Interface Bundle

How Does Interface Company Thrive in the Flooring Industry?

Interface, Inc. isn't just a flooring provider; it's a sustainability pioneer reshaping the commercial and residential design landscape with its innovative Interface SWOT Analysis. From modular carpet to luxury vinyl tile (LVT) and nora® rubber flooring, the company's commitment to environmental stewardship sets a new industry standard. Its groundbreaking initiatives, like 'Mission Zero' and 'Climate Take Back,' showcase a dedication to reducing carbon footprints and promoting sustainable manufacturing.

This exploration into Interface Company will uncover the secrets behind its success, offering insights for investors, customers, and industry watchers alike. We'll examine the inner workings of Interface flooring, exploring its revenue streams, strategic positioning, and the core processes that drive its value creation in the competitive flooring solutions market. Understanding the company's approach to product lifecycle and resource management provides a compelling case study in integrating profitability with purpose, covering topics such as Interface flooring cost per square foot and where to buy Interface flooring.

What Are the Key Operations Driving Interface’s Success?

The core operations of the Interface Company revolve around the design, manufacturing, and distribution of flooring solutions. The company specializes in modular carpet, LVT (Luxury Vinyl Tile), and nora® rubber flooring. These products serve diverse markets, including corporate offices, educational institutions, healthcare facilities, hospitality venues, government buildings, and retail spaces worldwide.

The value proposition of Interface flooring lies in its commitment to sustainability and innovation. The company offers flooring options that contribute to healthier indoor environments and reduce the environmental impact of buildings. Their operations are vertically integrated, ensuring quality and sustainability from raw material sourcing to manufacturing and distribution.

Key to Interface's operations is its proprietary manufacturing technology for carpet tiles, enabling precise design and efficient production. They also have expertise in nora® rubber flooring, known for its durability. The company’s supply chain emphasizes circularity through programs like ReEntry®, which reclaims end-of-life carpet tiles for recycling. This approach differentiates Interface modular flooring from competitors, providing customers with sustainable and high-performing flooring solutions.

Interface utilizes advanced manufacturing techniques to produce its flooring products. The company focuses on using recycled and bio-based materials. For example, some of their carpet tiles contain up to 89% recycled content. Manufacturing facilities are strategically located to optimize production and minimize environmental impact, often using renewable energy sources.

Interface has a global distribution network, leveraging direct sales forces, independent distributors, and showrooms. Partnerships with design firms, architects, and contractors are crucial for product specification and market penetration. This multi-channel approach ensures that Interface flooring reaches customers effectively across various regions and sectors.

Sustainability is deeply integrated into Interface's operations. Their commitment to circularity, as highlighted in the Growth Strategy of Interface, is a key differentiator. The ReEntry® program, for instance, exemplifies their efforts to close the loop on material usage. This focus on sustainability benefits customers by offering products with extended lifecycles and reduced embodied carbon.

Customers benefit from healthier indoor environments, reduced embodied carbon in buildings, and products with extended lifecycles. These benefits are a direct result of Interface's sustainable practices and innovative product design. The company's focus on sustainability enhances its value proposition and strengthens its position in the commercial flooring market.

Interface's operational strengths include its proprietary manufacturing technology and expertise in nora® rubber flooring. The company’s supply chain and distribution networks are also key to its success. These strengths contribute to Interface's ability to provide high-quality, sustainable flooring solutions.

- Proprietary manufacturing technology for precise design and efficient production of carpet tiles.

- Expertise in nora® rubber flooring, known for durability in demanding environments.

- A circular supply chain with programs like ReEntry® for recycling end-of-life carpet tiles.

- Global distribution networks including direct sales, independent distributors, and showrooms.

