Sunrun Bundle

Can Sunrun Maintain Its Solar Dominance?

Sunrun, a leader in the residential solar and energy services sector, has consistently demonstrated the importance of a strong growth strategy in the ever-evolving renewable energy industry. Founded in 2007, the company revolutionized the market with its solar-as-a-service model, making clean energy accessible to homeowners. But what does the future hold for this solar giant?

This Sunrun SWOT Analysis delves into Sunrun's current market position and future trajectory, examining its Sunrun growth strategy and evaluating its Sunrun future prospects within the dynamic solar energy market. We'll explore the Sunrun company analysis, including its expansion plans, competitive advantages, and technological innovations, to assess its long-term investment potential in the residential solar and renewable energy industry.

How Is Sunrun Expanding Its Reach?

The growth strategy of the company is centered on expanding its customer base, improving its service offerings, and exploring new market opportunities. A key focus is on further penetrating both existing and new states within the U.S., leveraging its established infrastructure and brand recognition. The company is actively seeking to increase its share in the growing home battery storage market, integrating solutions like the Tesla Powerwall and its own Brightbox battery to provide homeowners with greater energy independence and resilience. This aligns with the increasing demand for energy storage solutions, especially in regions prone to grid instability or with favorable solar incentives.

The company has also emphasized strategic partnerships to broaden its reach. These include collaborations with homebuilders to integrate solar and storage into new residential constructions. Furthermore, the company is exploring new business models beyond direct residential sales, potentially including community solar projects or virtual power plant initiatives that aggregate distributed energy resources. These initiatives are designed to diversify revenue streams, access new customer segments, and maintain a competitive edge in a rapidly evolving energy landscape. For those interested in the company's foundational principles, a good starting point is to understand the Mission, Vision & Core Values of Sunrun.

The company's focus on expansion is driven by the need to capitalize on the growing solar energy market and the increasing demand for renewable energy solutions. The company's strategic initiatives are designed to position it for continued growth and leadership in the residential solar and energy storage sectors.

The company continues to expand its operations across the United States, focusing on states with high solar irradiance and favorable regulatory environments. This includes both expanding its presence in existing markets and entering new states to increase its customer base. The company's strategy involves leveraging its established infrastructure and brand recognition to gain market share.

The company is heavily investing in the integration of battery storage solutions, such as the Tesla Powerwall and its own Brightbox battery. This strategy aims to provide homeowners with greater energy independence and resilience, especially in areas with grid instability. The increasing demand for energy storage solutions is a key driver of this expansion.

The company is actively forming strategic partnerships to expand its reach and enhance its service offerings. This includes collaborations with homebuilders to integrate solar and storage solutions into new residential constructions. These partnerships are designed to increase customer acquisition and market penetration.

The company is exploring new business models beyond direct residential sales, such as community solar projects and virtual power plant initiatives. These models aim to diversify revenue streams and access new customer segments. These initiatives help the company maintain a competitive edge in the evolving energy landscape.

The company's expansion strategies are designed to capitalize on the growing demand for solar energy and battery storage solutions. These strategies include geographic expansion, strategic partnerships, and the exploration of new business models. These initiatives are critical for the company's long-term growth and market leadership.

- Geographic Expansion: Targeting new states and increasing market share in existing ones.

- Battery Storage: Integrating battery solutions to enhance energy independence.

- Strategic Partnerships: Collaborating with homebuilders and other entities.

- New Business Models: Exploring community solar and virtual power plant initiatives.

Sunrun SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sunrun Invest in Innovation?

The Sunrun growth strategy is heavily reliant on innovation and technological advancements to maintain its position in the competitive solar energy market. The company continually invests in research and development to enhance the efficiency and capabilities of its solar and battery storage systems. This focus helps Sunrun meet evolving customer needs and stay ahead in the renewable energy industry.

Sunrun's future prospects are closely tied to its ability to integrate cutting-edge technology into its offerings. This includes optimizing energy management software and improving the durability of its hardware. The company's strategic approach to digital transformation and the integration of smart home energy solutions further solidify its position.

Sunrun company analysis reveals a commitment to providing comprehensive home energy ecosystems, which is evident in its integration of solar with electric vehicle (EV) charging solutions. This forward-thinking approach is crucial for meeting the increasing demand for sustainable energy solutions.

The Brightbox battery solution is a key component of Sunrun's technological advancements. It integrates advanced technology to optimize energy usage, giving homeowners more control over their electricity consumption. This reduces reliance on the grid and enhances energy independence.

Sunrun is leveraging digital transformation to streamline its operations. This includes improving sales, installation processes, and customer service through data analytics and automation. These improvements enhance efficiency and improve the overall customer experience.

Sunrun is at the forefront of the evolving energy landscape with its smart home energy management solutions. These solutions often incorporate IoT (Internet of Things) devices. This approach allows for better monitoring and management of energy consumption.

The integration of solar with electric vehicle (EV) charging solutions demonstrates Sunrun's forward-thinking approach. This strategy aims to provide comprehensive home energy ecosystems. This integration meets the growing demand for electric vehicle charging.

