Nkarta Bundle

How is Nkarta Revolutionizing Cell Therapy?

Dive into the world of Nkarta, a cutting-edge biotech company at the forefront of Nkarta SWOT Analysis, pioneering off-the-shelf natural killer (NK) cell therapies. Facing a dynamic shift in its strategic focus, Nkarta, a leading biotech company, is now concentrating on autoimmune diseases after a strategic pivot. This strategic realignment underscores Nkarta's commitment to addressing critical unmet medical needs with innovative solutions.

With a robust financial foundation, including a cash position projected to last until 2029, Nkarta therapeutics is poised to advance its clinical pipeline. This exploration will delve into how Nkarta's technology works, its strategic direction, and its potential impact on the cell therapy landscape. Understanding Nkarta's operations offers valuable insights for investors and industry stakeholders alike.

What Are the Key Operations Driving Nkarta’s Success?

The core operations of the Nkarta company are centered on the discovery, development, and commercialization of allogeneic, off-the-shelf natural killer (NK) cell therapies. Their primary focus is on treating autoimmune diseases. They aim to harness the power of NK cells to identify and eliminate abnormal cells, providing readily available, engineered cell therapies designed for deep therapeutic activity and broad accessibility in outpatient settings.

The value proposition of Nkarta therapeutics lies in its innovative approach to cell therapy. By offering 'off-the-shelf' allogeneic NK cell therapies, they eliminate the need for patient-specific cell collection, a process required for autologous cell therapies. This approach is designed to reduce patient burden, potentially shorten hospitalization times, and facilitate a quicker path to regulatory approval. Their lead product candidate, NKX019, is currently in clinical trials, targeting diseases like lupus nephritis and systemic sclerosis.

The company's operational process is built upon a sophisticated cell expansion and cryopreservation platform, combined with proprietary cell engineering technologies and CRISPR-based genome engineering capabilities. This allows Nkarta to generate a large supply of engineered NK cells, enhancing their ability to recognize and eliminate therapeutic targets. The company's trials are designed to evaluate the single-agent activity of NKX019, with patients receiving three-dose cycles following lymphodepletion with cyclophosphamide, without the need for supplemental cytokines or antibody-based therapeutics.

Nkarta uses a cell expansion and cryopreservation platform. They also utilize proprietary cell engineering technologies and CRISPR-based genome engineering. This allows them to produce a large supply of engineered NK cells.

The company's primary focus is on autoimmune diseases. They are currently investigating their lead product candidate, NKX019, in clinical trials for conditions like lupus nephritis, systemic sclerosis, myositis, and vasculitis.

Nkarta has ongoing clinical trials for NKX019. The Ntrust-1 trial is for lupus nephritis. The Ntrust-2 trial, expected to start patient enrollment by the end of 2024, covers systemic sclerosis, myositis, and vasculitis. Preliminary clinical data is expected in 2025.

Their 'off-the-shelf' approach sets them apart from competitors. This reduces patient burden by eliminating the need for apheresis. This potentially allows for a faster path to regulatory approval and increased accessibility.

Nkarta's operational model focuses on the single-agent activity of NKX019. Patients receive three-dose cycles following lymphodepletion. This approach aims to improve tolerability and safety. For more insights, check out the Growth Strategy of Nkarta.

- The Ntrust-2 trial is expected to initiate patient enrollment by the end of 2024.

- Preliminary clinical data from both Ntrust-1 and Ntrust-2 trials is anticipated in 2025.

- The company is focused on improving accessibility and potentially reducing hospitalization.

- Their approach aims for a favorable safety profile compared to some existing cell therapy approaches.

