Polaris Bundle

Can Polaris Revitalize Growth in a Shifting Powersports Landscape?

Polaris Inc., a titan in the powersports industry, boasts a legacy of innovation, from its pioneering snowmobiles to its diverse range of off-road vehicles and motorcycles. Founded on American ingenuity, the company has consistently adapted to market demands, building a global presence across nearly 100 countries. This Polaris SWOT Analysis will provide a detailed look into the company's strategies.

This deep dive into the Polaris Growth Strategy will explore the company's ambitious plans for expansion, its technological advancements, and its financial outlook amidst evolving Polaris Industry Trends. We'll dissect the Polaris Company Analysis, examining its Polaris Market Share and Polaris Business Model to understand how Polaris aims to capitalize on future growth opportunities in the powersports sector, including its strategic moves in the electric vehicle market and international expansion. Furthermore, we will explore Polaris Future Prospects and the company's long-term vision, offering actionable insights for investors and industry professionals.

How Is Polaris Expanding Its Reach?

The Polaris Growth Strategy focuses on expanding its market presence and product offerings. This involves a multi-faceted approach, including new product launches, geographical expansion, and strategic partnerships. The company aims to capitalize on industry trends and maintain its competitive edge through innovation and strategic initiatives.

Polaris Future Prospects are closely tied to its ability to adapt to market dynamics and consumer preferences. The company is actively pursuing opportunities in emerging markets and investing in technologies like electrification. Despite challenges in the powersports industry, Polaris is strategically positioning itself for long-term growth and sustainability.

A comprehensive Polaris Company Analysis reveals a commitment to innovation and strategic expansion. This includes new product introductions, market diversification, and strategic partnerships. These initiatives are crucial for driving future growth and maintaining a strong position in the powersports and marine industries.

In 2024, Polaris introduced several new product innovations. These include the Indian Motorcycle Scout lineup, the RZR Pro lineup, and new boats from Bennington and Hurricane. The Marine segment also launched 2025 model year boats with new models and redesigned features. Additionally, Polaris unveiled military snowmobiles with stealth capabilities in April 2024.

While North America remains the largest market, Polaris serves nearly 100 countries globally. The company aims to expand its presence in international markets. This diversification helps mitigate risks and tap into new customer bases. Expanding into international markets is part of the Polaris Growth Strategy.

Polaris is collaborating with over 1,200 dealerships to install Level 2 chargers. This supports its electrification initiatives. These partnerships are crucial for enhancing customer experience and driving innovation. The company's strategic alliances are a key component of its Polaris Business Model.

Polaris has focused on supporting its dealer network and managing inventory levels during the powersports industry downturn. The company reduced ORV dealer inventory by 16% year-over-year in 2024. This strategic approach aims to align supply with demand and improve pricing power. This is a key part of their Polaris Company Analysis.

Polaris is implementing corporate restructuring programs to enhance financial flexibility and operational efficiency. These initiatives incurred $23.4 million in costs in 2024. These efforts are designed to improve the company's long-term financial performance and ensure sustainable growth. To understand more about the company's financial structure, you can read about the Revenue Streams & Business Model of Polaris.

- Polaris Market Share leadership in the ORV segment.

- Focus on Polaris Future Growth Opportunities in off-road vehicles.

- Strategic inventory management to address Polaris Industry Trends.

- Investment in electrification and new technologies.

