Xiaomi Bundle

Can Xiaomi Conquer the Future?

From its humble beginnings in Beijing, Xiaomi has rapidly transformed from a smartphone disruptor to a global technology titan. Its initial success, fueled by the viral launch of the Mi One smartphone, quickly established its presence in the competitive market. Today, with a massive user base and a diverse product portfolio, Xiaomi's journey is far from over.

This Xiaomi SWOT Analysis explores the Xiaomi growth strategy, dissecting its ambitious plans to dominate the evolving tech landscape. We delve into Xiaomi's future prospects, examining its Xiaomi company analysis, market share, and innovative business model. Furthermore, we'll analyze its extensive product portfolio and global market presence, investigating how Xiaomi intends to compete with industry giants and achieve sustained revenue growth, including its expansion into electric vehicles and smart home technology, and the impact of its sustainability initiatives.

How Is Xiaomi Expanding Its Reach?

The Xiaomi growth strategy focuses on expanding its market presence and diversifying its product offerings. This strategy is driven by the company's ambition to become a leading technology brand globally. Xiaomi's approach involves entering new markets, developing innovative products, and strengthening its existing business segments.

A key element of Xiaomi's future prospects is its expansion into the electric vehicle (EV) market. This move is part of a broader strategy to diversify revenue streams and capitalize on the growing demand for smart mobility solutions. The company's ability to execute its plans and adapt to market changes will be crucial for its long-term success.

This article provides a Xiaomi company analysis, highlighting the key initiatives and strategies driving its growth. It also examines the company's financial performance, market positioning, and competitive landscape. Understanding these aspects is essential for evaluating Xiaomi's potential for future growth.

Xiaomi's foray into the EV market is a significant expansion initiative. The launch of the Xiaomi SU7 series in March 2024 marked a pivotal moment. The company aims to deliver 350,000 SU7 vehicles in 2025, showcasing its ambitious targets in this new segment.

Xiaomi continues to strengthen its presence in the smartphone sector. The company is improving its product mix in developed overseas markets by offering more premium products. Xiaomi's global market share in 2024 was 13.8%, solidifying its position among the top three smartphone manufacturers.

Xiaomi's IoT and lifestyle products revenue exceeded RMB100 billion for the first time in 2024, reaching RMB104.1 billion. The company aims to grow large appliance revenue by over 50% in 2025. This diversification strategy helps to create a comprehensive smart living experience for consumers.

Xiaomi is also expanding its 'MI Home' store network internationally. This initiative is designed to enhance brand visibility and provide customers with a direct retail experience. The expansion of physical stores supports Xiaomi's broader strategy to reach a wider audience and strengthen its market presence.

The company's commitment to innovation and diversification, as highlighted in Mission, Vision & Core Values of Xiaomi, is evident in its strategic moves across multiple sectors. These expansion initiatives are strategically pursued to access new customers, leverage its established ecosystem, and stay ahead of industry changes. Xiaomi's focus on innovation and market expansion is expected to drive its future growth and solidify its position in the global technology market.

Xiaomi's expansion strategy includes entering the EV market, growing its smartphone market share, and expanding its IoT and lifestyle product offerings. The company is also focused on international expansion through its 'MI Home' store network.

- Entry into the EV market with the Xiaomi SU7 series. Deliveries reached 136,854 vehicles by December 31, 2024.

- Continued expansion of its global footprint in the smartphone sector. Overseas revenue reached RMB153.9 billion in 2024.

- Growth in IoT and lifestyle products, with revenue exceeding RMB100 billion in 2024.

- Expansion of the 'MI Home' store network internationally.

