Nkarta Bundle

Can Nkarta's Innovative Approach Revolutionize Cancer Treatment?

Nkarta, Inc. is making waves in the biopharmaceutical industry with its pioneering work in natural killer (NK) cell therapies, aiming to transform cancer treatment. Founded in 2015, the company has strategically positioned itself to harness the power of NK cells, developing off-the-shelf, allogeneic cancer immunotherapies. This innovative approach promises to overcome limitations in current treatments, making Nkarta a key player in the competitive oncology market.

This Nkarta SWOT Analysis will explore the company's ambitious Nkarta growth strategy and future prospects, examining its clinical trial updates, pipeline drugs, and investment potential within the cell therapy landscape. We'll delve into Nkarta's technology platform and target diseases, providing insights into its financial performance and recent developments. Understanding Nkarta's competitive landscape and market share analysis is crucial for assessing its long-term success.

How Is Nkarta Expanding Its Reach?

The core of the Nkarta growth strategy hinges on expanding its clinical pipeline and potentially bringing its lead product candidates to market. The company is primarily focused on developing off-the-shelf, allogeneic NK cell therapies. This approach aims to provide readily available treatments for various hematologic malignancies and solid tumors, targeting significant unmet medical needs within the biopharmaceutical industry.

A key aspect of Nkarta's expansion involves the progression of its most advanced programs, NKX019 and NKX046, through clinical trials. NKX019 is being evaluated for relapsed/refractory B-cell malignancies, while NKX046 is designed to target a broader range of solid tumor indications. The successful completion of these trials and subsequent regulatory approvals would open up new therapeutic markets and significantly contribute to the company's future prospects.

To support these ambitious goals, Nkarta is actively working on optimizing its manufacturing processes. This optimization is crucial for large-scale production of its NK cell therapies, which is essential for commercialization and wider market access. This includes investments in internal manufacturing capabilities and exploring potential partnerships to ensure a robust supply chain. Furthermore, Nkarta may pursue strategic collaborations or licensing agreements to accelerate development and broaden the reach of its technologies.

Nkarta's expansion is heavily reliant on the progress of its clinical trials. The company's lead programs, NKX019 and NKX046, are currently in clinical development, targeting relapsed/refractory B-cell malignancies and solid tumors, respectively. Positive data from these trials are essential for regulatory approvals and market entry. The company is investing significantly in these programs to ensure their successful advancement.

To support its growth, Nkarta is focusing on optimizing its manufacturing processes. This includes investments in internal manufacturing capabilities and potential partnerships to ensure a robust supply chain. Efficient manufacturing is crucial for large-scale production, which is essential for commercialization and wider market access. The company is aiming to build a scalable and reliable manufacturing process.

Nkarta may pursue strategic collaborations or licensing agreements to accelerate development and broaden the reach of its technologies. These partnerships could lead to geographical expansion or diversification into new product categories within oncology. Collaborations can provide access to additional resources and expertise, accelerating the company's growth. The company is actively exploring potential partnerships.

Nkarta's future expansion could involve exploring new indications for its existing NK cell platforms. This approach aims to maximize the value of its proprietary technology and address unmet medical needs across a wider patient population. Pipeline expansion is a key element of the company's long-term growth strategy. The company is committed to identifying and pursuing new therapeutic opportunities.

Nkarta's primary expansion initiatives are focused on advancing its clinical pipeline, optimizing manufacturing, and exploring strategic collaborations. These efforts are designed to support the commercialization of its NK cell therapies and expand its market presence. The company's success hinges on the execution of these key strategies.

- Advancing NKX019 and NKX046 through clinical trials.

- Optimizing manufacturing processes for large-scale production.

- Exploring strategic collaborations and licensing agreements.

- Expanding the pipeline by exploring new indications for existing platforms.

