Interface Bundle

Who Really Owns Interface Inc.?

Founded by the visionary Ray C. Anderson, Interface Inc. revolutionized the commercial flooring industry with its innovative carpet tile solutions. From its humble beginnings in 1973, Interface has transformed into a global leader, constantly pushing the boundaries of sustainable flooring. But who holds the reins of this publicly traded company, and how has ownership shaped its remarkable journey?

Understanding the ownership structure of Interface SWOT Analysis is critical to grasping its strategic direction and market influence. Interface, a pioneer in sustainable flooring, has seen its ownership evolve significantly since its inception. This analysis will explore the key players, from the initial vision of Ray C. Anderson to the current landscape of shareholders, impacting the company's future in the competitive commercial flooring market. The company's commitment to environmental sustainability, including its 'Climate Take Back' mission, further adds layers of complexity to its ownership narrative.

Who Founded Interface?

The story of Interface, Inc. begins in 1973 with Ray C. Anderson, the company's founder. Anderson, armed with a degree in industrial and systems engineering from Georgia Institute of Technology, launched the venture with a vision to revolutionize the flooring industry. His prior experience in the carpet trade, including a joint venture involving carpet tiles, provided the foundation for his entrepreneurial endeavor.

Initially known as Carpets International Georgia, the company was established in LaGrange, Georgia. The focus was on the innovative fusion bonding process for manufacturing carpet tiles. Anderson's leadership was crucial in shaping the company's early direction, targeting the commercial flooring market. The company's name changed to Interface Flooring Systems in 1982, and it became a publicly traded corporation the following year.

While specific details about the initial ownership structure and early investors are not readily available in the provided information, Ray C. Anderson's role as the founder was central to the company's inception and early growth. His vision for sustainable practices and innovative products would later become a hallmark of Interface.

Ray C. Anderson, the founder of Interface, had over 14 years of experience in the carpet trade. He held a degree in industrial and systems engineering from Georgia Institute of Technology. His background included working with Callaway Mills and Deering-Milliken.

The company was initially named Carpets International Georgia. It was later renamed Interface Flooring Systems in 1982. The company's focus was on the innovative fusion bonding process for manufacturing carpet tiles.

Interface became a publicly traded corporation in 1983. This marked a significant step in the company's growth. The public offering allowed Interface to raise capital for expansion.

Interface initially focused on the commercial flooring market. This strategic choice allowed the company to specialize in a specific niche. The commercial market provided opportunities for growth.

The early days of Interface's growth strategy were marked by Ray C. Anderson's leadership and a focus on innovation. The company's transition from a private entity to a publicly traded corporation in the early 1980s was a pivotal moment. This shift allowed Interface to expand its operations and further its mission in the carpet tile and commercial flooring markets. As of 2024, Interface continues to be a major player in the sustainable flooring industry, with a strong emphasis on environmental responsibility, a legacy that began with Anderson's vision.

Interface SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Interface’s Ownership Changed Over Time?

The evolution of ownership for Interface, Inc. reflects its journey as a publicly traded entity. Initially, the company was likely closely held, but after going public in 1983, its ownership structure transformed. This transition saw a shift from a more concentrated ownership to a more dispersed model, typical for companies listed on public exchanges. The influence of institutional investors has grown significantly over time, shaping the company's strategic direction and financial performance.

As of May 2025, the ownership of Interface is predominantly held by institutional investors, reflecting a mature public company structure. The significant holdings by these investors, including mutual funds, underscore the confidence of large financial entities in the company's prospects. Simultaneously, the insider ownership, though smaller, indicates continued alignment between management and shareholder interests. This balance is crucial for ensuring both strategic vision and operational efficiency.

| Ownership Category | Percentage (May 2025) | Details |

|---|---|---|

| Institutional Investors | 98.99% | Includes mutual funds, investment firms, and other institutional entities. |

| Mutual Funds | 79.47% | A substantial portion of institutional holdings. |

| Insiders | 3.33% | Includes company executives and board members. |

Key institutional shareholders as of March 31, 2025, include BlackRock, Inc., The Vanguard Group, Inc., and others. These firms collectively hold a significant portion of the company's shares, influencing its strategic decisions. Detailed information on these holdings can be found in the company's filings, such as the 10-K for the year ending December 29, 2024, and the 10-Q for the quarter ending March 30, 2025. Understanding the ownership structure is vital for investors analyzing the company's stability and future prospects. To learn more, consider reading about the Growth Strategy of Interface.

Interface, Inc.'s ownership has evolved significantly since becoming public, with institutional investors now holding the majority of shares.

- Institutional investors hold 98.99% of shares as of May 2025.

- Mutual funds account for 79.47% of the total shares.

- Insiders have a notable stake, increasing their ownership to 3.33%.

- Key shareholders include BlackRock, The Vanguard Group, and others.

Interface PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Interface’s Board?

The current Board of Directors for Interface, Inc. is pivotal in steering the company's governance. Shareholders will elect ten members to the Board at the 2025 Annual Meeting, scheduled for May 15, 2025. The proxy statement, dated April 1, 2025, provides detailed information on the nominees, director independence, and corporate governance practices. This structure ensures that the company's strategic direction aligns with shareholder interests and regulatory requirements.

Institutional ownership is significant, and these major shareholders likely exert influence through their engagement with the board. The voting structure is based on one-share-one-vote, typical for publicly traded companies, with the record date for the 2025 annual meeting set as March 14, 2025. SEC filings, including Schedule 13D and 13G forms, report beneficial ownership exceeding 5% of equity securities, indicating large shareholder investment intentions. There is no information available about dual-class shares, special voting rights, or recent proxy battles.

| Aspect | Details | Date |

|---|---|---|

| Annual Meeting Date | May 15, 2025 | 2025 |

| Number of Directors to be Elected | 10 | 2025 |

| Record Date for Voting | March 14, 2025 | 2025 |

Understanding the board's composition and voting dynamics is crucial for anyone interested in the Interface Company. The company's structure supports a transparent governance model, which is essential for investors. For more insights into the company's strategic positioning, consider exploring the Target Market of Interface.

