Under Armour Bundle

Can Under Armour Rebound?

Under Armour, a global leader in athletic apparel and sports equipment, has revolutionized the sports industry with its innovative approach. From its inception, the Under Armour SWOT Analysis reveals a company built on performance-enhancing products designed for athletes worldwide. Understanding the inner workings of UA is essential for anyone tracking the brand's trajectory.

Recent financial results, including a 9% revenue decrease to $5.2 billion and a net loss of $201.3 million in fiscal 2025, underscore the importance of this analysis. This article delves into the Under Armour company's operations, revenue streams, and strategic adjustments, providing a crucial perspective for investors and industry watchers. Examining its Under Armour mission statement, product lines, and marketing strategy offers insights into its future potential.

What Are the Key Operations Driving Under Armour’s Success?

The core operations of the Under Armour company revolve around the design, development, marketing, and distribution of branded performance apparel, footwear, and accessories. The company's value proposition centers on providing products that enhance athletic performance, catering to a wide range of athletes, from professionals to everyday consumers.

The company aims to deliver innovative products with improved design to increase consumer consideration. This focus is supported by a global supply chain, product development, and diverse sales channels. Under Armour has been actively revamping its supply chain through a multi-year distribution logistics strategy.

The company's operational processes involve a global supply chain, product development, and diverse sales channels. Under Armour's distribution networks include direct-to-consumer channels, such as its owned and operated stores and e-commerce platforms, and wholesale partnerships with retailers. The company's efforts to streamline its creation engine, assortment, and merchandising approach are central to its strategy to deliver a more deliberate presentation to athletes and customers.

The company has been working on a multi-year distribution logistics strategy to enhance cross-channel capabilities. This strategy aims to ensure inventory availability and improve service levels. The goal is to drive cost efficiency across its direct-to-consumer (DTC) and wholesale businesses.

Under Armour uses both direct-to-consumer channels and wholesale partnerships. Direct channels include owned stores and e-commerce platforms. Wholesale partnerships involve selling products through various retailers.

Wholesale revenue decreased by 8% to $3.0 billion. Direct-to-consumer revenue declined by 11% to $2.1 billion. The company is focusing on streamlining its creation engine to deliver a more deliberate presentation to customers.

The company focuses on delivering transformative innovations steeped in performance and improved design language. This approach aims to increase consumer consideration and enhance the overall brand experience. This is part of their strategy to compete in the athletic apparel and sports equipment market.

The operational focus includes a global supply chain, product development, and diverse sales channels. The company's strategy involves streamlining its creation engine and merchandising approach.

- Global Supply Chain: Managing a complex network of suppliers and distributors.

- Product Development: Designing and innovating performance apparel, footwear, and accessories.

- Sales Channels: Utilizing both direct-to-consumer and wholesale channels for distribution.

- Brand Focus: Enhancing the brand's image and delivering a better experience to athletes.

Under Armour SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Under Armour Make Money?

The Under Armour company generates revenue through the sale of its athletic apparel, footwear, and accessories. The company utilizes two primary distribution channels: wholesale and direct-to-consumer (DTC). Understanding these revenue streams is key to analyzing the Under Armour company's financial performance and its ability to compete in the sports equipment market.

For the full fiscal year 2025, Under Armour's total revenue was reported at $5.2 billion. This represents a 9% decrease compared to fiscal year 2024. The company's revenue model is designed to capitalize on the growing demand for high-performance athletic wear and gear, serving a diverse customer base.

The Under Armour brand has implemented strategies to reduce promotional activities, aiming to establish a more premium brand image. Furthermore, the company is focusing on optimizing its inventory levels to streamline supply chain operations and achieve cost savings. This approach is part of a broader effort to enhance profitability and maintain a strong position in the competitive athletic apparel industry. You can learn more about the Growth Strategy of Under Armour.

The following details the revenue streams and performance metrics for the Under Armour company in fiscal year 2025:

- Wholesale Revenue: Decreased by 8% to $3.0 billion in fiscal year 2025. For the fourth quarter of fiscal 2025, wholesale revenue was $768 million, a 10% decrease.

- Direct-to-Consumer (DTC) Revenue: Decreased by 11% to $2.1 billion in fiscal year 2025. In the fourth quarter of fiscal 2025, DTC revenue fell 15% to $386 million.

- E-commerce Revenue: Dropped 27% in Q4 fiscal 2025, representing 37% of the total DTC business for the quarter. This decrease was due to planned reductions in promotional activities.

