National Grid Bundle

Can National Grid Power Your Portfolio's Future?

National Grid, a key player in the global energy market, is currently undergoing a major strategic shift. This transformation, including the recent sale of its US onshore renewables business, sets the stage for significant changes. This in-depth analysis explores National Grid's evolving strategies and future potential.

National Grid's strategic focus on electricity transmission and distribution, alongside its commitment to secure, affordable, and clean energy, positions it at the forefront of the energy transition. Understanding the National Grid SWOT Analysis can provide valuable insights into its strengths, weaknesses, opportunities, and threats within the UK energy market and beyond. This exploration delves into National Grid's investment plans, renewable energy projects, and its role in the energy sector analysis, offering a comprehensive view of its long-term business strategy and how it is adapting to climate change.

How Is National Grid Expanding Its Reach?

The National Grid growth strategy is heavily focused on significant investments in its electricity networks. This strategy aims to support the ongoing energy transition and modernize grid infrastructure. The company is directing substantial capital towards upgrading and expanding its networks to meet future energy demands.

National Grid future prospects look promising due to these strategic investments. The company is poised to play a crucial role in the energy sector, adapting to climate change and supporting the UK energy market. These initiatives are expected to drive substantial asset growth and enhance the company's long-term financial performance.

The National Grid company is undertaking ambitious expansion initiatives to strengthen its position in the energy sector. These initiatives involve considerable capital investment in grid infrastructure, supporting the shift towards cleaner energy sources. The company's strategic focus is on enhancing its network capabilities and adapting to the evolving energy landscape.

National Grid plans a total cumulative capital investment of approximately £60 billion over the five-year period from 2024/25 to 2028/29. This investment is nearly double the investment of the previous five years. This substantial investment is expected to drive annual group asset growth of around 10%.

The company plans to invest up to £35 billion in its UK Electricity Transmission business for the RIIO-T3 period (April 2026 to March 2031). This investment aims to maintain and upgrade existing networks and construct Accelerated Strategic Transmission Investment (ASTI) projects. This will increase network capacity by around £15 billion, with 14 additional ASTI projects confirmed.

In the US, National Grid is upgrading its upstate New York electricity transmission program. The company plans to invest over $4 billion in transmission network infrastructure through 2030. This 'Upstate Upgrade' involves more than 70 transmission enhancement projects and is projected to create over 1,700 new jobs.

The Massachusetts Electric Sector Modernization Plan (ESMP) outlines up to $2 billion in investment over the next five years, starting July 1, 2025, to upgrade the electric distribution network. This plan supports clean energy goals and enhances grid reliability.

To streamline its focus, National Grid is divesting certain assets. In February 2025, the company agreed to sell its US onshore renewables business to Brookfield Asset Management. This allows National Grid to allocate capital to its core infrastructure transformation. The company completed the sale of its UK Electricity System Operator business to the UK Government in October 2024 and the final 20% equity interest in National Gas Transmission in September 2024.

- These divestments are part of National Grid's strategy to focus on its core network infrastructure.

- The company is concentrating on its electricity transmission and distribution businesses to support the energy transition.

- These strategic moves are designed to enhance operational efficiency and financial performance.

- By focusing on its core competencies, National Grid aims to strengthen its position in the energy sector.

For further insights into the company's business model and revenue streams, you can read more in this article: Revenue Streams & Business Model of National Grid . These expansion initiatives and strategic adjustments highlight the company's commitment to long-term growth and its role in the evolving energy sector analysis and the UK energy market. The ongoing investments in grid infrastructure are crucial for supporting the energy transition and achieving National Grid's sustainability goals.

