Polaris Bundle

How Does Polaris Industries Thrive in the Powersports World?

Polaris Inc. isn't just a company; it's a global force, consistently reshaping the powersports landscape. With impressive net sales figures, like the $4.7 billion reported in 2023, Polaris demonstrates its financial prowess and market dominance. But how does this industry leader actually operate, and what drives its continued success?

To truly understand Polaris SWOT Analysis, we must explore its core operations, from designing and manufacturing its diverse range of Polaris products, including off-road vehicles and snowmobiles, to its strategic market positioning. Knowing How Polaris works is key to appreciating its value proposition for both customers and investors. This deep dive into the Polaris business model will provide a comprehensive view of its past, present, and future potential.

What Are the Key Operations Driving Polaris’s Success?

The core of how the Polaris company operates centers on creating and delivering value through its comprehensive approach to powersports. This involves the design, engineering, manufacturing, and marketing of a diverse range of products. These offerings cater to a wide array of customer segments, from recreational riders and outdoor enthusiasts to commercial and government clients.

Operational processes are vertically integrated, from the initial concept and design through manufacturing and distribution. The company uses advanced engineering and design capabilities to develop innovative products that meet evolving customer demands. A robust network of independent dealers serves as its primary sales channel, supplemented by online platforms for parts, garments, and accessories.

The Polaris business model focuses on innovation across diverse product categories, offering a broad portfolio that caters to distinct market niches. This approach translates into superior customer experiences and market differentiation. The company's ability to consistently innovate and adapt to market demands is a key factor in its success. For more information on the company's strategic growth, consider reading about the Growth Strategy of Polaris.

The company's diverse product portfolio includes off-road vehicles (ORVs) like ATVs and side-by-sides, snowmobiles, and motorcycles under brands such as Indian Motorcycle and Slingshot. Polaris products also include a wide range of related parts, garments, and accessories (PG&A).

Manufacturing occurs in various facilities, employing efficient production techniques to ensure quality and cost-effectiveness. The supply chain involves global sourcing of components and materials, along with sophisticated logistics to manage inventory. Products are delivered to dealerships and customers worldwide.

Customer service and support are integral to ensuring post-sale satisfaction and loyalty. The company focuses on building strong relationships with its customers through excellent service and support. This focus helps Polaris Industries maintain a competitive edge.

A robust network of independent dealers serves as the primary sales channel for Polaris vehicles. Online platforms for PG&A complement this network. This multi-channel approach ensures broad market coverage and accessibility for customers.

The operational uniqueness of How Polaris works lies in its ability to innovate consistently across diverse product categories. This includes a broad portfolio that caters to distinct market niches while maintaining high standards of quality and performance. The company's success is built on its ability to deliver superior customer experiences and achieve market differentiation.

- Vertical Integration: From design to distribution.

- Innovation: Consistent development of new products.

- Dealer Network: Strong relationships with independent dealers.

- Customer Focus: Prioritizing post-sale satisfaction.