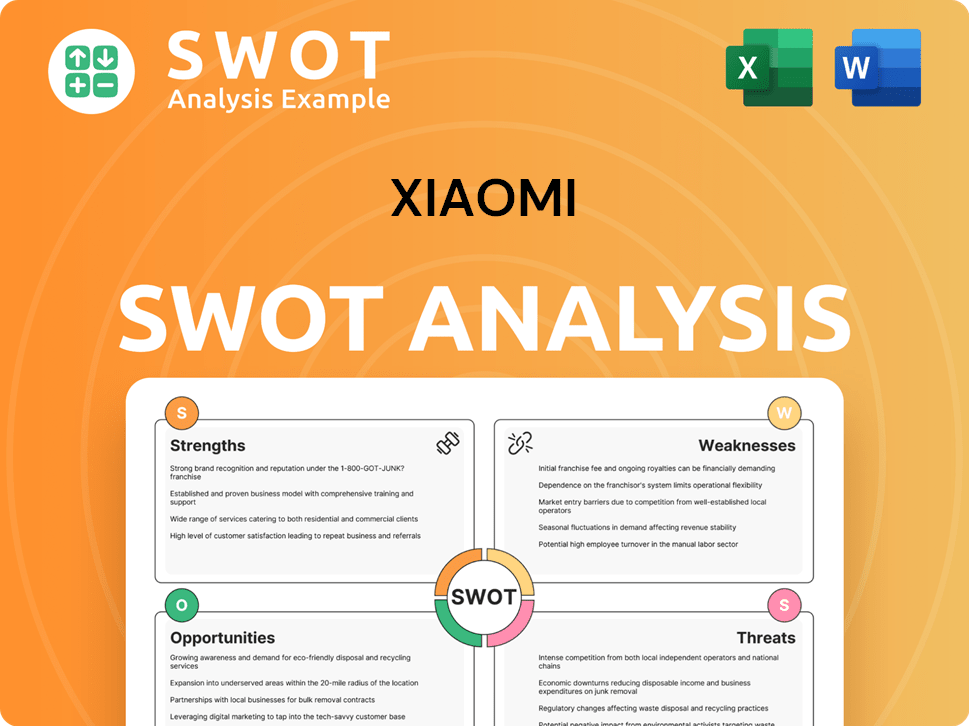

Xiaomi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Xiaomi Invest in Innovation?

Xiaomi's growth strategy is heavily reliant on its innovation and technology initiatives. The company is aggressively investing in research and development to maintain its competitive edge in the market. This focus allows Xiaomi to offer cutting-edge products and services, which is crucial for its future prospects.

The company's commitment to in-house development, particularly in chip design and software integration, is a key differentiator. By controlling more aspects of its product development, Xiaomi aims to enhance user experience and reduce its dependence on external suppliers. This strategy is essential for sustaining long-term growth and expanding its market share.

Xiaomi's approach to innovation extends beyond individual products, encompassing a comprehensive ecosystem. The 'Human x Car x Home' strategy integrates its diverse product portfolio, creating a seamless and connected experience for users. This integrated approach is designed to foster customer loyalty and drive further growth.

Xiaomi plans to invest up to $4.1 billion (30 billion yuan) in research and development by 2025. This investment is a significant increase from previous targets, signaling the company's commitment to innovation.

Xiaomi has earmarked over RMB50 billion for chip development over the next decade. The company's investment in chip development aims to enhance self-sufficiency and product differentiation.

Xiaomi plans a total R&D investment of RMB200 billion for 2026–2030. This substantial investment underscores Xiaomi's long-term commitment to technological advancement.

Xiaomi officially launched its self-developed XRING O1 and T1 system-on-chips (SoCs) in May 2025. These chips are designed to be the foundation for a new wave of Xiaomi products.

As of December 31, 2024, the number of connected IoT devices on its AIoT platform reached 904.6 million, a 22.3% year-over-year increase. The monthly active users of its Mi Home App also grew to 100.8 million in December 2024.

The successful launch of the Xiaomi SU7 electric vehicle integrates its automotive endeavors into its smart ecosystem. The EV business is grouped with AI and other innovative business units in its financial reporting.

Xiaomi's innovation strategy is multifaceted, involving significant investments in research and development, in-house chip development, and the creation of a smart ecosystem. These strategies are key to its future prospects and sustained growth.

- R&D Investment: Xiaomi plans to invest heavily in R&D, with a focus on AI, chip development, and operating systems. This investment is crucial for staying competitive.

- In-House Chip Development: The launch of self-developed SoCs aims to enhance self-sufficiency and product differentiation, reducing reliance on external suppliers.

- Smart Ecosystem: The 'Human x Car x Home' strategy integrates various products, creating a seamless user experience and driving customer loyalty.

- EV Integration: The Xiaomi SU7 electric vehicle further integrates the automotive business into the smart ecosystem, aligning with AI and other innovative units.

- Sustainability: Xiaomi is actively promoting low-carbon transition and development, integrating ESG risk management into its overall risk management process.

