THG Bundle

Who Really Controls THG?

THG plc, formerly The Hut Group, has captivated the e-commerce world with its direct-to-consumer model. From its Manchester, England, headquarters, THG has built a global empire spanning beauty, nutrition, and its Ingenuity platform. But who truly calls the shots at this retail giant, and how has its ownership evolved since its inception?

This exploration into THG SWOT Analysis will uncover the key players behind the scenes, from the founders to the current THG shareholders. We'll dissect the THG company ownership structure, examining major investment rounds and the impact of its IPO on the THG owner landscape. Understanding Who owns THG is crucial for anyone seeking to navigate the complexities of the e-commerce sector and the future of THG Group.

Who Founded THG?

The foundation of the company, now known as THG, was laid in Manchester in 2004. It was the brainchild of Matthew Moulding and John Gallemore, who started with an initial investment of £500,000. This marked the beginning of what would become a significant player in the online retail sector.

Matthew Moulding, currently serving as the CEO, and John Gallemore, who remains involved in the business, initially focused on an online retail model. Their strategy involved selling small, global products with high gross profit margins, aiming to maximize shareholder value. This early vision set the stage for the company's future growth and strategic direction.

Early on, the company's operations involved selling CDs and DVDs online, along with creating white-label web stores for major retailers like Asda and Tesco. This dual approach helped establish a presence in the market and generate early revenue streams.

The company was founded in 2004 in Manchester by Matthew Moulding and John Gallemore. They started with an initial investment of £500,000. This investment was crucial for launching the business and setting its early strategy.

The initial business model focused on online retail, selling CDs, DVDs, and creating white-label web stores. The founders aimed for high gross profit margins. This strategy helped establish a presence in the market and generate early revenue.

A key decision was to build their own technology platform, moving away from third-party solutions. This in-house development became a core part of the company. This strategic move provided greater control and efficiency.

Early investors included prominent figures such as Terry Leahy and Stuart Rose. These investments provided crucial capital and support. This early backing helped fuel the company's growth.

KKR acquired a 19.2% stake in 2014, followed by BlackRock's £138 million investment in February 2016. Sofina also acquired an undisclosed equity stake in May 2016. These investments supported the company's expansion.

Old Mutual Global Investors made their first private equity investment in August 2017. This investment further solidified the company's financial backing. This investment was a vote of confidence.

The company's ownership structure has evolved over time, with key investments from various entities. Understanding the evolution of THG company ownership is crucial. Early investments and strategic decisions shaped the company's trajectory.

- Matthew Moulding, as CEO, has a significant stake in the company.

- Early investors included Terry Leahy and Stuart Rose.

- KKR and Balderton Capital held significant stakes.

- BlackRock and Sofina made substantial investments, supporting expansion.

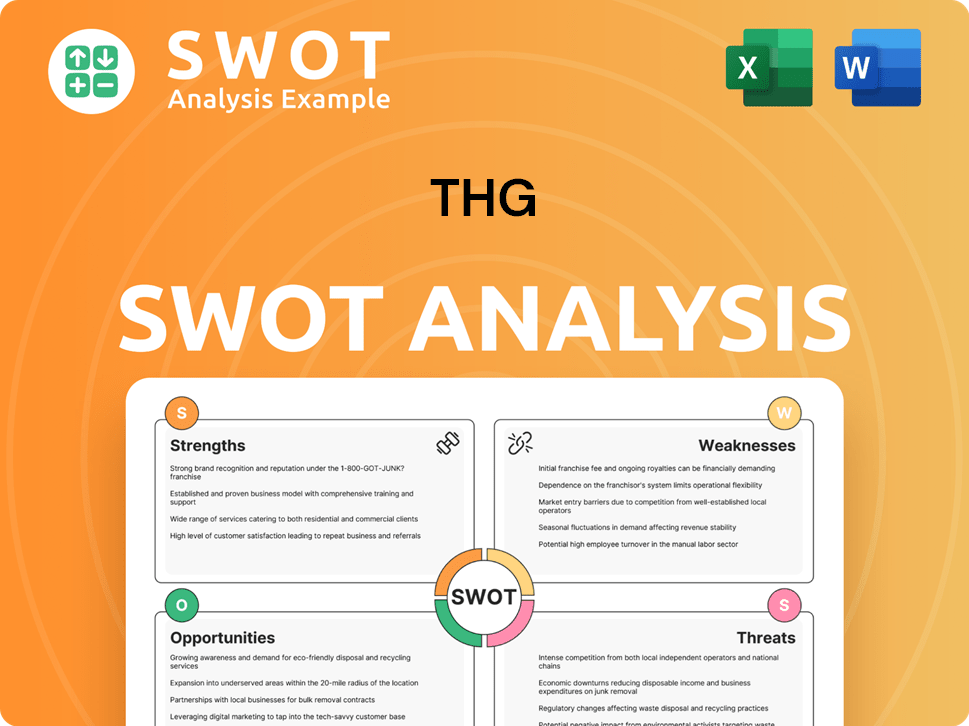

THG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has THG’s Ownership Changed Over Time?