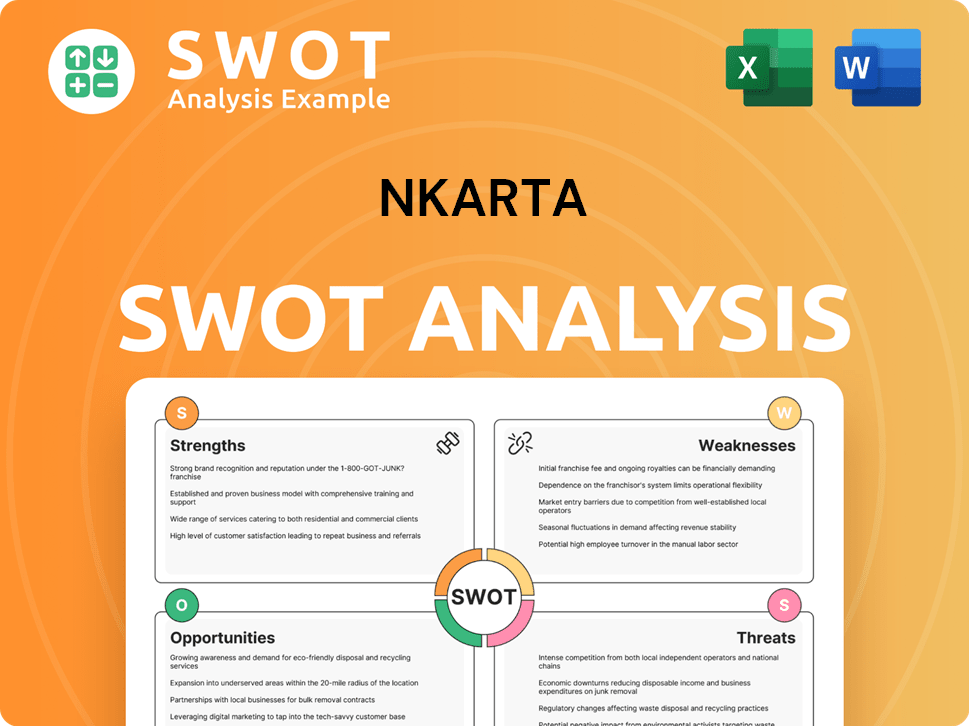

Nkarta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Nkarta Make Money?

As a clinical-stage biotech company, the current revenue streams for the Nkarta company are limited. The company is focused on research and development (R&D) and advancing its pipeline of NK cell therapies through clinical trials. Therefore, financial reports primarily reflect expenses related to these activities.

For Q1 2025, Nkarta reported a net loss of $32.0 million, or $0.43 per share. The net loss for the full year 2024 was $108.8 million, or $1.60 per share. R&D expenses were $24.2 million for Q1 2025 and $96.7 million for the full year 2024. General and administrative expenses were $12.4 million for Q1 2025 and $31.5 million for the full year 2024.

The future monetization strategies for Nkarta therapeutics will center on the successful development and commercialization of its NK cell therapies. This involves strategies such as product sales, licensing and partnerships, and milestone payments and royalties.

Once product candidates receive regulatory approval, revenue will come from direct sales to healthcare providers. Partnerships with larger pharmaceutical companies for development, manufacturing, or commercialization are also planned. A CRISPR collaboration involves Nkarta and CRISPR sharing equally in R&D costs and potential profits.

- Product Sales: Direct sales of therapies to healthcare providers after regulatory approval.

- Licensing and Partnerships: Agreements with larger pharmaceutical companies for development, manufacturing, or commercialization.

- Milestone Payments and Royalties: Upfront payments, milestone payments, and royalties from partnerships.

As a clinical-stage company, Nkarta's financial health is currently supported by its cash reserves. As of March 31, 2025, the company had a cash balance of $351.9 million, expected to fund operations into 2029. This cash runway extension of more than a year is due to cost reductions from a restructuring plan implemented in March 2025. For more information on the company's target market, you can read this article: Target Market of Nkarta.

