Snowflake Bundle

Can Snowflake Maintain Its Meteoric Rise?

Snowflake revolutionized data management with its cloud-first approach, but can this disruptor continue its impressive trajectory? Founded in 2012, Snowflake's innovative cloud data platform has fundamentally changed how businesses handle their data. This deep dive explores the Snowflake SWOT Analysis, its growth strategy, and the exciting future prospects of the company.

The Snowflake company analysis reveals a data warehousing leader, but the cloud computing market is dynamic. Understanding Snowflake's growth strategy is crucial for investors and businesses alike, as it competes in the evolving cloud data platform landscape. This exploration will examine Snowflake's market share, financial performance review, and long-term growth potential, providing insights into its ability to adapt and thrive.

How Is Snowflake Expanding Its Reach?

To bolster its Snowflake growth strategy, the company is actively pursuing several expansion initiatives. These efforts aim to broaden its market reach and diversify its revenue streams, ensuring sustained growth in the competitive cloud data platform landscape. A key focus involves geographical expansion, particularly in international markets where cloud adoption is rapidly increasing.

This expansion includes strategic moves to strengthen its presence globally. The company is expanding its sales teams, establishing local partnerships, and adapting its platform to meet regional compliance and data residency requirements. These steps are crucial for catering to a wider international customer base and capitalizing on the increasing demand for cloud-based data solutions.

In addition to geographical expansion, the company is also focusing on expanding its product categories. This involves moving beyond its core data warehousing capabilities to offer a more comprehensive data cloud ecosystem. This strategic shift includes advancements in data governance, data sharing, and the development of industry-specific solutions. This approach is designed to attract new customers, increase the value proposition for existing ones, and stay ahead of industry changes.

The company is expanding its global footprint to enhance its availability across various cloud providers and regions. This strategy supports the company's goal to serve a wider international customer base. The company is investing in sales teams and partnerships to cater to regional compliance and data residency needs.

Snowflake is expanding its offerings beyond core data warehousing to encompass a more comprehensive data cloud ecosystem. This includes advancements in data governance and data sharing. The company is launching new features and services, such as enhanced capabilities for unstructured data and machine learning workflows.

At its annual Summit in June 2024, the company announced significant advancements in AI and machine learning capabilities. These advancements aim to empower customers to build and deploy AI models more efficiently on their platform. This initiative is a key part of the company's strategy to remain competitive in the cloud computing market.

The company continues to focus on its 'Powered by Snowflake' program, fostering a robust partner ecosystem. This ecosystem builds applications and integrations on its platform, extending its reach and utility. This program is designed to increase the value proposition for existing customers and attract new ones.

These expansion initiatives are critical for achieving the company's Snowflake future prospects. By broadening its market reach and diversifying its product offerings, the company aims to maintain its competitive edge and drive long-term growth. The company's commitment to innovation and strategic partnerships, as highlighted in Mission, Vision & Core Values of Snowflake, further supports its expansion goals.

The company's expansion initiatives are focused on geographical growth and product diversification. These strategies are designed to enhance the company's market share and revenue streams. The company is also investing in AI and machine learning capabilities to stay ahead of industry trends.

- Geographical expansion into international markets.

- Product category expansion beyond core data warehousing.

- Advancements in AI and machine learning capabilities.

- Strengthening the 'Powered by Snowflake' partner ecosystem.

Snowflake SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Snowflake Invest in Innovation?

The sustained growth of Snowflake is significantly driven by its commitment to continuous innovation and a robust technology strategy. The company strategically invests in research and development (R&D) to enhance its core platform and introduce cutting-edge capabilities. This focus is crucial for maintaining its competitive edge in the cloud data platform market.

Snowflake's approach to digital transformation centers on offering a unified platform that simplifies data management. This allows organizations to extract greater insights from their data, which is a key driver of its growth. The company's architecture, which separates storage and compute, provides unparalleled flexibility and scalability, a key differentiator in the market.

Snowflake is actively integrating advanced technologies like artificial intelligence (AI) and machine learning (ML) to improve data processing, analytics, and automation. This includes the introduction of Snowflake Cortex, providing fully managed AI functions and vector search capabilities. This integration allows developers to build AI-powered applications directly within the Data Cloud, enhancing its utility and appeal.

Snowflake leverages AI and ML to enhance its platform. This includes features like Snowflake Cortex, which provides managed AI functions.

The Snowpark developer framework has seen significant advancements. Data engineers and scientists can now build complex data pipelines using various programming languages directly within Snowflake.

Snowflake provides a unified platform for data management. This simplifies data handling and enables organizations to derive more insights from their data.

