Spectrum Brands Bundle

Can Spectrum Brands Rebound and Thrive?

Spectrum Brands, a titan in the consumer products arena, has strategically realigned its focus. The company's recent divestiture of its Hardware and Home Improvement segment marks a pivotal shift. This strategic move sets the stage for a deep dive into Spectrum Brands' future prospects and growth strategy.

Founded over a century ago, Spectrum Brands SWOT Analysis reveals a company that has navigated significant market changes. This exploration will examine the company's evolution from its origins as Ray-O-Vac to its current status, analyzing its business model and financial performance. We'll also delve into Spectrum Brands' market analysis, including its growth strategy in North America and international expansion plans, to understand its long-term growth potential.

How Is Spectrum Brands Expanding Its Reach?

The expansion initiatives of the company are central to its long-term growth strategy. The company is implementing a multi-faceted approach to enhance its market position and drive future growth. This involves a combination of strategic portfolio management, organic growth within core segments, and geographic expansion, all underpinned by operational excellence.

A key element of the company's strategy involves disciplined portfolio management. This is demonstrated by the recent divestiture of the HHI business, which allowed the company to reduce debt and focus on higher-growth, higher-margin businesses. This strategic move is designed to streamline operations and allocate resources more effectively towards areas with greater potential for return.

The company is concentrating on organic growth within its core segments: Home & Garden, Global Pet Care, and Personal Care. These segments offer opportunities for market share gains through product innovation and enhanced distribution. The company is also exploring new product categories and adjacent markets within its existing segments to diversify revenue streams.

The company's strategy includes disciplined portfolio management, such as the HHI divestiture. This allows the company to reduce debt and focus on higher-growth businesses. This strategic move aims to streamline operations and allocate resources more efficiently.

The company is focused on organic growth within its core segments: Home & Garden, Global Pet Care, and Personal Care. This strategy involves product innovation and enhanced distribution to gain market share. The company is also exploring new product categories to diversify revenue streams.

The company continues to leverage its global presence, especially in the pet care segment. The company aims to capitalize on the growing humanization of pets and increasing demand for premium pet products. International expansion plans are a key part of the company's growth strategy.

Partnerships likely play a role in expanding reach and capabilities, particularly in e-commerce and digital engagement. The company's focus on operational excellence and supply chain optimization supports expansion efforts. These strategies ensure efficient delivery of new products and services.

Geographically, the company continues to leverage its global presence, particularly in the pet care segment. The company aims to capitalize on the growing humanization of pets trend and increasing demand for premium pet products. This focus on international expansion is a core component of the company's growth strategy. The company's market analysis indicates significant opportunities in international markets, driving the need for strategic expansion plans.

The company's expansion strategy is multifaceted, focusing on organic growth, strategic partnerships, and geographic expansion. The company is looking at new product development and strategic acquisitions. These initiatives are supported by operational efficiencies.

- Disciplined Portfolio Management: Streamlining operations and focusing on high-growth areas.

- Organic Growth: Expanding within core segments through innovation and distribution.

- Geographic Expansion: Capitalizing on global opportunities, particularly in pet care.

- Partnerships: Leveraging collaborations for market reach and capabilities.

