THG Bundle

Can THG Thrive After Ingenuity's Demerger?

THG, formerly The Hut Group, is at a critical juncture following the recent demerger of its Ingenuity arm. This strategic shift allows THG to refocus on its core direct-to-consumer (D2C) brands within the beauty and nutrition sectors. Founded in 2004, the company has evolved from online retail of CDs and DVDs to a global e-commerce powerhouse, making this THG SWOT Analysis particularly relevant.

This article delves into THG's THG growth strategy, examining its THG future prospects in the dynamic e-commerce landscape. We'll explore how THG plans to leverage its focused business model to enhance its THG market position and drive THG financial performance, providing a comprehensive THG company analysis to help you understand its potential for success. Understanding What is THG's growth strategy in e-commerce is key to evaluating its investment potential.

How Is THG Expanding Its Reach?

THG's expansion initiatives are primarily focused on strengthening its core divisions: Beauty and Nutrition. The company is strategically growing its global market presence, with a strong emphasis on omnichannel strategies that integrate both online and physical retail channels. This approach aims to enhance customer experience and drive revenue growth across various markets.

A key aspect of THG's strategy involves expanding its footprint in key global markets. The company is focusing on high-growth, profitable markets to maximize returns. This includes a strong emphasis on building customer loyalty through various schemes and programs. This is part of a broader plan to solidify its position as a leader in the global beauty and nutrition markets.

THG's expansion plans are designed to capitalize on emerging opportunities and strengthen its market position. The company is actively pursuing strategic partnerships and investments to support its growth objectives. This includes initiatives to improve operational efficiency and enhance its brand portfolio, ensuring long-term sustainability and profitability.

The Beauty division is concentrating on more profitable markets and building robust customer loyalty schemes. The UK and US markets have been particularly successful, accounting for approximately 82% of online beauty retail revenue in Q1 2025. THG is also expanding its physical retail presence with the opening of its first Lookfantastic store.

The Nutrition division is focused on a return to growth, with positive results seen in early 2025 across both online and offline channels. Myprotein, a major brand within this division, is undergoing a rebrand to support rapid expansion in global offline retail and licensing. THG is also entering the dairy market through a partnership with Müller.

Licensing and retail partnerships are driving offline revenue growth in the UK. In H2 2024, 14 new licensed products were launched. This strategy supports THG's omnichannel approach, providing customers with multiple touchpoints. This approach is crucial for enhancing the company's market position and revenue growth.

THG is selectively investing in developing markets where Myprotein has a competitive edge. This includes accelerating growth in areas like India by evolving to an on-site D2C operating model. This strategy allows for better market penetration and customer acquisition. For a deeper understanding of THG's origins, consider reading a Brief History of THG.

THG's expansion strategy focuses on strengthening core divisions and increasing global market presence. The company leverages omnichannel strategies, integrating online and in-store retail. This approach aims to drive revenue growth and enhance customer engagement.

- Focus on profitable markets and customer loyalty programs in Beauty.

- Rebranding and expansion of Myprotein in Nutrition.

- Leveraging licensing and retail partnerships for offline revenue.

- Strategic investments in developing markets like India.

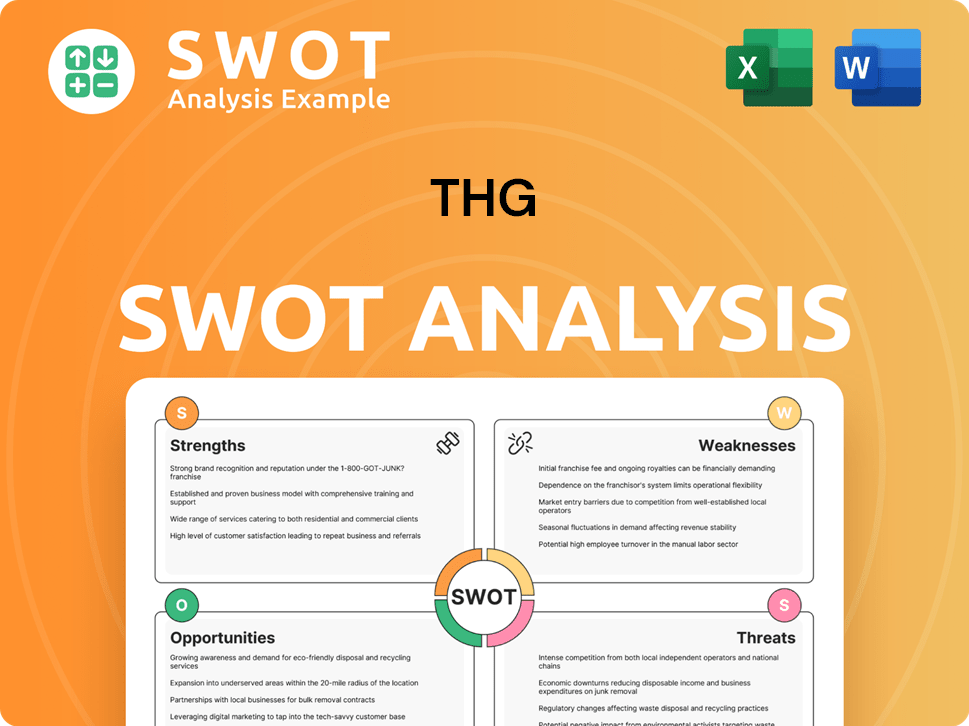

THG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does THG Invest in Innovation?