The architecture of Snowflake, which separates storage and compute, offers unparalleled flexibility and scalability. This is a key differentiator in the market.

Snowflake's commitment to innovation has been recognized through various industry accolades. This solidifies its position as a leader in the data cloud space.

Snowflake focuses on improving the developer experience. This contributes significantly to attracting and retaining customers.

Recent advancements in the Snowpark developer framework enable data engineers and data scientists to build complex data pipelines and applications using various programming languages directly on Snowflake. This focus on developer experience and expanded functionality significantly contributes to attracting and retaining customers. Snowflake's commitment to innovation has been recognized through various industry accolades, solidifying its position as a leader in the data cloud space. For a deeper understanding of its revenue streams and business model, consider reading about Revenue Streams & Business Model of Snowflake.

Snowflake's technological advancements are key to its future prospects. These advancements enhance its cloud data platform and support its growth strategy.

- Snowflake Cortex: Provides fully managed AI functions and vector search capabilities, enabling developers to build AI-powered applications.

- Snowpark Enhancements: Allows data engineers and scientists to build complex data pipelines and applications using various programming languages directly on Snowflake.

- Scalability and Flexibility: The separation of storage and compute offers unparalleled flexibility and scalability.

- Data Governance: Enhancements in data governance capabilities to ensure data security and compliance.

Snowflake PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Snowflake’s Growth Forecast?

The financial outlook for the company indicates continued expansion, supported by ambitious revenue targets and strategic investments. For the fiscal year 2025, the company anticipates product revenue to be between $3.25 billion and $3.30 billion. This represents a year-over-year growth of 22% to 23%. This projection reflects the growing adoption of its Data Cloud platform and the expansion of its customer base. The company's focus on profitability is also evident, with a projected non-GAAP adjusted free cash flow margin of 26% for fiscal year 2025.

This positive outlook is consistent with the company's historical financial performance, which has demonstrated consistent revenue growth since its inception. The company continues to invest significantly in research and development (R&D) and sales and marketing to support its expansion initiatives and maintain its competitive edge. These investments are crucial for maintaining its position in the cloud computing market. The company's financial strategy emphasizes balancing aggressive growth with a path toward increasing profitability and efficient capital deployment.

Analyst forecasts generally align with the company's positive outlook, citing the growing demand for cloud data solutions and its strong market position. The company's ability to maintain and grow its market share is a key factor in its future success. The financial narrative underpinning the company's strategic plans emphasizes balancing aggressive growth with a path towards increasing profitability and efficient capital deployment. To understand the competitive environment, consider the Competitors Landscape of Snowflake.

The company's growth strategy focuses on expanding its customer base and increasing the adoption of its Data Cloud platform. This involves strategic investments in R&D, sales, and marketing to drive long-term sustainable growth. The company aims to capitalize on the increasing demand for cloud data solutions.

The future prospects for the company are promising, supported by strong revenue projections and a focus on profitability. The company is well-positioned to benefit from the continued growth in the cloud data market. Its ability to innovate and adapt to changing market demands will be crucial for its long-term success.

The company holds a significant market share in the cloud data platform space, driven by its innovative solutions and strong customer base. It competes with other major players in the data warehousing and cloud computing markets. Maintaining and growing market share is a key strategic objective.

The company's financial performance has been characterized by consistent revenue growth and a focus on improving profitability. Key metrics include product revenue, adjusted free cash flow margin, and customer acquisition cost. The company's financial health supports its growth initiatives.

The company operates on a consumption-based pricing model, where customers pay for the resources they use. This model allows for flexibility and scalability. The company's business model is centered around providing a comprehensive cloud data platform.

- Data warehousing

- Data lake solutions

- Data sharing features

- Data governance capabilities

Snowflake Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Snowflake’s Growth?

The Snowflake company analysis reveals that its growth trajectory faces several potential risks and obstacles. Navigating intense competition in the cloud data platform market is a significant challenge. Furthermore, adapting to evolving regulatory landscapes and technological disruptions requires continuous strategic adjustments.

A key concern for Snowflake's future prospects involves staying ahead in a dynamic technological environment. The company must continuously innovate and adapt to maintain its competitive edge. Internal challenges, such as attracting and retaining top talent, also pose potential hurdles to sustained growth.

Snowflake's market share and financial performance are closely tied to its ability to overcome these obstacles. The company employs a multi-faceted approach, including product innovation, strategic partnerships, and robust risk management, to navigate these challenges effectively.

The cloud data platform market is highly competitive, with major players like AWS, Microsoft Azure, and Google Cloud. These competitors offer similar data warehousing and analytics services, putting pressure on Snowflake to differentiate itself. Continuous innovation and strategic partnerships are crucial for maintaining a strong market position.