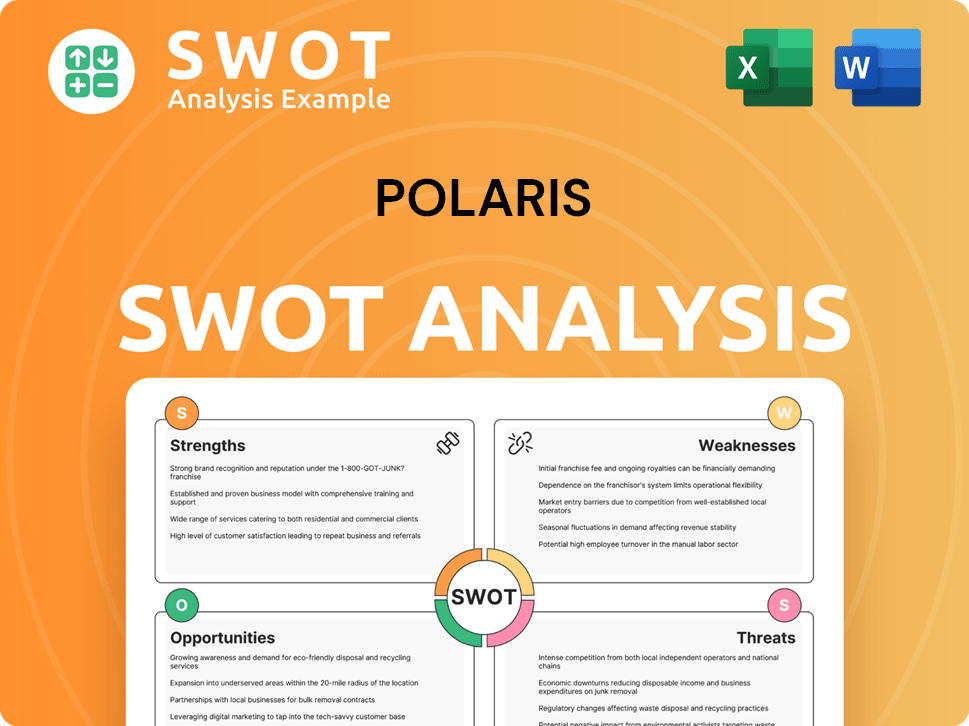

Polaris SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Polaris Make Money?

Let's explore the revenue streams and monetization strategies of the Polaris company. This analysis will delve into how the company generates income and the methods it employs to maximize profitability across its diverse product lines. Understanding these strategies is crucial for anyone looking to assess the company's financial health and market position.

The following sections will provide a detailed breakdown of the revenue sources, including product sales, aftermarket contributions, and financing options. We'll also examine how Polaris leverages its brand and dealer network to drive sales and sustain customer engagement.

The company's approach to generating revenue is multifaceted, focusing on both direct sales and recurring revenue streams.

The primary revenue stream for Polaris comes from the sale of its extensive range of products. This includes off-road vehicles (ORVs), snowmobiles, on-road vehicles, and marine products. The company's net sales for fiscal year 2023 were approximately $4.7 billion.

ORVs and snowmobiles are the largest contributors to Polaris's revenue, accounting for roughly 78% of total sales in 2023. This segment generated approximately $3.6 billion. Key products include ORVs like RANGER, RZR, and GENERAL, as well as ATVs and snowmobiles.

On-road vehicles, including Indian Motorcycle and Slingshot, represent a significant portion of the revenue. In 2023, this segment contributed about 9% of total sales, equivalent to $442 million.

Marine products, primarily boats, also play a role in Polaris's revenue generation. This segment accounted for approximately 8% of sales in 2023, totaling $393 million.

The Aftermarket segment, which includes parts, garments, and accessories (PG&A), is a key component of Polaris's revenue strategy. It contributed around 5% of sales, or $265 million, in 2023, demonstrating a successful cross-selling strategy.

Polaris employs several strategies to monetize its products and services effectively. These include cross-selling and up-selling PG&A, offering financing solutions through Polaris Acceptance, and leveraging its brand and dealer network.

Polaris uses a combination of direct sales, aftermarket products, and financing to generate revenue. The company's approach includes:

- Aftermarket Sales: The PG&A segment provides a consistent revenue stream, enhancing customer lifetime value.

- Financing Solutions: Polaris Acceptance supports sales by providing financing options for both wholesale and retail customers.

- Dealer Network and Brand Strength: Leveraging a strong dealer network and brand reputation to maximize market penetration.

- Strategic Acquisitions: Acquisitions like Transamerican Auto Parts (2016) and Nautic Global Group (2018) have expanded revenue sources and market presence.