The company's innovation and technology strategy is a core element of its operations, historically emphasizing in-house development to foster direct-to-consumer relationships worldwide. This approach is central to understanding the THG growth strategy. Even after the demerger of Ingenuity, the technology and logistics arm, the company continues to leverage technological advancements to drive growth within its Beauty and Nutrition segments. This focus is key to the THG future prospects.

The company has undertaken extensive efficiency drives incorporating both automation and AI to become a leaner and fitter group. This commitment to technological advancement is a crucial aspect of the THG company analysis. This strategy supports the company's THG business model and its ability to maintain a strong THG market position.

For instance, the company's creative agency, THG Studios, launched a new AI tool for image creation in March 2025. This demonstrates the company's proactive approach to integrating cutting-edge technology. Lookfantastic, a beauty brand, also implemented an AI tool in November 2024 to potentially boost sales during peak trading events like Black Friday. These initiatives highlight the company's dedication to enhancing customer experience and operational efficiency, which directly impacts its THG financial performance.

The company is actively using AI and automation to streamline operations and improve customer experience. This includes AI tools for image creation and sales boosts during peak trading periods. This is a key element of THG's digital marketing strategy.

The company is committed to sustainability, with targets to reduce Scope 1 and 2 carbon emissions by 90% by 2030 and achieve 100% renewable energy for its operations by 2025. Net-zero targets by 2040 have been validated by the Science Based Targets Initiative (SBTi).

In 2024, the company progressed its Group-wide membership with the Roundtable on Sustainable Palm Oil (RSPO). It's also exploring scaling up the removal of plastic scoops from its Myprotein range after a successful trial in July 2024. These actions are part of THG's sustainability initiatives.

The company's investment in technology, including AI, aims to enhance its competitive edge and improve operational efficiency. These investments are designed to support THG's long-term growth strategy. The company's focus on innovation is crucial for THG's competitive advantages in the market.

Efficiency drives, incorporating automation and AI, are designed to make the company leaner and more effective. These efforts are essential for improving THG's financial performance review. The company's ability to adapt to technological changes will influence its THG market share analysis.

The company's focus on innovation and technology supports its expansion plans. These innovations are essential for THG's expansion plans in Asia. The company's approach to technology is vital for understanding THG's investment opportunities.

The company's approach to technology and sustainability is multifaceted, focusing on both internal efficiencies and external commitments. These actions are essential for understanding the THG's future prospects in the beauty industry and how the company plans to expand internationally. The company's technological advancements are key to its THG's revenue growth forecast.

- Implementation of AI tools for image creation and sales optimization.

- Commitment to significant carbon emission reductions and renewable energy adoption.

- Active participation in sustainable practices like RSPO membership and plastic reduction initiatives.

- Focus on operational efficiency through automation and AI.

