Nkarta Bundle

Who Really Owns Nkarta?

Ever wonder who's truly calling the shots at Nkarta, a rising star in the biotech world? Unraveling the Nkarta SWOT Analysis is just the beginning. Understanding the company's ownership structure is key to grasping its strategic direction and future potential. From its early days to its current standing, the ownership landscape paints a fascinating picture.

This exploration of "Who owns Nkarta" delves into the evolution of Nkarta's ownership, from its founding investors to current shareholders. We'll examine the influence of Nkarta investors, the roles of Nkarta executives, and the impact of its IPO on the company's trajectory. Knowing the Nkarta company ownership structure provides valuable insights into its operations and future prospects, including its Nkarta stock performance.

Who Founded Nkarta?

The company, Nkarta, Inc., was co-founded by Dr. Dario Campana and Dr. Nghia Tran. Dr. Campana is a recognized expert in NK cell biology. While specific equity splits at the company's inception are not publicly disclosed, it's common for founders in early-stage biotechnology companies to retain significant equity.

Early ownership often involves angel investors, venture capital firms, and potentially friends and family who provide seed funding. These initial investments are crucial for funding early research and development, as well as operational costs. The founders' vision for developing novel NK cell therapies was reflected in the early distribution of control, with initial investors backing their scientific expertise and commercialization potential.

Early agreements in biotechnology startups often include vesting schedules to ensure founders' continued commitment, and buy-sell clauses to manage potential founder departures. Public records do not detail specific early ownership disputes or buyouts for Nkarta. Such events can significantly reshape a company's initial equity distribution and control.

Founders typically hold substantial equity to align their interests with the company's long-term success. Vesting schedules are common to incentivize continued commitment.

Seed funding from angel investors, venture capital, and family/friends is crucial for early-stage research and operations. This initial capital fuels the company's growth.

Vesting schedules ensure founders remain committed over time, preventing premature departures. These schedules often span several years.

Buy-sell clauses manage potential founder departures, ensuring a smooth transition. These clauses outline procedures for equity transfer.

The early distribution of equity reflects the founders' vision and the investors' confidence. This structure supports the company's goals.

Early investors provide critical capital to support early research and development. Their backing is essential for the company's initial growth.

Understanding the early ownership structure of the Revenue Streams & Business Model of Nkarta is key to assessing the company's foundation. While specific details are not always public, the influence of the founders and early investors is paramount. It is important to note that as of the latest financial reports, the exact percentage of ownership held by the founders at the time of inception is not available, but it is common for founders to hold a significant portion of the company's equity to align their incentives with long-term success. The early investors, typically venture capital firms, provide the necessary capital to fund the research and development of NK cell therapies. These early investments are critical for the company's ability to advance its pipeline and reach key milestones. The early ownership structure sets the stage for future financing rounds, partnerships, and ultimately, the company's trajectory in the competitive biotechnology landscape. As the company grows, the ownership structure evolves through subsequent funding rounds and public offerings, potentially diluting the founders' initial stakes.