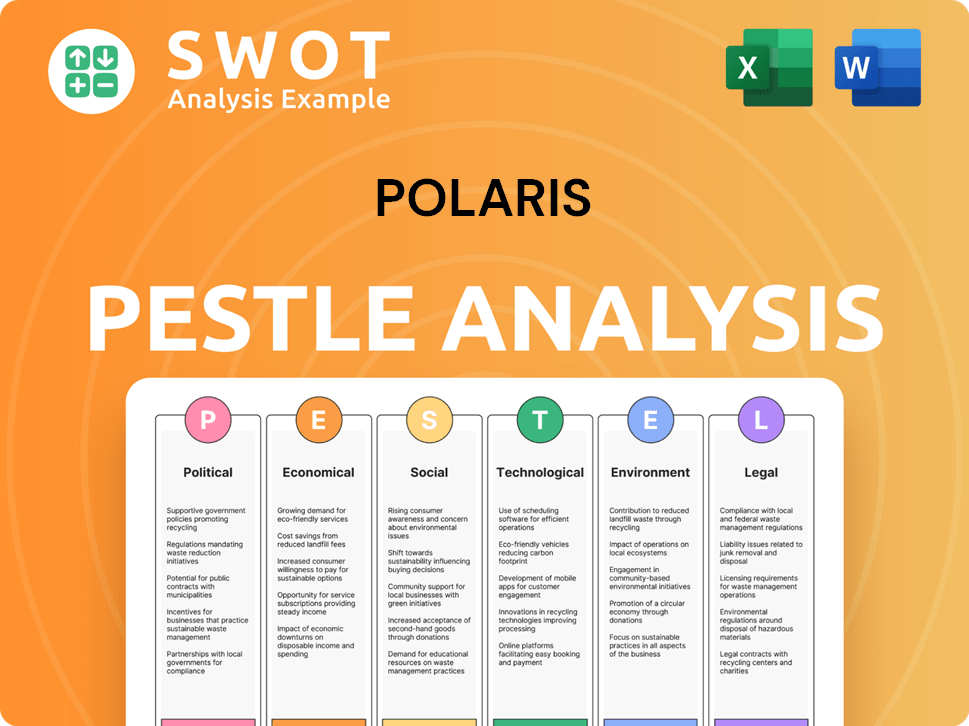

Polaris PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Polaris’s Business Model?

The evolution of the Polaris company is marked by significant milestones and strategic shifts that have defined its trajectory. A key strategic move was the re-launch of Indian Motorcycle in 2013, which revitalized a historic brand and positioned Polaris as a strong contender in the cruiser motorcycle market. The company has also increasingly focused on electric vehicle (EV) technology, highlighted by the introduction of the all-electric RANGER XP Kinetic in collaboration with Zero Motorcycles, showcasing a commitment to sustainable powersports.

The company has adeptly navigated operational and market challenges, including supply chain disruptions and inflationary pressures in recent years. Polaris responded by optimizing its manufacturing processes, diversifying its supply base, and implementing pricing strategies to counteract rising costs. Despite these challenges, Polaris has demonstrated resilience.

The company's competitive edge is maintained through a combination of factors. Its strong brand portfolio, which includes names like Polaris RANGER, RZR, and Indian Motorcycle, fosters customer loyalty and market recognition. Technological leadership, particularly in off-road performance, vehicle connectivity, and electric powertrains, allows Polaris to offer innovative products. Economies of scale, derived from its extensive manufacturing capabilities and global distribution network, enable cost efficiencies and broader market reach.

The re-launch of the Indian Motorcycle brand in 2013 was a pivotal moment, significantly impacting the company's position in the cruiser motorcycle market. The introduction of electric vehicles, such as the RANGER XP Kinetic, in partnership with Zero Motorcycles, highlights a strategic shift towards sustainable powersports. The company has consistently expanded its product offerings and market reach through acquisitions and organic growth, solidifying its position in the powersports industry.

The company has focused on technological innovation, particularly in off-road vehicles and electric powertrains, to stay ahead of market trends. Strategic partnerships, like the one with Zero Motorcycles, have been crucial for entering and excelling in the EV market. Polaris has also optimized its manufacturing processes and supply chain to manage costs and maintain profitability in a dynamic market environment.

A strong brand portfolio, including iconic names like Polaris RANGER and Indian Motorcycle, enhances customer loyalty and market recognition. Technological leadership in off-road performance, vehicle connectivity, and electric powertrains differentiates Polaris from competitors. A vast dealer network and comprehensive PG&A offerings create a robust ecosystem that enhances customer value and provides recurring revenue.