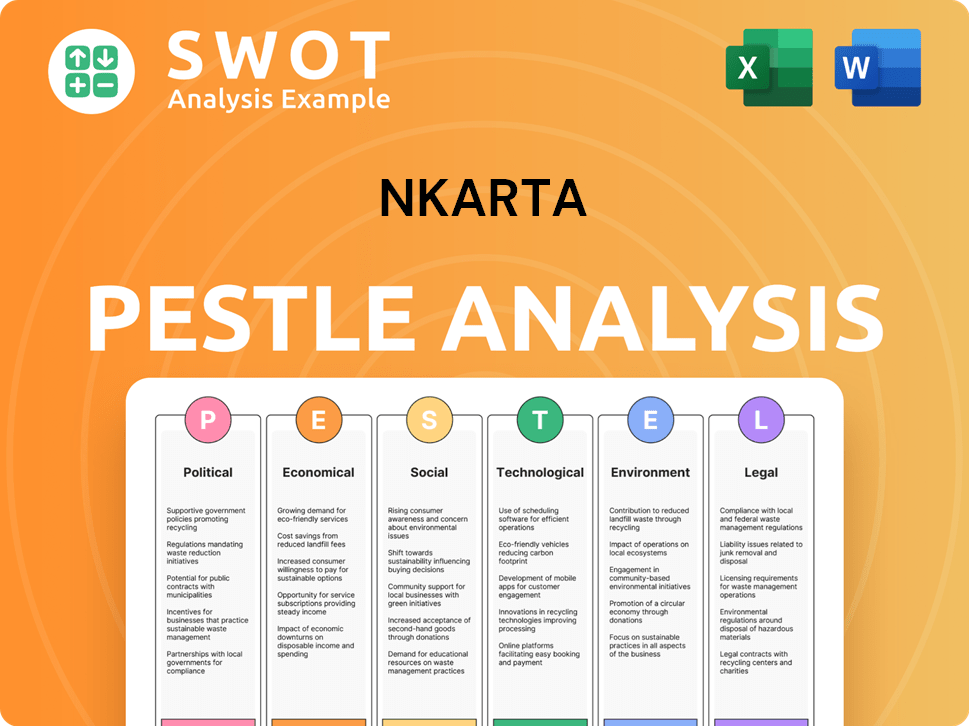

Nkarta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Nkarta’s Business Model?

The Nkarta company has navigated a series of strategic shifts and operational challenges, significantly impacting its trajectory in the biotech industry. These moves, driven by clinical trial outcomes and market dynamics, have shaped its focus on innovative therapies. The company's evolution showcases its adaptability in the competitive landscape of cell therapy, particularly in the development of NK cell therapy.

Key decisions, such as discontinuing the development of NKX019 in lymphoma in November 2024, highlight Nkarta's strategic agility. This was followed by the discontinuation of NKX101 in March 2024, demonstrating the inherent risks and complexities in early-stage biopharmaceutical development. These strategic pivots reflect Nkarta's responsiveness to emerging clinical data and market opportunities.

To address operational and market challenges, including the high costs associated with clinical trials and manufacturing, Nkarta implemented a strategic restructuring plan in March 2025. This included a workforce reduction of 34%, or 53 positions, and a halving of executive staffing. The goal was to extend its cash runway into 2029 and streamline operations.

Discontinuation of NKX019 in lymphoma in November 2024, despite a 71% partial response rate, to focus on autoimmune diseases. This strategic shift underscores the company's focus on market differentiation and potential. The company's pipeline is now focused on autoimmune diseases.

Discontinuation of NKX101 in March 2024 due to complete response rate drop-off. A strategic restructuring plan in March 2025, including a 34% workforce reduction to extend the cash runway to 2029, demonstrates financial prudence.

Pioneering off-the-shelf, allogeneic NK cell therapies offers greater accessibility and potential for improved tolerability. Proprietary cell expansion and cryopreservation platform, combined with cell engineering and CRISPR-based genome engineering capabilities, provides a unique foundation.

Focus on autoimmune diseases with NKX019 trials for lupus nephritis (Ntrust-1) and systemic sclerosis, myositis, and vasculitis (Ntrust-2). Preliminary clinical data are planned for 2025, which will be crucial catalysts for the company.