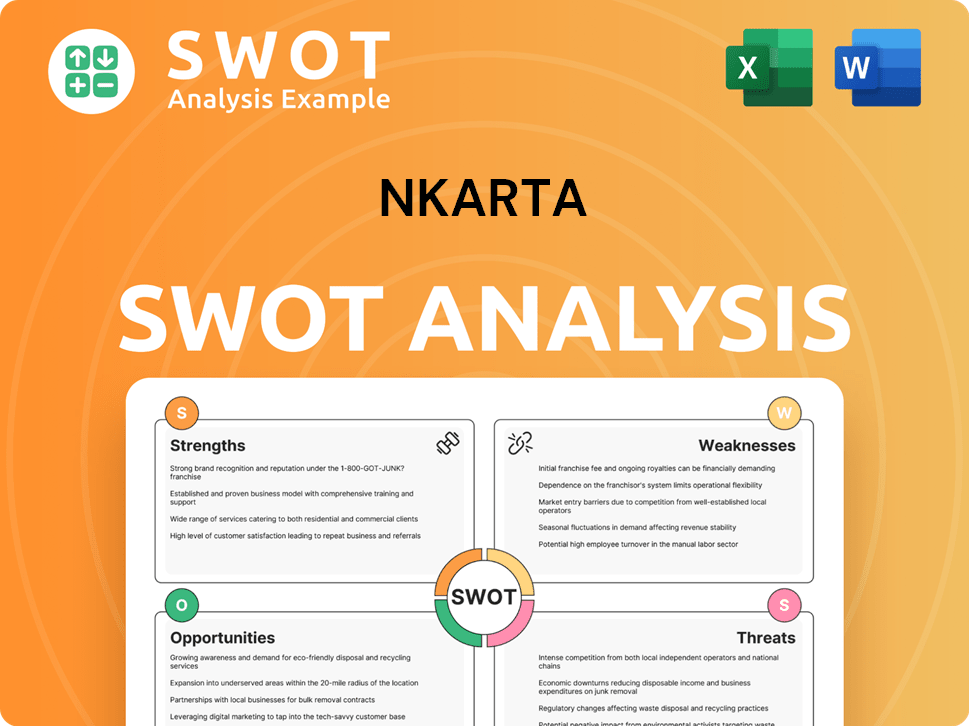

Nkarta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nkarta Invest in Innovation?

The growth strategy of Nkarta is deeply intertwined with its innovation and technology strategy, particularly its proprietary NK cell expansion and engineering platform. This platform is central to the company's ability to develop and commercialize allogeneic NK cell therapies. The company's focus on this technology is a key driver for its future prospects within the biopharmaceutical industry.

Nkarta's technological advantage lies in its capacity to generate large quantities of highly active, allogeneic NK cells from a single donor. These cells can then be engineered with specific targeting receptors. This 'off-the-shelf' approach represents a significant innovation in cell therapy, aiming to overcome the logistical and manufacturing challenges often associated with autologous therapies, thereby influencing the Nkarta company analysis.

The company consistently invests in research and development (R&D) to enhance the potency, persistence, and specificity of its NK cell therapies. This commitment is crucial for advancing its pipeline drugs and improving its investment potential.

Nkarta's innovation strategy includes using chimeric antigen receptors (CARs) and other targeting modules to enhance NK cells' ability to recognize and kill cancer cells. NKX019, for instance, incorporates a CAR targeting CD19, a protein found on B-cell malignancies.

The company is also exploring novel engineering approaches to improve NK cell trafficking to tumor sites and overcome the immunosuppressive tumor microenvironment. These strategies are critical for improving the efficacy of cell therapy.

Nkarta leverages advanced automation and quality control systems to ensure the consistent production of high-quality cell therapy products. These processes are vital for meeting regulatory approvals and maintaining the integrity of the therapy.

The company's continuous investment in its proprietary platform and its progression of novel cell therapy candidates through clinical trials underscore its leadership in this innovative field. This commitment supports the company's long-term growth.

The 'off-the-shelf' approach offers significant advantages, including reduced manufacturing costs and faster treatment timelines compared to autologous therapies. This positions Nkarta favorably within the competitive landscape.

Nkarta's focus on NK cell therapy, coupled with its innovative technology platform, positions it well for future growth. The company's ability to advance its pipeline and achieve regulatory approvals will be key to realizing its potential. Read more about the company's core values in Mission, Vision & Core Values of Nkarta.

Nkarta's technology platform is designed to address several critical aspects of cell therapy, including scalability, efficacy, and safety. The company's focus on allogeneic NK cells offers the potential for broader patient access and more convenient treatment options.