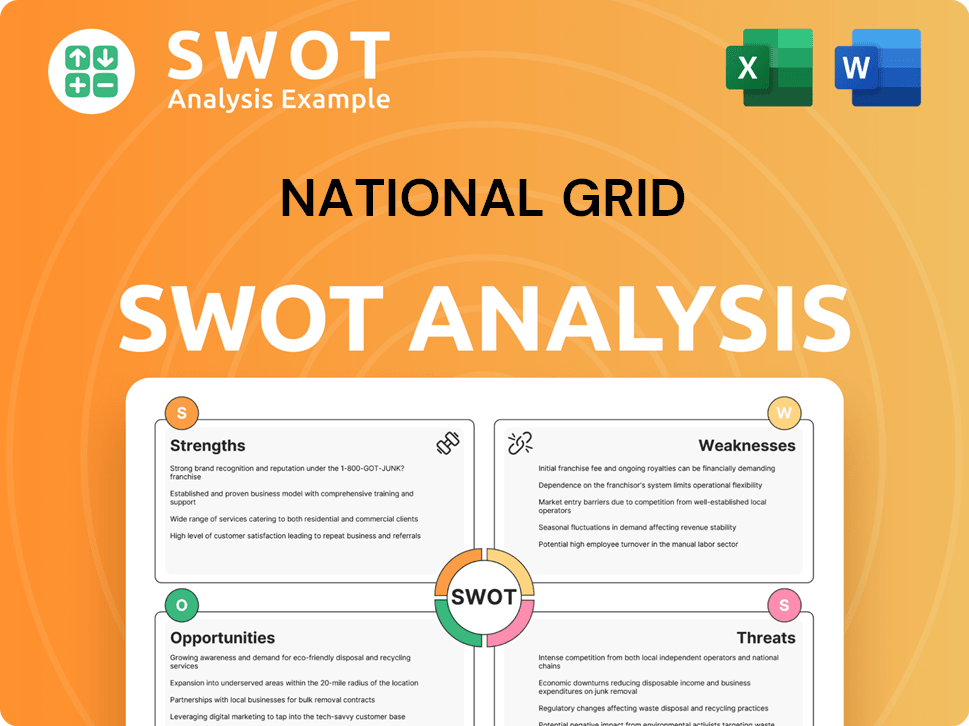

National Grid SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does National Grid Invest in Innovation?

The innovation and technology strategy of the company is central to its mission of facilitating the energy transition and achieving net-zero emissions. This strategy involves significant investments in modernizing networks, improving reliability, and integrating low-carbon solutions. The company's Distribution Future Energy Scenarios (DFES), published in January 2025, guides strategic planning for network development, forecasting demand and generation growth up to 2050, with a focus on low-carbon technologies.

The company's commitment to reducing its environmental footprint is demonstrated through its investment plans and operational changes. The company aims to achieve net-zero emissions by 2050 for Scope 1, 2, and 3 emissions. The company is also investing in new technologies to optimize existing infrastructure and prepare for the increased electrification of transportation and heating.

The company's ongoing efforts include the deployment of innovative technologies and digital transformation initiatives to enhance grid efficiency and support the transition to a sustainable energy system. These initiatives are essential for the company's long-term growth and its role in the UK energy market.

The DFES, published in January 2025, is a critical tool for strategic planning, forecasting demand and generation growth up to 2050. It incorporates plans from 120 local authorities and nearly 8,000 local projects, ensuring a comprehensive approach to network development.

Approximately £60 billion is planned to be invested over five years, with around £51 billion allocated for 'green investment.' This investment aligns with the EU Taxonomy, emphasizing renewable energy and infrastructure development.

The company aims for net-zero emissions by 2050 for Scope 1, 2, and 3 emissions. A near-term target is to reduce absolute Scope 1 and 2 GHG emissions by 60% by 2030/31 (from a 2018/19 baseline).

The company is committed to sustainability, including replacing 60% of its fleet with zero-emission vehicles in FY24. It also aims to maintain an 80% recycling rate in construction projects.

The company is actively exploring and deploying innovative technologies such as power control devices and dynamic line ratings. These technologies help maximize the capacity of existing infrastructure.

The RIIO-ED2 business plan (2023-2028) for its electricity distribution business includes commitments to be ready for 1.5 million electric vehicles and 600,000 heat pumps. This signifies readiness for increased electrification.

Digital transformation is a key focus, with new planning tools for smarter decision-making and new data and monitoring systems. These initiatives are part of the Massachusetts Electric Sector Modernization Plan.

- The company's investment plans, including the £51 billion 'green investment,' highlight its commitment to renewable energy and infrastructure.

- The DFES provides a roadmap for future network development, considering the growth of low-carbon technologies.

- The company's emission reduction targets and sustainability efforts demonstrate its dedication to environmental responsibility.

- The deployment of innovative technologies and digital transformation initiatives enhances grid efficiency and supports the energy transition.

- The company's focus on smart grid initiatives and readiness for electric vehicles and heat pumps positions it well for future growth.

For more insights into the company's market positioning, consider reading about the Target Market of National Grid .

