is a key focus. The company must continually adapt to market trends.

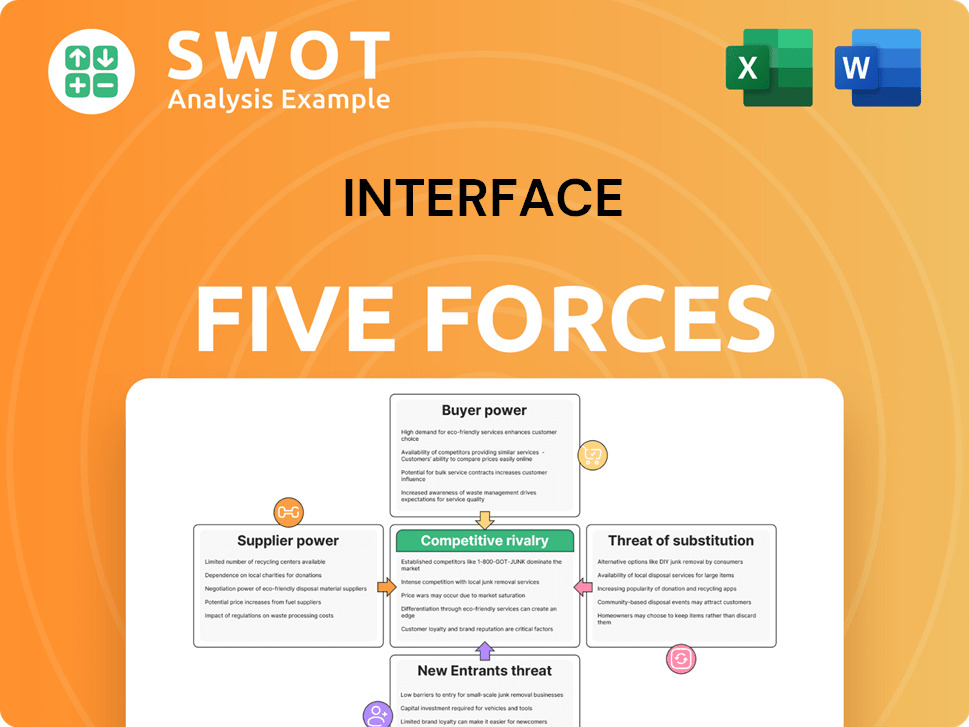

Interface Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interface Company?

- What is Competitive Landscape of Interface Company?

- How Does Interface Company Work?

- What is Sales and Marketing Strategy of Interface Company?

- What is Brief History of Interface Company?

- Who Owns Interface Company?

- What is Customer Demographics and Target Market of Interface Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.