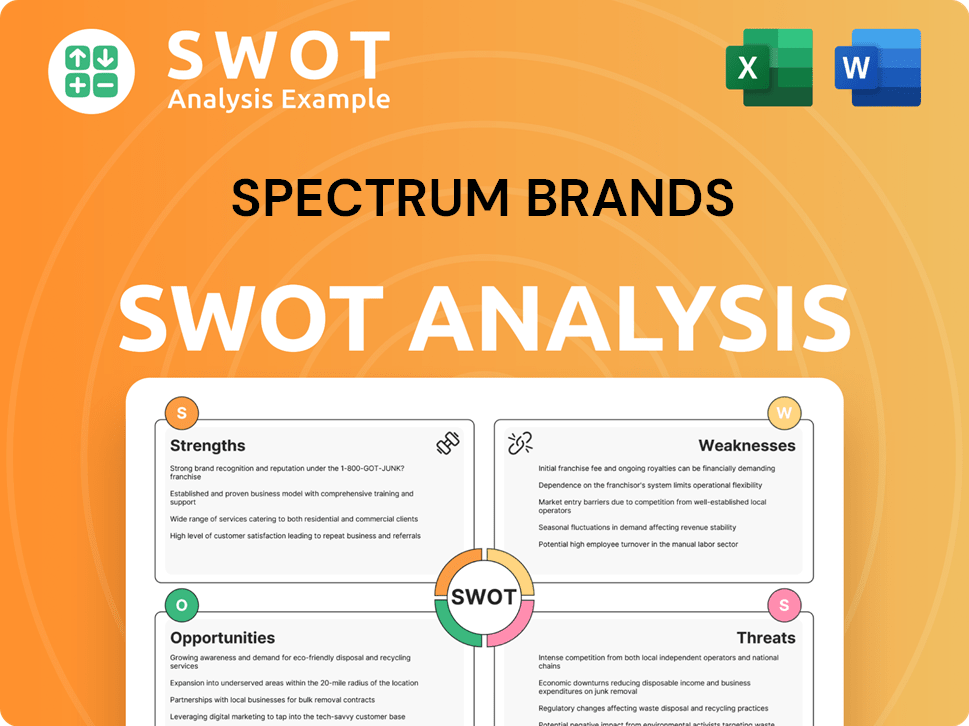

Spectrum Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Spectrum Brands Invest in Innovation?

Innovation and technology are crucial for the long-term success of any company, and that holds true for Spectrum Brands. Their approach involves significant investments in research and development (R&D) to enhance its product offerings across various segments like Home & Garden, Global Pet Care, and Personal Care. This strategy is designed to meet evolving consumer demands and drive overall growth.

A key aspect of Spectrum Brands' strategy is digital transformation. This includes optimizing e-commerce platforms and improving digital marketing to connect with today's consumers. While specific details on technologies like AI or IoT aren't always public, the consumer products industry is increasingly using data analytics and connected devices for product development and customer engagement. This focus helps Spectrum Brands stay competitive and relevant in the market.

Spectrum Brands is committed to innovation, which is evident in its pursuit of intellectual property and continuous improvements in manufacturing processes. This dedication aims to deliver differentiated products that meet changing consumer needs and support the company's growth goals. This commitment is a key part of their overall strategy, as highlighted in a brief history of Spectrum Brands.

Spectrum Brands invests in R&D to improve products, especially in areas like sustainability and smart technology. This helps the company stay ahead of consumer trends and maintain a competitive edge.

The company focuses on digital transformation by improving e-commerce and digital marketing. This helps Spectrum Brands reach modern consumers more effectively and boost sales.

Spectrum Brands strives to differentiate its products through innovation and intellectual property. This strategy helps them meet evolving consumer needs and support growth objectives.

Developing more sustainable products is a key part of Spectrum Brands' innovation efforts. This aligns with growing consumer demand for environmentally friendly options.

Spectrum Brands is leveraging smart technology, particularly in its pet care devices. This enhances product functionality and user experience, appealing to tech-savvy consumers.

Continuous improvement in manufacturing processes is a priority. This ensures efficiency and helps deliver high-quality products that meet consumer expectations.

Spectrum Brands' innovation strategy includes several key elements to drive growth and maintain a competitive advantage. These strategies are designed to meet evolving consumer demands and improve operational efficiency.

- Research and Development: Investing in R&D to create new and improved products, focusing on sustainability and smart technologies.

- Digital Transformation: Optimizing e-commerce platforms and enhancing digital marketing to reach a wider consumer base.

- Product Differentiation: Pursuing intellectual property and continuous improvement in manufacturing to offer unique products.

- Data Analytics: Utilizing data analytics to understand consumer behavior and inform product development.

- Sustainability Initiatives: Developing eco-friendly products to meet the growing demand for sustainable options.