The ownership structure of THG, also known as The Hut Group, has seen considerable shifts since its inception. The company's initial public offering (IPO) on the London Stock Exchange on September 16, 2020, was a pivotal moment. This IPO raised £920 million for the company and £961 million for existing owners, with a market capitalization of £5.4 billion at the time. This event significantly altered the ownership landscape, introducing a broader base of shareholders. Following the IPO, Matthew Moulding, the co-founder, received a substantial payout.

However, the company's share price experienced a significant decline. By early October 2021, the share price had dropped by over 60%. As of June 11, 2025, the market capitalization stood at £328.20 million. This decline prompted strategic adjustments and further investment from key stakeholders. These changes reflect the dynamic nature of THG's ownership and its response to market conditions.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO | September 16, 2020 | Raised capital, introduced new shareholders, and provided substantial payout to Matthew Moulding. |

| Share Price Decline | Early October 2021 | Led to strategic adjustments and investor reactions. |

| Matthew Moulding's Investments | Ongoing (since IPO) | Continued investment in the company, demonstrating confidence and commitment. |

| Kelso Group Holdings PLC Stake | December 2023 | Activist investor involvement, influencing company strategy and governance. |

Key stakeholders in THG include institutional investors and Matthew Moulding. As of March 31, 2025, Moulding's equity interest was approximately 25% on a fully diluted basis. He has consistently invested in the company since the IPO, buying back shares and committing additional funds. Other notable investors include Sofina. The involvement of activist investors and ongoing investments by Moulding highlight efforts to stabilize and enhance the company's strategy and governance. To understand more about the company's financial structure, you can read Revenue Streams & Business Model of THG.

THG's ownership structure has evolved significantly since its IPO in 2020.

- Matthew Moulding holds a significant equity stake, demonstrating a strong commitment to the company.

- Institutional investors play a crucial role in THG's ownership.

- Activist investor involvement has influenced company strategy and governance.

- The IPO and subsequent investments have shaped the current ownership landscape.

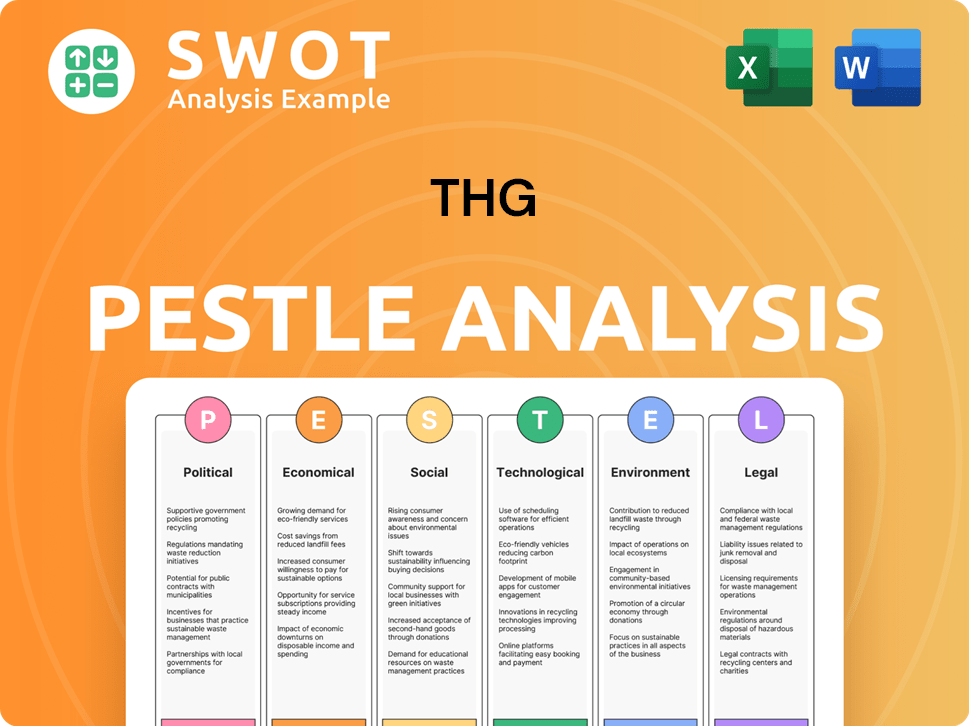

THG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on THG’s Board?