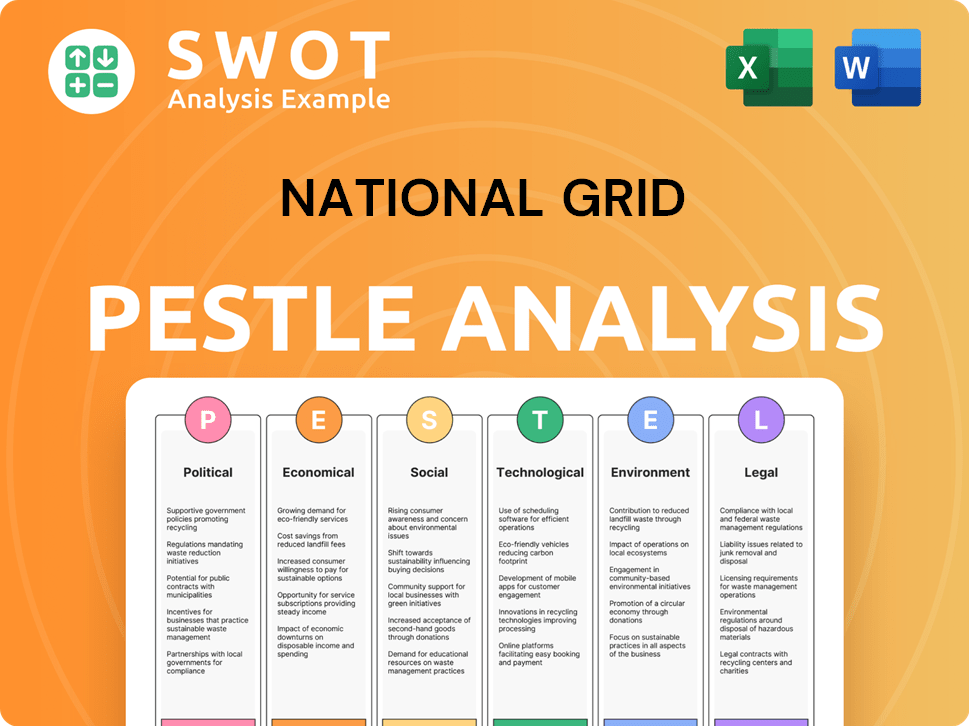

National Grid PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is National Grid ’s Growth Forecast?

The financial outlook for National Grid reflects a robust growth strategy, underpinned by substantial capital investments and anticipated asset expansion. The company is poised for significant investment over the coming years, which is expected to drive considerable financial growth. This strategic approach is designed to capitalize on opportunities within the energy sector and support the UK's energy transition.

National Grid's future prospects are promising, with a focus on enhancing grid infrastructure and integrating renewable energy sources. The company's investment plans are a key component of its long-term business strategy, aiming to meet the evolving demands of the energy market. This commitment to investment is expected to yield strong financial results and contribute to sustainable growth.

For the fiscal year ending March 31, 2025, National Grid reported a revenue of £18.4 billion, although this was a 7.4% decrease from FY 2024, largely due to the sale of its UK Electricity System Operator business. However, underlying operating profit increased by 12% to £5.4 billion, driven by higher rates in the US, increased inflation-linked revenues in the UK, and cost efficiency. Net income for FY25 was £2.83 billion, up 28% from FY24, with a profit margin of 15% (up from 11% in FY24) due to lower expenses. Statutory EPS for FY25 was 60.0p, up 8% from 55.5p, while underlying EPS was 73.3p, up 2%. The company recommended a final dividend of 30.88p, resulting in a total dividend of 46.72p, a 3.2% increase compared to the rebased dividend per share of 45.26p.

National Grid plans to invest approximately £60 billion over the five-year period from 2024/25 to 2028/29. This substantial investment is a cornerstone of the company's growth strategy. The investment will focus on enhancing grid infrastructure and supporting renewable energy projects.

The company anticipates an asset growth Compound Annual Growth Rate (CAGR) of around 10% due to its investment strategy. This growth is expected to enhance the company's financial performance. This asset growth is crucial for long-term value creation.

National Grid projects an underlying Earnings Per Share (EPS) CAGR of 6-8% from a 2024/25 EPS baseline of 73.3p. This growth is a key indicator of the company's financial health. The EPS growth reflects the effectiveness of the company's strategic initiatives.

For the current financial year, National Grid anticipates strong operational performance, with underlying EPS expected to align with the 6-8% CAGR range. This positive outlook is supported by strategic investments and operational efficiencies. The company's financial performance reflects its commitment to the energy transition.