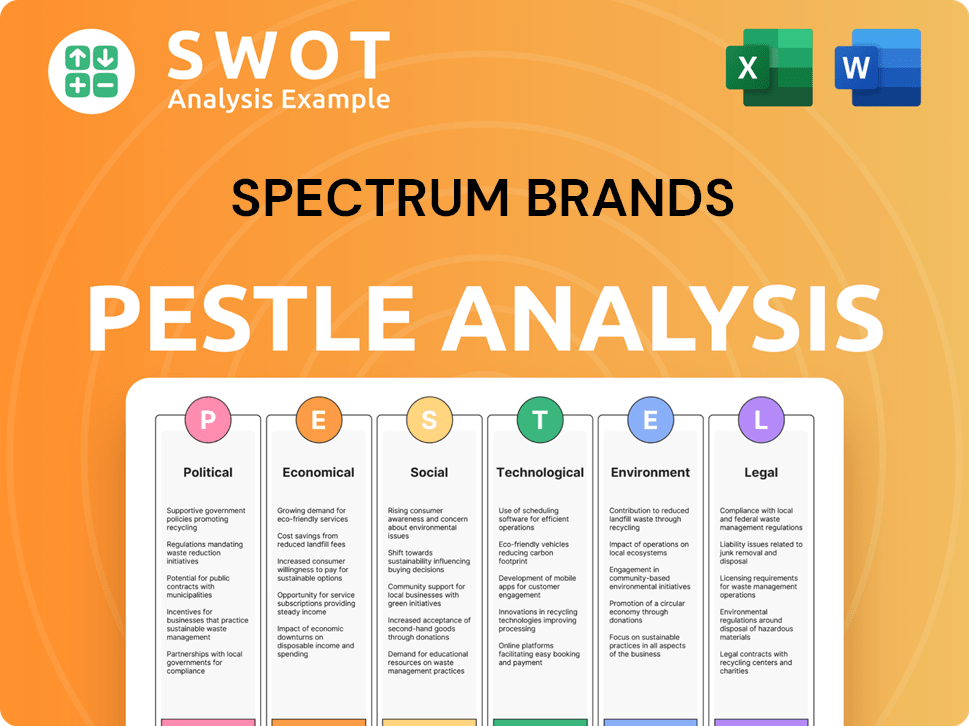

Spectrum Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Spectrum Brands’s Growth Forecast?

The financial outlook for Spectrum Brands is largely shaped by its strategic focus on core business segments and a commitment to operational efficiency. Following the divestiture of the Hardware & Home Improvement (HHI) division, the company has significantly reduced its debt, which has strengthened its financial position. This strategic move allows for greater flexibility in capital allocation and supports long-term growth initiatives.

For fiscal year 2024, Spectrum Brands anticipates consolidated net sales from continuing operations to remain flat to increase by up to 2% compared to fiscal year 2023, excluding the impact of foreign exchange rates. This projection reflects a cautious but optimistic view, considering the current economic environment and the company's ongoing efforts to streamline operations. Furthermore, the company projects adjusted EBITDA from continuing operations to be between $330 million and $350 million.

Spectrum Brands' financial strategy emphasizes improving gross margins and managing operating expenses effectively. This approach is designed to enhance profitability and generate strong free cash flow. The company aims to use this cash flow for further debt reduction, strategic investments, or shareholder returns. This disciplined capital allocation strategy is a key component of Spectrum Brands' plan to maximize shareholder value through sustainable growth. For a deeper understanding of the company's consumer base, you can explore the Target Market of Spectrum Brands.

Market analysis suggests a stable to modest growth trajectory for Spectrum Brands. This is supported by the company's efforts to streamline operations and concentrate on profitable categories. The company’s ability to adapt to changing consumer preferences and market dynamics will be crucial for its future prospects.

Spectrum Brands' business model focuses on a portfolio of consumer brands across various segments. This diversified approach helps mitigate risks and capitalize on different market opportunities. The business model is designed to deliver value through product innovation and operational excellence.

The company's financial performance is closely tied to its ability to manage costs and drive sales growth. Key metrics include revenue, gross margin, and adjusted EBITDA. The company’s disciplined approach to capital allocation is a key factor in its financial health.

Spectrum Brands' growth strategy involves a combination of organic growth initiatives and strategic acquisitions. The company aims to expand its market share and enter new markets through product innovation. Focus on core segments and operational efficiency are key drivers.