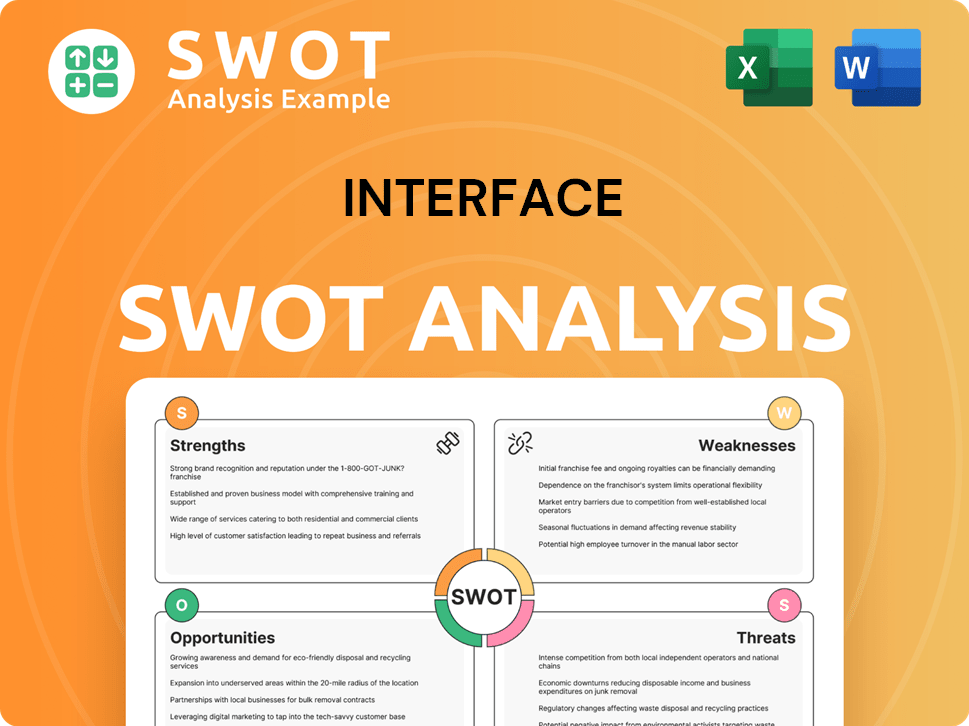

Interface SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Interface Make Money?

The revenue streams and monetization strategies of the Interface Company are centered around its diverse flooring product offerings. The company primarily generates revenue through the sale of modular carpet, luxury vinyl tile (LVT), and nora® rubber flooring. These products cater to both commercial and residential markets, establishing multiple avenues for revenue generation.

In fiscal year 2023, Interface reported net sales of $1.268 billion, demonstrating the scale of its operations. While specific figures for 2024-2025 are still emerging, the company's financial performance reflects its ability to adapt to market demands and maintain a strong position in the flooring industry. The company's focus on innovation and sustainability further enhances its market appeal.

Interface employs a premium pricing model, reflecting the high quality, design innovation, and sustainability of its products. This strategy allows the company to capture value and maintain profitability. Furthermore, Interface utilizes a direct sales approach for large commercial projects, complemented by a robust distribution network for broader market reach, ensuring comprehensive market coverage.

Interface's monetization strategies are designed to maximize revenue across different market segments. The company leverages its brand reputation and commitment to sustainability to attract environmentally conscious clients. The recurring demand for flooring in commercial spaces, due to wear and tear or redesigns, creates a steady revenue stream. For more insights, consider exploring the Target Market of Interface.

- Product Sales: The primary revenue stream comes from selling modular carpet, LVT, and nora® rubber flooring.

- Premium Pricing: Reflects the high quality, design innovation, and sustainability of the products.

- Direct Sales and Distribution: Direct sales for large projects and a distribution network for broader market reach.

- Recurring Revenue: Steady demand from commercial spaces due to wear and tear and redesigns.

- Sustainability Focus: Attracts environmentally conscious clients and fosters repeat business.

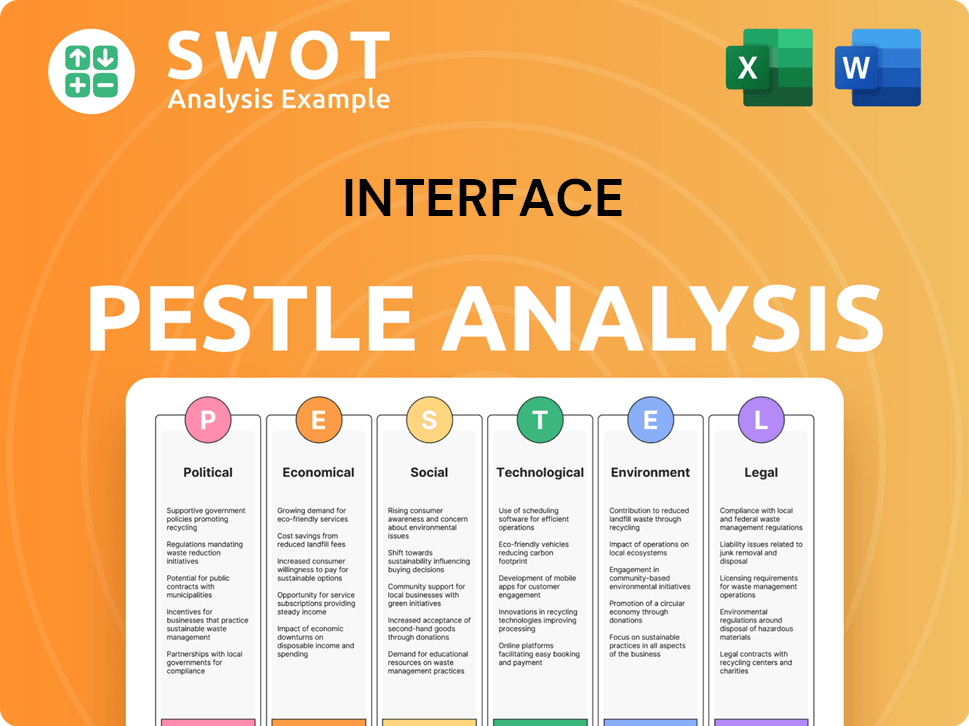

Interface PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Interface’s Business Model?