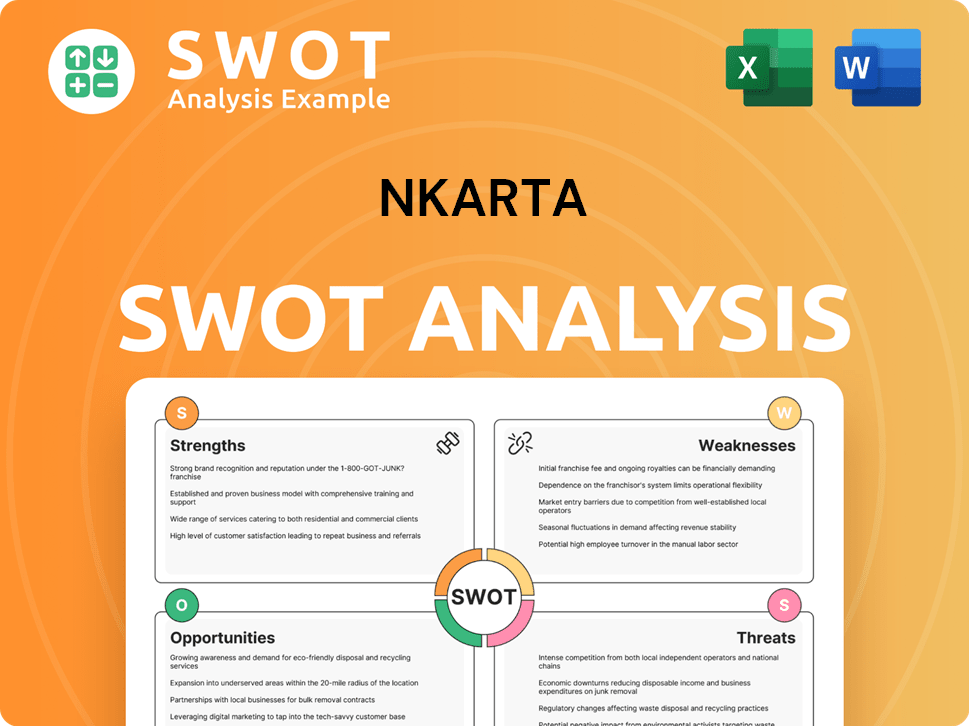

Nkarta SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nkarta’s Ownership Changed Over Time?

The initial public offering (IPO) of Nkarta, Inc. on July 17, 2020, was a pivotal event in the company's ownership evolution. Listed on the Nasdaq Global Select Market under the ticker symbol 'NKTR,' the IPO transitioned Nkarta from a privately held entity, primarily backed by venture capital, to a publicly traded company. This transition significantly broadened the shareholder base, introducing institutional and retail investors to the company's stock.

Following the IPO, Nkarta's ownership structure has seen considerable shifts. A substantial portion of the company is now held by institutional investors, mutual funds, and index funds. This shift has led to changes in the company's governance and strategic direction, as institutional investors often have significant influence. The company's stock price history reflects these changes, influenced by market dynamics and investor sentiment. For more information on the company's growth strategy, see Growth Strategy of Nkarta.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | July 17, 2020 | Transitioned from private to public ownership; broadened shareholder base. |

| Subsequent Offerings/Share Issuances | Ongoing | Dilution of existing shares; potential shift in major shareholders. |

| Institutional Investment | Ongoing | Increased institutional holdings; influence on company strategy. |

As of the first quarter of 2025, major institutional holders of Nkarta stock typically include large asset management firms and healthcare-focused investment funds. Individual insider ownership, comprising shares held by founders and current executives, is also a factor. The company's financial reports provide detailed information on the current ownership structure, including a list of major investors and their respective holdings. Understanding the Nkarta company ownership structure is crucial for assessing the company's strategic direction and financial stability. The company's leadership team and board of directors also play a significant role in shaping the company's future.

The shift from private to public ownership has significantly altered Nkarta's shareholder base.

- Institutional investors now hold a significant portion of the company's shares.

- Individual insider ownership is also a factor, though typically smaller than institutional holdings.

- Understanding the ownership structure is crucial for assessing the company's strategic direction.

- The company's annual reports provide detailed ownership information.

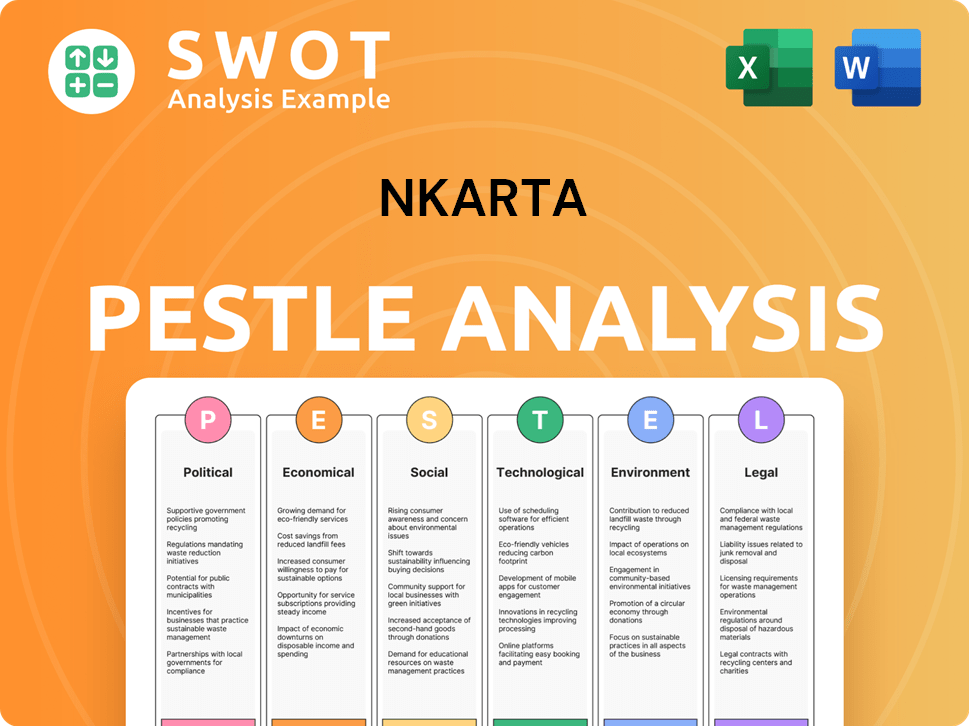

Nkarta PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nkarta’s Board?

