Spectrum Brands Bundle

Who Really Owns Spectrum Brands?

Unraveling the ownership of Spectrum Brands is key to understanding its strategic moves and market position. From its origins as a battery company to its current status as a global consumer products powerhouse, Spectrum Brands' evolution is a fascinating study in corporate transformation. Understanding Spectrum Brands SWOT Analysis is crucial to understanding its market dynamics.

The journey of Spectrum Brands, from its roots as Rayovac Company in 1906 to its present-day structure, reflects significant shifts in ownership and strategic direction. Examining the company's ownership structure, including its major shareholders and the influence of institutional investors, provides crucial insights into its governance and future prospects. Understanding who owns Spectrum Brands, its parent company, and its various brands is essential for investors and anyone interested in the company's financial performance and overall strategy. The company's history timeline reveals a dynamic landscape of acquisitions and divestitures, making the analysis of Spectrum Brands ownership a compelling endeavor.

Who Founded Spectrum Brands?

The details of the founding ownership structure of Spectrum Brands, specifically tracing back to its predecessor, Rayovac Company, are not extensively documented in public records. Rayovac Company was established in 1906 by James B. Ramsey, who is credited with developing the initial dry cell battery in his laboratory. While Ramsey is acknowledged as the founder, specific information about other early investors or the initial distribution of equity among early supporters is not readily available.

Early agreements, such as vesting schedules or buy-sell clauses, from the early stages of Rayovac are also not commonly disclosed in public historical accounts. The core vision of the founding team, focused on innovation in battery technology, would have influenced the control mechanisms established to guide the company's initial development and expansion. Information on initial ownership disputes or buyouts from this early period is also not typically found in public historical accounts.

The evolution of Spectrum Brands, and its ownership, is a story that has been shaped by various acquisitions and corporate restructuring over the years. The company has expanded its portfolio significantly, moving beyond its initial focus on battery technology to include a diverse range of consumer products.

Rayovac Company was founded in 1906.

James B. Ramsey is credited as the founder of Rayovac.

The initial focus was on innovation in battery technology.

Specifics on early ownership details are not widely available in public records.

Details on early agreements like vesting schedules are not commonly disclosed.

Information on initial ownership disputes or buyouts from this early era is also not typically found in public historical accounts.

Understanding the early ownership of Spectrum Brands (formerly Rayovac) is challenging due to limited public information. The company's history is marked by a focus on innovation in battery technology, and later, expansion through acquisitions. For more insights into the company's current structure and financial performance, further research is recommended. You can also read more about the company's history and structure in this article about Spectrum Brands.

- James B. Ramsey founded Rayovac in 1906.

- Specific early ownership details are not widely available.

- The company's evolution includes significant acquisitions.

- Focus on battery technology initially, expanding to consumer products.

