Samsung Electronics Bundle

Can Samsung Electronics Maintain Its Tech Titan Status?

In the wake of Apple's iPhone revolution, Samsung Electronics charted a course of relentless innovation. From its origins as a trading company, Samsung transformed into a global powerhouse, dominating sectors like semiconductors and consumer electronics. This journey highlights the crucial role of a dynamic Samsung Electronics SWOT Analysis in navigating the ever-evolving tech landscape.

This article delves into Samsung's ambitious Samsung growth strategy, examining its plans for future expansion and continuous Samsung innovation to secure its Samsung Electronics future. We'll explore Samsung's prospects through detailed Samsung market analysis, dissecting its Samsung business model and strategic initiatives, including its investments in research and development, partnerships, and product diversification, to offer a comprehensive view of its trajectory within the technology industry, including its challenges and opportunities, and its global market share trends.

How Is Samsung Electronics Expanding Its Reach?

Samsung Electronics is actively pursuing expansion initiatives to broaden its market reach and diversify revenue streams. This strategy focuses on both geographical and product category growth. The company aims to capitalize on rising demand in emerging markets and enhance its product offerings to maintain a competitive edge.

A key element of this strategy involves strengthening its presence in emerging markets. This is particularly evident in regions where smartphone adoption and demand for consumer electronics are increasing. Furthermore, Samsung is investing in product diversification, enterprise solutions, and strategic partnerships to fuel its growth.

The company is also expanding its enterprise business, offering solutions in areas like network infrastructure and digital signage. Strategic partnerships and potential mergers and acquisitions are also part of the plan to gain access to new technologies and expand its intellectual property portfolio.

Samsung is focusing on strengthening its presence in emerging markets, where smartphone adoption is rapidly increasing. For instance, the company aims to bolster its premium smartphone segment in India, a market where it already holds a significant share. This expansion is supported by targeted marketing and product launches, tailored to local consumer preferences.

Samsung is heavily investing in its home appliance and TV divisions, introducing AI-powered features and smart home connectivity. This innovation aims to attract new customers and maintain a competitive edge in the consumer electronics market. The company's focus on innovation is a key aspect of its Mission, Vision & Core Values of Samsung Electronics.

Samsung is expanding its enterprise business by offering solutions in areas like network infrastructure and digital signage. This strategic move allows the company to tap into the growing demand for B2B technology solutions. This expansion is expected to contribute significantly to the company's revenue diversification.

Samsung is actively pursuing strategic partnerships and potential mergers and acquisitions to gain access to new technologies. This approach is designed to expand its intellectual property portfolio and enhance its competitive advantage. Continuous development in foundry services for semiconductor manufacturing is a prime example of this strategy.

Samsung's growth strategy includes geographical expansion, product diversification, and strategic partnerships. These initiatives are designed to increase market share and revenue streams. The company's focus on innovation and emerging markets is crucial for its future prospects.

- Targeted marketing and product launches in emerging markets, particularly in India.

- Investment in AI-powered features and smart home technology for home appliances and TVs.

- Expansion of enterprise solutions in network infrastructure and digital signage.

- Strategic partnerships and potential mergers and acquisitions to acquire new technologies.

Samsung Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsung Electronics Invest in Innovation?

The core of Owners & Shareholders of Samsung Electronics's sustained success is its relentless focus on innovation and technology. This approach is fueled by significant investments in research and development (R&D) and a commitment to staying at the forefront of technological advancements. This strategy directly supports the company's growth objectives by enabling the creation of new products and platforms that drive market demand, ensuring a competitive edge in the fast-paced tech industry.

The company consistently allocates a substantial portion of its revenue to R&D, fostering in-house talent and collaborating with external innovators and research institutions. This proactive investment strategy allows the company to explore new technologies and improve existing products, ensuring it meets evolving consumer needs and market demands. This commitment to innovation is crucial for maintaining its position in the global market and driving future growth.

The company's dedication to innovation is evident in its diverse product portfolio and strategic initiatives. From the advancements in AI for on-device processing in smartphones, as seen in the Galaxy S24 series, to its investments in sustainability, the company is continuously evolving. These initiatives not only enhance user experience but also align with global environmental goals, appealing to environmentally conscious consumers and driving long-term value.

The company's R&D spending reached approximately $20.5 billion in 2023, reflecting a commitment to innovation. This investment supports the development of cutting-edge technologies and new product offerings. This significant investment underscores the company's dedication to maintaining its competitive edge in the global market.

The company is a leader in digital transformation, integrating AI, IoT, and 5G technologies across its product portfolio. This integration enhances user experience and creates new functionalities, as seen in the Galaxy S24 series. These advancements are crucial for staying competitive and meeting evolving consumer demands.

The company is heavily invested in sustainability initiatives, developing energy-efficient products and exploring eco-friendly manufacturing processes. This aligns with global environmental goals and appeals to environmentally conscious consumers. These initiatives are becoming increasingly important in the competitive landscape.