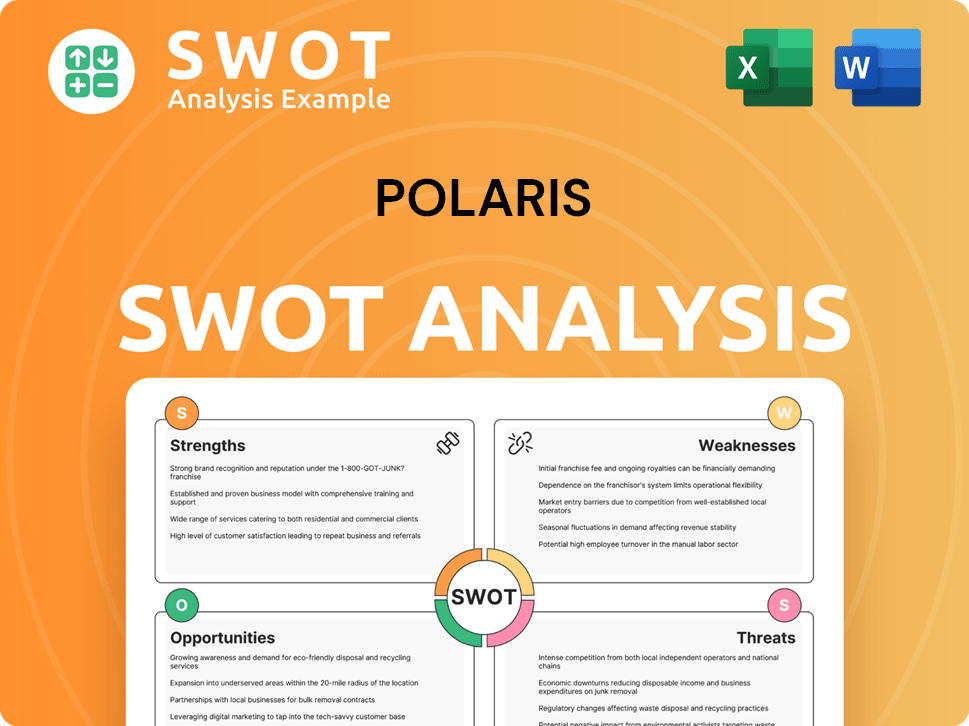

Polaris SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Polaris Invest in Innovation?

The success of any powersports company hinges on its ability to understand and respond to evolving customer needs and preferences. This includes anticipating future trends in the market and adapting product offerings accordingly. The company must also consider factors like environmental concerns and technological advancements.

Consumer preferences are shifting towards more sustainable and technologically advanced products. There's a rising demand for electric vehicles (EVs) and vehicles with enhanced features. The company's ability to integrate cutting-edge technology and offer eco-friendly options is crucial for maintaining its competitive edge.

The company's approach to innovation and technology is fundamental to its growth strategy and future prospects. This commitment is evident in its substantial investments in research and development, which are a key driver of its competitive advantage.

The company dedicates a significant portion of its revenue to research and development. This investment is crucial for developing new products and incorporating technological advancements. In 2024, the company's R&D expenses were reported at $337 million.

Electrification is a major focus, with the company aiming to lead in powersports EVs. The rEV'd Up Platform is a key component, designed for ATVs, UTVs, and motorcycles. The company also secured a $200 million contract with the U.S. Army for electric MRZR Alpha models.

To support EV adoption, the company has partnered with over 1,200 dealerships. These partnerships involve the installation of Level 2 chargers. This initiative ensures that customers have access to charging infrastructure.

Beyond electrification, the company consistently enhances product performance and features. Recent examples include the redesigned Indian Scout motorcycle and new versions of off-road vehicles. These improvements aim to meet evolving consumer demands.

Advanced technologies, such as Advanced Driver-Assistance Systems (ADAS), are integrated into the company's products. Predictive trail navigation, rolled out in its 2024 snowmobile models, enhances the riding experience. These innovations contribute to growth objectives.

Innovation is deeply embedded in the company's DNA. This commitment is a key driver of its global leadership in the powersports industry. The ongoing focus on innovation is a critical element of the company's long-term strategy.

The company's innovation strategy is multifaceted, encompassing significant investments in R&D, the strategic development of electric vehicles, and the integration of advanced technologies to enhance product offerings. Its focus on electrification and technological advancements positions it well to meet future market demands and maintain its leadership in the powersports industry. Understanding the Target Market of Polaris is crucial for tailoring these innovations effectively.

The company's growth strategy is heavily reliant on technological innovation and strategic investments. These initiatives are designed to drive future growth and maintain its market leadership.

- R&D Investments: Continuous investment in research and development, with over 4% of sales allocated to R&D.

- Electrification: Aggressive pursuit of electrification across its product lines, including ATVs, UTVs, and motorcycles.

- Strategic Partnerships: Collaborations with dealerships to support the adoption of electric vehicles through charging infrastructure.

- Product Enhancements: Regular updates and redesigns of existing product lines to incorporate advanced features and improve performance.

- Advanced Technologies: Integration of advanced driver-assistance systems and other cutting-edge technologies to enhance the riding experience.