- Allogeneic Platform: The use of allogeneic cells allows for off-the-shelf availability, which can significantly reduce manufacturing timelines and costs.

- CAR Engineering: The integration of CARs enhances the NK cells' ability to target and kill cancer cells, improving therapeutic efficacy.

- Manufacturing Excellence: Advanced manufacturing processes are essential for ensuring the consistent production of high-quality cell therapy products.

- Clinical Trials: The company is actively involved in clinical trials to evaluate the safety and efficacy of its NK cell therapies.

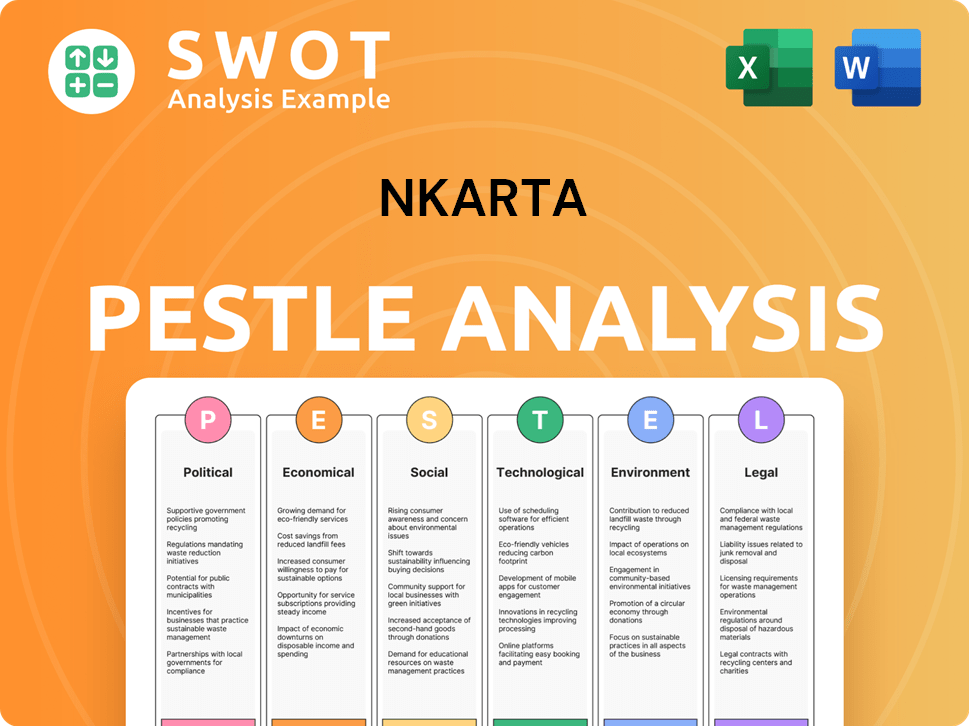

Nkarta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Nkarta’s Growth Forecast?

The financial outlook for Nkarta is heavily reliant on the advancement of its clinical pipeline and its capacity to secure additional funding. As a clinical-stage biopharmaceutical company, Nkarta does not currently generate revenue from commercialized products, placing it in a phase of significant investment.

Nkarta's financial health is crucial for its Nkarta growth strategy. The company's ability to successfully navigate clinical trials and secure necessary capital will determine its Nkarta future prospects. This situation is typical for companies in the biopharmaceutical industry, where substantial upfront investments are required before potential returns.

For the first quarter of 2024, Nkarta reported cash, cash equivalents, and marketable securities totaling $219.0 million as of March 31, 2024. This financial position is projected to fund operations into the second quarter of 2025. The company's financial strategy must balance research and development costs with the need to maintain sufficient cash reserves.

In Q1 2024, Nkarta's net loss was $32.4 million, or $0.57 per share. This is an improvement compared to a net loss of $38.9 million, or $0.90 per share, in Q1 2023. Research and development expenses decreased to $24.7 million in Q1 2024 from $31.9 million in Q1 2023, primarily due to reduced clinical trial and manufacturing activities.

General and administrative expenses remained relatively stable at $8.0 million in Q1 2024, compared to $7.1 million in Q1 2023. The fluctuations in expenses reflect the dynamic nature of clinical-stage biopharmaceutical companies. These expenses are critical for supporting ongoing clinical trials and operational needs.