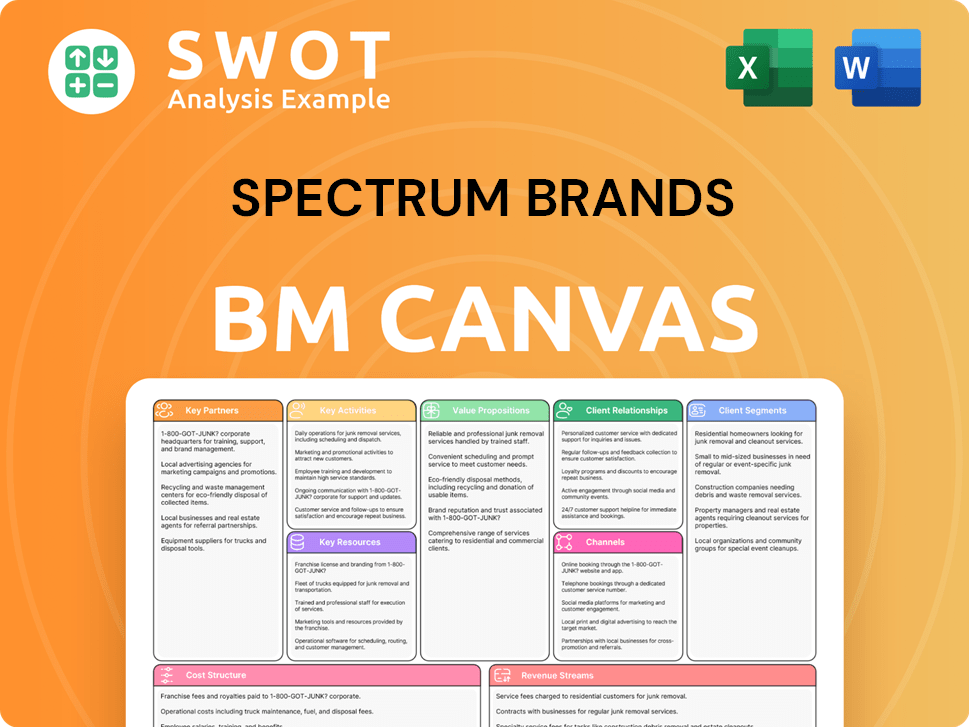

Spectrum Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Spectrum Brands’s Growth?

The growth trajectory of the Spectrum Brands company faces several potential risks and obstacles that could influence its future prospects. These challenges span market dynamics, operational complexities, and external pressures, all of which require proactive management. A thorough Spectrum Brands market analysis reveals the need for strategic adaptability to navigate these hurdles effectively.

Intense competition, regulatory changes, and supply chain vulnerabilities are among the key risks. Technological disruptions and the necessity of maintaining a diverse brand portfolio add further complexity. The company's ability to adapt and innovate will be critical in overcoming these challenges and achieving its growth objectives. Understanding the Spectrum Brands business model is also essential for assessing its resilience.

Spectrum Brands' strategic initiatives and future prospects are shaped by its ability to address these risks. The company's financial performance and strategic decisions are closely watched by investors and stakeholders alike. The company's approach to risk management and its ability to adapt to changing market conditions will be crucial for long-term success. You may find additional insights in the Marketing Strategy of Spectrum Brands.

Spectrum Brands operates in highly competitive markets, facing established players and emerging direct-to-consumer brands. This competition can pressure pricing, reduce market share, and necessitate continuous innovation. The company must differentiate its products and services to maintain a competitive edge. This requires a deep understanding of Spectrum Brands consumer trends and insights.

Changes in regulations, especially concerning product safety, environmental standards, and international trade, pose significant risks. Compliance costs can increase, and market access may be impacted, affecting Spectrum Brands' operational efficiency. The company must stay agile in adapting to evolving regulatory landscapes. The company's sustainability initiatives are also important.

Supply chain disruptions, whether from geopolitical events, natural disasters, or raw material price fluctuations, present operational risks. These disruptions can lead to production delays, increased costs, and reduced profitability. The company needs robust supply chain management strategies. The company's financial results and earnings reports often reflect these challenges.