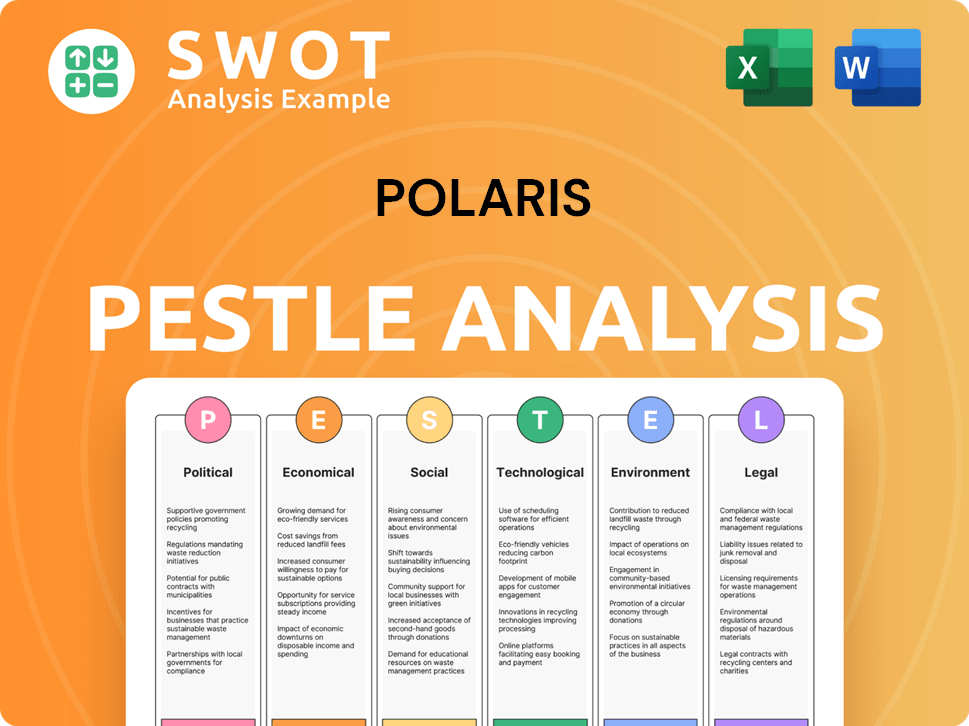

Polaris PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Polaris’s Growth Forecast?

The financial outlook for Polaris Inc. in 2025 points to continued challenges, with expectations of further sales declines and reduced earnings per share. This follows a difficult 2024, where the company experienced a significant drop in sales and adjusted diluted earnings per share.

In 2024, consolidated net sales were $8.6 billion, a 6% decrease compared to $9.0 billion in 2023. The Off-Road segment remained a significant contributor, accounting for $4,617.4 million in net sales. The On-Road segment brought in $1,667.9 million, and the Marine segment contributed $907.4 million.

For the first quarter of 2025, Polaris reported worldwide sales of $1.56 billion, a 12% decrease compared to Q1 2024. North American sales decreased by 11% to $1.29 billion from $1.44 billion in Q1 2024. The company reported a net loss attributable to Polaris of $67 million for Q1 2025.

In Q1 2025, worldwide sales decreased by 12% to $1.56 billion. North American sales, representing 84% of total sales, decreased by 11% to $1.29 billion. This decline reflects the current market conditions and economic uncertainty affecting the powersports industry.

Polaris reported a net loss attributable to Polaris of $67 million in Q1 2025, a significant shift from a net income of $4 million in Q1 2024. The adjusted net loss was $51 million, with an adjusted diluted loss per share of $0.90.

For the fiscal year 2024, Polaris reported a 20% decrease in sales, reaching $7,175 million. Adjusted diluted earnings per share (EPS) decreased by 65% to $3.25. The gross profit was $1.97 billion, with a gross profit margin of 23.44%.

The operating profit for 2024 was $808.3 million, yielding an operating profit margin of 9.61%. Net profit for 2024 was $532.4 million, resulting in a net profit margin of 6.33%. However, the gross profit margin decreased to 16.0% in Q1 2025.

