Xiaomi Bundle

Who Buys Xiaomi Products?

Xiaomi's journey from a smartphone disruptor to a global tech giant is a fascinating study in understanding its Xiaomi SWOT Analysis. The company's strategic shift towards a 'Human × Car × Home' ecosystem has dramatically reshaped its customer base. Unveiling the customer demographics Xiaomi targets is crucial for anyone seeking to understand its market dominance and future potential.

This exploration delves into the Xiaomi target market, examining the evolution of Xiaomi customer profile from its early days to its current expansive reach. We'll analyze the key characteristics of Xiaomi users and Xiaomi audience, including their age, income, location, and tech savviness. Furthermore, this Xiaomi market analysis will uncover how Xiaomi segments its customers and adapts its strategies to cater to their diverse needs, including Xiaomi customer age range, Xiaomi customer income levels, and Xiaomi customer location analysis.

Who Are Xiaomi’s Main Customers?

Understanding the customer demographics of the company is crucial for its success. Initially, the primary customer segments for the company were younger, tech-savvy individuals. This included millennials and Generation Z, who were drawn to the brand's focus on innovation, quality, and affordable pricing for their electronic devices. These customers valued the high-end features offered at competitive prices.

As of March 2025, the company's reach has expanded significantly. The company boasts a massive global user base. Monthly active users (MAU) reached approximately 718.8 million across smartphones and tablets. The AIoT (AI+IoT) platform had approximately 943.7 million smart devices connected as of March 31, 2025, excluding smartphones, laptops, and tablets.

The company is not only focused on the mid-to-low-end smartphone market. There has been a strategic shift towards premiumization. In Q4 2024, the company's market share in the RMB3,000 segment (approximately $470) in mainland China rose to 23.3%, and in the RMB4,000 to RMB5,000 segment, it increased to 24.3%, ranking No. 1. This indicates a move to target higher-income segments, as seen with products like the Xiaomi 15 Ultra and the Xiaomi SU7 Ultra EV.

The company's customer base is diverse, encompassing various age groups, income levels, and geographic locations. The initial focus on younger demographics has expanded to include a broader audience. This expansion is a result of the company's diverse product offerings and competitive pricing strategies, making it accessible to a wider range of consumers.

The target market includes tech enthusiasts, budget-conscious consumers, and those seeking value for money. The company's product range caters to different segments, from entry-level smartphones to high-end devices. The company's strategy has allowed it to capture a significant share of the global market.

The company's smartphone market targets a broad audience, with a strong emphasis on value and innovation. The company has successfully positioned itself as a provider of high-quality, feature-rich smartphones at competitive prices. This strategy has resonated well with consumers worldwide.

The customer profile is evolving as the company expands its product offerings and market reach. The company's foray into the premium market, with products like the Xiaomi 15 Ultra and the Xiaomi SU7 Ultra EV, is attracting higher-income consumers. The company's user base now includes a mix of tech enthusiasts, value seekers, and premium product consumers.

The company's customer base has experienced significant growth, driven by its expanding product portfolio and global market presence. The AIoT platform had approximately 943.7 million smart devices connected as of March 31, 2025. The number of users with five or more devices connected to the company's AIoT platform reached 19.3 million, up 26.5% year-over-year.

- The company's ability to deliver high-end features at competitive prices is a key factor in attracting customers.

- The company's focus on innovation and quality has enhanced its brand image and customer loyalty.

- The expansion into the premium market is attracting higher-income customers.

- The company's diverse product offerings cater to various customer segments, from entry-level to high-end consumers.

To gain a more detailed understanding of the company's business model, you can explore the Revenue Streams & Business Model of Xiaomi.