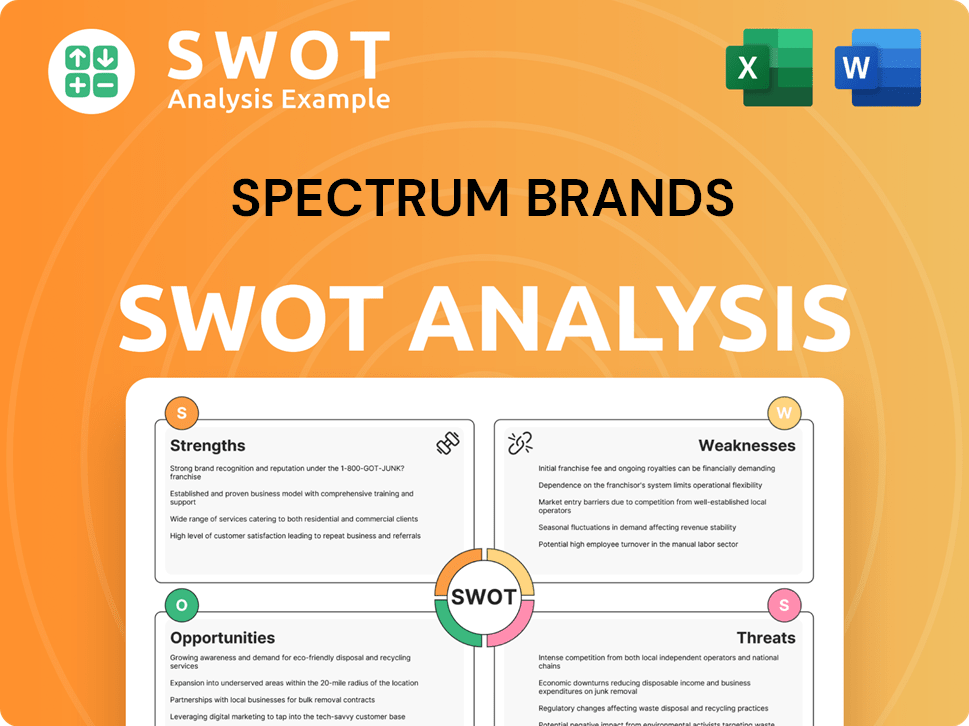

Spectrum Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Spectrum Brands’s Ownership Changed Over Time?

The ownership structure of Spectrum Brands Holdings, traded on the New York Stock Exchange under the ticker SPB, has evolved significantly through mergers, acquisitions, and divestitures. This Growth Strategy of Spectrum Brands has reshaped its ownership landscape. The company's history includes various strategic moves that have influenced its current shareholder base, particularly the role of institutional investors.

As of early 2025, institutional investors hold a considerable portion of Spectrum Brands' shares. For example, as of March 31, 2025, Vanguard Group Inc. and BlackRock Inc. are among the largest institutional shareholders. Their investments are often managed through mutual funds and ETFs. The company's market capitalization, which was roughly $2.6 billion as of April 2025, highlights its position in the consumer products sector. The influence of these major shareholders often impacts company strategy and governance.

| Shareholder | Stake (Approximate) | Notes |

|---|---|---|

| Vanguard Group Inc. | Significant | One of the largest institutional shareholders. |

| BlackRock Inc. | Significant | Another major institutional investor. |

| Other Institutional Investors | Variable | Includes various mutual funds and ETFs. |

The shifts in institutional holdings reflect market sentiment and investment strategies related to Spectrum Brands' performance. Understanding the ownership structure provides insights into the company's strategic direction and financial health. The company's financial performance and strategic decisions are closely watched by these major stakeholders.

Spectrum Brands' ownership is primarily influenced by institutional investors. These investors, such as Vanguard and BlackRock, hold a significant portion of the company's shares. The company's market capitalization was approximately $2.6 billion as of April 2025.

- Institutional investors hold a substantial stake.

- Vanguard and BlackRock are major shareholders.

- Market capitalization is around $2.6 billion (April 2025).

- Changes in holdings reflect market sentiment.

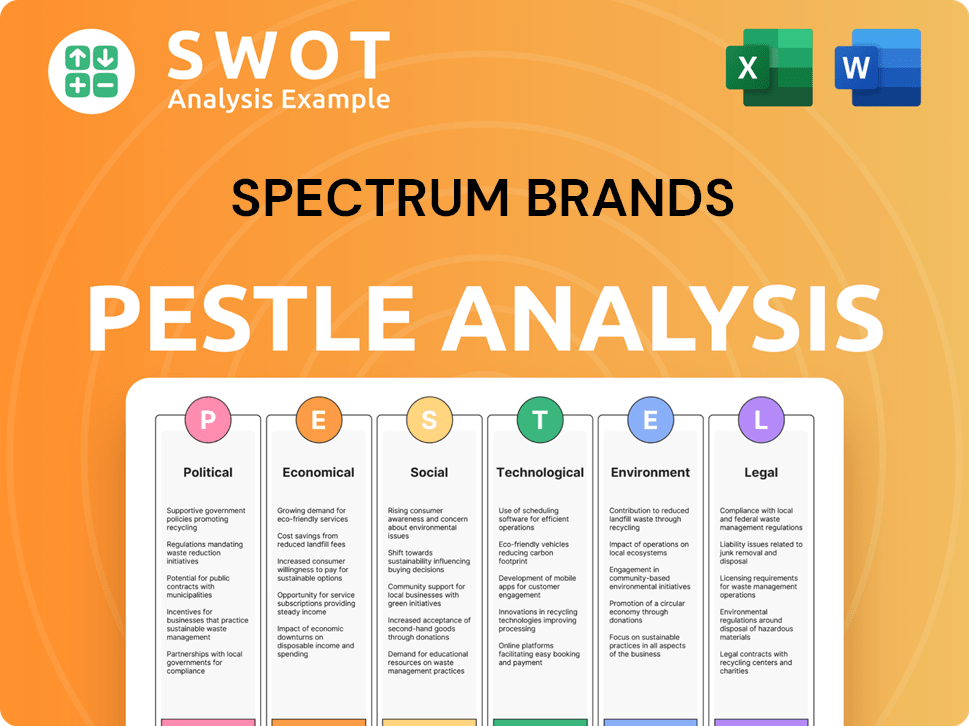

Spectrum Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Spectrum Brands’s Board?