As of early 2025, the board of directors for the Nkarta company includes a mix of individuals. These individuals represent major shareholders, independent directors, and company executives. The composition of the board is vital for governance and decision-making processes. Directors with backgrounds in venture capital or investment firms that previously funded Nkarta often hold seats, reflecting their ongoing interests in the company's performance and strategic direction. Independent directors, not affiliated with management or major shareholders, provide objective oversight.

The board's decisions are influenced by both management and major shareholders, which dictate the company's strategic direction. This includes clinical development, partnerships, and financial management. The specific breakdown of board members representing major shareholders is not always explicitly stated. Understanding the board's composition is critical for anyone looking into Nkarta's competitors and its overall market position.

| Board Member | Title | Affiliation |

|---|---|---|

| Paul Hastings | Chairman of the Board | Nkarta |

| Nadya Farcich | Director | Independent |

| Gregory Weaver | Director | Venture Capital |

The voting structure for publicly traded companies like Nkarta typically operates on a one-share-one-vote basis. Each common share entitles the holder to one vote on corporate matters. There is no public indication of dual-class shares, special voting rights, or golden shares. Proxy battles or activist investor campaigns have not been prominently reported for Nkarta in recent years. The company's stock symbol is NKTX.

Understanding Nkarta ownership involves looking at the board of directors and major shareholders. The board includes independent directors and representatives from venture capital firms. The voting structure is generally one share, one vote.

- The board includes independent directors.

- Major shareholders influence strategic direction.

- Voting is typically one share, one vote.

- No dual-class shares are publicly indicated.

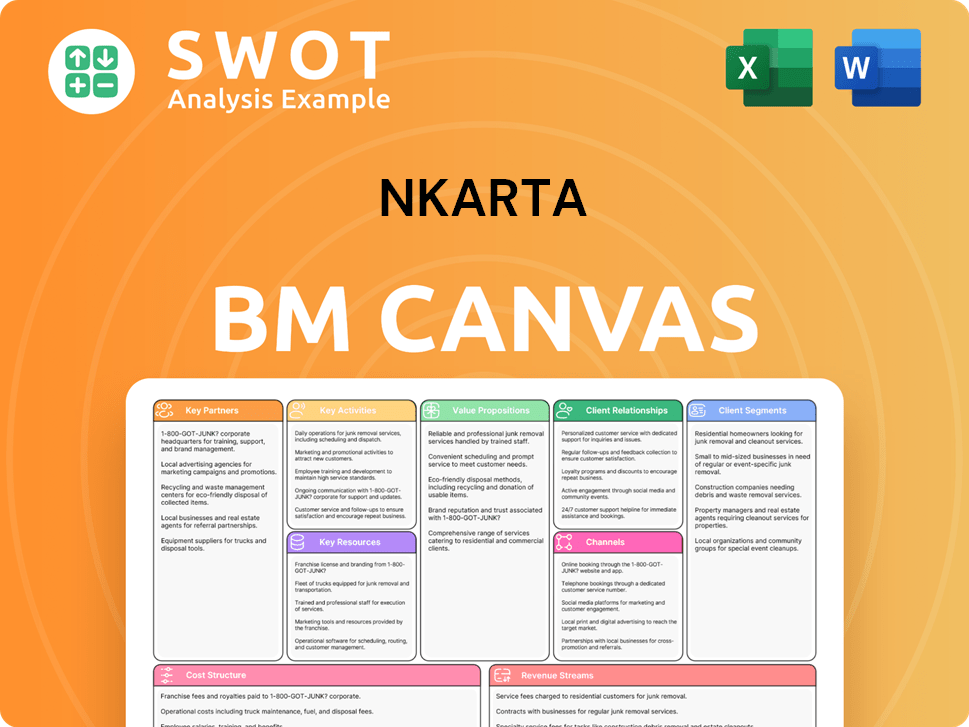

Nkarta Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nkarta’s Ownership Landscape?

