Snowflake Bundle

Unlocking the Power of Data: How Does Snowflake Revolutionize Data Management?

Snowflake has fundamentally reshaped how businesses handle their data, emerging as a dominant force in the cloud data platform arena. Its innovative approach to data warehousing offers a cloud-native solution, simplifying the complexities of traditional data systems. With a remarkable 29.21% revenue increase to $3.63 billion in fiscal year 2025, Snowflake's growth underscores its critical role in digital transformation across industries.

This in-depth analysis will dissect the core operations of the Snowflake SWOT Analysis, examining its value proposition, revenue streams, and strategic initiatives. We'll explore its architecture, including how Snowflake stores data and its data sharing features, alongside its robust security features and data governance capabilities. Understanding the Snowflake data warehouse, including its performance and query optimization, is crucial for anyone looking to leverage the power of cloud computing and data analytics.

What Are the Key Operations Driving Snowflake’s Success?

The core of Snowflake's business centers around its cloud data platform, offering a fully managed service designed to simplify how businesses store, process, and analyze data. Snowflake's primary focus is on providing a robust data warehousing solution, but it also supports data lakes, data engineering, data science, and data application development. This comprehensive approach allows the company to cater to a broad spectrum of data-related needs, making it a versatile solution for various industries.

Snowflake's value proposition lies in its ability to streamline data management, reduce operational overhead, and provide cost efficiencies. Its architecture separates compute from storage, enabling independent scaling and pay-as-you-go pricing. This model contrasts with traditional data warehousing systems, offering customers greater flexibility and control over their spending. The platform's features, such as automatic scaling, query optimization, and robust security, further enhance its appeal.

Snowflake serves a diverse customer base, including large enterprises and mid-sized companies across sectors such as healthcare, manufacturing, finance, and technology. The company's ability to integrate with major cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) provides customers with strategic flexibility and helps avoid vendor lock-in. This multi-cloud approach allows customers to leverage their preferred cloud environments while maintaining unified governance, which is a key differentiator in the market.

Snowflake offers a range of features designed to optimize data management and analytics. Its architecture supports independent scaling of compute and storage, allowing for cost-effective resource allocation. The platform includes features such as query optimization, data sharing, and time travel, enhancing performance and data accessibility. These capabilities help businesses make informed decisions and improve operational efficiency.

Snowflake's operational model is designed to minimize administrative overhead. The platform handles tasks such as automatic scaling, query optimization, and data compression. This serverless approach reduces the need for manual intervention, allowing IT teams to focus on strategic initiatives. This operational efficiency translates into reduced costs and improved productivity for customers.

Snowflake's data sharing capabilities allow secure and seamless data exchange between different organizations. The platform supports integrations with various data sources and tools, streamlining data ingestion and transformation processes. This facilitates collaboration and enhances the value of data assets. Snowflake's data integration tools support a wide range of data formats and sources.

The pay-as-you-go pricing model of Snowflake allows customers to optimize their data warehousing costs. By separating compute and storage, users only pay for the resources they consume. This flexibility helps businesses control expenses and scale their data infrastructure efficiently. Snowflake's cost analysis tools provide insights into resource usage and spending patterns.

Snowflake distinguishes itself through its unique architecture, which offers significant advantages over traditional data warehousing solutions. The platform's ability to scale compute and storage independently provides greater flexibility and cost efficiency. This architecture, combined with its comprehensive features, positions Snowflake as a leader in the cloud data platform market.

- Scalability: Snowflake's architecture allows for seamless scaling of compute and storage resources.

- Performance: Query optimization and data caching features enhance query performance.

- Security: Robust security features, including data encryption and access controls, protect sensitive data.

- Ease of Use: The platform's user-friendly interface and automated features simplify data management tasks.

The company's success is also driven by its strategic partnerships and commitment to innovation. According to recent financial reports, Snowflake's revenue has consistently grown, with a reported revenue of over $2.8 billion in fiscal year 2024, reflecting a 36% year-over-year increase. This growth is supported by a strong customer base and high customer retention rates. The company's focus on innovation, as highlighted in the Growth Strategy of Snowflake, and its ability to adapt to evolving market demands are crucial for its continued success in the competitive landscape of cloud computing and data analytics. Snowflake's market capitalization as of early 2024 was approximately $20 billion, demonstrating its significant presence in the tech industry.

Snowflake SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Snowflake Make Money?

The [Company Name] primarily generates revenue through a consumption-based pricing model. This approach allows customers to pay for the actual data volume stored and the compute resources they use, offering flexibility and cost efficiency.

