Spectrum Brands Bundle

How Does Spectrum Brands Thrive in the Consumer Goods Market?

Spectrum Brands, a global powerhouse, shapes the home, garden, pet care, and personal care sectors with its iconic brands. From Remington to Tetra, its products are household staples, but how does this Spectrum Brands SWOT Analysis help the company? Understanding the inner workings of Spectrum Brands is key for anyone interested in the consumer goods market.

This deep dive into the Spectrum Brands company will explore its business model, revenue streams, and strategic positioning. We'll examine how Spectrum Brands products are manufactured and distributed, and its ability to adapt and compete in a dynamic global market. Whether you're curious about Spectrum Brands stock or its recent acquisitions, this analysis offers valuable insights.

What Are the Key Operations Driving Spectrum Brands’s Success?

The core operations of the Spectrum Brands company revolve around manufacturing and marketing a diverse range of consumer products. These products span several key segments, including Home & Garden, Pet Care, and Personal Care. Their business model emphasizes a global distribution network, ensuring products reach consumers through various channels.

Spectrum Brands creates value by efficiently managing its supply chain and leveraging its strong brand recognition. This approach allows the company to offer quality products and maintain a competitive edge. The company's focus on operational excellence and strategic partnerships supports its ability to meet consumer needs effectively.

The company's value proposition lies in its ability to provide a wide array of consumer goods through trusted brands. This diversification reduces reliance on any single product line, contributing to its overall resilience and market presence. The company's operational effectiveness is further enhanced by its ability to adapt to changing market dynamics and consumer preferences.

Offers pest control, lawn and garden care, and cleaning products. Serves homeowners and gardeners, providing solutions for maintaining outdoor spaces. This segment benefits from seasonal demand and consumer focus on home improvement.

Provides aquatics, pet food, and pet grooming products. Caters to pet owners with essential and specialized products. This segment benefits from the growing pet ownership trend globally.

Encompasses grooming tools, hair care appliances, and oral care products. Addresses individual grooming needs with a range of products. This segment is driven by personal care routines and beauty trends.

Products are distributed through mass merchandisers, home improvement centers, and specialty retailers. This multi-channel approach ensures broad market reach and accessibility for consumers. Strategic partnerships are key to this distribution strategy.

Spectrum Brands' operational efficiency is bolstered by a global supply chain, advanced manufacturing, and robust logistics. These elements ensure timely product delivery and cost-effectiveness. The company's diversified brand portfolio allows for cross-category synergies, reducing dependence on any single product line.

- Global Supply Chain: Efficient sourcing of raw materials.

- Advanced Manufacturing: Ensures product quality and scale.

- Robust Logistics: Timely product delivery to various channels.

- Strategic Partnerships: Collaborations with retailers for market reach.

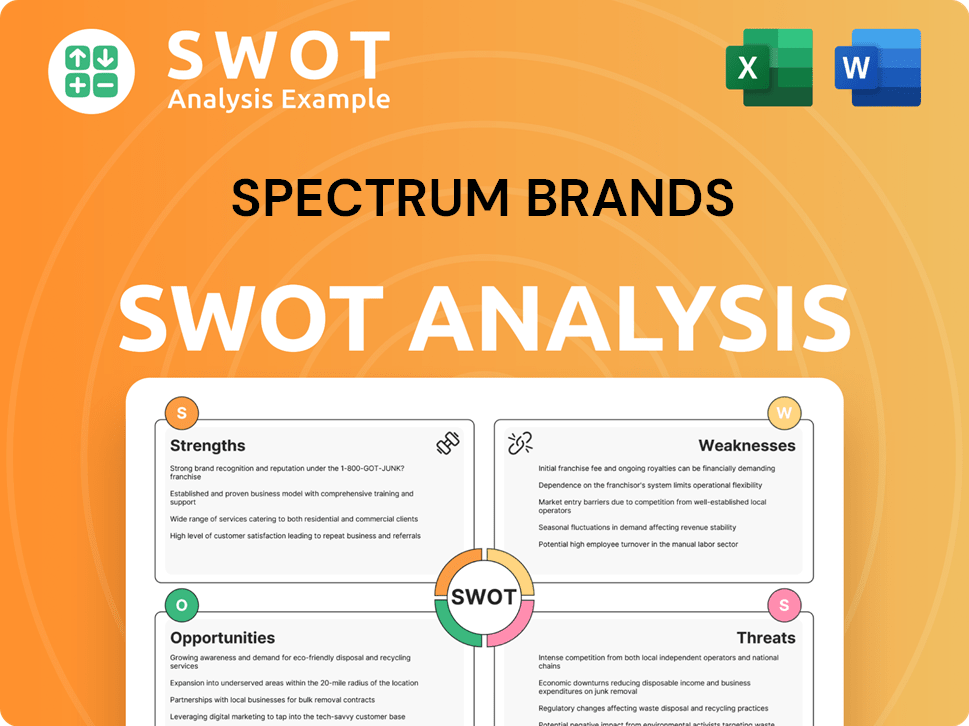

Spectrum Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Spectrum Brands Make Money?