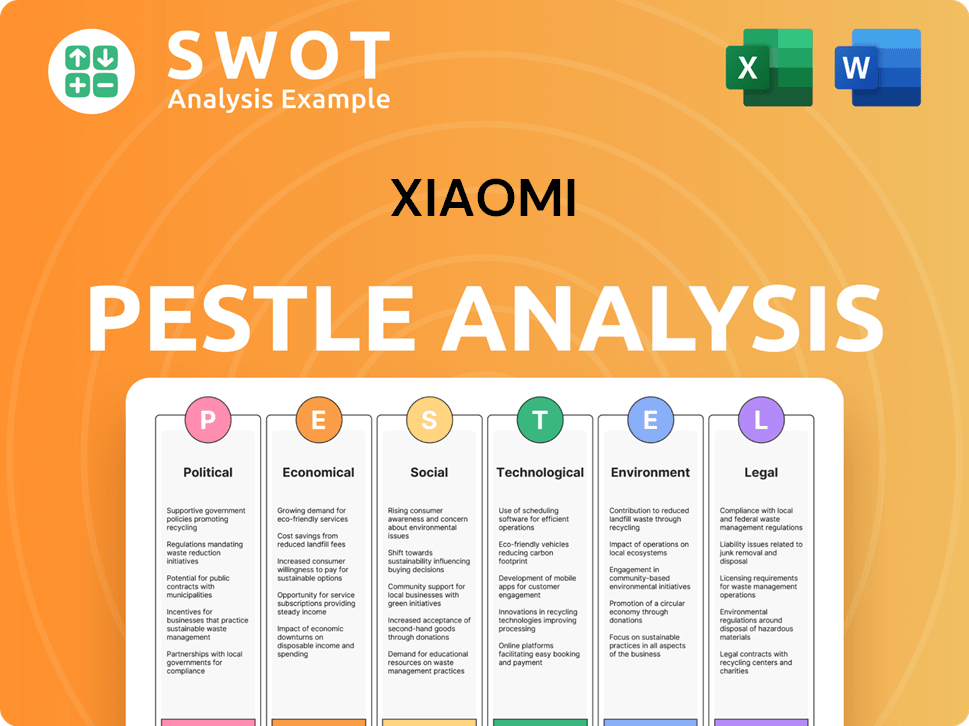

Xiaomi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Xiaomi’s Growth Forecast?

Xiaomi's financial performance in 2024 and early 2025 shows robust growth, setting a positive tone for its future. The company's strategy has been effective in driving revenue and expanding its market presence. This growth is supported by a diversified product portfolio and strategic investments in key areas.

The company's financial health is strong, with significant revenue increases across various segments. This includes smartphones, IoT devices, and internet services. The expansion into the electric vehicle market also represents a significant growth opportunity, although it is still in its early stages.

Understanding the financial outlook is crucial for assessing the Xiaomi growth strategy and Xiaomi future prospects. This involves analyzing revenue streams, profitability, and strategic investments. A comprehensive Xiaomi company analysis requires a deep dive into these financial aspects.

In 2024, Xiaomi achieved a record-high total revenue of RMB365.9 billion, marking a 35.0% year-over-year increase. Adjusted net profit also reached a new high of RMB27.2 billion, reflecting a 41.3% increase year-over-year. This strong performance indicates effective execution of its business strategies.

Xiaomi's positive momentum continued into the first quarter of 2025. The company reported revenue of CN¥111.3 billion, a 47% increase from Q1 2024. Net income for Q1 2025 was CN¥10.9 billion, a substantial 161% increase, demonstrating strong financial management and market demand.

The smartphone segment remains a core driver of Xiaomi's revenue. In 2024, this segment generated RMB191.8 billion, a 21.8% increase year-over-year. Smartphone shipments reached 168.5 million units globally, up 15.7% year-over-year, highlighting strong market demand and Xiaomi market share.

The IoT and lifestyle products segment also experienced significant growth. Revenue reached a record high of RMB104.1 billion in 2024, a 30.0% increase year-over-year. The segment's gross profit margin was 20.3%, showcasing its profitability and contribution to Xiaomi's business model.

Internet services revenue grew to RMB34.1 billion in 2024, up 13.3% year-over-year. This segment maintained a high gross profit margin of 76.6%, indicating its importance in Xiaomi's overall profitability and its contribution to the Xiaomi product portfolio.

The smart EV and other new initiatives segment generated RMB32.8 billion in revenue in 2024. While this segment had an adjusted net loss of RMB6.2 billion, the gross profit margin reached 18.5%. The adjusted net loss narrowed to RMB0.7 billion in Q4 2024, showing progress.