Nkarta's future financial success hinges on the progress of its lead programs, NKX019 and NKX046, through clinical trials. Successful advancement will likely require additional capital raises or strategic partnerships. Analysts and the company will focus on the duration of current cash reserves and the timing of key clinical milestones.

To support its Nkarta growth strategy, the company may pursue various capital-raising strategies. These could include public offerings, private placements, or collaborations with larger pharmaceutical companies. The ability to secure funding is essential for continuing research and development efforts, especially in the field of cell therapy and NK cell therapy.

Understanding Nkarta's financial position is vital for investors. The company's financial health is directly tied to the success of its clinical trials and its ability to secure funding. Investors should monitor key metrics such as cash runway, net losses, and R&D expenses.

- Cash Runway: The period for which Nkarta can fund its operations with current cash reserves.

- Net Loss: The difference between revenues and expenses, indicating the company's profitability.

- R&D Expenses: Costs associated with research and development, a significant component of Nkarta's spending.

- Partnerships and Collaborations: Strategic alliances that could provide additional funding and resources.

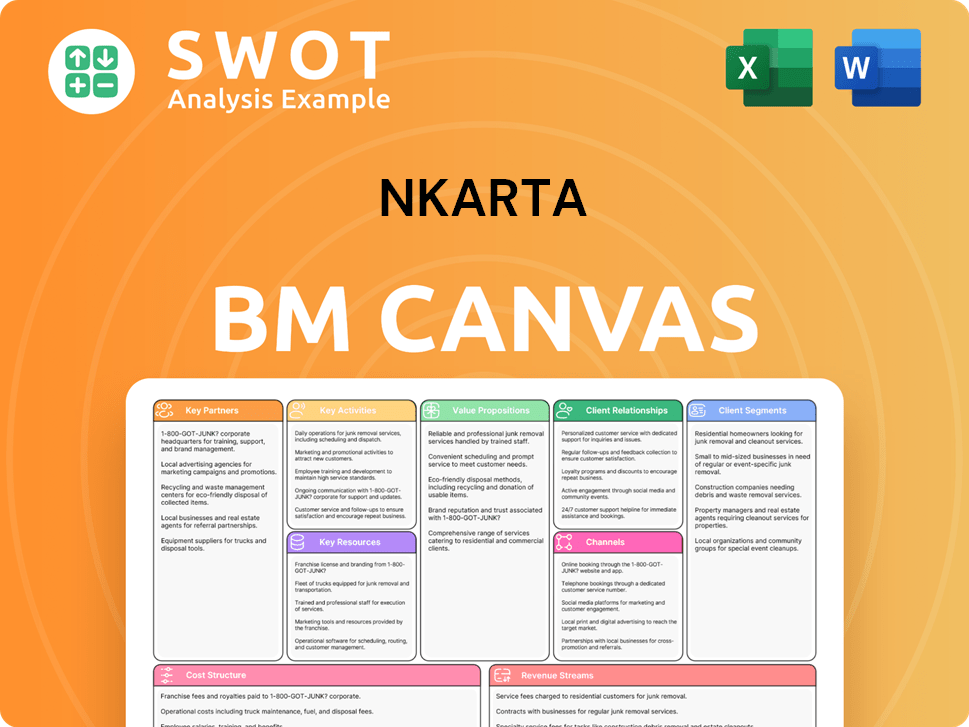

Nkarta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Nkarta’s Growth?

The path for any company, including those in the biopharmaceutical industry like Nkarta, is fraught with potential risks and obstacles. Success in the field of cell therapy, particularly with innovative approaches such as NK cell therapy, is far from guaranteed. Several factors could significantly impact the company's growth and future prospects.

One of the primary challenges is the high failure rate in clinical trials, a common issue in the biopharmaceutical industry. Furthermore, the development of allogeneic cell therapies presents unique hurdles, including cell persistence and immune rejection. These complexities can lead to delays, increased costs, and potential setbacks in the Nkarta growth strategy.

Market competition is another significant factor affecting Nkarta's trajectory. The oncology space, especially for cell therapies, is intensely competitive, with numerous companies vying for market share. To maintain a competitive edge, Nkarta must continuously innovate and differentiate its therapies. A thorough Nkarta company analysis reveals that navigating these challenges is crucial for future success.