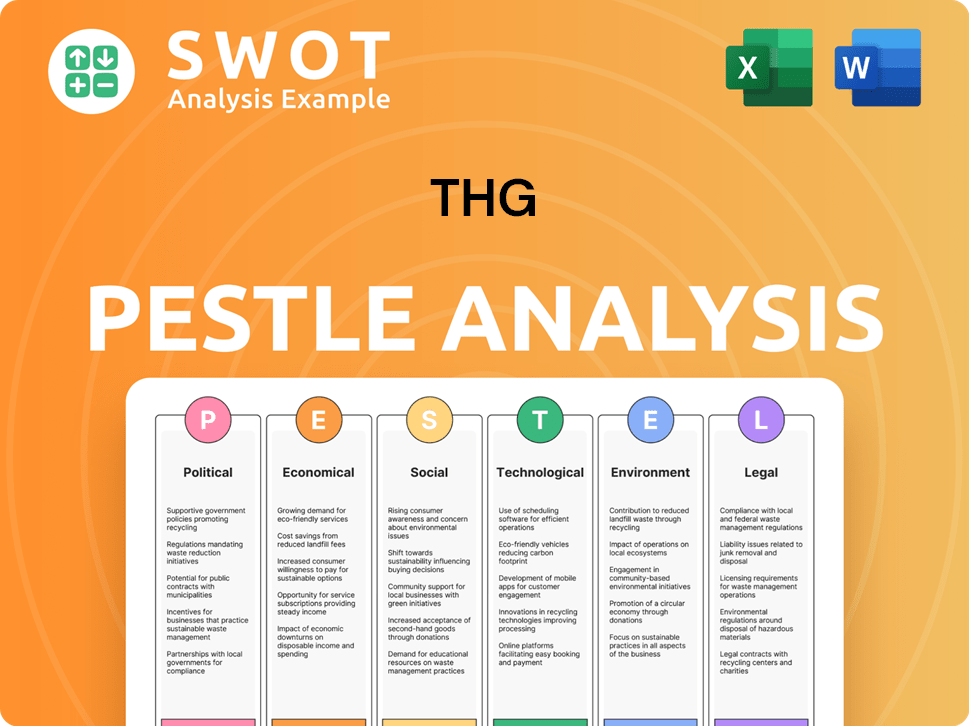

THG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is THG’s Growth Forecast?

The financial outlook for THG in 2025 signals a strategic pivot towards growth, particularly within its Nutrition division, while maintaining the strong performance of its Beauty segment. This forecast comes after a period of financial adjustments in 2024, which included a pretax loss and a decline in revenue. Understanding the Mission, Vision & Core Values of THG can provide additional context to its strategic direction.

The company's projections for 2025 are centered on achieving mid-single-digit percentage revenue growth in both its Nutrition and Beauty divisions. This expectation is a key component of THG's overall strategy to stabilize and enhance its financial performance. The company's ability to navigate market challenges and capitalize on growth opportunities will be crucial in achieving these targets.

THG's financial performance in 2024 reflects a complex landscape, with varying results across its business segments. The Beauty division demonstrated resilience, while the Nutrition arm faced headwinds due to rebranding and promotional activities. The company's strategic initiatives and financial management will be critical in driving future growth.

THG anticipates mid-single-digit percentage revenue growth in both its Nutrition and Beauty divisions for 2025. This forecast is a key indicator of the company's strategic direction and its ability to adapt to market dynamics.

The THG business model has shown resilience in the face of market challenges. The company's market position, particularly in the Beauty division, remains strong. Understanding THG's market share analysis is crucial for assessing its competitive advantages.

In 2024, THG reported a pretax loss from continuing operations of £202.4 million, a widening from £92.3 million in 2023. Revenue declined by 6.8% to £1.75 billion. This financial performance highlights the need for strategic adjustments.

The Beauty division demonstrated resilience in 2024, with a 4.6% jump in revenues to £1.1 billion. This performance underscores the potential for THG's future prospects in the beauty industry. THG's digital marketing strategy will be key to maintaining this momentum.

In March 2025, THG completed a £90 million fundraise, including a £60 million contribution from CEO Matthew Moulding, to reduce gross debt and strengthen its balance sheet. This capital raise and the extension of its revolving credit facility are expected to lower the group's leverage ratio from 3.2x to 2.6x based on continuing adjusted EBITDA of £92 million for 2024. The company aims to achieve a net cash position over time and significantly reduce capital expenditures to approximately £20 million per annum post-demerger. These financial strategies are designed to support THG's long-term growth strategy and improve its financial health.

THG's competitive advantages include its strong presence in the Beauty division and its strategic financial initiatives. These strengths are crucial for navigating market challenges and capitalizing on opportunities. Understanding what are THG's key competitors is essential for a comprehensive analysis.

THG's strategic focus on growth and financial restructuring presents several investment opportunities. The company's ability to execute its plans will be a key factor in its success. Investors should consider THG's expansion plans in Asia.

Risks facing THG include market volatility, competition, and the successful execution of its growth strategies. The company's ability to mitigate these risks will be critical for its future performance. It is crucial to analyze what is THG's growth strategy in e-commerce to understand the risks.

THG's financial performance review reveals a mixed picture, with challenges in 2024 but positive expectations for 2025. The company's strategic initiatives will be crucial in driving revenue growth and improving profitability. THG's revenue growth forecast is a key indicator.

THG's digital marketing strategy is essential for driving sales and engaging customers. The company's online presence and marketing efforts will play a key role in its growth. THG's recent acquisitions and their impact should also be considered.

THG's sustainability initiatives are increasingly important for attracting customers and investors. The company's commitment to environmental and social responsibility will be a factor in its long-term success. The company's long-term growth strategy should also incorporate these initiatives.