Due to economic uncertainty, Polaris has withdrawn its full-year 2025 guidance for sales and adjusted earnings. However, the company introduced Q2 2025 sales guidance of $1.6 billion to $1.8 billion. Analysts' consensus projects an EPS range from -$1.73 to $2.26, with an average estimate of $0.16 for the full fiscal year 2025. The company's earnings are expected to grow by 157.66% in the next year, from $1.11 to $2.86 per share.

As of December 31, 2024, Polaris's total long-term debt was $1.84 billion, with total stockholders' equity at $1.47 billion. The company has a robust credit facility with $1.1 billion of availability. Polaris aims to leverage its existing cash balances, operating cash flows, and credit facilities to fund operations and shareholder returns.

- Focus on existing cash balances, operating cash flows, and credit facilities.

- Committed to mid-cycle financial targets given in 2022.

- Aiming for mid-single-digit sales growth, mid-to-high teens EBITDA margin, and double-digit EPS growth in the long term.

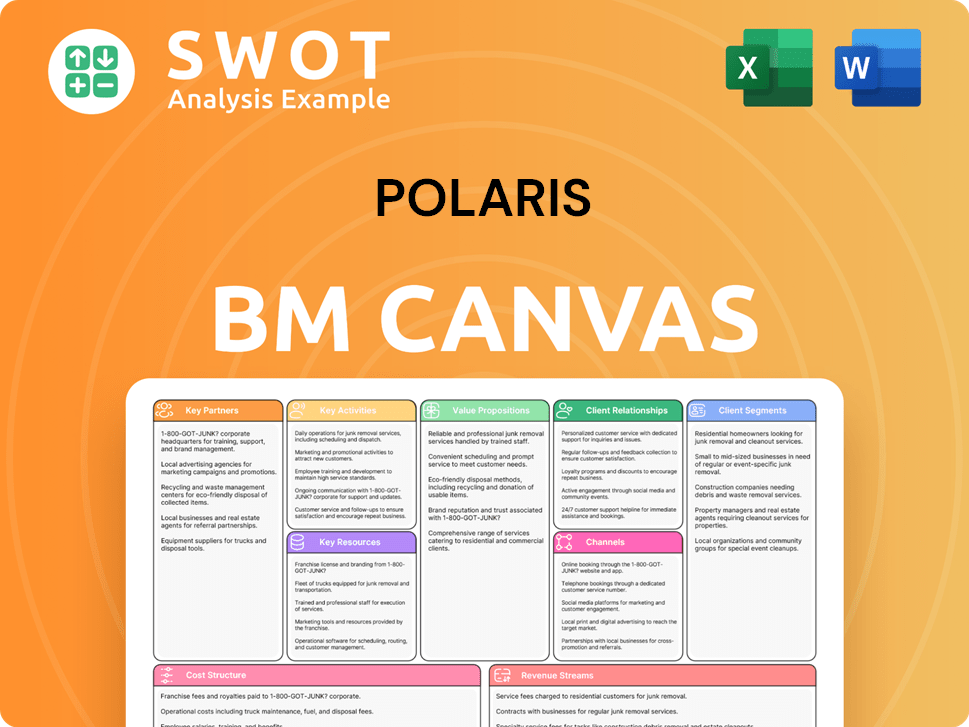

Polaris Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Polaris’s Growth?

The path to growth for Polaris Inc. is fraught with potential risks and obstacles, particularly within the dynamic powersports industry. These challenges span market competition, macroeconomic conditions, operational inefficiencies, and regulatory hurdles. Understanding these risks is critical for assessing the Polaris Company Analysis and its future prospects.

Intense competition and economic volatility are significant factors that could influence Polaris's Future Prospects. The company faces pressure from established competitors and new entrants, potentially leading to pricing pressures and reduced profitability. Furthermore, consumer spending on discretionary items like powersports vehicles is highly sensitive to economic downturns and interest rate fluctuations, which could impact sales.

Internal and external factors are at play, impacting the company's trajectory. Supply chain disruptions, production inefficiencies, and regulatory changes add to the complexity. Additionally, geopolitical instability and trade policies pose risks, particularly given the company's manufacturing presence in Mexico and China, potentially increasing costs and affecting its Polaris Market Share.

Polaris faces strong competition from established players like Honda, Yamaha, and BRP. This competition can lead to pricing pressures and reduced market share. The competitive landscape demands continuous innovation and strategic responses to maintain a competitive edge.