This utility model is a cornerstone of their monetization strategy. It enables businesses to scale their data warehousing and analytics operations as needed, making it a popular choice in the cloud computing market.

For the fiscal year 2025, [Company Name] reported an annual revenue of $3.63 billion, marking a 29.21% increase year-over-year. Product revenue, a key indicator of performance, reached $943.3 million in the fourth quarter of fiscal year 2025, reflecting a 28% year-over-year growth. In the first quarter of fiscal year 2026 (ended April 30, 2025), product revenue hit $996.8 million, growing 26% year-over-year. The total revenue for the quarter ending April 30, 2025, was $1.04 billion, an increase of 25.75% year-over-year.

Beyond its core product consumption model, [Company Name] employs other strategies to generate revenue and enhance its platform's value. These include the Data Marketplace and the expansion of AI and machine learning capabilities.

- The Data Marketplace allows organizations to securely share and monetize their data assets, creating an ecosystem effect. This attracts more users and data providers, increasing the platform's value.

- The company is also focusing on expanding its AI and machine learning capabilities, such as Snowpark and Cortex, which are expected to contribute to future revenue growth. Snowpark, for example, is projected to contribute approximately 3% to FY25 revenues.

- [Company Name]'s net revenue retention rate, which was 126% as of January 31, 2025, and 124% as of April 30, 2025, indicates strong customer expansion and consumption patterns, demonstrating the effectiveness of its monetization approach within its existing customer base. To understand who is the target market of [Company Name], read this article: Target Market of Snowflake.

Snowflake PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Snowflake’s Business Model?

The journey of Snowflake has been marked by several key milestones, strategic moves, and a strong competitive edge. Its cloud-native architecture, which separates compute and storage, has been a game-changer in the data warehousing landscape. This design, coupled with a usage-based pricing model, has been a key differentiator since its inception, setting it apart from traditional data warehousing solutions.

A pivotal strategic move was the introduction of the Snowflake Data Exchange (now Data Marketplace) in 2019, which enhanced its competitive position by enabling secure data sharing and monetization across organizations. This fostered a powerful network effect, significantly boosting its market presence. In fiscal year 2025, the company continued to accelerate product development, launching several new features.

The company's focus on innovation, including the rapid adoption of its AI feature family, Snowflake Cortex, and improvements in its go-to-market strategy, has significantly impacted new product adoption. Strategic partnerships, such as the expanded collaboration with Microsoft to integrate OpenAI into Snowflake Cortex, further solidify its market position, enabling more comprehensive solutions.

Since its founding, Snowflake has achieved several significant milestones. The launch of the Snowflake Data Exchange in 2019 was a pivotal moment, enabling secure data sharing. In fiscal year 2025, the company accelerated product development, launching a significant number of new features, reflecting its commitment to innovation and market leadership.

Snowflake's strategic moves have been crucial to its success. Its cloud-native architecture, which separates compute and storage, has been a key differentiator. The company's expansion of its AI capabilities and partnerships, such as the collaboration with Microsoft, further strengthen its market position and provide more comprehensive solutions.

Snowflake's competitive advantages are numerous and include its multi-cloud architecture, which allows seamless data integration across AWS, Azure, and Google Cloud. The company's simplified management and continuous innovation, with regular updates and new features, also contribute to its strength. Its robust financial performance, with consistent revenue growth, further sustains its business model.

Snowflake has faced operational challenges, including increased GPU-related costs and pricing pressure from intensifying competition. In response, the company has focused on cost efficiency while continuing to invest in innovation. Addressing security concerns, Snowflake implemented mandatory multi-factor authentication for new accounts and is phasing out single-factor password logins by November 2025.

Snowflake's competitive advantages stem from its architecture and business model. Its multi-cloud architecture allows seamless integration across AWS, Azure, and Google Cloud. The separation of compute and storage resources enables granular management and cost optimization, which is a critical aspect when considering how Snowflake works. The company's continuous innovation and robust financial performance further sustain its business model.

- Multi-cloud Support: Snowflake supports AWS, Azure, and Google Cloud, offering flexibility.

- Separation of Compute and Storage: This allows independent scaling and cost management.

- Simplified Management: Automation capabilities extend beyond basic maintenance.

- Continuous Innovation: Regular updates and new features enhance the platform.

Snowflake Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Snowflake Positioning Itself for Continued Success?

