Kimberly-Clark Bundle

Can Kimberly-Clark's 'Powering Care' Strategy Reshape Its Future?

Kimberly-Clark, a titan in the personal care industry, is embarking on a significant transformation with its 'Powering Care' strategy, launched in 2024. This strategic shift, the most comprehensive in the company's 150-year history, aims to redefine its market position and drive future growth. From its origins in 1872, the company has evolved into a global leader, and now it's time to see how its new approach will impact its future.

This Kimberly-Clark SWOT Analysis delves into the specifics of this ambitious plan, examining the Kimberly-Clark growth strategy and its potential impact on the company's Kimberly-Clark future prospects. We'll explore the Kimberly-Clark company analysis, evaluating key aspects such as Kimberly-Clark market share, Kimberly-Clark financial performance, and the evolution of its Kimberly-Clark business model. The analysis will also touch upon Kimberly-Clark strategic initiatives 2024 and the overall Kimberly-Clark competitive landscape analysis, providing a comprehensive view of the company's trajectory.

How Is Kimberly-Clark Expanding Its Reach?

The expansion initiatives of Kimberly-Clark are primarily centered around increasing manufacturing capacity, entering new product categories through innovation, and optimizing its global operating model. These strategic moves are crucial for the company's Kimberly-Clark growth strategy and future prospects.

A significant aspect of this strategy involves a substantial investment in North America. This commitment underscores the company's focus on strengthening its presence in key markets and capitalizing on growth opportunities. These efforts are designed to enhance Kimberly-Clark market share and improve overall Kimberly-Clark financial performance.

The company's strategic initiatives are designed to drive long-term value and ensure sustainable growth. The company's focus on innovation and operational efficiency is vital for navigating the Kimberly-Clark competitive landscape analysis.

Kimberly-Clark plans to invest over $2 billion in its North America business over the next five years. This is the largest domestic expansion in over 30 years. The investment includes new manufacturing facilities and expansions of existing sites, focusing on high-growth categories.

A new advanced manufacturing facility is planned in Warren, Ohio, spanning over a million square feet. This facility will serve the Northeast and Midwest regions, focusing on baby diapers and incontinence products. Construction is scheduled to begin in May 2025.

The Beech Island, South Carolina, site will be expanded with a state-of-the-art automated distribution center. This center will use advanced robotics and AI-powered logistics to improve efficiency. The expansion aims to enhance operational capabilities and speed to market.

These expansion projects are expected to create over 900 highly skilled jobs. These jobs will be in industrial automation and advanced manufacturing. This will strengthen the domestic supply chain.

Beyond North America, Kimberly-Clark is reorganizing its operations into three segments: North America, International Personal Care (IPC), and International Family Care & Professional (IFP). The IPC segment will focus on growth in core categories across five core markets and 50 enterprise markets by optimizing routes-to-market and simplifying product portfolios. IFP aims to improve its business mix and profitability by growing six iconic brands in family care and professional markets, leveraging shared technology platforms. This strategic reorganization is part of the company's broader 'Powering Care' strategy, designed to cultivate agility, speed, and focused execution across its global operations. For more insights, you can refer to the article on Kimberly-Clark's strategic initiatives 2024.

Kimberly-Clark is focusing on several key areas to drive growth and improve financial performance. These initiatives are designed to address Kimberly-Clark challenges and opportunities in the market.

- Enhancing manufacturing capacity through significant investments in North America.

- Entering new product categories via innovation, focusing on high-growth areas.

- Optimizing the global operating model through reorganization into focused business segments.

- Leveraging advanced technologies like AI and robotics to improve operational efficiency.