The biopharmaceutical industry faces a high attrition rate in clinical trials. Many promising drug candidates fail to demonstrate sufficient efficacy or safety in later-stage trials, which could significantly impact the Nkarta future prospects.

Regulatory bodies like the FDA have stringent guidelines for novel cell therapies. Delays or rejections of Nkarta's drug candidates would severely impact its growth trajectory, affecting Nkarta's stock forecast.

The oncology space is highly competitive, with numerous companies pursuing similar or alternative treatment modalities. Nkarta must continually innovate and differentiate its therapies to maintain a competitive edge; this is a key point in any Nkarta company analysis.

The manufacturing of complex cell therapies requires a robust supply chain. Disruptions could delay product availability and impact Nkarta's financial performance. Understanding the supply chain is crucial for Nkarta investment potential.

Nkarta's financial runway depends on its ability to raise additional capital. A challenging economic environment or investor sentiment could hinder future funding rounds, influencing Nkarta's investor relations.

Allogeneic cell therapies face potential issues with cell persistence, engraftment, and immune rejection. These complexities can lead to setbacks in clinical trials and affect the Nkarta pipeline drugs.

Nkarta mitigates these risks through diversified clinical programs, robust preclinical research, and stringent quality control in manufacturing. Strategic financial planning is also essential. For more insights, explore Revenue Streams & Business Model of Nkarta. These strategies are vital for the Nkarta growth strategy.

The competitive landscape includes companies developing similar cell therapies, such as those targeting cancer. Nkarta must differentiate its products to gain Nkarta market share analysis. This includes ongoing Nkarta recent developments.

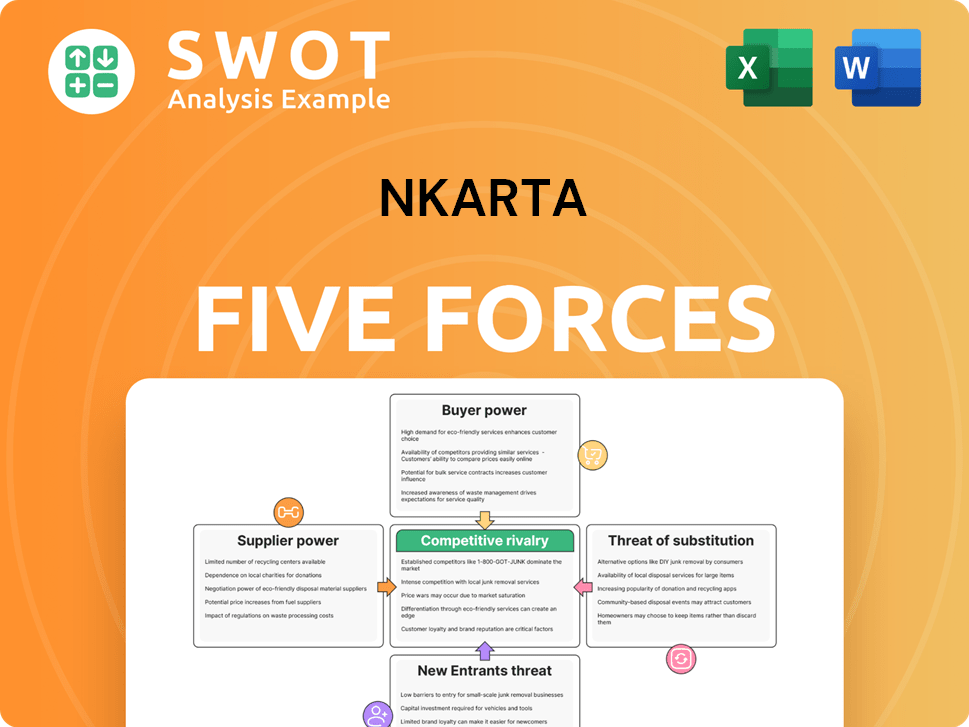

Nkarta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nkarta Company?

- What is Competitive Landscape of Nkarta Company?

- How Does Nkarta Company Work?

- What is Sales and Marketing Strategy of Nkarta Company?

- What is Brief History of Nkarta Company?

- Who Owns Nkarta Company?

- What is Customer Demographics and Target Market of Nkarta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.