The Board of Directors oversees the strategic direction of Interface Inc. The voting structure is straightforward, with one share equating to one vote, ensuring equitable shareholder representation. This approach supports the company's commitment to transparency and accountability.

- Shareholder elections are held annually.

- Institutional investors hold a significant stake.

- Governance follows standard public company practices.

- The company focuses on sustainable flooring solutions.

Interface Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Interface’s Ownership Landscape?

Over the past few years, Interface Inc. has maintained its strategic focus on sustainability and operational efficiency. The company's financial performance in 2024 showed resilience, with global billings increasing across all product categories, leading to enhanced profitability despite industry challenges. Net sales reached $1.316 billion in 2024, reflecting a 4.3% year-over-year increase. Cash from operations generated $$148 million, which facilitated the repayment of $$115 million in debt. As of early February 2025, the backlog of unshipped orders was approximately $$223.4 million.

A notable trend in Interface's ownership structure is the sustained high level of institutional ownership. This remained at 98.99% in May 2025, with mutual fund holdings unchanged at 79.47%. Insider ownership saw a slight uptick, increasing from 3.24% to 3.33% in May 2025. Interface's commitment to becoming carbon-negative by 2040 and achieving verified science-based targets by 2030 is a key differentiator, appealing to investors increasingly focused on environmental, social, and governance (ESG) leadership. In April 2024, the company shifted its strategy away from carbon offsets, prioritizing direct carbon reduction. Recent SEC filings in 2025, including a Form 8-K on June 12, 2025, show the elimination of the Chief Innovation & Sustainability Officer position, potentially indicating a restructuring within the company's sustainability leadership.

| Metric | 2024 | 2025 (as of May) |

|---|---|---|

| Net Sales | $1.316 billion | N/A |

| Cash from Operations | $148 million | N/A |

| Institutional Ownership | 98.99% (as of May 2025) | 98.99% |

| Mutual Funds Holding | 79.47% (as of May 2025) | 79.47% |

| Insider Ownership | 3.24% (as of May 2025) | 3.33% |

The evolution of Interface Company, from its founding to its current market position, highlights its adaptation and innovation in the commercial flooring sector. For a deeper dive into the history of Interface and its strategic direction, explore this article about Interface.

Interface is a leader in sustainable flooring solutions, offering products like carpet tile. It focuses on eco-friendly manufacturing.

The company's commitment to carbon neutrality and reducing environmental impact is a key part of its business strategy, attracting investors interested in ESG.

Interface Inc. continues to innovate and adapt in the commercial flooring market. Recent financial results show the company's resilience.

Interface's product range caters to various commercial needs, providing durable and design-focused flooring solutions for different sectors.

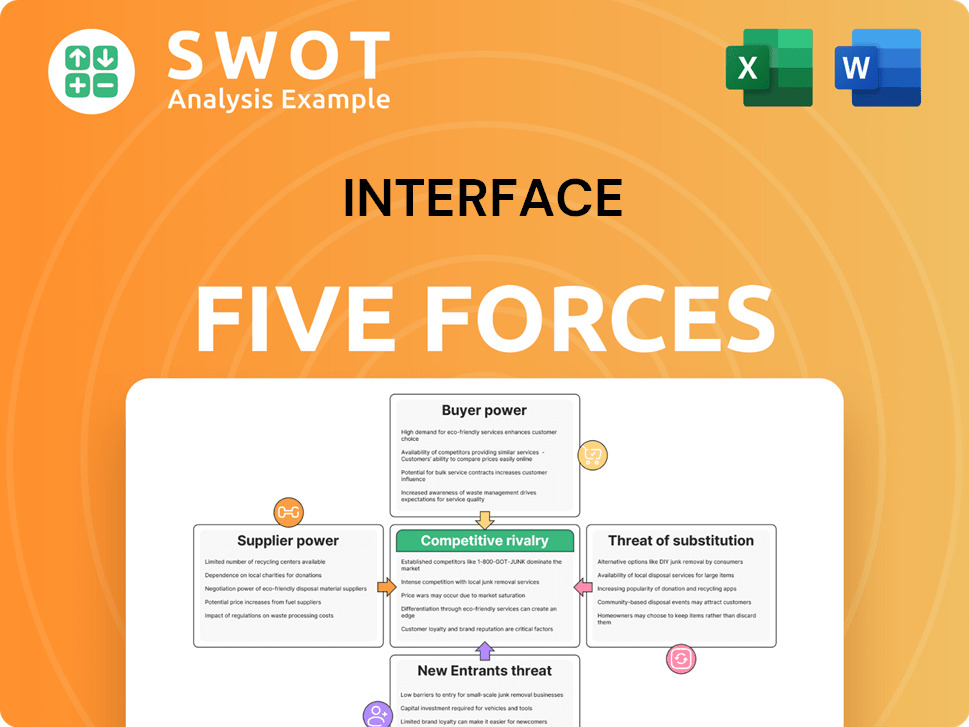

Interface Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Interface Company?

- What is Competitive Landscape of Interface Company?

- What is Growth Strategy and Future Prospects of Interface Company?

- How Does Interface Company Work?

- What is Sales and Marketing Strategy of Interface Company?

- What is Brief History of Interface Company?

- What is Customer Demographics and Target Market of Interface Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.