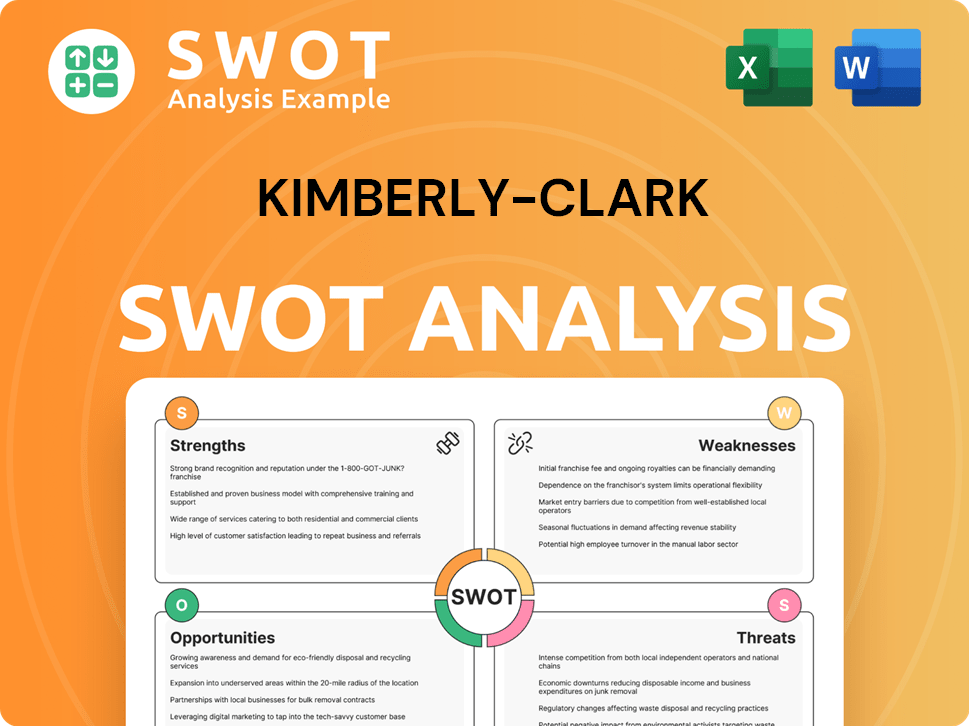

Kimberly-Clark SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kimberly-Clark Invest in Innovation?

The innovation and technology strategy of the company is a core element of its overall growth strategy. This approach is designed to meet evolving consumer needs and maintain a competitive edge in the market. The company's focus on innovation is evident in its investments in research and development, as well as its commitment to sustainability.

The company's 'Powering Care' strategy is significantly driven by continuous investment in innovation and technology. This strategy focuses on accelerating 'Pioneering Innovation' by investing in science and technology to meet evolving consumer needs. This includes enhancing existing brands and launching new product lines. The company's digital transformation efforts, such as the expansion of its digital technology center, are crucial for analyzing consumer trends, optimizing production processes, and forecasting demand more accurately.

Sustainability is a critical component of the company's innovation strategy. The company aims to deliver products with enhanced consumer benefits while striving to use less material and increasing the use of more sustainable materials. A notable ambition is to be 100% Natural Forest Free across its product portfolio, with a goal of being more than halfway there by 2030. In 2024, the company received an Innovation Strategy award in the 'Ability to Change' category, recognizing its commitment to adapting to market demands and promoting healthy lifestyles globally, partly through reusable products that reduce waste.

R&D investments and proprietary manufacturing technologies enable the creation of new and improved consumer products. This focus on innovation has led to significant growth in its innovation pipeline value. The company is continuously investing in research and development to stay ahead of market trends.

The company is expanding its digital technology center to analyze consumer trends and optimize production processes. Digital transformation is crucial for forecasting demand more accurately and improving operational efficiency. This includes leveraging data analytics and digital tools to enhance product development and supply chain management.

Sustainability is a key focus, with the goal of using less material and increasing the use of sustainable materials. The company aims to be 100% Natural Forest Free across its product portfolio. These initiatives are part of a broader effort to reduce environmental impact and meet consumer demand for eco-friendly products.

The company is focused on launching new product lines and enhancing existing brands. This includes innovations in material invention, product engineering, and manufacturing process innovation. The company's product development pipeline is robust, with new launches planned for 2025.

The company has seen a significant growth in its innovation pipeline value. The contribution to personal care growth has doubled since 2019. This pipeline includes a variety of projects aimed at meeting evolving consumer needs and market demands.

The company's commitment to adapting to market demands has been recognized with awards. This includes promoting healthy lifestyles globally through reusable products. The ability to change and adapt is crucial for long-term success in the consumer goods market.

The company's approach to innovation and technology is multi-faceted, focusing on several key areas to drive growth and maintain its competitive position. The company's growth strategy is heavily reliant on these initiatives, which are designed to meet evolving consumer needs and market demands. For a deeper understanding, you can explore the Competitors Landscape of Kimberly-Clark.