Nkarta's competitive advantage lies in its allogeneic NK cell therapy platform, offering a readily available treatment option. The company’s focus on autoimmune diseases, such as lupus nephritis and systemic sclerosis, positions it in a growing market. Preliminary clinical data from ongoing trials are expected in 2025, which will be critical for the company's future.

- Allogeneic NK cell therapies offer advantages over autologous therapies.

- Proprietary cell expansion and cryopreservation platform.

- Focus on autoimmune diseases with planned clinical data releases in 2025.

- Strategic restructuring to extend cash runway into 2029.

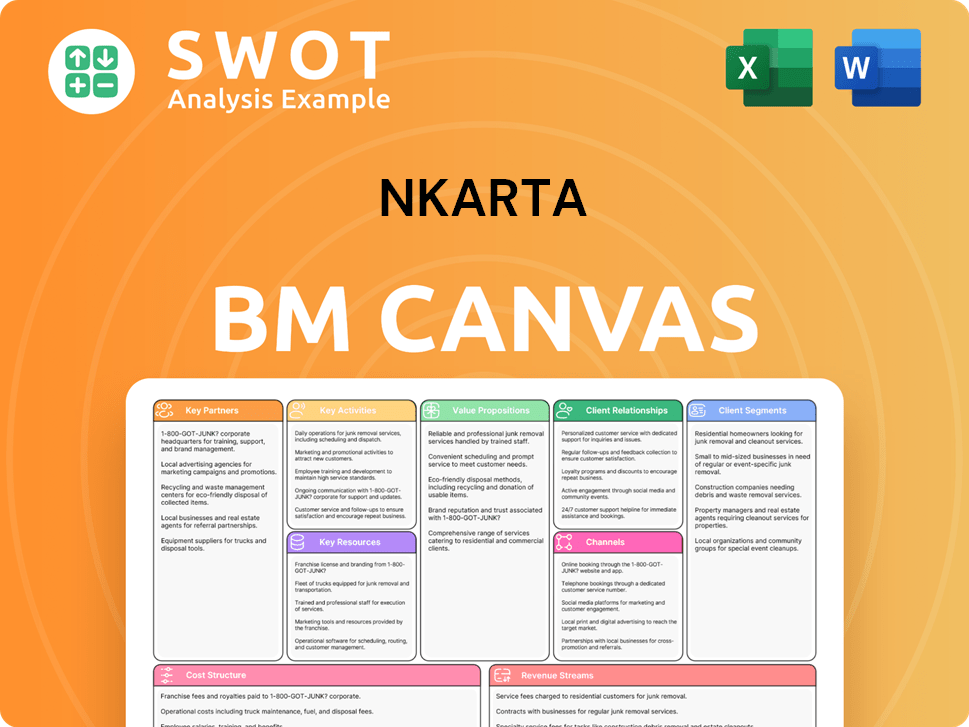

Nkarta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Nkarta Positioning Itself for Continued Success?

The Nkarta company is a clinical-stage biopharmaceutical firm specializing in allogeneic, off-the-shelf natural killer (NK) cell therapies, with a strategic focus on autoimmune diseases. This positions the company within the competitive landscape of the broader NK cell therapy market, which sees over 140 active players and more than 160 pipeline therapies. Nkarta therapeutics distinguishes itself through its allogeneic, off-the-shelf approach, specifically targeting autoimmune conditions.

Key risks for Nkarta include the inherent challenges of clinical development, like the possibility that early-stage trial results may not predict future success. The complexity of manufacturing CAR NK cell therapies, regulatory hurdles, and competition from other companies developing similar products also contribute to the risks. The company's limited operating history and past financial losses are also significant factors, and its path to profitability hinges on the successful development and commercialization of its product candidates.

Nkarta is strategically positioned in the NK cell therapy market, focusing on allogeneic, off-the-shelf treatments for autoimmune diseases. This focus sets it apart from other companies in the field. The company is navigating a competitive market, but its specific approach offers a differentiated pathway for potential growth and market share.

The company faces standard clinical development risks, including the uncertainty of early trial results. Manufacturing complexities, regulatory hurdles, and competition are also significant factors. The company's financial performance and ability to achieve profitability depend on successful product development and commercialization.

