Samsung Electronics Bundle

How Does Samsung Electronics Thrive in the Tech World?

Samsung Electronics, a titan in the global technology arena, consistently showcases its influence through groundbreaking product releases and impressive financial results. In Q1 2025, the company reported record-breaking revenue, driven significantly by the success of its AI-enhanced Galaxy S25 series. With a market capitalization exceeding $260 billion as of May 2025, Samsung remains a dominant force in the electronics sector.

This article provides a deep dive into the Samsung Electronics SWOT Analysis, exploring its core value propositions, manufacturing processes, and diverse revenue streams. We'll examine the Samsung company's key milestones, competitive advantages, and strategic initiatives, including its focus on emerging technologies like AI. Understanding the Samsung business model is key to appreciating its sustained market leadership and future trajectory, providing valuable insights for investors and industry observers alike, while also highlighting Samsung products and Samsung operations.

What Are the Key Operations Driving Samsung Electronics’s Success?

The core operations of the Samsung company are centered around creating and delivering value across a broad spectrum of products and services. This encompasses consumer electronics, such as smartphones and televisions, and also extends to enterprise-focused offerings like memory products. The Samsung business model is designed to cater to diverse customer segments, including individual consumers, businesses, and various organizations.

Operational efficiency is a cornerstone of Samsung Electronics. Key processes include advanced manufacturing, strategic sourcing, and a robust global logistics network. A highly integrated supply chain allows for significant control over product quality and timely releases. This integrated approach ensures that Samsung products are consistently high in quality and reliability.

Samsung distinguishes itself through innovation and a strong brand reputation. The company invests heavily in research and development to drive continuous technological advancements. This commitment to R&D ensures its products remain at the forefront of technology, enhancing its competitive edge in the global market.

Samsung's operational excellence is built on several key processes. These include advanced manufacturing capabilities that ensure high-quality products. Strategic sourcing is crucial for obtaining components efficiently. A robust global logistics and distribution network ensures timely product delivery worldwide.

Samsung's value proposition focuses on innovation and technological leadership. Consistent investment in research and development is a key driver. A strong brand reputation builds customer trust and loyalty. The company aims to provide high-quality, reliable products that meet customer needs.

Samsung allocates substantial resources to research and development. In 2024, the company's total R&D expenditure was approximately $24.09 billion. This significant investment underscores Samsung's commitment to innovation and technological advancement.

Samsung's unique approach includes a vertically integrated business model. This is particularly evident in its Device Solutions (DS) division, which handles memory, system LSI, and foundry businesses. This integration supports efficiency and technological leadership.

Samsung's operational model is unique due to its vertical integration, especially in its Device Solutions (DS) division. This allows the company to develop and produce key components internally, enhancing efficiency and technological leadership. The Device eXperience (DX) division focuses on differentiated products and services. This comprehensive approach translates into customer benefits through high-quality, reliable products and a seamless cross-device experience. To understand more about the company's growth strategy, read this article about the Growth Strategy of Samsung Electronics.

Samsung offers several key benefits to its customers. These include high-quality and reliable products. The company provides a seamless cross-device experience, enhancing user convenience. Features like Quick Share and Samsung Flow facilitate smooth transitions between devices.

- High-Quality Products: Samsung is known for producing reliable, high-quality products.

- Seamless Experience: The company provides a smooth cross-device experience.

- Innovation: Samsung consistently introduces innovative products.

- Customer Trust: The strong brand reputation fosters customer trust and loyalty.

Samsung Electronics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Samsung Electronics Make Money?

The Samsung company generates revenue through a diverse range of products and services. Key revenue streams include product sales from smartphones, televisions, home appliances, and semiconductors. Service revenue, encompassing warranties and extended service plans, also contributes to its financial performance.

In fiscal year 2024, Samsung Electronics reported KRW 300.9 trillion in annual revenue. The first quarter of 2025 saw consolidated revenue reach KRW 79.14 trillion (approximately $55.4 billion), a 10% year-over-year increase, demonstrating the company's strong financial position.

