Snowflake Bundle

Who Really Owns Snowflake?

Understanding the intricate web of Snowflake SWOT Analysis and its ownership is key to grasping its future trajectory. From its humble beginnings to its current status as a cloud data giant, Snowflake's ownership structure has dramatically evolved. This deep dive will unravel the story of who owns Snowflake Inc., from its founders to the institutional investors shaping its destiny.

This exploration of Snowflake ownership will examine the company's history, starting with its founders and early investors, and then move on to its current major stakeholders, including public shareholders and the influential role of its board of directors. We'll also analyze the impact of the Snowflake IPO on its ownership structure and how factors like Snowflake stock price and current market capitalization reflect its success. Learn about the Snowflake company leadership team and discover the answers to questions like "Who are the major shareholders of Snowflake?" and "Does Berkshire Hathaway own Snowflake?"

Who Founded Snowflake?

The cloud data warehousing company, Snowflake, was established by three experts in data warehousing: Benoît Dageville, Thierry Cruanes, and Marcin Zukowski. The founders brought extensive experience in database architecture and query processing to the table. Their combined expertise formed the foundation for Snowflake's innovative approach to data management.

Benoît Dageville, with a background at Oracle, served as Snowflake's President of Product. Thierry Cruanes, also from Oracle, became the SVP of Engineering. Marcin Zukowski, who co-founded Vectorwise, contributed his expertise in vectorized query processing. This team's combined skills were crucial in developing Snowflake's unique cloud-native data platform.

While the exact initial equity splits aren't publicly known, it's typical for founders to hold significant stakes, often subject to vesting schedules. Early backers played a vital role in Snowflake's initial development. Sutter Hill Ventures was a key early investor, providing seed funding and crucial support. Mike Speiser, a managing director at Sutter Hill Ventures, served as interim CEO and significantly influenced the company's strategy.

Benoît Dageville: Database architecture at Oracle, President of Product.

Thierry Cruanes: Oracle veteran, SVP of Engineering.

Marcin Zukowski: Co-founder of Vectorwise, expert in vectorized query processing.

Sutter Hill Ventures provided seed funding.

Mike Speiser of Sutter Hill Ventures served as interim CEO.

The team's vision for a cloud-native data platform attracted early investments.

The founders' vision for a cloud-native data platform was key to attracting early investments, reflecting their belief in the disruptive potential of their technology. Understanding the Growth Strategy of Snowflake helps to understand its ownership. As of early 2024, Snowflake's market capitalization was approximately $20 billion. The company's ownership structure includes institutional investors, with the largest shareholders including investment firms. Knowing who owns Snowflake is crucial for anyone looking to invest in Snowflake stock. The initial public offering (IPO) occurred in September 2020. Currently, the company's leadership team continues to drive its strategic direction.

The founders of Snowflake brought extensive experience in data warehousing.

- Benoît Dageville, Thierry Cruanes, and Marcin Zukowski founded the company.

- Early investors, like Sutter Hill Ventures, played a crucial role.

- The company's cloud-native data platform vision attracted early investments.

- Understanding the ownership structure is key for investors.

Snowflake SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Snowflake’s Ownership Changed Over Time?

The ownership structure of Snowflake Inc. has seen considerable changes, especially following its initial public offering (IPO) on September 16, 2020. This IPO was a significant event, marking one of the largest software IPOs ever, with an initial market capitalization exceeding $70 billion, signaling strong investor confidence. Before the IPO, Snowflake secured substantial funding through various rounds from prominent venture capital and private equity firms, shaping its early ownership landscape.