The journey of the Interface Company has been marked by significant milestones, strategic moves, and a commitment to sustainability. The company's evolution reflects a proactive approach to market demands and environmental responsibility. This has positioned Interface flooring as a leader in the commercial flooring sector.

A key aspect of Interface's strategy involves adapting to changing market dynamics. The company has faced operational challenges, including supply chain disruptions and fluctuating raw material costs. However, it has responded by optimizing its global supply chain and investing in manufacturing efficiencies. These actions have helped maintain its competitive edge.

The company's competitive advantages are built on a strong brand, sustainable practices, and a global network. Interface continually integrates new trends like biophilic design and smart building technologies. This approach helps maintain its position in the dynamic flooring market, ensuring its business model remains robust.

A major milestone was the 'Mission Zero' initiative launched in 1994, aiming to eliminate environmental impact by 2020. This led to innovations in recycled content and renewable energy. The company's focus on sustainability has been a core element of its strategy.

A pivotal move was the acquisition of nora® systems in 2018. This expanded the product portfolio beyond carpet tiles to include rubber flooring. This diversification strengthened the company's position as a flooring solutions provider.

The company's competitive edge stems from its sustainability leadership and global network. The ReEntry® program exemplifies its commitment to circular economy principles. This resonates with environmentally conscious clients, enhancing its market appeal.

In recent years, the company has focused on optimizing its supply chain to address disruptions. It has also invested in manufacturing efficiencies to manage costs. These efforts support its ability to maintain profitability and market share.

The company's commitment to sustainability is a key differentiator in the commercial flooring market. Interface modular flooring is designed with circular economy principles in mind. The company's initiatives include closed-loop manufacturing and the use of recycled materials.

- The ReEntry® program allows for the recycling of used flooring products.

- The company continually innovates in product design to reduce environmental impact.

- Interface actively seeks partnerships to advance its sustainability goals.

- These efforts have helped the company reduce its carbon footprint significantly.

For more detailed insights into the financial aspects and ownership structure of the company, you can review the information available at Owners & Shareholders of Interface. This provides a deeper understanding of the company's strategic direction and financial performance.

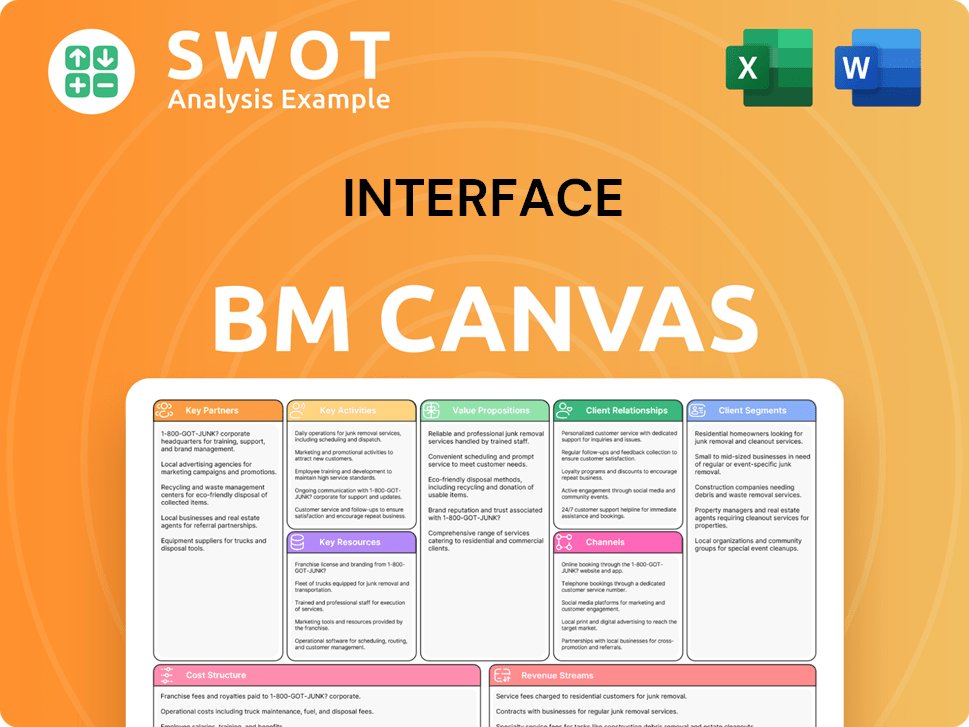

Interface Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Interface Positioning Itself for Continued Success?