The company holds key patents in areas like display technology, memory solutions, and mobile communication protocols. These patents underscore the company's leadership in innovation and contribute directly to its growth objectives. These innovations are critical to maintaining a competitive advantage.

The company's semiconductor business is a significant growth driver, with increasing demand for advanced chips. The company's investments in cutting-edge manufacturing processes and technologies position it well for future growth. This segment is critical to the company's overall financial performance.

The company maintains a strong market share in key product categories, including smartphones and displays. Continuous innovation and product diversification are crucial for sustaining this market position. Maintaining and expanding market share is a key strategic objective.

The company's future growth strategy includes several key focus areas that leverage its innovative capabilities and market position. These strategies are designed to ensure continued success in a dynamic market. These initiatives are crucial for future success.

- AI and Machine Learning: Expanding AI capabilities in devices and services to enhance user experience and create new revenue streams.

- 5G and Connectivity: Leveraging 5G technology to drive innovation in mobile devices, network infrastructure, and connected services.

- Semiconductor Advancements: Investing in advanced chip technologies to meet the growing demand for high-performance computing and memory solutions.

- Sustainability: Developing eco-friendly products and manufacturing processes to meet environmental goals and appeal to conscious consumers.

- Smart Home and IoT: Expanding its ecosystem of connected devices and services to create a seamless and integrated smart home experience.

Samsung Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Samsung Electronics’s Growth Forecast?

The financial outlook for Samsung Electronics is centered on significant revenue targets and strategic investments. The company's performance in early 2024 indicates a strong recovery, particularly in its semiconductor business. This positive trajectory is supported by increasing demand for AI-related semiconductors, which is a key driver for future growth. The Revenue Streams & Business Model of Samsung Electronics highlights the diverse revenue streams that contribute to this financial strength.

In the first quarter of 2024, Samsung reported an operating profit of 6.6 trillion won (approximately $4.8 billion USD). This is a substantial increase from the 640 billion won reported in the same period last year. This financial performance reflects a robust recovery in the semiconductor sector and the effectiveness of Samsung's strategic initiatives. The company is focused on maintaining strong profit margins through optimized production and a focus on high-value products.

Samsung aims to maintain robust profit margins by optimizing its production processes and focusing on high-value products. Investment levels remain high, particularly in R&D and capital expenditures for semiconductor manufacturing, to ensure long-term competitiveness and technological leadership. Analysts' forecasts generally align with Samsung's positive outlook, anticipating sustained growth in its key business segments. The company's strong cash flow and healthy balance sheet provide the financial flexibility to pursue strategic initiatives, including potential acquisitions and further expansion into emerging technologies.

The semiconductor division is expected to be a primary growth driver, fueled by the rising demand for AI-related semiconductors. Samsung is investing heavily in R&D and capital expenditures to maintain its technological edge. This strategic focus is crucial for the future of Samsung's semiconductor business outlook.

Samsung's commitment to innovation is evident in its substantial investments in research and development. These investments are critical for maintaining a competitive advantage. Capital expenditures are focused on expanding and upgrading semiconductor manufacturing capabilities.

Samsung's strong financial position allows it to pursue strategic initiatives, including potential acquisitions. These moves are aimed at expanding into new markets and technologies. The company is exploring opportunities in emerging technologies to diversify its portfolio.

With a healthy balance sheet and strong cash flow, Samsung has the financial flexibility to support its growth strategy. This financial strength enables the company to navigate market fluctuations. The company's financial performance analysis indicates a positive trajectory.

Samsung Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Samsung Electronics’s Growth?

While the future looks bright for Samsung Electronics, several potential risks and obstacles could affect its trajectory. These challenges range from intense competition to geopolitical instability, requiring proactive management and strategic foresight. Understanding these potential pitfalls is essential for a comprehensive Samsung market analysis and evaluating Samsung prospects.

The company's growth strategy must navigate a complex landscape of technological advancements, regulatory changes, and global economic fluctuations. A failure to adapt swiftly or to anticipate shifts in consumer behavior could significantly impact Samsung's financial performance analysis. The company's ability to mitigate these risks will determine its long-term success.

Samsung's continued success hinges on its ability to innovate, manage its supply chains, and respond effectively to market dynamics. This involves strategic planning, investment in research and development, and a keen understanding of the evolving technology landscape. Furthermore, the company must maintain a strong focus on sustainability initiatives to ensure its long-term viability.

The global market is highly competitive, with established players and emerging companies constantly vying for market share. This competition is particularly fierce in the smartphone and consumer electronics sectors. Competitors continually release new products and technologies, which requires Samsung to continuously innovate and improve its offerings to maintain its competitive advantages.

Changes in regulations, including antitrust scrutiny and data privacy laws, pose significant challenges. Compliance with these regulations can be costly and may limit operational flexibility. The company must navigate complex legal environments in various global markets to ensure its business practices meet all legal standards.