- Research and Development (R&D): Continuous investment in R&D to create new and improved products. This includes material invention, product engineering, and manufacturing process innovation.

- Digital Transformation: Leveraging digital technologies to analyze consumer trends, optimize production, and improve demand forecasting. This involves expanding digital technology centers and utilizing data analytics.

- Sustainability: Focusing on sustainable materials and reducing environmental impact. This includes initiatives to be Natural Forest Free and reduce waste.

- Product Development: Launching new product lines and enhancing existing brands. This involves a robust pipeline of new product launches planned for 2025.

- Innovation Pipeline: Growing the value of the innovation pipeline and increasing its contribution to personal care growth. This includes a variety of projects aimed at meeting evolving consumer needs.

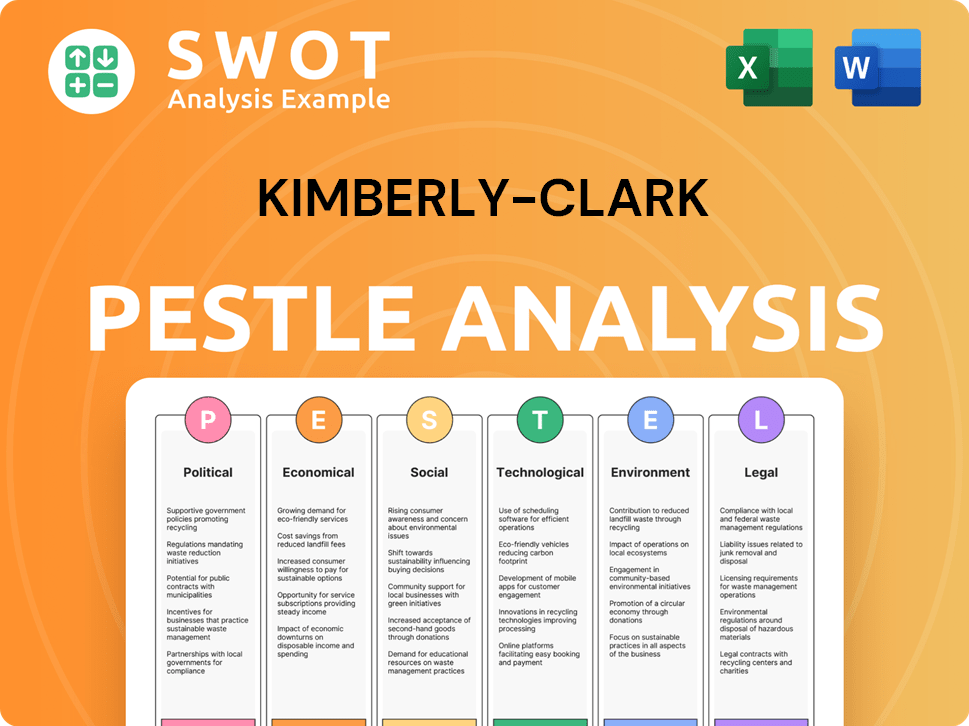

Kimberly-Clark PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kimberly-Clark’s Growth Forecast?

The financial outlook for Kimberly-Clark in 2025 focuses on sustained growth and operational efficiency. The company's performance in 2024 set a base for future strategic initiatives, aiming to navigate market dynamics effectively. Understanding the financial performance is crucial for assessing the Owners & Shareholders of Kimberly-Clark.

In 2024, Kimberly-Clark reported net sales of $20.1 billion, though this was a 1.8% decrease from the previous year. This decline was primarily due to negative impacts from foreign currency translation and divestitures. However, organic sales grew by 3.2%, indicating underlying strength in the business.

Kimberly-Clark's 2025 projections indicate an expectation of organic sales growth above the average rate of 2%. However, reported net sales are expected to be negatively impacted by currency translation and the divestiture of PPE and the exit of private label diapers in the U.S. The company anticipates adjusted operating profit to grow at a high single-digit rate, with adjusted earnings per share expected to grow at a mid-to-high single-digit rate.

Net sales reached $20.1 billion. Organic sales grew by 3.2%. Adjusted operating profit was $3.2 billion, a 9.4% increase. Adjusted earnings per share (EPS) increased by 11.1% to $7.30.

Organic sales growth is projected to be above 2%. Adjusted operating profit is expected to grow at a high single-digit rate. Adjusted earnings per share are expected to grow at a mid-to-high single-digit rate. The company plans approximately $200 million in SG&A savings over the next two years.