Over the past few years, the ownership of the Nkarta company has seen shifts, mirroring the biotechnology industry's dynamic nature. While share buybacks haven't been a primary financial strategy, like many clinical-stage biotech firms, secondary offerings are common to raise capital for research and development. Such offerings can alter the ownership percentages of existing Nkarta investors.

Mergers and acquisitions haven't significantly reshaped Nkarta's ownership through direct acquisition. However, industry trends indicate an increasing presence of institutional ownership. Founder dilution is a natural outcome of funding rounds. The company's progress in clinical trials and potential commercialization will be key drivers of its future ownership dynamics. Understanding the Nkarta ownership structure is crucial for anyone interested in the company.

| Ownership Type | Percentage (Approximate) | Notes |

|---|---|---|

| Institutional Investors | Varies, but often a significant portion | Large funds seeking exposure to the biotech sector. |

| Insiders (Executives & Board) | Typically a smaller percentage | Ownership by the Nkarta executives and board members. |

| Retail Investors | Remainder | Individual investors holding smaller stakes. |

The Nkarta stock ownership landscape is influenced by factors like clinical trial outcomes and market conditions. As of late 2024, institutional investors generally hold a substantial portion of shares. The company's future, including potential changes in the Nkarta company ownership structure, is closely tied to its clinical developments and financial performance. For more detailed information about the company, you can check out this article about Nkarta.

Institutional investors, such as mutual funds and hedge funds, often hold a large percentage of shares in biotech companies like Nkarta. This ownership structure can influence stock performance.

The ownership stake held by Nkarta executives and board members is a key indicator of confidence in the company's future. This can be a factor in the Nkarta stock valuation.

Market conditions and investor sentiment significantly impact the ownership of Nkarta. Positive clinical trial results often attract more investment, influencing the Nkarta stock price history.

The future ownership of Nkarta will be shaped by its clinical progress and strategic decisions. The Who owns Nkarta question is always evolving.

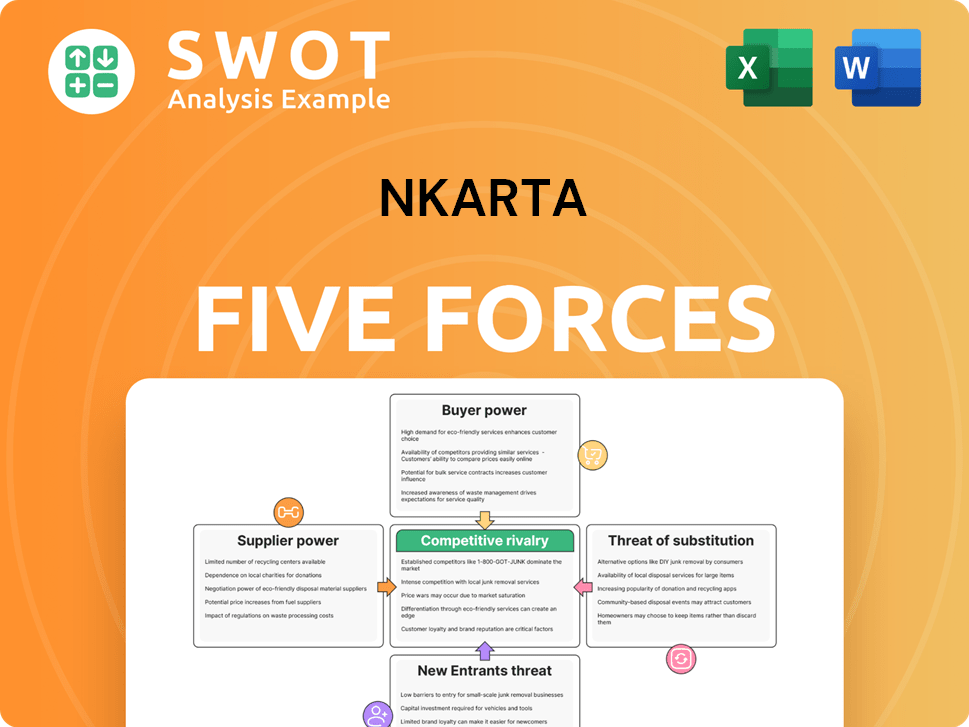

Nkarta Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nkarta Company?

- What is Competitive Landscape of Nkarta Company?

- What is Growth Strategy and Future Prospects of Nkarta Company?

- How Does Nkarta Company Work?

- What is Sales and Marketing Strategy of Nkarta Company?

- What is Brief History of Nkarta Company?

- What is Customer Demographics and Target Market of Nkarta Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.