The current board of directors of Spectrum Brands Holdings significantly influences its governance and mirrors the company's ownership structure. As of early 2025, the board typically includes a mix of independent directors and those with connections to major shareholders or the company's executive leadership. While specific individuals representing major shareholders like Vanguard or BlackRock aren't usually direct board members, the interests of these large institutional investors are often considered through engagement with independent directors and the overall board composition. Understanding the composition of the board is essential for investors seeking to understand the strategic direction and governance of the company.

The interests of various investor types are balanced by the board's fiduciary duty to all shareholders, which guides the company's strategic direction. The voting structure of Spectrum Brands generally follows a one-share-one-vote principle, which is common for publicly traded companies. This means that each share of common stock typically entitles its holder to one vote on matters submitted to shareholders. There are no publicly reported instances of dual-class shares or other arrangements that grant outsized control to specific individuals or entities through special voting rights or golden shares. For more insight into how the company operates, you can explore the Revenue Streams & Business Model of Spectrum Brands.

| Board Member | Role | Affiliation |

|---|---|---|

| David Maura | Chairman of the Board | Independent |

| Robert F. Pragada | Director, President and CEO | Executive |

| G. Thomas Long | Lead Independent Director | Independent |

Recent proxy battles or activist investor campaigns for Spectrum Brands have not been prominently reported in early 2025, suggesting a relatively stable governance environment. The board's decision-making is shaped by its fiduciary duty to all shareholders, balancing the interests of various investor types while guiding the company's strategic direction. The board's structure and the voting rights associated with shares are key components of understanding Spectrum Brands' ownership and governance.

The board of directors plays a key role in Spectrum Brands' governance. The voting structure is based on a one-share-one-vote principle.

- Board composition includes independent directors.

- Major shareholders influence board decisions.

- No dual-class shares are reported.

- The board balances interests of all shareholders.

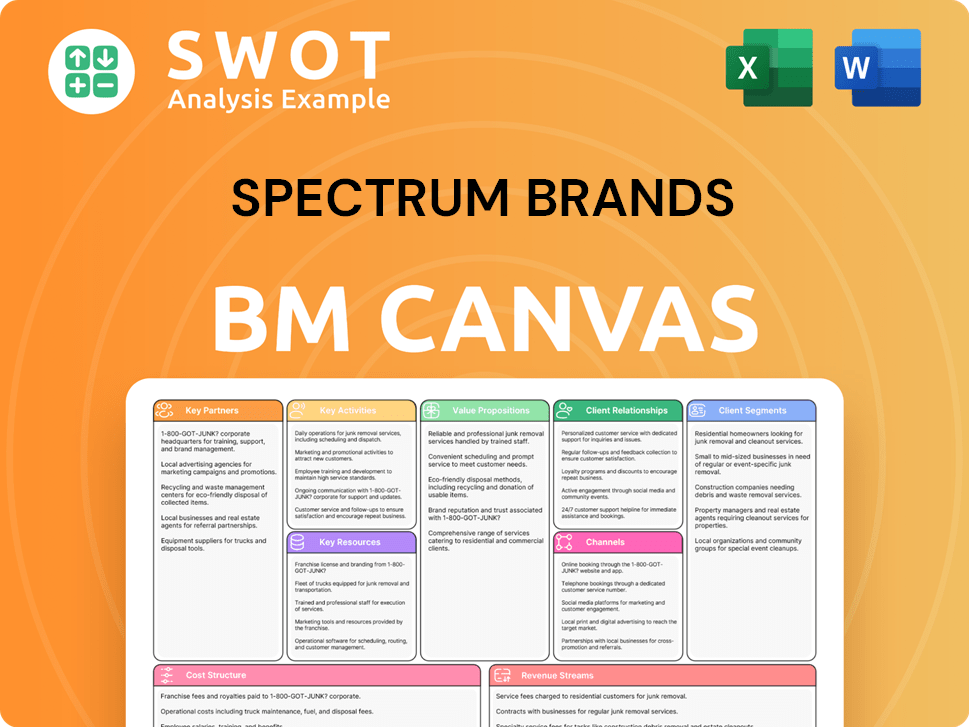

Spectrum Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Spectrum Brands’s Ownership Landscape?