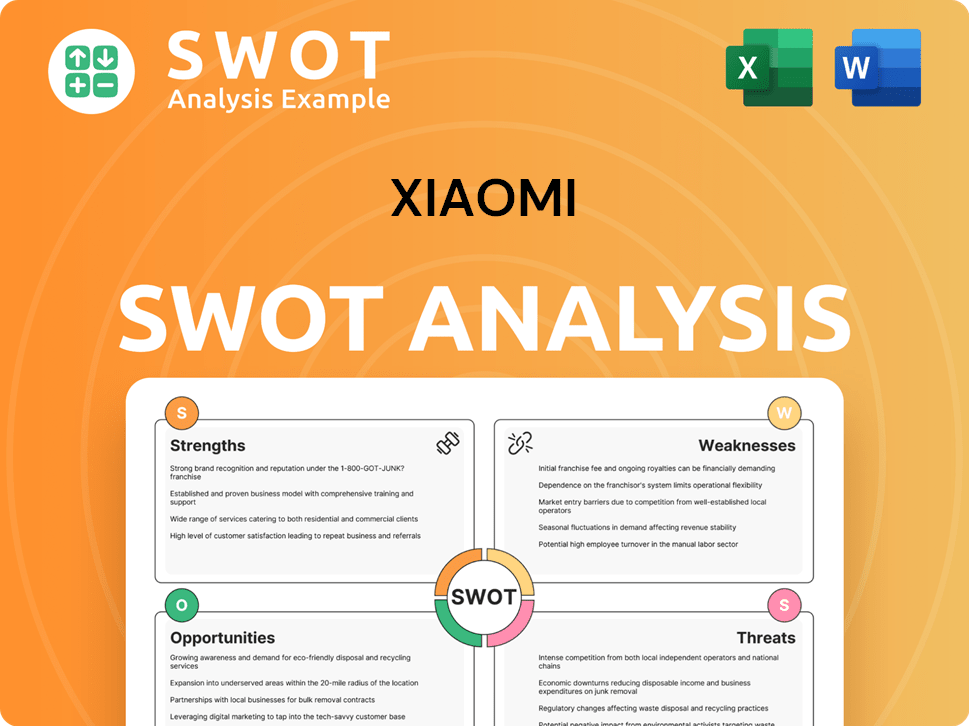

Xiaomi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Xiaomi’s Customers Want?

The customer needs and preferences of Xiaomi are centered around obtaining high-quality, innovative technology at an accessible price point. This focus on value for money is a core driver for Xiaomi's customer base, particularly in price-sensitive markets. The company's ability to offer competitive features without the premium pricing of rivals is a key factor in its market success.

Xiaomi's customers are also looking for seamless integration across their devices and an interconnected experience. The company actively builds and expands its 'Human × Car × Home' ecosystem, which ties together personal devices, smart home products, and vehicles. This strategy enhances user experience and promotes brand loyalty.

Xiaomi actively incorporates user feedback into its product development, using platforms like the 'Mi Community' to gather insights. This data-driven approach ensures that new products meet evolving customer needs and preferences, reflecting a customer-centric approach to innovation and product design.

The cost-performance ratio is a significant decision-making criterion for Owners & Shareholders of Xiaomi customers. They seek advanced features without the premium price tags often associated with competitors.

Customers prioritize seamless integration and an interconnected experience across their devices. Xiaomi addresses this through its 'Human × Car × Home' smart ecosystem.

Xiaomi actively incorporates user feedback and market insights into its product development. The 'Mi Community' platform is a key tool for gathering this feedback.

The company's continuous investment in research and development, with plans to allocate 10% of its revenue towards innovation in 2024, further demonstrates its commitment to meeting consumer demands.

The ecosystem approach fosters brand loyalty and increases customer lifetime value. This interconnected approach is a key differentiator.

MIUI 14, Xiaomi's custom Android ROM, integrated over 100 user-suggested features, showing the company's responsiveness to user feedback.

Xiaomi's customer base, including its Xiaomi users and Xiaomi audience, prioritizes value, seamless integration, and a responsive product development process. These preferences drive the company's strategic decisions.

- Value for Money: Customers seek high-quality products at accessible prices, making the cost-performance ratio a critical factor.

- Seamless Connectivity: The 'Human × Car × Home' ecosystem provides an interconnected experience across devices, enhancing user convenience.

- User-Driven Innovation: Xiaomi actively incorporates user feedback through platforms like 'Mi Community,' ensuring products meet evolving needs.

- Continuous Improvement: Ongoing investment in R&D, with 10% of revenue allocated to innovation, demonstrates a commitment to cutting-edge features.