The Spectrum Brands company generates revenue primarily through the sale of its consumer products. Its business model focuses on selling products across various segments, with product sales as the main revenue driver. For the fiscal year 2024, the company reported significant sales figures across its diverse portfolio.

Spectrum Brands utilizes a multi-faceted monetization strategy. This includes volume sales through retail partnerships and tiered pricing strategies for different products. The company also leverages its brand equity to command premium pricing in certain categories. This approach helps to optimize revenue generation.

Spectrum Brands' financial performance is closely tied to its ability to sell its products effectively. The company's focus on higher-margin categories and brands through acquisitions and divestitures is a key part of its strategy. This strategic approach helps improve profitability and streamline revenue efforts.

The primary revenue streams for Spectrum Brands are product sales across three main segments. In 2024, net sales reached $2.9 billion, showcasing the company's broad market presence. The company's financial health is influenced by its ability to manage its product portfolio and market positioning.

- Home & Garden segment contributed $1.1 billion in net sales.

- Pet Care segment accounted for $1.1 billion in net sales.

- Personal Care segment generated $0.7 billion in net sales.

- The company's focus on acquisitions and divestitures is a key aspect of its business model.

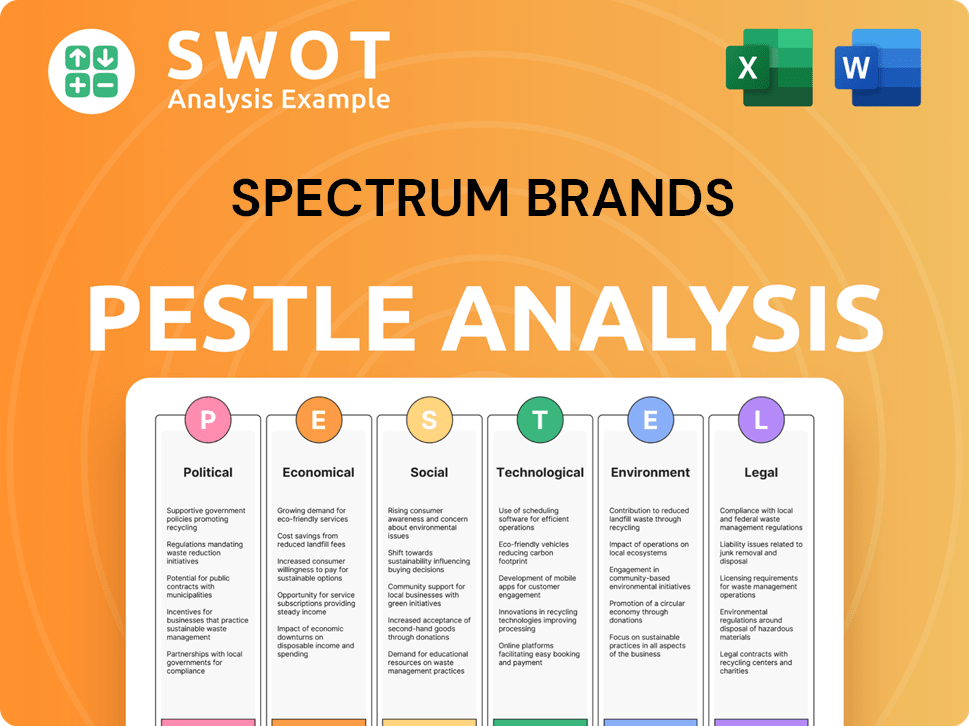

Spectrum Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Spectrum Brands’s Business Model?

The evolution of the Spectrum Brands company has been marked by significant strategic shifts and key milestones that have shaped its operational and financial landscape. One of the most impactful moves in recent years was the divestiture of its Hardware and Home Improvement (HHI) segment. This strategic decision allowed the company to streamline its focus and allocate resources more effectively.

Spectrum Brands' strategic moves have been geared towards enhancing profitability and focusing on core segments. These adjustments reflect the company's commitment to adapting to market dynamics and improving its competitive position. The company has also navigated operational challenges, including supply chain disruptions and inflationary pressures.