In recent years, the ownership landscape of Spectrum Brands has been significantly reshaped by strategic decisions and market dynamics. A major shift occurred in 2023 with the sale of its Hardware and Home Improvement (HHI) segment to Assa Abloy for $4.3 billion. This transaction was a pivotal move, altering the company's portfolio and influencing its financial structure. Following the divestiture, Spectrum Brands initiated substantial share buybacks, signaling its commitment to returning capital to shareholders and adjusting its outstanding share count. This strategic shift allowed Spectrum Brands to focus on its remaining core segments: Home & Garden, Global Pet Care, and Personal Care. This is a clear example of how Spectrum Brands' target market has evolved.

The company's ownership profile has also been affected by broader industry trends, such as the increasing presence of institutional investors. Large asset managers continue to hold significant stakes in Spectrum Brands. While founder dilution is a natural process for a public company like Spectrum Brands, the focus has been on strategic portfolio management and capital allocation. Spectrum Brands has communicated its strategy to optimize its remaining businesses and explore growth opportunities. This may lead to further ownership changes through acquisitions, divestitures, and ongoing share repurchase programs.

The sale of the HHI segment for $4.3 billion in 2023 was a major strategic move. This reshaped the company's focus and financial structure. Share buybacks were implemented to return value to shareholders. The company is now concentrating on its core segments for future growth.

Institutional investors hold substantial stakes in Spectrum Brands. The company is focused on strategic portfolio management. Future ownership shifts may occur through acquisitions or divestitures. Ongoing share repurchase programs are also a possibility.

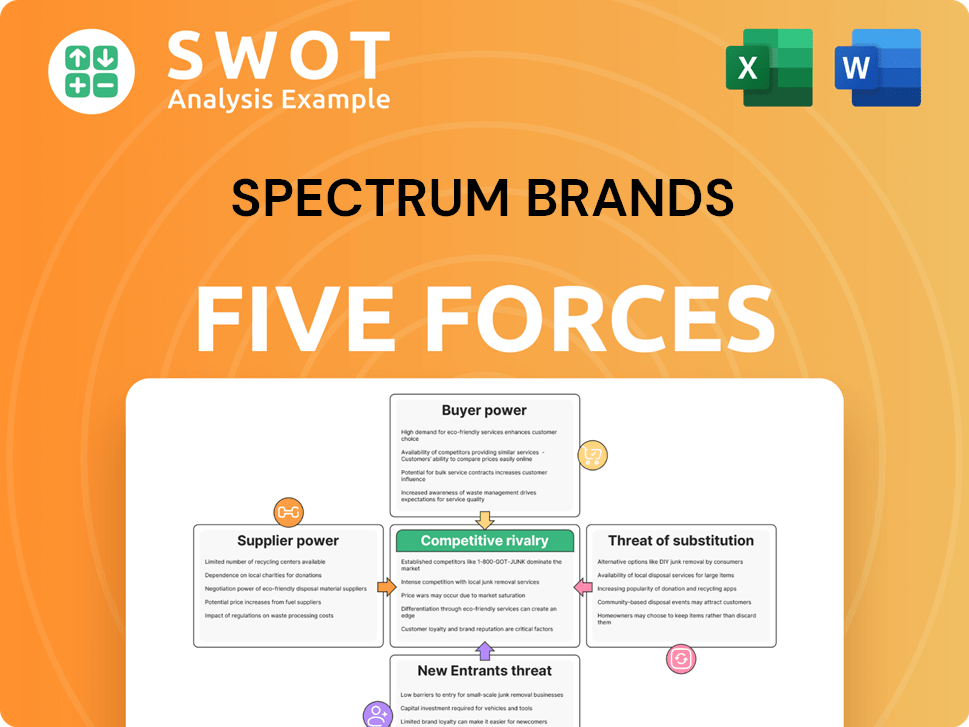

Spectrum Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Spectrum Brands Company?

- What is Competitive Landscape of Spectrum Brands Company?

- What is Growth Strategy and Future Prospects of Spectrum Brands Company?

- How Does Spectrum Brands Company Work?

- What is Sales and Marketing Strategy of Spectrum Brands Company?

- What is Brief History of Spectrum Brands Company?

- What is Customer Demographics and Target Market of Spectrum Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.