Supply chain disruptions, as seen in recent global events, remain a significant concern. Dependence on critical components, such as semiconductors, makes Samsung vulnerable. The company must proactively manage its supply chain to mitigate potential disruptions, which includes diversifying its supplier base and improving its logistics.

Geopolitical tensions and trade disputes can disrupt manufacturing and distribution networks. These issues can lead to increased costs, reduced market access, and operational challenges. Samsung must monitor geopolitical risks and develop strategies to adapt to changing global dynamics.

The rapid pace of technological change requires constant innovation. Failure to anticipate or adapt to new technologies could erode Samsung's competitive edge. Samsung's investment in research and development is crucial to stay ahead of the curve. For instance, in 2023, Samsung invested $20.9 billion in R&D, demonstrating its commitment to innovation.

Managing a vast and complex global organization presents challenges in terms of resource allocation and operational efficiency. Streamlining internal processes and ensuring effective communication across different business units is critical. Samsung's ability to maintain operational excellence is fundamental to its overall performance.

Samsung mitigates these risks through diversification, robust risk management frameworks, and proactive scenario planning. Diversification across business units, such as semiconductors, displays, and consumer electronics, helps reduce reliance on any single market. For instance, the company's memory chip business contributed a significant portion of its revenue, with $15.4 billion in sales in Q1 2024.

The company has actively sought to diversify its manufacturing footprint and strengthen supplier relationships to enhance supply chain resilience. This includes establishing manufacturing facilities in multiple countries and developing strong partnerships with key suppliers. For example, Samsung is expanding its semiconductor manufacturing capacity in the United States, with an investment of over $17 billion.

Continuous innovation and adaptation to new technologies are crucial. Investing heavily in R&D, exploring strategic partnerships, and staying at the forefront of technological advancements are essential. Samsung's commitment to innovation is evident in its substantial investments in areas like AI, 5G, and foldable display technologies.

Understanding and responding to market dynamics is essential for sustained success. This involves analyzing consumer behavior, monitoring competitor activities, and adapting product offerings to meet evolving demands. Samsung's ability to anticipate market trends and launch successful products is a key factor in its growth. For a deeper understanding of the competitive landscape, read about the Competitors Landscape of Samsung Electronics.

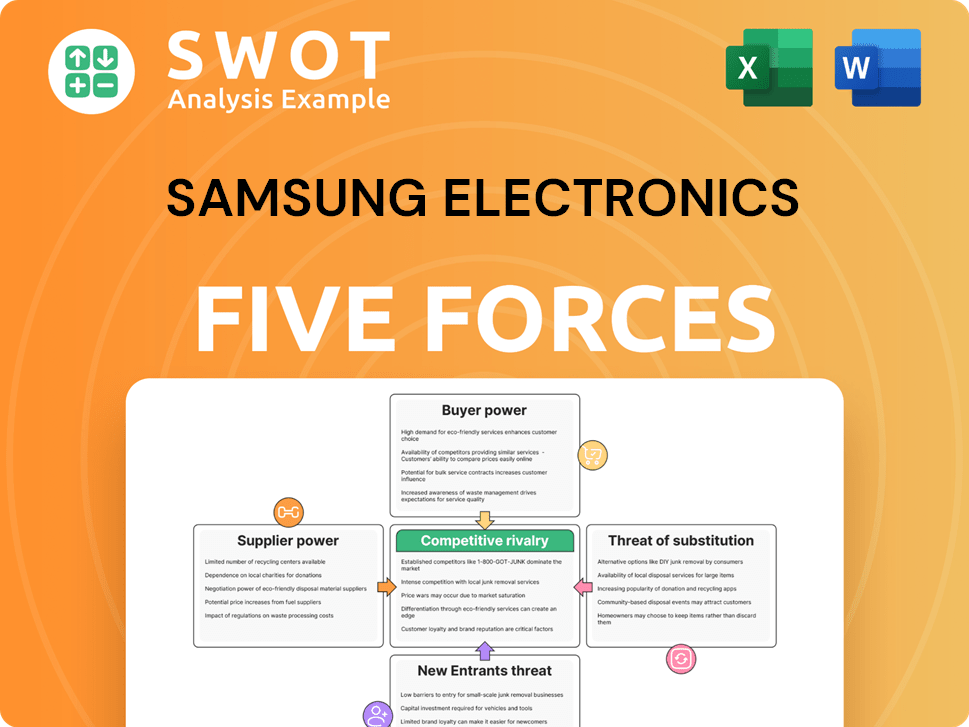

Samsung Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Electronics Company?

- What is Competitive Landscape of Samsung Electronics Company?

- How Does Samsung Electronics Company Work?

- What is Sales and Marketing Strategy of Samsung Electronics Company?

- What is Brief History of Samsung Electronics Company?

- Who Owns Samsung Electronics Company?

- What is Customer Demographics and Target Market of Samsung Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.