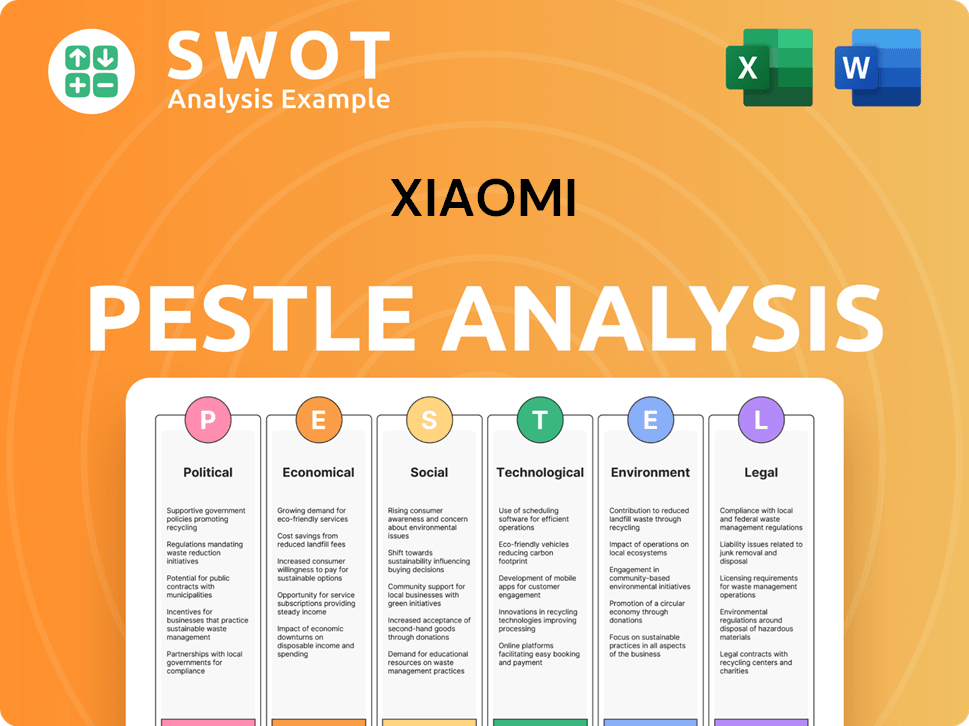

Xiaomi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Xiaomi operate?

The geographical market presence of Xiaomi is substantial, with its products available in over 100 countries and regions globally. While China remains a key market, Xiaomi has successfully expanded its reach internationally. In 2022, nearly half (49.2%) of its revenue came from international markets, showcasing its global strategy.

Xiaomi's success is evident in its strong market positions worldwide. It has tailored its offerings and marketing strategies to suit diverse regional preferences. This approach, combined with a focus on cost-effective products, has enabled Xiaomi to gain a competitive edge in various markets.

In Q1 2025, Xiaomi maintained its position as the third-largest smartphone vendor globally, with a market share of 14% and 41.8 million units shipped. The company's strategy includes expanding its "New Retail" model, focusing on Africa, Latin America, Southeast Asia, and Europe, with plans to establish localized operations and Mi Home stores in these regions.

In Q4 2024, Xiaomi's smartphone market share in mainland China increased by 3.0 percentage points year-over-year to 15.8%, marking four consecutive quarters of market share growth. In Q1 2025, Xiaomi even returned to the top spot in China's smartphone market with a 19% share, driven by a 40% jump in shipments.

In 2023, Xiaomi was the leading smartphone brand in India with an 18.7% market share. This highlights the company's success in a key emerging market, demonstrating its ability to cater to local consumer needs and preferences.

Xiaomi ranked second in Spain, capturing 24.5% of the smartphone market in 2023. This demonstrates a strong foothold in the European market, indicating the brand's appeal to a diverse customer base.

Xiaomi held a 12.3% market share in Indonesia in 2023, placing it among the top five smartphone brands. This shows its competitiveness in the Southeast Asian market, a region with significant growth potential.

In Q1 2025, Xiaomi retained the top spot among smartphone vendors in Malaysia, achieving an 18% unit share in sell-in shipments. This highlights the company's continuous success and strong market presence in the region.

Xiaomi is also consolidating its presence in Latin America, reaching second place, with a 10% increase in growth in the region over the last year. This indicates a successful expansion strategy in a rapidly growing market.