Despite market challenges, Polaris reported a diluted EPS of $6.75 for the full year 2023, demonstrating resilience. The company's ability to manage costs and maintain profitability is a key factor in its financial success. Polaris continues to adapt to new trends, such as the increasing demand for electric vehicles, ensuring its sustained relevance and competitive strength in the dynamic powersports landscape.

The company's competitive advantage stems from its strong brand recognition, technological innovation, and robust dealer network. Polaris focuses on product innovation, particularly in electric vehicles and connected riding experiences, to meet evolving consumer demands. The company leverages its economies of scale and global distribution network to achieve cost efficiencies and expand market reach. The company's strategic moves and financial performance are well-documented; you can read more about it in this article about Polaris.

- Strong Brand Portfolio: Iconic brands like Polaris RANGER and Indian Motorcycle.

- Technological Leadership: Innovation in off-road performance and electric powertrains.

- Extensive Dealer Network: Comprehensive PG&A offerings and customer support.

- Strategic Partnerships: Collaborations like the one with Zero Motorcycles.

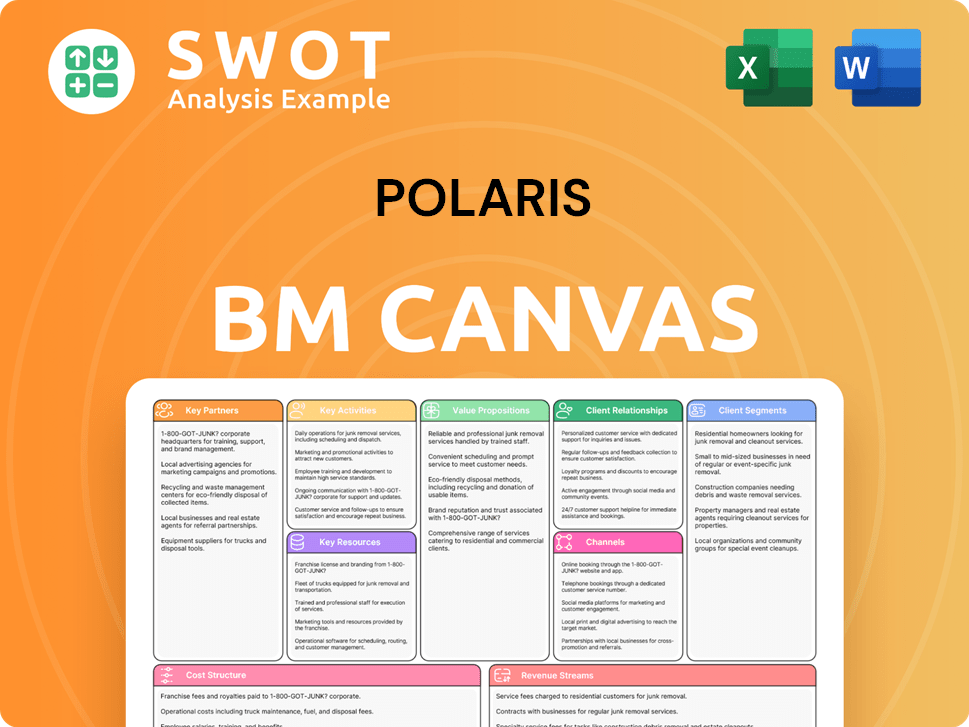

Polaris Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Polaris Positioning Itself for Continued Success?

The Polaris company holds a leading position in the powersports industry, with a strong market share in key segments. Polaris Industries products are sold in over 100 countries through a network of independent dealers and distributors. The company focuses on strong brand recognition, product innovation, and a comprehensive aftermarket support system to foster customer loyalty. Learn more about Owners & Shareholders of Polaris.

However, Polaris faces several risks, including potential regulatory changes, new competitors in the electric powersports segment, and economic downturns. Supply chain volatility and inflationary pressures also present operational challenges. To sustain and expand, the company is focused on innovation, particularly in electrification, and expanding its global footprint. The company's future outlook depends on its ability to navigate market shifts and capitalize on emerging opportunities.