The company holds a strong position within the cloud data warehousing and analytics industry, recognized for its scalability and ease of use. As of October 2024, DB-Engines ranked it 7th, highlighting its rapid rise in the data warehousing sector. With a significant customer base, including 745 Forbes Global 2000 customers as of January 31, 2025, the company demonstrates strong customer loyalty and global reach.

Despite its robust position, several risks and challenges persist. Intense competition from major cloud providers and regulatory changes concerning data privacy present ongoing hurdles. Rapid technological advancements also necessitate continuous investment in research and development to maintain a competitive edge. To learn more about the competitive environment, see the Competitors Landscape of Snowflake.

The company is a leading player in cloud data warehousing, known for its scalability and ease of use. Its ranking by DB-Engines and its customer base, including many of the Forbes Global 2000, underscore its strong market presence. The company's focus on multi-cloud capabilities enhances its appeal to a broad audience.

The company faces intense competition from established cloud providers, which could erode its market share. Regulatory changes, particularly in data privacy, pose ongoing challenges, requiring continuous adaptation. Rapid technological advancements also demand significant investment in R&D to maintain a competitive edge.

The company is expanding its AI and machine learning capabilities through offerings like Snowpark and Cortex. It is also working on improving its data engineering and data science tools. The company plans to explore new pricing models and expand into new markets to remain competitive.

The company is focusing on AI and machine learning, improving data engineering and science tools, and enhancing data fusion. It is also exploring new pricing models and expanding into new markets. These initiatives aim to broaden its total addressable market beyond SQL analytics.

The company's future is tied to its ability to convert new customers into AI consumption dollars and develop its 'System of Intelligence'. This system aims to evolve analytics from static dashboards to dynamic, agent-driven insights. The company is also focusing on improving data fusion and simplifying complex data structures.

- Expansion of AI and Machine Learning capabilities with Snowpark and Cortex.

- Improvements in data engineering and data science tools.

- Exploration of new pricing models and market expansion.

- Development of a 'System of Intelligence' for dynamic insights.

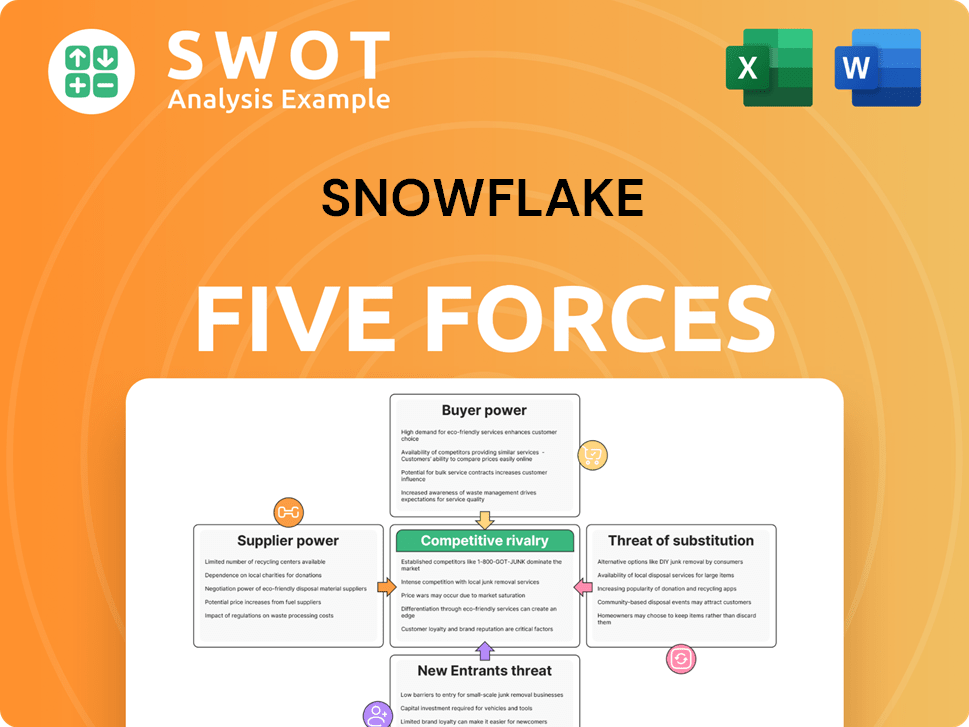

Snowflake Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snowflake Company?

- What is Competitive Landscape of Snowflake Company?

- What is Growth Strategy and Future Prospects of Snowflake Company?

- What is Sales and Marketing Strategy of Snowflake Company?

- What is Brief History of Snowflake Company?

- Who Owns Snowflake Company?

- What is Customer Demographics and Target Market of Snowflake Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.