The current board of directors at THG, also known as THG Group or The Hut Group, includes Charles Allen as chairman and Matthew Moulding as CEO. Charles Allen took over as chairman from Moulding in March 2022. This change followed scrutiny of the company's governance practices, with Moulding remaining in his role as CEO. Understanding the structure of THG company ownership is crucial for investors and stakeholders.

Historically, Matthew Moulding held a 'golden share' that gave him considerable control, including the ability to block any takeover bids. This arrangement, along with his dual role as CEO and chairman, created governance concerns. It also prevented THG from being included in FTSE indices. Moulding relinquished this golden share in June 2023, addressing investor concerns and paving the way for a premium listing on the London Stock Exchange.

| Board Member | Position | Notes |

|---|---|---|

| Charles Allen | Chairman | Replaced Matthew Moulding as Chairman in March 2022 |

| Matthew Moulding | CEO | Also previously held the Chairman position |

| Other Directors | Various | Details of other directors are available in THG's public filings |

As of March 31, 2025, the total voting rights in THG were 1,390,694,730, with ordinary shares carrying one vote each. This is an increase from 1,322,058,529 as of December 31, 2024. The company does not hold any treasury shares. In May 2024, an activist investor, Kelso, called for the removal of Chairman Lord Charles Allen, citing a 'lack of action and clarity' on strategies to improve share value. However, Kelso's ownership of approximately 0.4% (5.5 million shares out of 1.33 billion) suggested that Lord Allen's position was secure. For more insights, explore the Target Market of THG.

The governance structure of THG has evolved, with changes in leadership and the relinquishing of the golden share. The voting rights are concentrated in ordinary shares, influencing THG shareholders. Understanding the ownership structure is vital for anyone interested in THG company ownership.

- Charles Allen is the current chairman.

- Matthew Moulding remains the CEO.

- The golden share was eliminated in June 2023.

- Total voting rights were 1,390,694,730 as of March 31, 2025.

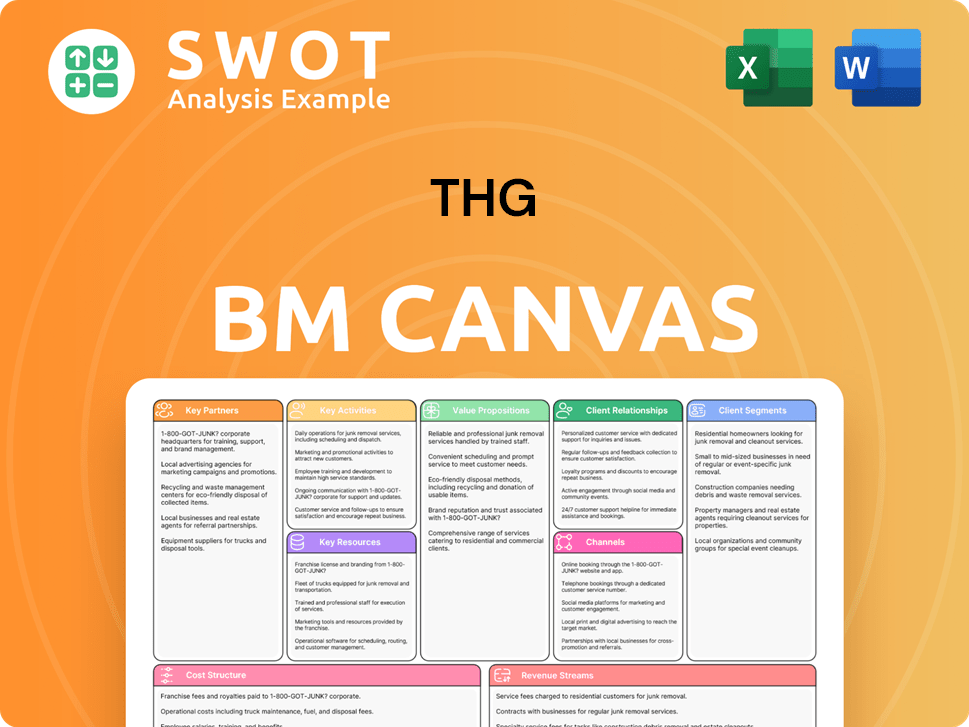

THG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped THG’s Ownership Landscape?