Prior to going public, key investors included Sutter Hill Ventures, Altimeter Capital, ICONIQ Capital, Redpoint Ventures, and Sequoia Capital. These firms held considerable equity, providing the necessary capital for Snowflake's rapid expansion and technological advancements. Post-IPO, the ownership structure broadened to include a wide array of public shareholders, such as institutional investors, mutual funds, and index funds, alongside the remaining stakes of founders and early investors. This shift has significantly impacted the company's trajectory.

| Event | Impact | Date |

|---|---|---|

| Pre-IPO Funding Rounds | Established early ownership, fueled growth | Various |

| IPO | Expanded shareholder base, increased capital | September 16, 2020 |

| Institutional Investment | Increased institutional ownership, potential influence on strategy | Ongoing |

As of early 2025, major institutional holders of Snowflake stock include firms like Vanguard Group Inc., BlackRock Inc., and Fidelity Management & Research Co. These entities collectively hold a substantial portion of Snowflake's outstanding shares, reflecting a trend of increasing institutional ownership in high-growth technology companies. While founder stakes have diluted over time due to subsequent funding rounds and the IPO, Benoît Dageville and Thierry Cruanes continue to hold significant positions. This evolution in ownership has influenced Snowflake's strategy by providing access to public markets for further capital, increasing scrutiny from a wider range of investors, and potentially impacting governance decisions through the influence of large institutional shareholders. If you're interested in understanding more about the company's financial workings, you can explore the Revenue Streams & Business Model of Snowflake.

Snowflake's ownership has evolved significantly since its founding, transitioning from venture capital backing to a public company with a diverse shareholder base.

- The IPO in 2020 was a pivotal moment, opening the door to public investment.

- Institutional investors now hold a significant portion of the company's stock.

- Founders still maintain considerable influence.

- Understanding the ownership structure is crucial for anyone looking to invest in Snowflake stock.

Snowflake PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Snowflake’s Board?

The current board of directors at Snowflake, as of early 2025, is composed of individuals with extensive industry experience and representatives from major investment firms. This structure is designed to offer strategic oversight and ensure effective governance. Key figures include Frank Slootman, the Chairman and former CEO, and Mike Speiser, a managing director at Sutter Hill Ventures, a significant early investor. This composition reflects a balance between internal leadership and external expertise, guiding the company's strategic direction.

The board's composition includes a mix of independent members and representatives from major shareholders, ensuring a diverse range of perspectives. The presence of individuals like Mike Speiser, representing a key early investor, highlights the influence of early stakeholders. This setup is intended to facilitate informed decision-making and maintain alignment with both short-term market dynamics and long-term strategic goals. The leadership team also plays a crucial role in shaping the company's trajectory, as highlighted in the Growth Strategy of Snowflake.

| Board Member | Title | Affiliation |

|---|---|---|

| Frank Slootman | Chairman | Snowflake Inc. |

| Mike Speiser | Managing Director | Sutter Hill Ventures |

The voting structure at Snowflake is primarily based on a one-share-one-vote system for its publicly traded Class A common stock. However, the company employs a dual-class share structure. Class B common stock, largely held by founders and early investors, carries higher voting rights, such as 10 votes per share. This structure gives significant control to early stakeholders. This dual-class structure allows for long-term strategic decision-making, reducing the immediate influence of short-term market fluctuations.

Understanding who owns Snowflake, including its shareholders and investors, is crucial for anyone interested in the company. The ownership structure, including the dual-class shares, significantly impacts decision-making. Snowflake's market capitalization as of early 2025 is substantial, reflecting its position in the cloud data platform market.

- The dual-class share structure grants founders and early investors disproportionate control.

- Class A shares have one vote per share, while Class B shares have 10 votes per share.

- Major shareholders and institutional investors play a key role in the company's direction.

- The leadership team, including the CEO, influences strategic decisions.

Snowflake Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Snowflake’s Ownership Landscape?

Over the past few years, the ownership landscape of Snowflake Inc has seen interesting developments. While major shifts in the fundamental ownership structure haven't occurred through significant share buybacks or secondary offerings, the company has continued to draw and keep institutional investors. The transition in leadership, with Sridhar Ramaswamy succeeding Frank Slootman as CEO in February 2024, has been a notable event. Such changes can affect investor confidence and, consequently, the stock's ownership dynamics as investors reassess their positions.