Polaris maintains a strong market share in the off-road vehicle market with its RANGER and RZR brands. The Indian Motorcycle brand continues to gain traction in the cruiser segment. Polaris's global reach is extensive, with products sold in over 100 countries.

Potential regulatory changes related to emissions and safety standards could require costly product redesigns. New competitors, particularly in the electric powersports segment, pose a threat. Economic downturns and changing consumer preferences could also impact sales.

Polaris is focused on innovation, particularly in electrification, with plans to introduce more electric vehicle models. The company aims to expand its global footprint and enhance its digital capabilities. Leadership emphasizes operational excellence and disciplined capital allocation.

Polaris anticipates full-year 2024 adjusted diluted EPS in the range of $8.10 to $8.50. This reflects continued confidence in its future performance and strategic direction. The company's success depends on its ability to adapt to market changes.

Polaris is focusing on several key initiatives to drive growth and profitability. These include expanding its electric vehicle offerings and enhancing its digital capabilities to improve customer engagement. The company is also committed to operational excellence and disciplined capital allocation.

- Innovation in Electrification: Expanding the range of electric vehicle models.

- Global Expansion: Increasing its presence in international markets.

- Digital Transformation: Improving customer engagement and sales efficiency.

- Operational Excellence: Focusing on efficiency and cost management.

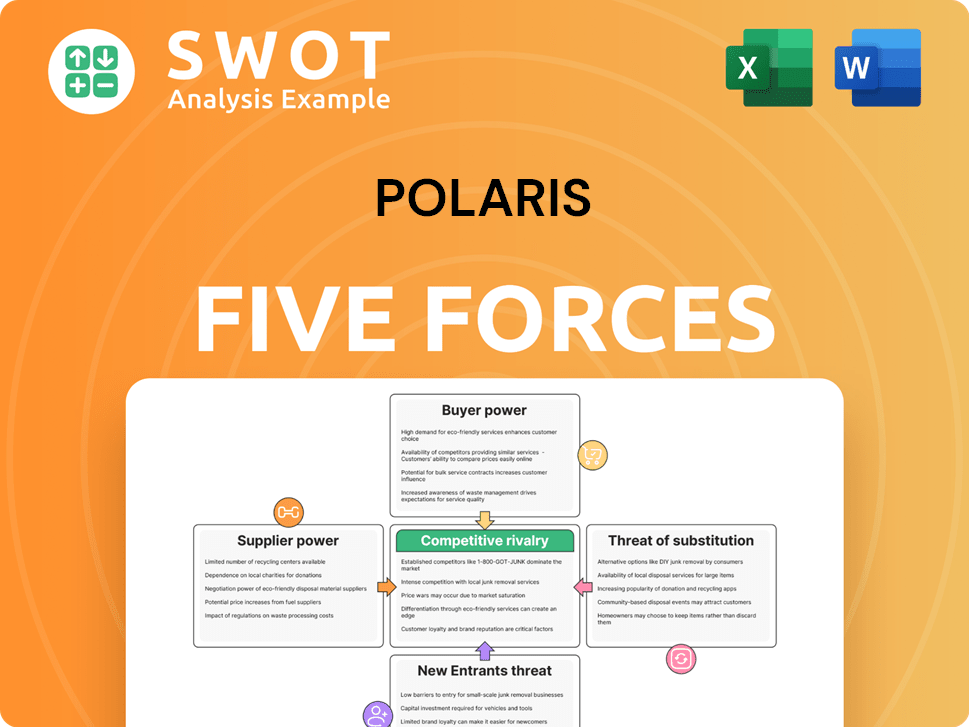

Polaris Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Polaris Company?

- What is Competitive Landscape of Polaris Company?

- What is Growth Strategy and Future Prospects of Polaris Company?

- What is Sales and Marketing Strategy of Polaris Company?

- What is Brief History of Polaris Company?

- Who Owns Polaris Company?

- What is Customer Demographics and Target Market of Polaris Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.