Sunrun focuses on improving customer experience through technological advancements and streamlined processes. This includes enhanced energy management tools and responsive customer service. These improvements increase customer satisfaction.

Sunrun's technological focus aims to improve the efficiency and resilience of its systems. This includes enhancements to solar panels and battery storage. These improvements help the company maintain a competitive edge.

Sunrun's technological initiatives are designed to enhance its market position and customer offerings. These initiatives are crucial for maintaining its leadership in the residential clean energy sector. For more details on Sunrun's target market, consider reading about the Target Market of Sunrun.

- Advanced energy management software to optimize energy usage.

- Improved hardware for enhanced system durability and performance.

- Integration of smart home technology and IoT devices for better energy control.

- Development of comprehensive EV charging solutions to meet the growing demand.

- Data analytics and automation to streamline sales, installation, and customer service.

Sunrun PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Sunrun’s Growth Forecast?

The financial outlook for Sunrun reflects its ambitious growth trajectory within the solar energy market and strategic investments in the renewable energy industry. For the full year 2024, the company anticipates an increase in subscriber additions, which signals continued demand for its residential solar and battery storage solutions. This growth is supported by a focus on improving its cost structure and operational efficiency to enhance profit margins.

Sunrun's financial performance is significantly influenced by its recurring revenue model, primarily through long-term leases and power purchase agreements. This model provides a stable and predictable cash flow, which is crucial for sustaining its expansion initiatives. The company's ability to secure financing for its projects and effectively manage its debt plays a critical role in its ability to grow.

The company's financial strategy also involves leveraging tax credits and incentives available for renewable energy, which significantly impact its profitability and competitive pricing. While specific revenue targets and detailed profit projections for late 2024 and 2025 are subject to market conditions and company announcements, analyst forecasts generally indicate continued revenue growth driven by increased deployments and expanding service offerings.

Sunrun primarily generates revenue through long-term leases and power purchase agreements (PPAs). These agreements provide a predictable revenue stream, contributing to financial stability. This model allows customers to access solar energy without significant upfront costs.

Sunrun focuses on improving its cost structure and operational efficiency. This includes optimizing installation processes and supply chain management. These efforts aim to enhance profit margins and improve overall financial performance.

The company benefits significantly from tax credits and incentives for renewable energy. These financial benefits reduce the cost of solar installations, making them more competitive. Tax credits are a key factor in Sunrun's pricing strategy.

Securing financing for projects and managing debt effectively are crucial for supporting expansion. Sunrun's ability to access capital and manage its financial obligations is essential for its growth. This includes managing debt levels to maintain financial health.

Sunrun's business model centers around providing residential solar and battery storage solutions. This includes offering various financing options like leases and PPAs, which allows customers to access solar energy with minimal upfront investment. This model drives customer acquisition and long-term revenue streams.

Analyst forecasts generally predict continued revenue growth for Sunrun, driven by increased deployments and expanding service offerings. However, specific financial projections depend on market conditions and company announcements. Investors should monitor financial reports for updates.

Sunrun's financial performance is influenced by its recurring revenue model and cost management strategies. The company's ability to maintain and improve profit margins is critical. Key metrics include revenue growth, gross margin, and subscriber additions.

Sunrun acquires customers through direct sales, partnerships, and marketing campaigns. The company focuses on educating consumers about the benefits of solar energy. Customer acquisition costs are a key factor in evaluating the company's profitability.

Sunrun's competitive advantages include its established brand, extensive customer base, and integrated service offerings. The company's focus on customer service and technological innovation also contributes to its competitive edge. They also benefit from the increasing demand for residential solar solutions.

Sunrun's expansion plans involve increasing its market share and expanding its service offerings. This includes entering new geographic markets and enhancing its battery storage solutions. The company's growth strategy is focused on increasing its customer base and revenue.

Sunrun is a leading player in the residential solar market. Its market share is influenced by factors such as customer acquisition, installation capacity, and competitive pricing. The company's market position is continuously evaluated against competitors.

- Market share is a key indicator of the company's success.

- Sunrun's market share is influenced by its ability to acquire and retain customers.

- The company faces competition from other solar providers.

- Market share analysis helps to assess Sunrun's competitive position.

Sunrun Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Sunrun’s Growth?

The path for the company towards growth is not without its challenges. Several potential risks and obstacles could impact its expansion plans and long-term success. Understanding these challenges is crucial for investors and stakeholders assessing the company's future prospects.

The company faces significant hurdles from intense competition in the residential solar and storage sectors. Additionally, regulatory changes and supply chain issues could affect the company's performance. These factors can impact profitability and customer satisfaction, which are critical for sustained growth.

Rising interest rates and technological disruptions also pose threats. High financing costs and the emergence of new energy solutions could challenge the company's market position. To navigate these risks, the company employs diversification strategies and proactive risk management.