Analysts predict strong future growth for Xiaomi. The company is focused on expanding its electric vehicle business and maintaining its position in the smartphone and IoT markets. This includes strategic investments and innovation to drive future revenue.

- Analysts forecast an average five-year revenue growth of 15.7%.

- The operating profit margin is expected to increase from 6.7% in 2024 to 11.3% by 2029.

- The EV business is projected to achieve positive operating profit by the end of the forecast period.

- Xiaomi aims to deliver 350,000 SU7 Series vehicles in 2025.

Xiaomi's financial stability is further supported by a low debt-to-equity ratio of 0.15 and a current ratio of 1.58 as of March 2025. The company's recent equity placement raised RMB38 billion, which is expected to cover EV business spending for at least the next two years, in addition to RMB94 billion in net cash. To understand more about Xiaomi's revenue streams, you can read this article: Revenue Streams & Business Model of Xiaomi.

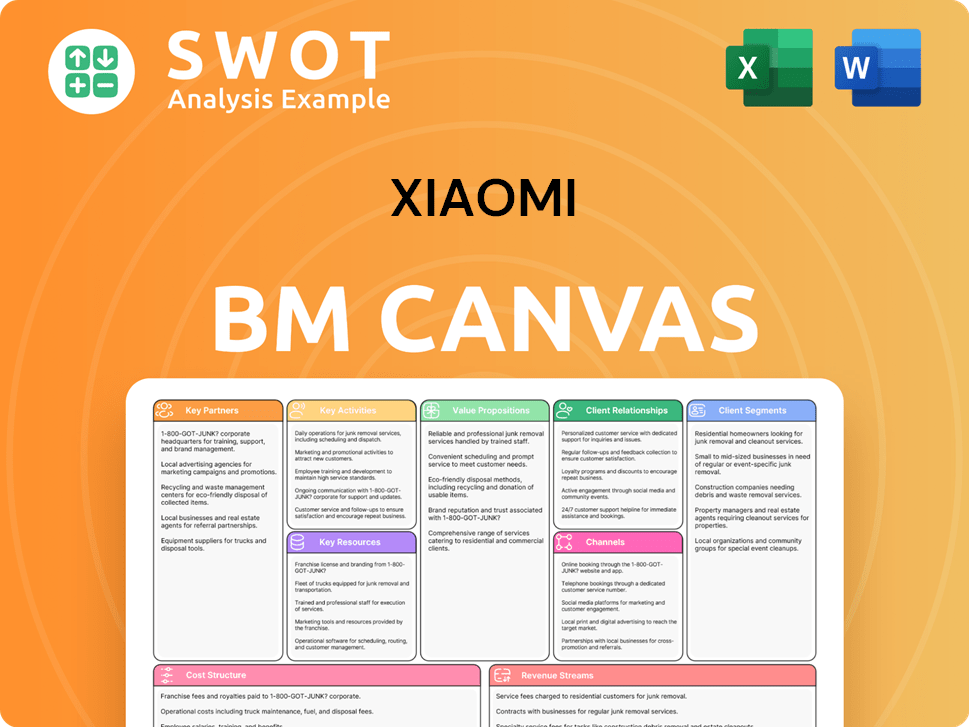

Xiaomi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Xiaomi’s Growth?

The path forward for Xiaomi, despite its impressive growth, is not without its share of obstacles. Navigating the fiercely competitive global market, managing geopolitical uncertainties, and ensuring a resilient supply chain are critical for maintaining its upward trajectory. Understanding these potential challenges is vital for assessing Xiaomi's long-term prospects and investment potential.

Xiaomi's strategic and operational risks are significant factors that could influence its future ambitions. The company's success hinges on its ability to adapt to market dynamics, mitigate external pressures, and effectively manage its diverse business ventures. These factors will be crucial in shaping the company's performance.

Xiaomi's future prospects depend on its ability to navigate several key challenges. The company must continuously innovate, manage geopolitical risks, and ensure a stable supply chain to achieve sustainable growth. Addressing these issues is essential for Xiaomi's continued success.

The smartphone market is intensely competitive, with major players like Samsung and Apple. Domestic competitors such as Huawei, Honor, and vivo also pose significant challenges. Xiaomi must continuously innovate and differentiate its products to maintain its Xiaomi market share.

Geopolitical tensions, particularly between the United States and China, represent a significant risk. Regulatory actions could impact Xiaomi's global operations, as seen with the company's previous blacklisting by the US Department of Defense in 2021. These actions could affect Xiaomi's global market presence and challenges.