Net sales decreased by 6% year-over-year to $4.8 billion. The decline was primarily due to foreign currency translation, divestitures, and a 1.6% organic sales decline. Despite these headwinds, the adjusted gross margin held steady at 36.9%.

Analysts anticipate an EPS of $7.50 for the current year, a 2.7% increase from fiscal 2024. The average price target for Kimberly-Clark (KMB) is $142.83. The company maintains a debt-to-adjusted EBITDA ratio of 1.9 and has a dividend yield of 3.8%.

Several financial metrics highlight Kimberly-Clark's position and future prospects. These indicators are crucial for understanding the company's performance and potential for growth. Analyzing these metrics offers insights into the company's financial health and strategic direction.

- Organic Sales Growth: Key driver of revenue, with a target above 2% in 2025.

- Adjusted Operating Profit Growth: Expected to grow at a high single-digit rate in 2025.

- Adjusted EPS Growth: Projected to grow at a mid-to-high single-digit rate in 2025.

- Debt-to-Adjusted EBITDA Ratio: Stands at 1.9, indicating a moderate debt level.

- Dividend Yield: Currently at 3.8%, reflecting the company's commitment to shareholders.

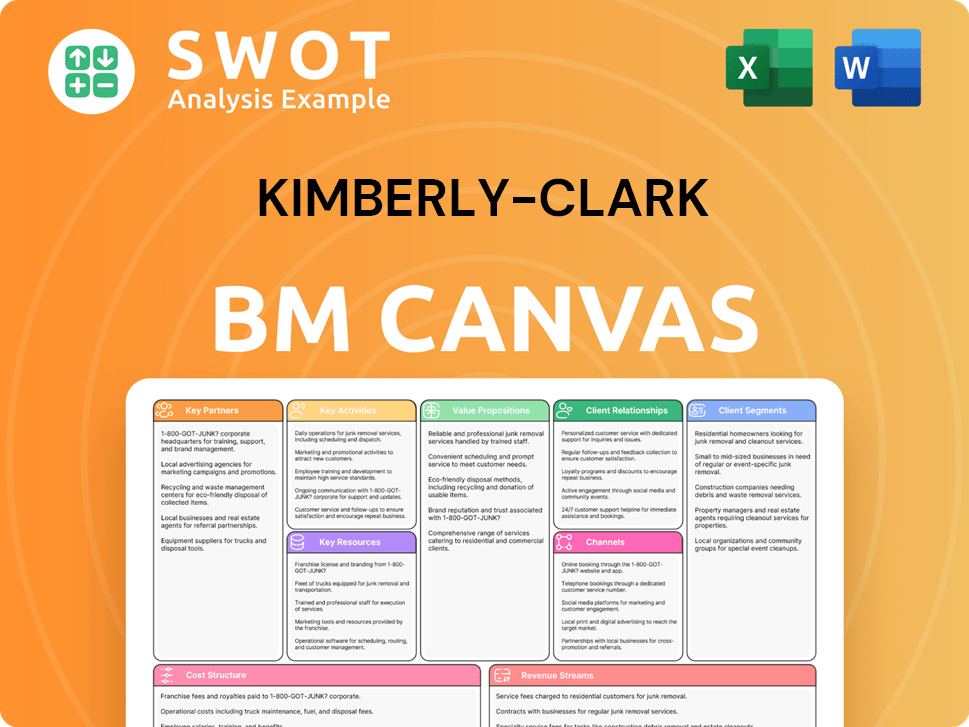

Kimberly-Clark Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kimberly-Clark’s Growth?

The company faces several potential risks and obstacles that could impact its growth. These challenges range from intense market competition and fluctuating raw material costs to geopolitical uncertainties and technological disruptions. Understanding these risks is crucial for evaluating the company's future prospects and its ability to execute its growth strategy effectively.

One of the primary challenges is the competitive landscape within the consumer goods industry. The company operates in a market where pricing power can be limited, and consumers may shift to lower-priced alternatives, such as private-label products, especially during economic downturns. This competitive pressure, combined with other factors, requires the company to continuously innovate and adapt to maintain and grow its market share.