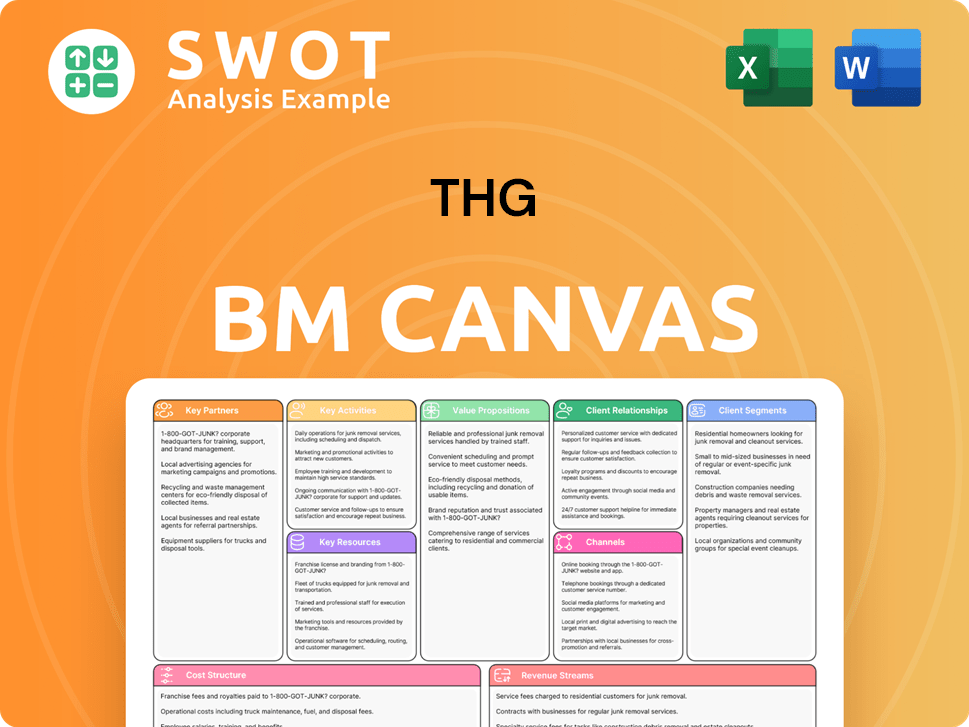

THG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow THG’s Growth?

The company faces several potential risks and obstacles that could impact its future. These challenges include intense market competition, potential weaknesses in consumer demand, and operational execution issues. The demerger of the Ingenuity technology division, while intended to simplify operations, introduces new risks related to supplier concentration.

Navigating these risks is crucial for THG to achieve its growth objectives. The performance of the Nutrition division, particularly Myprotein, and the impact of UK wage inflation on fulfillment costs are significant concerns. THG’s ability to manage these issues will be key to its long-term success.

The company's strategic focus on its core Beauty and Nutrition businesses, along with efforts to improve profitability and reduce debt, is intended to mitigate these risks. However, external factors and internal execution remain critical determinants of THG's financial health and market position.

Intense competition within the beauty retail sector poses a significant challenge to THG's revenue growth. The company operates in a dynamic market where consumer preferences and trends can shift rapidly. This competitive landscape requires continuous innovation and adaptation to maintain market share.

Potential weaknesses in consumer demand, particularly in the US market, represent a considerable risk. The US accounts for approximately 25% of THG's Beauty sales, making it a crucial market for the company's financial performance. Economic downturns or shifts in consumer spending habits could negatively impact sales.

Operational execution is critical for THG to achieve its deleveraging and positive cash flow generation goals. The company's 2024 financial performance fell short of projections, highlighting the importance of efficient operations. Streamlining processes and managing costs are essential for improving profitability.

The demerger of Ingenuity introduces material supplier-concentration risk. Disruptions at Ingenuity could affect THG's ability to fulfill orders, potentially impacting revenue and customer satisfaction. Mitigating this risk requires robust supply chain management and contingency plans.

The Nutrition division, especially Myprotein, faced challenges in 2024 due to weaker online sales and the consequences of a rebrand. Lower-than-expected performance in Asia and a reduction in average selling prices for nutrition supplements to clear legacy stock also contributed to these issues. The 'rebrand hangover' and inventory clearance pose ongoing risks.

UK wage inflation could significantly impact fulfillment costs, potentially by over 6%. Rising labor costs can erode profit margins and necessitate operational adjustments. Efficient workforce management and cost control measures are essential to offset this risk.

Regulatory changes and supply chain vulnerabilities are ongoing concerns for any global e-commerce business. THG must adapt to evolving regulations in different markets and manage potential disruptions to its supply chains. These factors can affect the company's ability to operate efficiently and meet customer demands. For more insights, you can also check the Competitors Landscape of THG.

THG aims to mitigate these risks through a focused strategy on its core Beauty and Nutrition businesses. This includes efforts to improve profitability and reduce debt, which are crucial for long-term financial health. The company's ability to execute these strategies effectively will determine its success in a challenging market environment.

THG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.