The Interface Company holds a significant position in the global commercial flooring market, particularly in the modular carpet and sustainable flooring segments. It's well-regarded among architects, designers, and corporate clients due to its focus on sustainability and design. Interface flooring has a strong brand presence and a wide distribution network across numerous countries.

However, Interface Company faces various challenges. These include potential economic downturns affecting commercial construction, fluctuations in raw material prices, and intense competition. The company also navigates evolving environmental regulations and the emergence of new flooring technologies. To address these, Interface is focused on strategic initiatives like sustainable product development and expanding into new markets.

Interface has a strong presence in the commercial flooring sector, especially with its Interface modular flooring and sustainable products. Its brand is recognized for quality and design. The company's reach is global, with established sales and distribution channels.

Key risks include economic downturns, raw material price volatility, and competition. Changes in environmental standards and new technologies pose challenges. The company must also adapt to evolving design preferences within the flooring solutions market.

The future outlook emphasizes Interface's 'Climate Take Back' mission, which aims to reverse global warming. The company plans to expand its profitability through product diversification, operational efficiency, and by leveraging its environmental stewardship to capture a larger share of the increasingly sustainability-driven global flooring market. For more information about Interface Company's strategy, you can read the Marketing Strategy of Interface.

Interface focuses on sustainable product innovation and market expansion. It aims to strengthen its position in LVT and nora® rubber flooring. The company’s plans include product diversification and operational efficiency.

Interface Company continues to innovate in the sustainable flooring market. It is essential for investors and stakeholders to consider the company's ability to adapt to changing market demands and environmental regulations. Understanding the Interface flooring product specifications and its commitment to sustainability are crucial.

- The company's focus on sustainable products aligns with growing market demands.

- Expansion into new geographic markets is a key strategic move.

- Operational efficiency and product diversification are critical for sustained profitability.

- The company's environmental stewardship strengthens its market position.

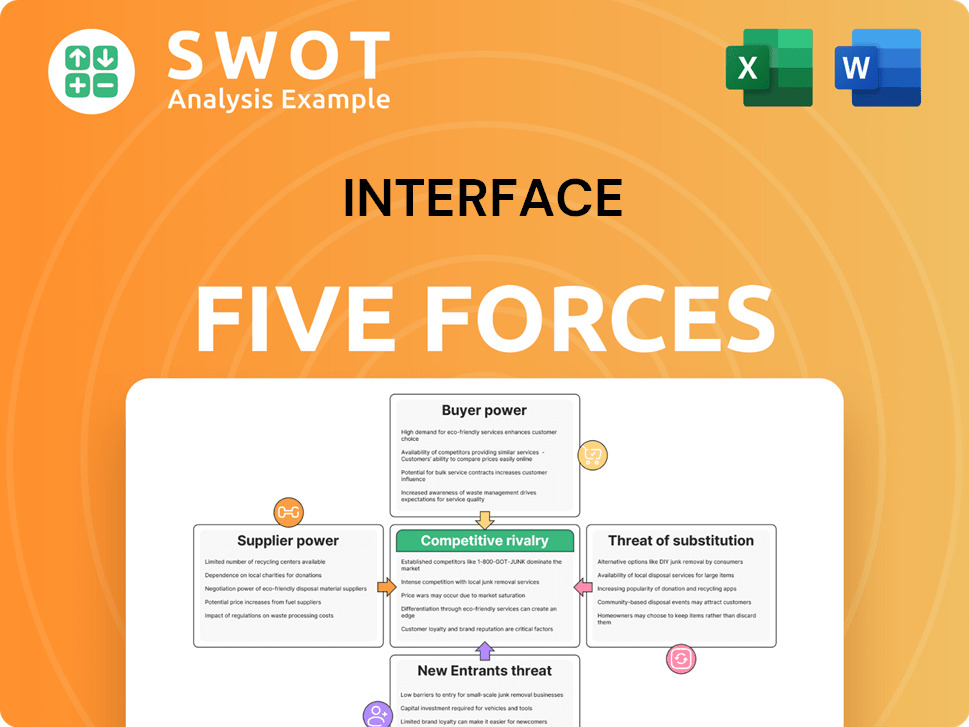

Interface Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interface Company?

- What is Competitive Landscape of Interface Company?

- What is Growth Strategy and Future Prospects of Interface Company?

- What is Sales and Marketing Strategy of Interface Company?

- What is Brief History of Interface Company?

- Who Owns Interface Company?

- What is Customer Demographics and Target Market of Interface Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.