Net debt decreased by £2.2 billion to £41.1 billion, aided by £6.8 billion of net proceeds from a rights issue and £1.8 billion from divestments. The company's regulatory gearing is currently 61%, trending back to the high 60% range by the end of RIIO-T3. National Grid's Group Return on Equity (RoE) for 2024/25 was 9.0%. Analyst forecasts predict revenue to grow 7.8% per annum on average over the next three years, compared to a 3.2% growth forecast for the integrated utilities industry in Europe. The average twelve-month stock price forecast for National Grid is GBX 1,131.67, with a high of GBX 1,200 and a low of GBX 1,070, representing a potential upside of 8.14% from the current price.

National Grid's financial performance in FY25 was marked by increased profitability and strategic debt management. The company's focus on operational efficiency and strategic investments is evident in its financial results. The company's financial outlook is positive, supported by its strategic investments and operational improvements.

- Revenue of £18.4 billion.

- Underlying operating profit increased by 12% to £5.4 billion.

- Net income for FY25 was £2.83 billion, up 28% from FY24.

- Statutory EPS for FY25 was 60.0p, up 8% from 55.5p.

- Underlying EPS was 73.3p, up 2%.

- Total dividend of 46.72p, a 3.2% increase.

- Net debt decreased by £2.2 billion to £41.1 billion.

The company’s future prospects are promising, with analysts predicting robust revenue growth. National Grid's strategic investments and operational improvements are expected to drive continued financial success. The company's commitment to the energy transition and grid infrastructure modernization positions it for long-term growth. For more information on the company's strategies, consider reading about the Marketing Strategy of National Grid .

- Capital investment of approximately £60 billion over five years.

- Asset growth CAGR of around 10%.

- Underlying EPS CAGR of 6-8%.

- Revenue growth forecast of 7.8% per annum over the next three years.

- Potential upside of 8.14% from the current stock price.

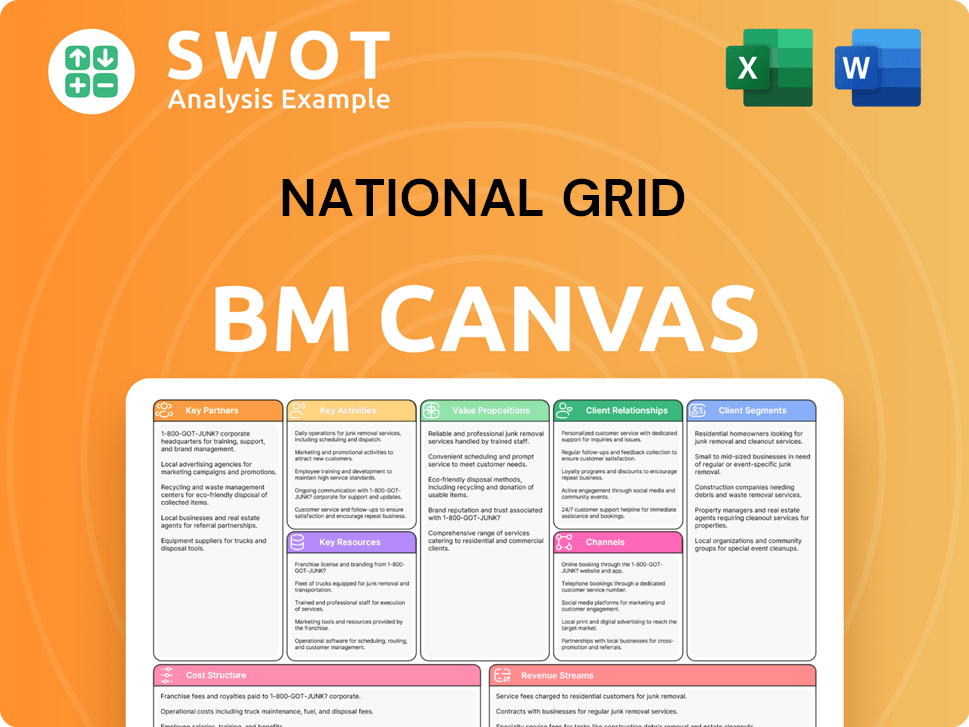

National Grid Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow National Grid ’s Growth?

The National Grid's growth strategy faces several risks and obstacles, particularly within the dynamic energy sector. These challenges include market competition, regulatory changes, and the rapid pace of technological disruption. Understanding these potential pitfalls is crucial for evaluating the National Grid company's long-term prospects.

Regulatory pressures, such as those impacting electric and gas delivery rates, can significantly affect the National Grid's financial performance. The company's substantial investment plans also introduce financial risks, especially in a high-rate environment. Addressing these challenges requires careful planning and robust risk management strategies.

Technological advancements and the shift towards cleaner energy sources introduce both opportunities and obstacles for National Grid's future prospects. The company must navigate the complexities of integrating new renewable sources and managing an evolving grid. This requires strategic planning and effective execution to ensure sustainable growth.