Furthermore, external factors such as regulatory changes, trade barriers, and currency volatility add complexity to the company's operations. These factors can affect sales and profitability, particularly in international markets. The company's response to these challenges, including strategic initiatives, will be key to navigating these risks and achieving sustainable growth. For a deeper dive into its strategies, consider reading about the Marketing Strategy of Kimberly-Clark.

Intense competition within the consumer goods sector poses a constant challenge. Limited pricing power and the threat of consumers switching to lower-cost alternatives, including private-label brands, can squeeze profit margins. This requires the company to focus on innovation and efficient operations to maintain its competitive edge.

Fluctuations in raw material costs, especially for cellulose fiber, a key component in many products, can significantly impact profitability. The company's ability to adjust selling prices quickly enough to offset these cost increases is a critical factor in managing margins. This requires effective supply chain management and pricing strategies.

Regulatory changes, trade barriers, and geopolitical events can negatively affect sales and profitability, particularly in international markets. Increased tariffs, sanctions, and export controls can disrupt supply chains and raise input costs. The company must navigate these complexities to protect its global operations.

Geopolitical uncertainties, such as conflicts and trade restrictions, can disrupt supply chains and increase costs. Currency volatility, especially in high-inflation markets, also poses a significant risk. For 2025, currency translation effects are expected to negatively impact net sales by approximately 300 basis points.

The inability to innovate or effectively market products could threaten growth. The company must stay ahead of evolving consumer trends and successfully launch new products to maintain market share. Investments in digital transformation and innovation are critical for future success.

Despite challenges, the company demonstrates operational resilience through productivity gains and targeted innovation. For instance, in Q1 2025, the company aimed to achieve over $3 billion in gross productivity gains and $200 million in SG&A savings to mitigate cost pressures and enhance its operating model.

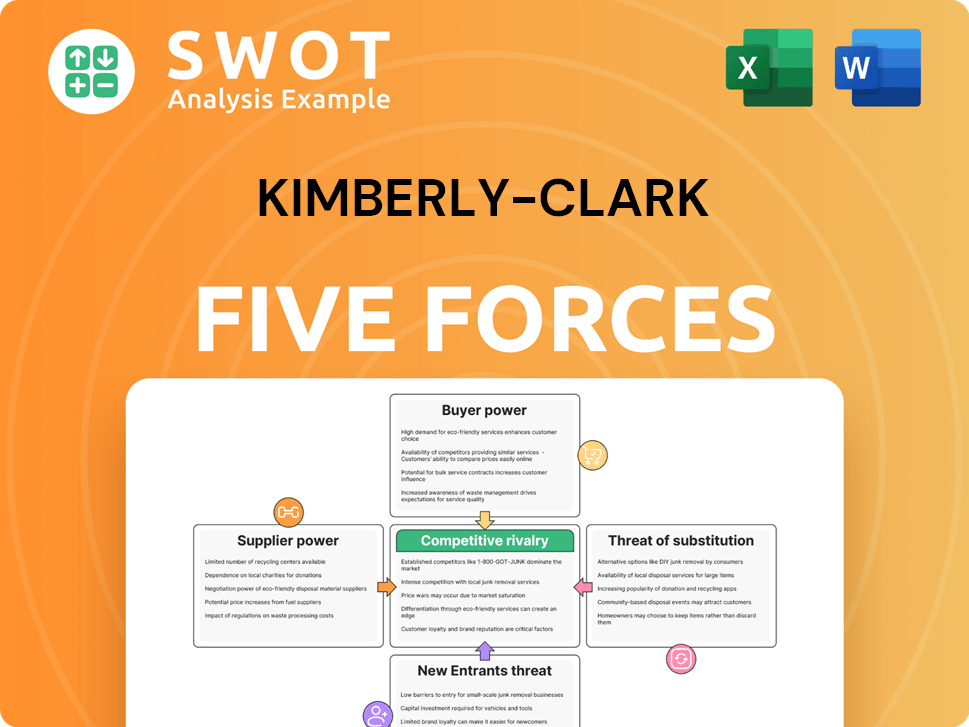

Kimberly-Clark Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kimberly-Clark Company?

- What is Competitive Landscape of Kimberly-Clark Company?

- How Does Kimberly-Clark Company Work?

- What is Sales and Marketing Strategy of Kimberly-Clark Company?

- What is Brief History of Kimberly-Clark Company?

- Who Owns Kimberly-Clark Company?

- What is Customer Demographics and Target Market of Kimberly-Clark Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.