The Mobile Experience (MX) Division was a significant revenue generator, contributing KRW 37 trillion to consolidated revenue in Q1 2025. The Device Solutions (DS) Division, which includes semiconductor manufacturing, posted KRW 30.1 trillion in consolidated revenue in Q4 2024. Samsung Display Corporation (SDC) reported KRW 8.1 trillion in consolidated revenue in Q4 2024.

Samsung employs various monetization strategies to boost sales and customer engagement. These include dynamic pricing, bundling, and expansion into emerging markets. These strategies help the company maintain its competitive edge and drive revenue growth.

- Dynamic pricing adjusts prices based on market demand and competitor pricing.

- Bundling offers integrated solutions, such as promotional packages with smartphones and accessories.

- Expansion into emerging markets diversifies revenue sources and increases market share.

Samsung Electronics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Samsung Electronics’s Business Model?

Samsung Electronics has established itself as a global leader through strategic moves and consistent innovation. The company's journey is marked by significant milestones, from pioneering advancements in display technology to its dominance in the smartphone market. Its strategic focus on cutting-edge technologies, particularly in artificial intelligence (AI) and next-generation advancements, has been a key driver of its growth.

The company's operational and market challenges have shaped its strategic responses. Despite facing headwinds in the semiconductor division and stock price fluctuations, Samsung has demonstrated resilience by adapting its strategies. The company's competitive edge stems from its brand strength, technological leadership, and vast manufacturing capabilities, which continue to sustain its business model.

The company's commitment to innovation is evident in its substantial investments in research and development (R&D) and capital expenditures. Samsung allocated KRW 53.6 trillion ($37 billion) in capital expenditure in 2024, with a focus on semiconductor facilities and display upgrades. This strategic investment underscores Samsung's commitment to maintaining its competitive advantage in the electronics industry.

Samsung has achieved numerous milestones, including breakthroughs in display technology and its leading position in the smartphone market. The company's early adoption of advanced technologies has been pivotal. Its success is built on a foundation of continuous innovation and strategic market positioning.

A key strategic move has been its aggressive investment in AI and next-generation technologies. Samsung has been investing heavily in semiconductors and 5G/6G telecommunications. The company is focused on high-bandwidth memory (HBM) production, and expanding its product portfolio.

Samsung's competitive advantages include strong brand recognition and technological leadership, particularly in memory chips. Its economies of scale from manufacturing and a vast ecosystem of interconnected devices further sustain its business model. Samsung has a strong global market share.

Samsung has faced operational and market challenges, including headwinds in its semiconductor division and stock price fluctuations. In response, Samsung is accelerating AI-focused semiconductor development and strengthening strategic partnerships. The company is also focusing on HBM production.

Samsung's focus on AI is evident in its product launches, such as the Galaxy S24 series and AI TVs, aiming to lead the AI screen market. The company's strong brand value, estimated at $100.8 billion in 2024, supports its market position. Samsung's technological leadership in memory chips provides a significant edge.

- Samsung is expanding its product portfolio and providing exceptional customer service.

- The company is driving sustainable growth, as seen in its priorities for the Consumer Electronics Division in the East African market in 2025.

- Samsung's ability to adapt and innovate is crucial for its long-term success.

- For more insights, explore the Growth Strategy of Samsung Electronics.

Samsung Electronics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Samsung Electronics Positioning Itself for Continued Success?

The Samsung Electronics company holds a significant position in the global technology market, though it faces dynamic challenges. Its industry standing is marked by both successes and areas needing strategic focus. The company's future outlook is shaped by its response to market dynamics and its strategic initiatives.

Samsung's operations are influenced by various factors, including economic conditions, geopolitical risks, and intense competition. The company's ability to adapt to these challenges will be crucial for its continued success.

In Q1 2025, Samsung led the smartphone market with a 20% share, followed by Apple at 19%. Despite this, Samsung's global market share declined in 2024 across key areas like televisions and smartphones due to increasing competition. Samsung has maintained the top spot in the European microwave market for a decade.