The Solar energy market is highly competitive, with numerous companies vying for market share. Established players and new entrants continually challenge the company's position. This competition can lead to price wars and reduced profit margins.

Changes in government policies, particularly regarding net metering and solar incentives, can significantly impact the economics of solar installations. Unfavorable adjustments could reduce the attractiveness of Residential solar for homeowners. The company actively engages with policymakers to advocate for favorable renewable energy policies.

Supply chain disruptions, particularly for essential components like solar panels and batteries, can create problems. Increased costs and installation delays can negatively affect profitability and customer satisfaction. Mitigating these vulnerabilities is a key focus for the company.

The Renewable energy industry is subject to rapid technological advancements. New energy solutions or more efficient competitors could challenge the company's market position. Staying at the forefront of innovation is crucial to maintaining a competitive edge.

Increases in interest rates can raise the cost of financing, affecting both the company and its customers. Higher financing costs could slow down the adoption rates. The company must manage its financial strategies to adapt to changing economic conditions.

The company employs diversification strategies, offering a range of products and services. It also focuses on robust risk management frameworks and scenario planning to prepare for various market and regulatory shifts. For more information on the company's business model, see the article on Revenue Streams & Business Model of Sunrun.

The company's market share in the residential solar sector is a critical factor in its success. As of late 2023, the company held a significant portion of the U.S. residential solar market, but competition is fierce. Tracking the company's market share growth or decline is essential for evaluating its performance. The company’s ability to maintain and grow its market share depends on its ability to adapt to market dynamics and customer preferences.

The company's financial performance, including revenue, gross margins, and profitability, is crucial for assessing its viability. Analyzing the company's financial statements provides insights into its operational efficiency and financial health. Investors should monitor key financial metrics to understand the company's ability to generate returns and manage its financial obligations.

The company's Sunrun growth strategy in 2024 will likely focus on expanding its customer base and increasing its service offerings. This includes geographic expansion, strategic partnerships, and investments in innovative technologies. Success will depend on effective execution of these strategies and the company's ability to adapt to market changes. The company's ability to execute its expansion plans will be key to its future prospects.

Assessing the company's long-term investment potential requires evaluating its Sunrun future prospects and its ability to navigate challenges. Investors should consider factors such as market trends, competitive dynamics, and regulatory changes. A thorough Sunrun company analysis is essential for making informed investment decisions. The long-term viability of the company depends on its capacity to adapt to changes in the energy market.

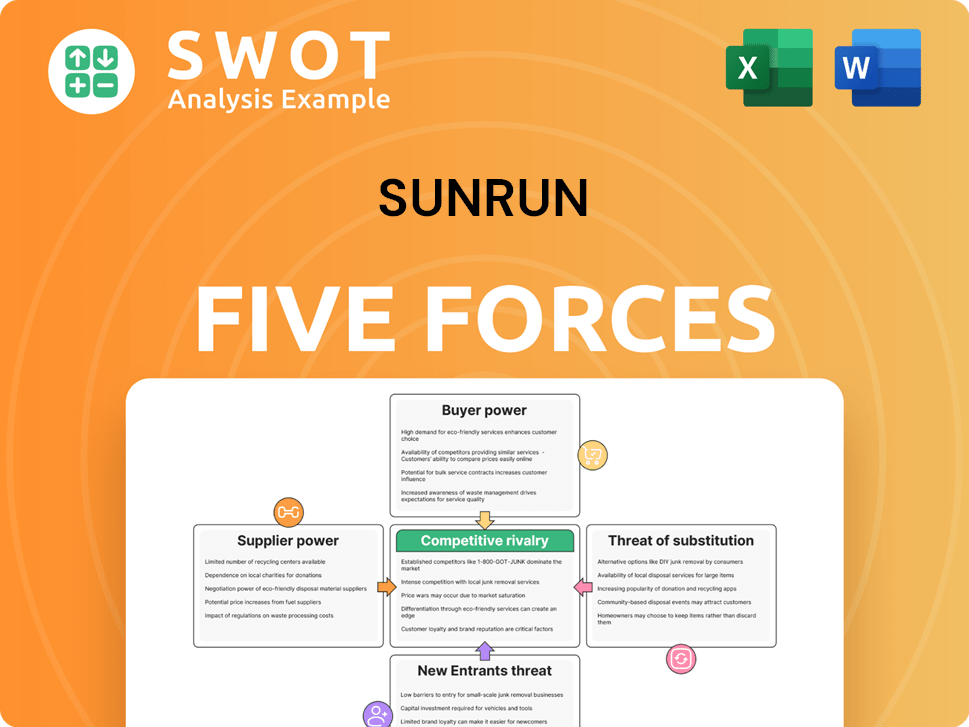

Sunrun Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sunrun Company?

- What is Competitive Landscape of Sunrun Company?

- How Does Sunrun Company Work?

- What is Sales and Marketing Strategy of Sunrun Company?

- What is Brief History of Sunrun Company?

- Who Owns Sunrun Company?

- What is Customer Demographics and Target Market of Sunrun Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.