The company's ability to maintain a strong market presence is supported by its well-recognized brands, extensive distribution network, and established relationships with major retailers. These competitive advantages have been crucial in navigating market challenges and capitalizing on growth opportunities. The company continues to adapt to new trends, such as the increasing demand for sustainable products in the home and garden sector and premiumization in pet care.

A critical milestone was the divestiture of the Hardware and Home Improvement (HHI) segment to Assa Abloy in 2023 for approximately $4.3 billion. This move allowed Spectrum Brands to reduce its debt significantly. The company has also focused on operational efficiencies and inventory management to mitigate headwinds.

The primary strategic focus has been on streamlining operations and enhancing profitability. This includes concentrating resources on businesses with strong growth potential. The company has emphasized strategic pricing and product innovation to maintain its market relevance and competitive standing.

Spectrum Brands benefits from a strong portfolio of well-recognized brands, fostering customer loyalty. Its extensive global distribution network and long-standing relationships with major retailers provide a crucial competitive edge. The company's ability to adapt to market trends, such as the demand for sustainable products, is also a key strength.

The financial performance of Spectrum Brands reflects its strategic adjustments and operational efficiency efforts. While specific 2024 or 2025 figures are not available, the divestiture of HHI in 2023 was a significant step towards improving its financial position. For more details on the company's background, consider reading the Brief History of Spectrum Brands.

Spectrum Brands maintains a competitive edge through its strong brand portfolio and global distribution network. These advantages are critical for market penetration. The company's focus on innovation and sustainability also supports its market position.

- Strong Brand Portfolio: Well-recognized brands that foster customer loyalty.

- Global Distribution Network: Extensive reach and established relationships with retailers.

- Product Innovation: Continuous investment in new product development and marketing.

- Sustainability Initiatives: Adapting to the increasing demand for eco-friendly products.

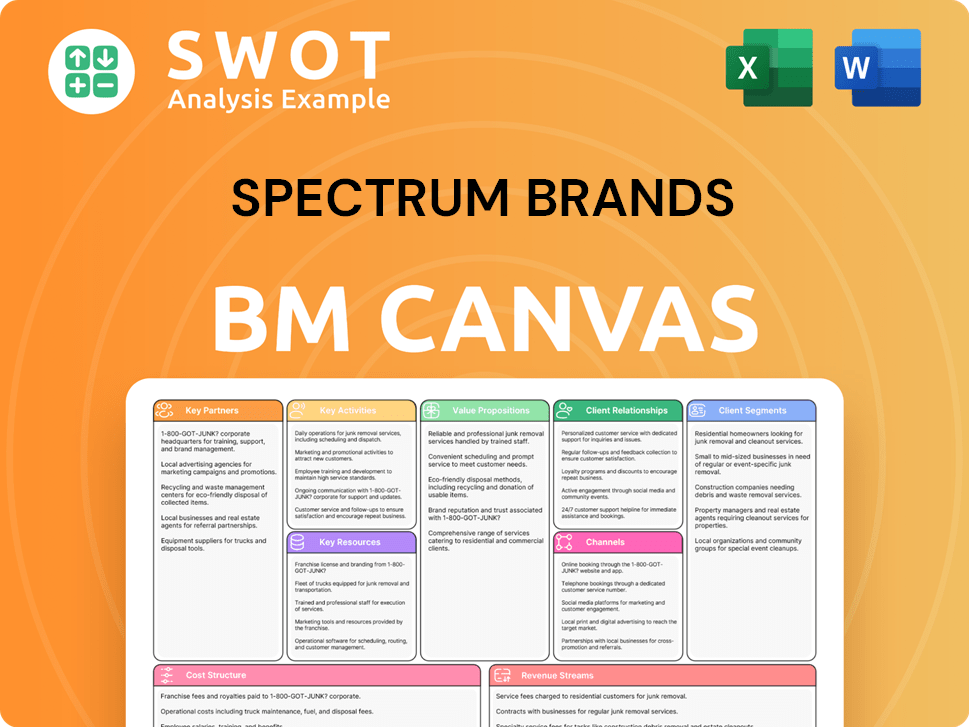

Spectrum Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Spectrum Brands Positioning Itself for Continued Success?

Understanding the industry position, potential risks, and future outlook of Spectrum Brands is crucial for investors and stakeholders. The Spectrum Brands company operates in several consumer-focused segments, each with its own competitive dynamics. Analyzing these factors provides a comprehensive view of the company's potential for growth and sustainability.