Industry trends for high-growth tech companies like Snowflake often include increasing institutional ownership, as large funds seek exposure to leading cloud and data platforms. Founder dilution is a natural process as companies mature and go through multiple funding rounds and IPOs. However, the dual-class share structure at Snowflake helps to mitigate some of this dilution of control for its founders. The company's ongoing growth and strategic partnerships have also influenced investor sentiment and ownership stability. Public statements and analyst reports about growth projections, product innovation, and market expansion indirectly impact ownership trends by attracting new investors or reinforcing existing holdings. To learn more about the company's strategies, you can read about the Marketing Strategy of Snowflake.

| Metric | Details | Data (as of late 2024/early 2025) |

|---|---|---|

| Market Capitalization | Current valuation of the company | Approximately $70 billion (subject to market fluctuations) |

| Institutional Ownership | Percentage of shares held by institutional investors | Around 60-70% |

| Key Institutional Holders | Major institutional investors | Fidelity, BlackRock, and The Vanguard Group |

The change in CEO, with Sridhar Ramaswamy taking over from Frank Slootman in early 2024, is a significant recent development. This shift can influence investor perceptions and impact ownership dynamics. Leadership changes often lead to re-evaluations of investment positions by shareholders.

Snowflake continues to attract and maintain a high level of institutional ownership. Large funds are seeking exposure to leading cloud and data platforms. This trend indicates confidence in the company's long-term growth prospects.

Snowflake's partnerships with major cloud providers influence investor sentiment. These collaborations demonstrate the company's integration into the broader cloud ecosystem. Such partnerships can enhance the company's market position.

Public discussions about growth projections and market expansion attract new investors. Analysts often focus on product innovation. These factors indirectly influence ownership trends.

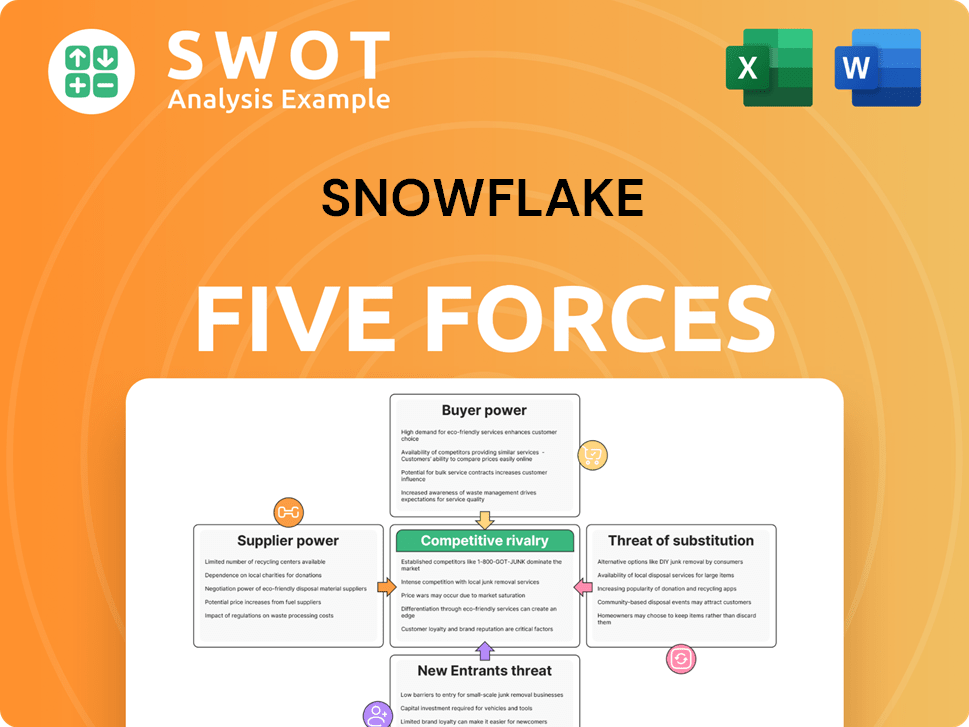

Snowflake Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Snowflake Company?

- What is Competitive Landscape of Snowflake Company?

- What is Growth Strategy and Future Prospects of Snowflake Company?

- How Does Snowflake Company Work?

- What is Sales and Marketing Strategy of Snowflake Company?

- What is Brief History of Snowflake Company?

- What is Customer Demographics and Target Market of Snowflake Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.