Proposed changes to electric and gas delivery rates in New York, effective April 1, 2025, could increase average residential customer bills, potentially facing public scrutiny. Regulators are under pressure to limit utilities' profits due to tight consumer budgets and high energy costs.

The company's investment plans, including the £60 billion over five years, introduce financial risks related to funding costs in a high-rate environment. While these are currently considered well-covered, the situation requires ongoing monitoring and management.

The rapid pace of the energy transition presents both opportunities and obstacles. While investing heavily in cleaner energy networks, National Grid's 2024/25 Scope 1 and 2 emissions rose to 7.4mt CO₂e. This highlights the challenge of managing emissions during infrastructure development.

Supply chain vulnerabilities are a concern, although National Grid has secured supply chain and delivery mechanisms for over two-thirds of its £60 billion investment plan. This proactive approach is crucial for ensuring project delivery.

The company's commitment to net-zero by 2050 is ambitious, and while progress has been made, achieving these targets requires continuous effort and adaptation. Replacing 60% of its fleet with zero-emission vehicles in FY24 is a positive step.

The complexity of integrating new renewable sources and managing an evolving grid also presents operational challenges, requiring robust planning and execution. National Grid's Distribution Future Energy Scenarios (DFES) and alignment with national Future Energy Pathways are crucial.

Despite these challenges, National Grid's strong balance sheet and robust risk management frameworks, including scenario planning through its Future Energy Scenarios, are key to navigating these obstacles. High levels of network reliability, with Transmission and Distribution reliability steady at 99%-100% across all company-owned networks in FY24, demonstrates operational effectiveness.

The company's ability to adapt to changing market conditions and technological advancements will be critical for its long-term success. Continuous investment in grid infrastructure and renewable energy projects is essential. For a deeper understanding of the company's origins, consider reading a Brief History of National Grid .

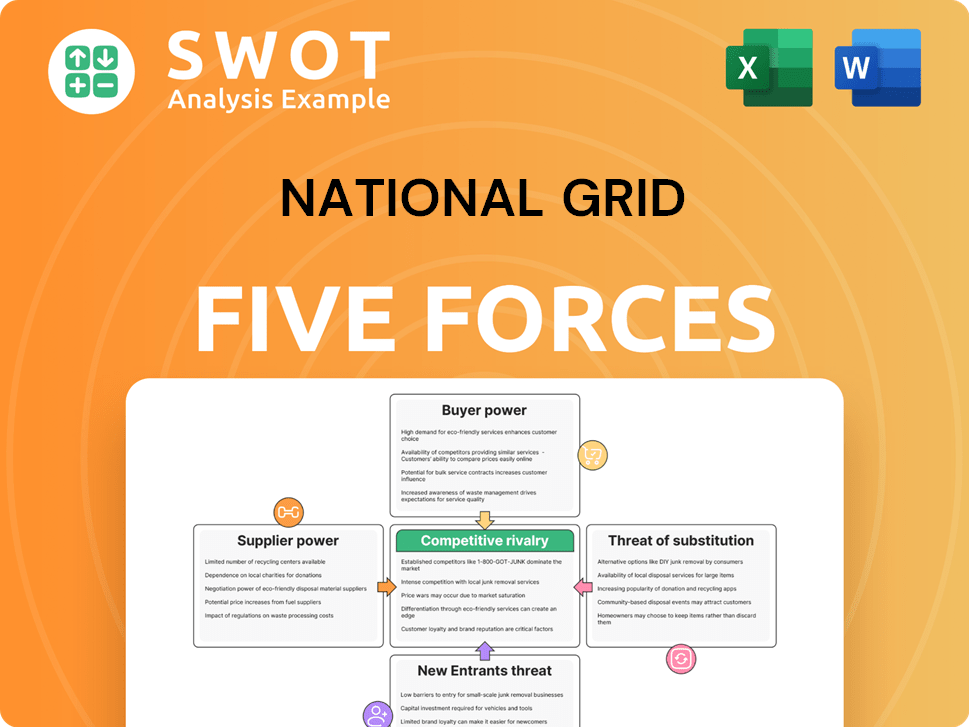

National Grid Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of National Grid Company?

- What is Competitive Landscape of National Grid Company?

- How Does National Grid Company Work?

- What is Sales and Marketing Strategy of National Grid Company?

- What is Brief History of National Grid Company?

- Who Owns National Grid Company?

- What is Customer Demographics and Target Market of National Grid Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.