Xiaomi's success is attributed to its ability to adapt to local market needs. This includes offering cost-effective products in markets like Thailand, where it targets the mid- and low-end mobile phone segments. The company is also expanding its "New Retail" strategy to international markets, focusing on building localized operations and opening Mi Home stores.

- Focus on cost-effective products tailored to specific market segments.

- Expansion of 'New Retail' strategy with localized operations.

- Strategic market positioning and adaptation to local consumer preferences.

- Continuous market share growth in key regions.

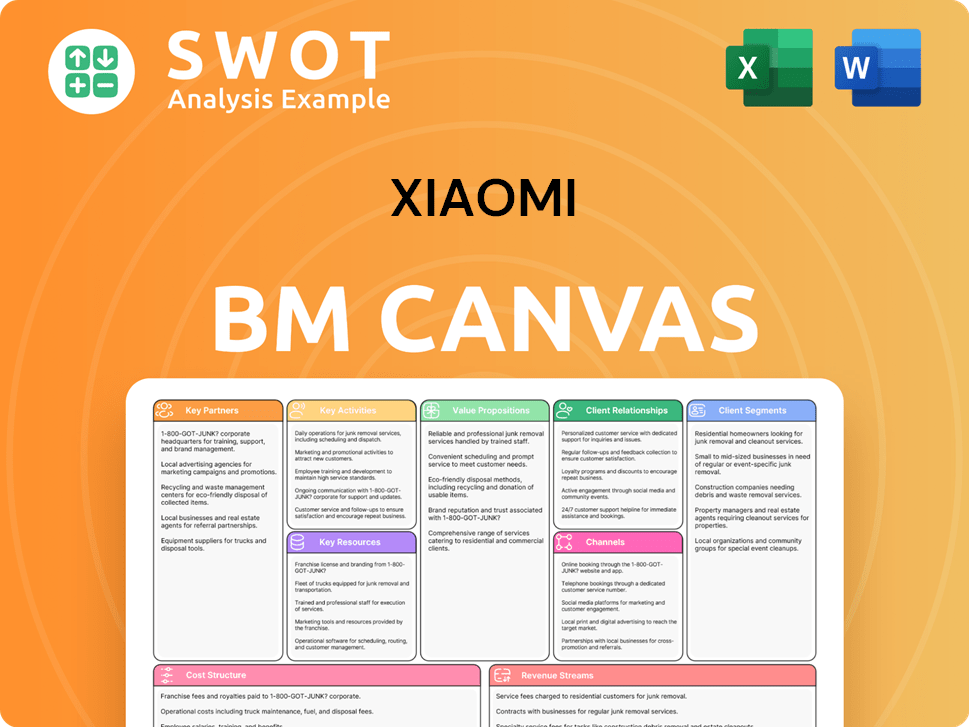

Xiaomi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Xiaomi Win & Keep Customers?

Regarding customer acquisition and retention, the company leverages a multifaceted approach. A key strategy involves its online-first distribution model, mainly through Mi.com. This method minimizes overhead costs, enabling competitive pricing. This strategy helps in efficient customer acquisition.

The company focuses on building and nurturing a strong user community, known as 'Mi Fans'. This community-centric approach, facilitated by the Mi Community platform, allows users to interact, provide feedback, and participate in activities, fostering brand loyalty and organic growth. The company's ecosystem approach, integrating smartphones with a wide range of AIoT devices and smart home products, builds brand loyalty and increases customer lifetime value.

The company's commitment to providing high-quality technology at accessible prices also serves as a strong retention factor, as customers perceive great value from their purchases. Additionally, the company is focusing on strengthening its after-sales services to enhance customer satisfaction and loyalty.

The company's online-first distribution model, mainly through Mi.com, is a primary acquisition strategy. This approach helps minimize overhead costs. Competitive pricing is a direct result of this distribution strategy, making products accessible to a wider audience, which is a key component of the company's Growth Strategy of Xiaomi.

The use of 'Hunger Marketing' and flash sales generates excitement and urgency. These strategies have been effective in creating rapid sell-outs. This approach significantly boosts media coverage and assists in acquiring new customers.

The Mi Community platform is central to the retention strategy. It allows users to interact, provide feedback, and participate in activities. This fosters brand loyalty and organic growth. This platform is a crucial element in understanding its customer base.