Xiaomi's reliance on external manufacturers for critical components creates supply chain vulnerabilities. Disruptions due to geopolitical conflicts, natural disasters, or production bottlenecks can impact operations. The company is developing in-house chipsets to reduce reliance on foreign suppliers.

Rapid diversification into the electric vehicle (EV) market strains resources. The EV market is highly competitive. The SU7's operating loss in 2024 was approximately CNY 6 billion. A fatal accident involving an SU7 highlights potential safety and reputational risks.

The rapid expansion into the EV market could strain Xiaomi's financial and operational resources. The company needs to ensure efficient allocation of capital across its various business segments. This is particularly crucial given the high investment needs of the EV sector.

The fatal highway accident involving an SU7 has raised concerns about the reliability of Xiaomi's autopilot systems. This incident highlights potential safety and reputational risks in the nascent EV division. Maintaining consumer trust is vital for the sustained success of its EV venture.

Xiaomi's 'Human x Car x Home' ecosystem aims to create synergies across its product lines, mitigating risks through diversification. This strategy focuses on integrating its diverse product portfolio. This approach is designed to enhance customer experience.

The company implements risk management frameworks, including assessing emerging risks such as climate change. Integrating ESG risk management into its overall processes is a key focus. This approach aims to enhance the company's long-term sustainability.

Xiaomi's strong financial position, including significant net cash and a recent equity placement, provides a buffer. This financial strength supports its investments and helps it navigate potential challenges. This financial stability is crucial for Xiaomi's long-term success.

Xiaomi faces intense competition in the smartphone market, with rivals such as Samsung, Apple, and other domestic players. The company's success depends on its ability to differentiate its products and maintain its market position. For more insights into the competitive environment, refer to the Competitors Landscape of Xiaomi.

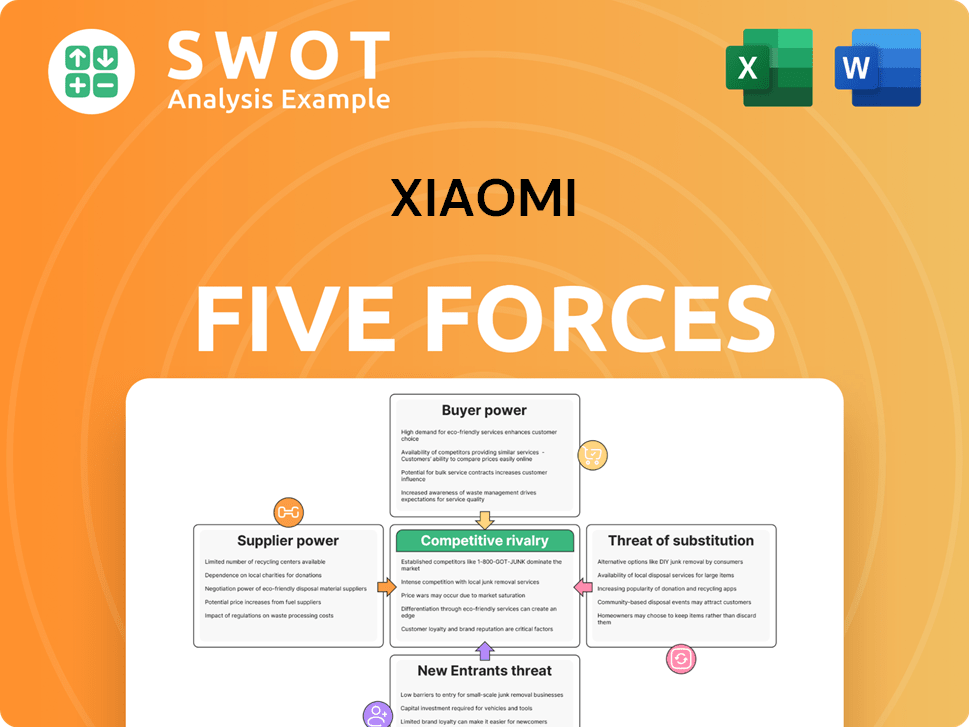

Xiaomi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Xiaomi Company?

- What is Competitive Landscape of Xiaomi Company?

- How Does Xiaomi Company Work?

- What is Sales and Marketing Strategy of Xiaomi Company?

- What is Brief History of Xiaomi Company?

- Who Owns Xiaomi Company?

- What is Customer Demographics and Target Market of Xiaomi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.