Nkarta's future is shaped by its strategic initiatives and innovation roadmap, particularly the advancement of NKX019 for multiple autoimmune diseases. Preliminary clinical data from the Ntrust-1 and Ntrust-2 trials is expected in 2025. The company's financial position, with $351.9 million in cash as of March 31, 2025, provides a strong foundation for achieving key clinical milestones.

Nkarta aims to sustain and grow its revenue through successful clinical trials and product sales. The company anticipates significant expenses related to clinical trials and manufacturing and may seek additional capital through various financing methods. Leadership remains confident in the potential advantages of NKX019 for treating autoimmune diseases.

Nkarta is focused on advancing its clinical pipeline, particularly NKX019 for autoimmune diseases, with anticipated clinical data in 2025. The company's strong cash position, extending its financial runway, supports its ability to reach key clinical milestones. The company is strategically positioned in the cell therapy market, focusing on allogeneic, off-the-shelf treatments.

- Nkarta's primary focus is on developing NK cell therapies for autoimmune diseases.

- Preliminary clinical data from trials like Ntrust-1 and Ntrust-2 are expected in 2025.

- The company's cash position, as of March 31, 2025, was $351.9 million, providing a financial runway.

- Nkarta is addressing the challenges of clinical development, manufacturing, and competition.

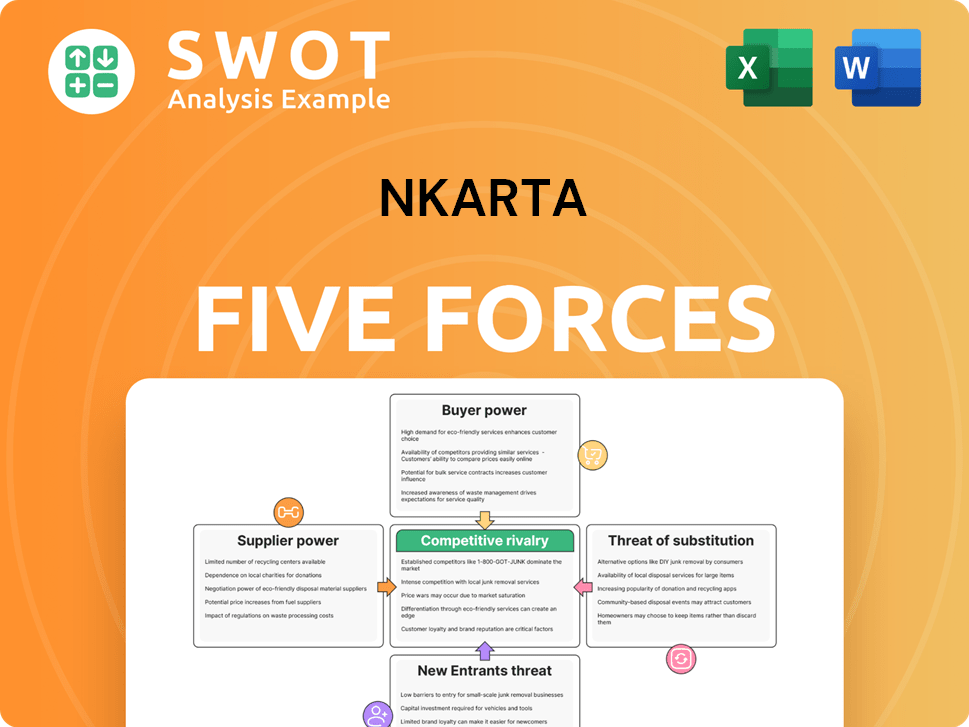

Nkarta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nkarta Company?

- What is Competitive Landscape of Nkarta Company?

- What is Growth Strategy and Future Prospects of Nkarta Company?

- What is Sales and Marketing Strategy of Nkarta Company?

- What is Brief History of Nkarta Company?

- Who Owns Nkarta Company?

- What is Customer Demographics and Target Market of Nkarta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.