Iterative product development, driven by user feedback on the MIUI operating system, enhances customer satisfaction. Regular updates based on customer insights ensure that offerings meet evolving needs. This approach helps in retaining customers.

The company integrates smartphones with a wide range of AIoT devices and smart home products. This builds brand loyalty and increases customer lifetime value. This approach provides a comprehensive, interconnected experience.

- This strategy enhances customer retention.

- It encourages repeat purchases within the ecosystem.

- The interconnected experience strengthens brand loyalty.

- It increases the overall customer lifetime value.

The company's commitment to providing high-quality technology at accessible prices is a strong retention factor. Customers perceive great value from their purchases. This value proposition is a key driver for customer retention.

- Affordable pricing attracts a broad customer base.

- High-quality products enhance customer satisfaction.

- Perceived value encourages repeat purchases.

- Customer loyalty is fostered through value and quality.

The company focuses on strengthening its after-sales services to enhance customer satisfaction and loyalty. Improved customer service is crucial for retention. Effective after-sales support builds customer trust.

- Enhanced support improves customer satisfaction.

- It fosters loyalty and encourages repeat purchases.

- Effective service builds trust in the brand.

- This strategy reduces customer churn.

In 2025, the company plans to expand its retail network, targeting 20,000 Mi Home stores. This expansion supports both acquisition and retention efforts. Physical touchpoints enhance customer engagement.

- More stores increase brand visibility.

- Physical stores offer a tangible customer experience.

- Expanded retail network supports customer acquisition.

- It enhances customer retention through improved accessibility.

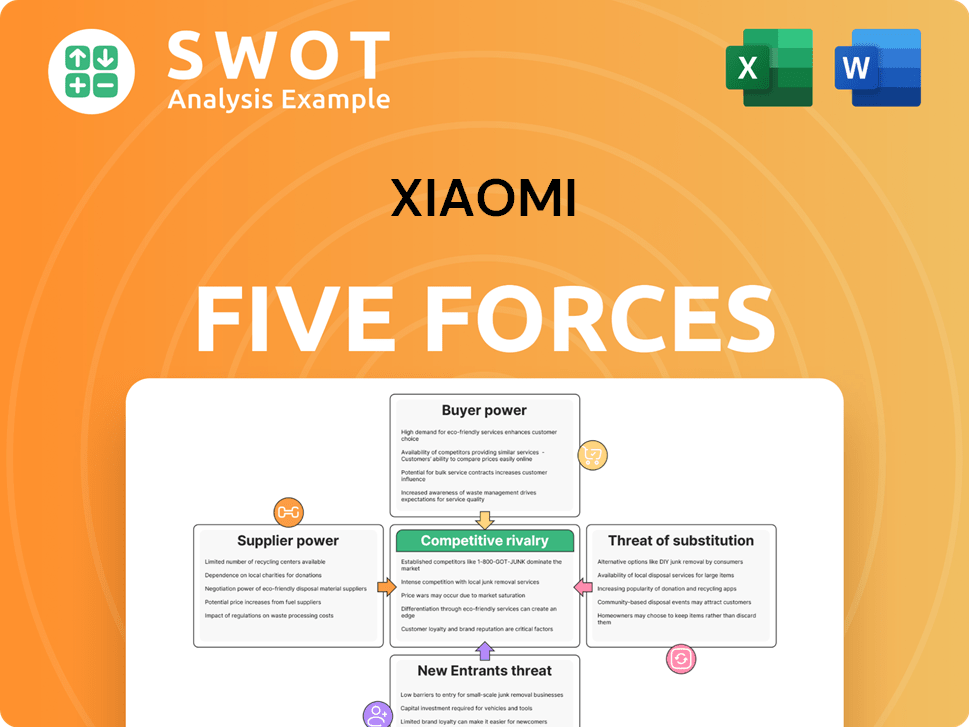

Xiaomi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Xiaomi Company?

- What is Competitive Landscape of Xiaomi Company?

- What is Growth Strategy and Future Prospects of Xiaomi Company?

- How Does Xiaomi Company Work?

- What is Sales and Marketing Strategy of Xiaomi Company?

- What is Brief History of Xiaomi Company?

- Who Owns Xiaomi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.