Technological advancements can lead to rapid shifts in consumer preferences and the emergence of superior product alternatives. Spectrum Brands must invest in research and development and embrace innovation to stay ahead of the curve. The company's new product development strategy is critical. The company's long-term growth potential is linked to its ability to adapt.

Managing a diverse portfolio of brands and ensuring consistent innovation across various segments requires significant resource allocation and strategic oversight. This complexity can strain operational capabilities if not managed effectively. The company's acquisition and merger strategy plays a role in portfolio optimization. The company's challenges and opportunities are closely tied to portfolio management.

Economic recessions can impact consumer spending, particularly on discretionary products. This could lead to reduced sales volumes and decreased profitability. The company's ability to navigate economic cycles is crucial. The company's market share and ranking may fluctuate during economic downturns. The company's stock price forecast is often influenced by economic conditions.

Spectrum Brands employs several strategies to mitigate these risks. Portfolio diversification across various product categories and geographic regions helps reduce the impact of any single market downturn. Robust risk management frameworks are in place to identify and address potential threats proactively. Continuous monitoring of market trends and regulatory landscapes ensures the company remains adaptable. The company's international expansion plans are part of its risk mitigation strategy.

Strategic divestitures, such as the recent sale of the Hardware & Home Improvement (HHI) business, demonstrate the company's willingness to adapt its portfolio. This allows Spectrum Brands to focus on core strengths and emerging opportunities. These actions help optimize the portfolio in response to market dynamics and emerging obstacles. The company's financial performance is often impacted by such strategic decisions.

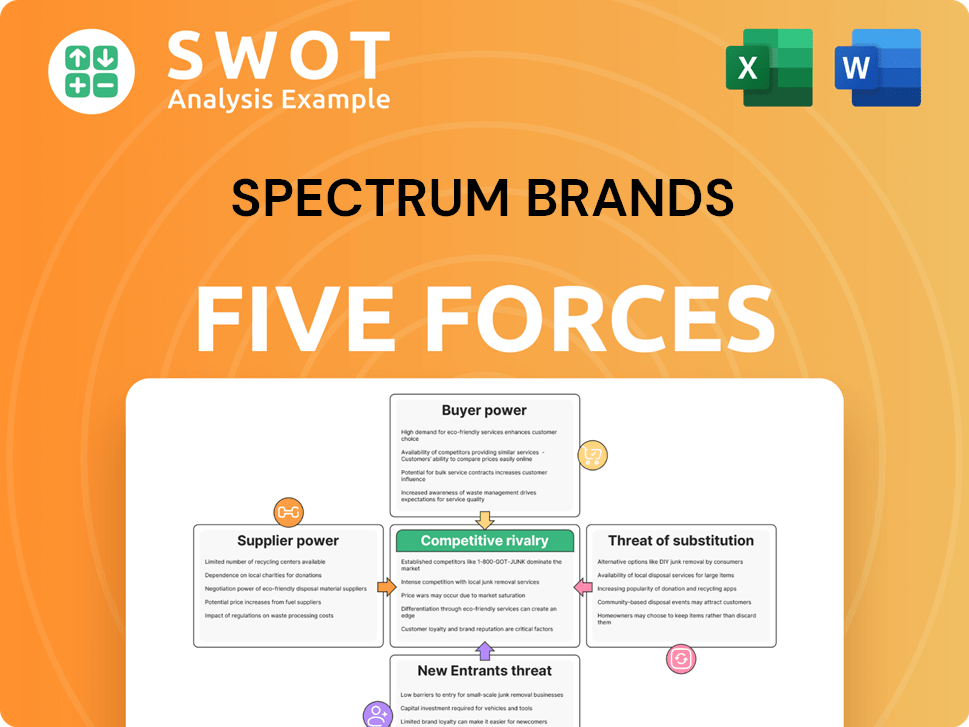

Spectrum Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spectrum Brands Company?

- What is Competitive Landscape of Spectrum Brands Company?

- How Does Spectrum Brands Company Work?

- What is Sales and Marketing Strategy of Spectrum Brands Company?

- What is Brief History of Spectrum Brands Company?

- Who Owns Spectrum Brands Company?

- What is Customer Demographics and Target Market of Spectrum Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.