Key risks include challenges in the memory chip market due to oversupply and slower demand recovery. Geopolitical risks, fluctuating raw material costs, and intense competition from Chinese brands and Apple also pose threats. Patent infringement lawsuits and shareholder pressure also present risks.

Samsung is focusing on AI, premium chip technology, and market leadership in consumer electronics. The company plans to enhance its technological advantages in AI and expand in the AI chip market. Samsung is also committed to sustainability and expects a recovery in memory market demand from Q2 2025.

These include expanding in the AI chip market and exploring partnerships with automotive companies. Samsung aims to accelerate technology migration in memory products. The company has set goals for 100% renewable energy usage by 2050 and eliminating plastics in mobile packaging by 2025.

The Samsung business model is constantly evolving to address market dynamics and consumer preferences. The company's strategic initiatives and focus on innovation are critical for maintaining its competitive edge. For more details on Samsung's approaches, you can review the Marketing Strategy of Samsung Electronics.

Samsung's customer loyalty for Galaxy phones increased to 76% in 2025. The company aims for significant sales growth in premium segments in 2025. Samsung is investing heavily in its research and development to stay ahead of the competition.

- Smartphone market share in Q1 2025: 20%

- Decline in smartphone market share in 2024: 18.3%

- European microwave market leadership: 10 consecutive years

- Customer loyalty for Galaxy phones in 2025: 76%

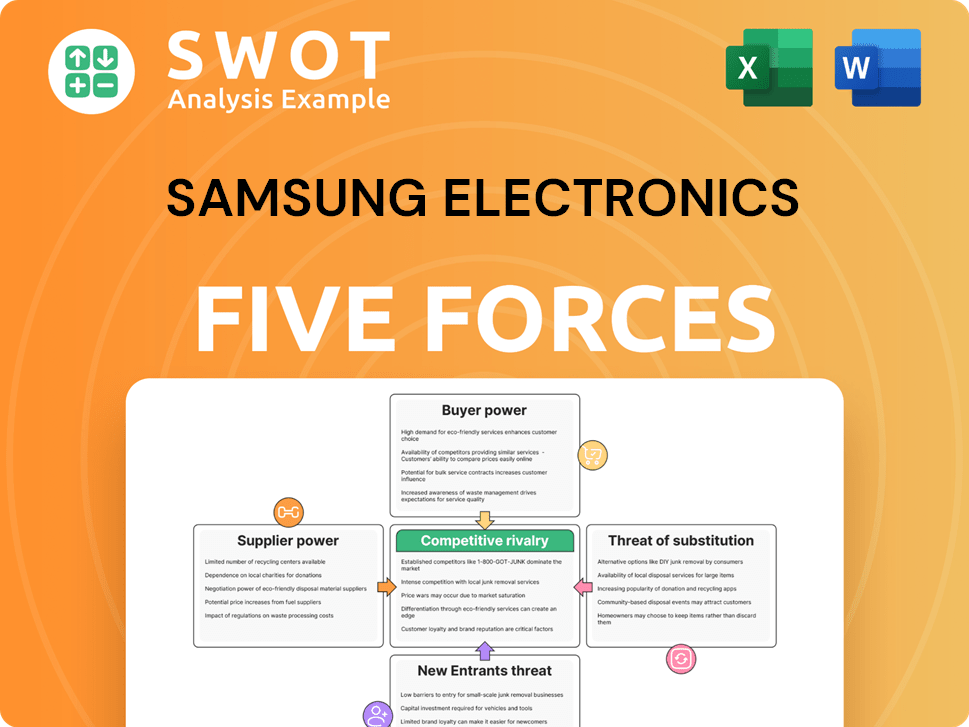

Samsung Electronics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Samsung Electronics Company?

- What is Competitive Landscape of Samsung Electronics Company?

- What is Growth Strategy and Future Prospects of Samsung Electronics Company?

- What is Sales and Marketing Strategy of Samsung Electronics Company?

- What is Brief History of Samsung Electronics Company?

- Who Owns Samsung Electronics Company?

- What is Customer Demographics and Target Market of Samsung Electronics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.