Consumer spending on powersports vehicles is highly sensitive to economic downturns, interest rate fluctuations, and inflation. The industry experienced a down-cycle in 2024, with North American retail sales down 8%. Polaris projects a further sales decline of 1-4% for 2025, indicating continued pressure.

Disruptions in the supply chain can lead to increased costs and delayed product launches. While Polaris has made efforts to optimize production schedules, issues with product quality could result in recalls and reputational damage. These operational challenges require proactive management.

Regulatory changes, particularly concerning environmental standards and safety regulations, can increase compliance costs. Adapting to these changes requires significant investment and strategic planning. Compliance is an ongoing concern for the company.

Manufacturing exposure in Mexico and China presents risks from potential tariffs and geopolitical instability, which could increase costs. These factors can disrupt operations and impact profitability. Managing international trade risks is crucial.

Polaris's Q1 2025 results show a net loss and declining sales across segments, highlighting the ongoing impact of these obstacles. The company acknowledges its future recovery is reliant on a rebound in the powersports industry and stable macroeconomic conditions. The company has withdrawn its full-year 2025 guidance due to trade and economic uncertainty.

Polaris employs various strategies to address these risks, including corporate restructuring to drive operating efficiencies and strategic investments in technology. The company focuses on maintaining strong dealer and distributor relationships to support sales growth. The company's focus on Polaris Growth Strategy also includes product innovation.

The powersports industry is subject to evolving trends, including the growing interest in electric vehicles. Adapting to these trends and developing new technologies is essential for long-term success. For more information, consider reading about the Brief History of Polaris.

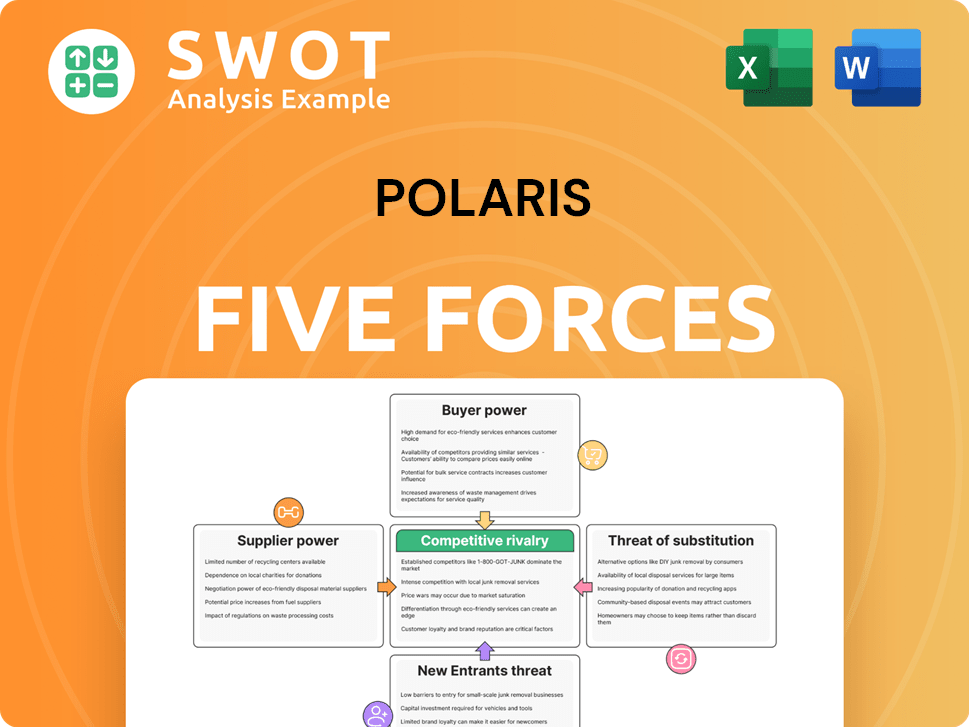

Polaris Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Polaris Company?

- What is Competitive Landscape of Polaris Company?

- How Does Polaris Company Work?

- What is Sales and Marketing Strategy of Polaris Company?

- What is Brief History of Polaris Company?

- Who Owns Polaris Company?

- What is Customer Demographics and Target Market of Polaris Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.