Data privacy and governance regulations are constantly evolving worldwide. Snowflake must ensure its platform complies with these changes across various jurisdictions. This requires significant investment in legal and technical resources to avoid penalties and maintain customer trust.

Rapid advancements in technologies such as AI and quantum computing can disrupt Snowflake's core offerings. The company must proactively integrate new technologies to remain relevant. This includes adapting to the rapid evolution of generative AI and other emerging data architectures.

Attracting and retaining top engineering and sales talent is critical for Snowflake's growth. Competition for skilled professionals is intense in the tech industry. Effective strategies for talent acquisition and retention are vital to support product development and market expansion.

Snowflake diversifies its customer base and service offerings to reduce reliance on any single sector or product. This strategy helps mitigate risks associated with economic downturns or changes in specific industries. Expanding into new markets is a key component of this diversification.

Snowflake forms strategic partnerships to expand its ecosystem and enhance its offerings. These collaborations provide access to new technologies, markets, and customer segments. Partnerships are crucial for driving innovation and increasing market penetration.

Snowflake's financial performance is subject to market dynamics and competitive pressures. As of the latest financial reports, the company continues to demonstrate strong revenue growth, but it also faces challenges in managing costs and achieving profitability. Investors closely watch metrics like customer acquisition cost and customer lifetime value.

The Snowflake stock forecast depends on various factors, including market trends, competitive positioning, and overall economic conditions. Analysts provide varying estimates based on their assessment of the company's growth potential and risk factors. Investors should conduct thorough due diligence and consider professional financial advice.

Snowflake's data governance capabilities are vital for ensuring data quality, security, and compliance. These features are essential for attracting and retaining customers in regulated industries. Effective data governance helps manage risks related to data breaches and non-compliance.

Snowflake's long-term growth potential hinges on its ability to innovate, expand its market presence, and adapt to changing market conditions. The company's success depends on its strategic execution and its capacity to overcome challenges in a competitive landscape. Continuous investment in research and development is critical.

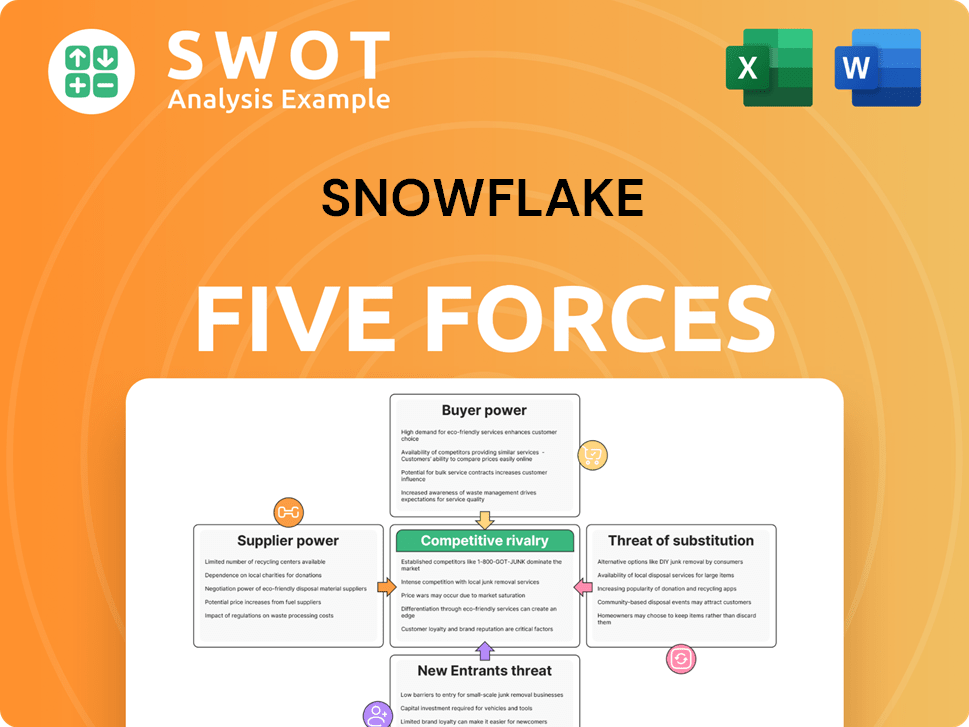

Snowflake Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snowflake Company?

- What is Competitive Landscape of Snowflake Company?

- How Does Snowflake Company Work?

- What is Sales and Marketing Strategy of Snowflake Company?

- What is Brief History of Snowflake Company?

- Who Owns Snowflake Company?

- What is Customer Demographics and Target Market of Snowflake Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.