Over the past few years, the ownership structure of THG has seen significant shifts. In January 2025, THG demerged its technology and logistics arm, Ingenuity. This move was supported by a £10 million investment from Matthew Moulding. Subsequently, in March 2025, THG raised £90 million through a share and convertible loan issue, with £60 million coming from Moulding, increasing his stake. This capital injection aimed to streamline the company's debt and position it for future growth.

Further impacting the ownership landscape, THG has undertaken strategic divestments. The OnDemand division, including webstores like Zavvi, was sold in July 2023. In June 2024, the Luxury division, which included web stores like Allsole and Coggles, was sold to Frasers Group. Despite these efforts, the company has faced challenges, including a sustained decline in its share price. The company's share price has dropped significantly since its IPO.

| Event | Date | Details |

|---|---|---|

| Ingenuity Demerger | January 2025 | Demerged technology and logistics arm; Matthew Moulding invested £10 million. |

| Share and Convertible Loan Issue | March 2025 | Raised £90 million; £60 million from Matthew Moulding. |

| OnDemand Division Sale | July 2023 | Sold OnDemand division, including Zavvi. |

| Luxury Division Sale | June 2024 | Sold Luxury division, including Allsole and Coggles. |

| FTSE 250 Removal | June 2025 | Removed from FTSE 250 due to share price decline. |

These developments highlight the evolving ownership dynamics and strategic adjustments within THG. The company's efforts to restructure and adapt to market conditions are evident through its demergers, fundraising activities, and asset sales. A brief history of THG provides additional context on the company's journey and ownership evolution.

Matthew Moulding's total share purchases in THG have reached £110 million since the IPO. His investments reflect a commitment to the company's future.

The company reported operating losses of £147.9 million in 2024. THG has also cut 2,500 jobs since early 2022, as part of its operational efficiency review.

The share price decline led to THG's removal from the FTSE 250 index. The market value plunged to £328.75 million—a 97% drop since its IPO peak.

The fundraise aims to simplify the company's debt structure and position it for future growth, lowering the group's leverage ratio from 3.2x to 2.6x.

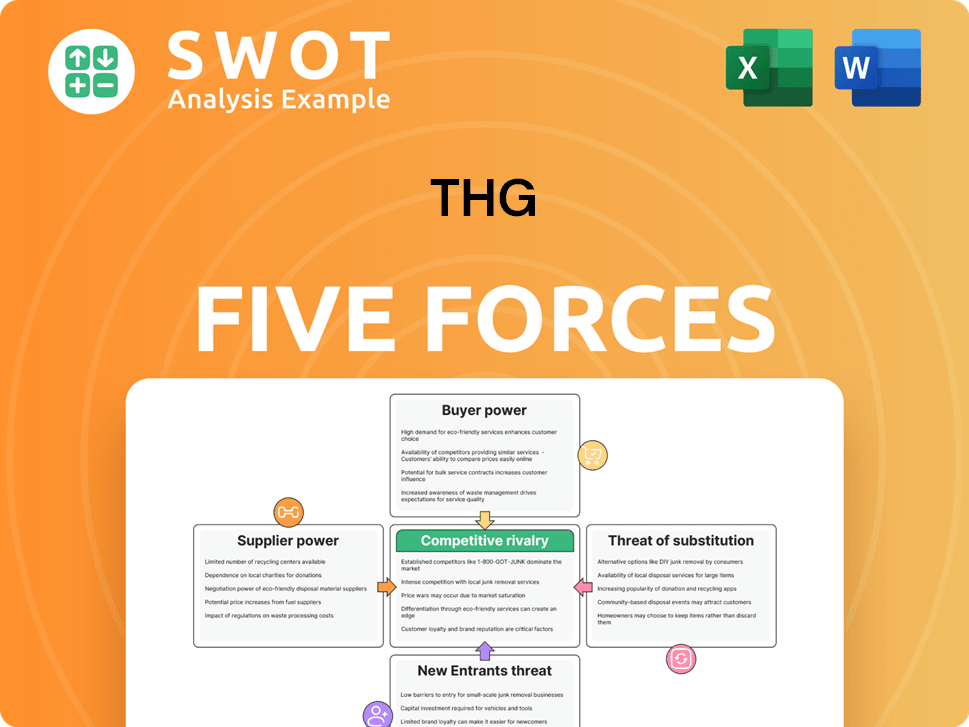

THG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of THG Company?

- What is Competitive Landscape of THG Company?

- What is Growth Strategy and Future Prospects of THG Company?

- How Does THG Company Work?

- What is Sales and Marketing Strategy of THG Company?

- What is Brief History of THG Company?

- What is Customer Demographics and Target Market of THG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.