Spectrum Brands' business model involves a portfolio of well-known brands, which are exposed to various market risks. These risks, along with strategic initiatives, shape the company's future. The following sections explore these key aspects in detail.

Spectrum Brands holds a significant market position across its diverse segments. In Home & Garden, it competes with major players in pest control and lawn care. The company maintains a strong presence in Pet Care, particularly in aquatics. The Remington brand in Personal Care faces competition from other grooming appliance manufacturers. Spectrum Brands' market share is supported by strong brand recognition and extensive retail distribution.

Key risks impacting Spectrum Brands' operations include supply chain volatility, which can increase costs and affect product availability. Changing consumer preferences, such as a shift towards private-label brands, and new product innovations from competitors also pose risks. Economic downturns impacting consumer spending on discretionary items could affect sales. These factors can influence the financial performance of Spectrum Brands.

Looking ahead, Spectrum Brands focuses on strategic initiatives to drive growth and profitability. The company aims to leverage its strengthened financial position to invest in brand building, product innovation, and potential acquisitions. Leadership is committed to operational excellence and portfolio optimization. The company aims to capitalize on growth opportunities in pet care and home & garden while maintaining its position in personal care.

Spectrum Brands is likely to focus on expanding its presence in high-growth markets and enhancing its product offerings. The company has shown interest in acquisitions to strengthen its market position. Investments in e-commerce and digital marketing are also expected. These initiatives are designed to improve the company's competitive edge. For more insights, explore the Competitors Landscape of Spectrum Brands.

Spectrum Brands must navigate challenges such as supply chain disruptions and changing consumer behavior. The company's ability to manage costs and adapt to market trends will be crucial. Strategic decisions regarding product innovation and distribution channels are also important.

- Operational efficiency improvements.

- Strategic investments in brand building.

- Focus on expanding market share in key segments.

- Exploration of potential acquisitions to enhance the product portfolio.

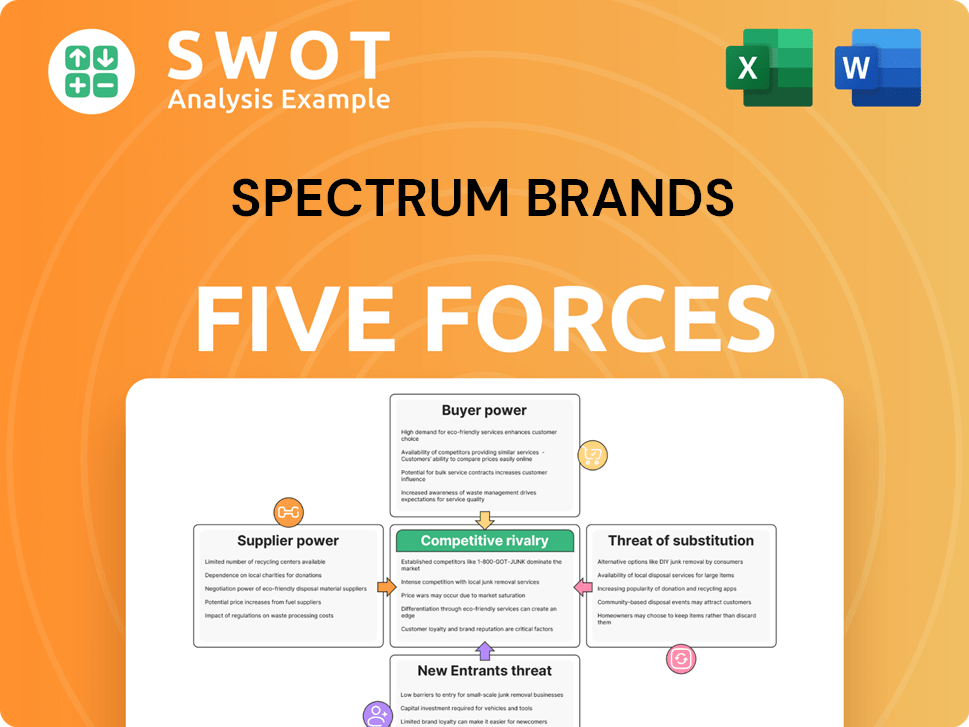

Spectrum Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spectrum Brands Company?

- What is Competitive Landscape of Spectrum Brands Company?

- What is Growth Strategy and Future Prospects of Spectrum Brands Company?

- What is Sales and Marketing Strategy of Spectrum Brands Company?

- What is Brief History of Spectrum Brands Company?

- Who Owns Spectrum Brands Company?

- What is Customer Demographics and Target Market of Spectrum Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.