- Apparel Revenue: Decreased by 9% to $3.5 billion.

- Footwear Revenue: Declined by 13% to $1.2 billion.

- Accessories Revenue: Rose by 1% to $411 million.

Under Armour PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Under Armour’s Business Model?

The Growth Strategy of Under Armour has been marked by significant shifts and strategic realignments. The company, facing a competitive landscape in the athletic apparel market, has undertaken several key initiatives to bolster its financial and operational performance. These moves are designed to address challenges and capitalize on opportunities within the sports equipment and athletic apparel sectors.

A major step in this direction was the approval of a restructuring plan in May 2024. This plan aims to enhance financial and operational efficiencies. It reflects a broader effort by the company to adapt to evolving market dynamics and strengthen its position in the athletic apparel industry. The restructuring plan is a crucial part of the company's strategy to navigate the competitive retail environment.

The restructuring plan is projected to incur between $70 to $90 million in pre-tax restructuring and related charges. By the end of Q4 fiscal 2025, Under Armour had recognized $58 million in restructuring and impairment charges and $31 million in other related transformational expenses. This involves streamlining the product lineup and focusing primarily on men's athletic apparel.

The approval of a restructuring plan in May 2024 was a key milestone for the Under Armour company. This plan is designed to improve financial and operational efficiencies. By the end of Q4 fiscal 2025, the company had recognized significant restructuring and impairment charges.

Under Armour is implementing a 'strategic reset' to elevate its products and brand storytelling. This includes streamlining its creation engine and assortment. The company is also improving its e-commerce platform and enhancing its supply chain capabilities.

Historically, Under Armour's competitive advantages included brand strength and product innovation. The company is focusing on transformative innovations to maintain its edge. Under Armour is also working to connect with young athletes through team sports.

Under Armour experienced an 8% revenue decline in North America in fiscal 2024. The company is working to improve gross margins and reduce excess inventory. Marketing investments are being reprioritized to drive growth.

Under Armour's 'strategic reset' is a comprehensive plan to reignite brand relevance and achieve sustainable, profitable growth. This includes a focus on product elevation, enhanced storytelling, and a more efficient operating model. The company is also emphasizing transformative innovations to stay competitive in the athletic apparel market.

- Elevating products and storytelling to enhance brand appeal.

- Tightening distribution channels for better market reach.

- Refining the operating model to improve efficiency.

- Improving e-commerce platform to enhance customer experience.

Under Armour Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Under Armour Positioning Itself for Continued Success?

The Under Armour company faces a competitive landscape dominated by industry giants. Its market position is challenged by established brands like Nike and Adidas, which hold larger market shares and stronger brand recognition. In fiscal 2024, the company experienced a decline in its North American market share within the sportswear category.

The company's dependence on the North American market for a significant portion of its revenue makes it susceptible to regional economic fluctuations and consumer spending patterns. Key risks include ongoing brand strength concerns, intense competition, and potential impacts from global economic events and currency fluctuations. The company has also addressed material weaknesses in its internal control over financial reporting.

The Under Armour company operates within a highly competitive athletic apparel and sports equipment market. It competes with well-established brands like Nike and Adidas, which have larger market shares. The company's performance is heavily influenced by consumer spending and economic conditions, especially in North America, where it generates a significant portion of its revenue.

Key risks include brand strength concerns, intense competition, and potential impacts from global economic events and currency fluctuations. The company has identified material weaknesses in its internal control over financial reporting. The brand has become heavily reliant on promotions, which may affect consumer perception and pricing expectations.

The company is focused on a strategic reset to drive sustainable, profitable growth. For Q1 2026, revenue is expected to decrease by 4% to 5%. Gross margin is anticipated to increase by 40 to 60 basis points. The company is implementing market-specific commercial strategies and enhancing products.

Strategic initiatives include enhancing products, storytelling, and tightening distribution. They are also refining their operating model. The company aims to strengthen the brand in the Americas and expand in EMEA. In the Asia-Pacific region, the company is navigating a challenging environment. The company's leadership is confident that actions are gaining traction, with a strengthened product lineup expected in Fall 2025.

The company's strategic reset includes a focus on product enhancement, improved storytelling, tighter distribution, and refining its operating model. Under Armour is working on market-specific commercial strategies. For example, in the Americas, the focus is on a 'reset and strengthen' approach through disciplined marketplace management. For more insights into their approach, consider exploring the Marketing Strategy of Under Armour. In EMEA, the company is focused on expanding into new countries, while in the Asia-Pacific region, it faces a challenging environment. The company expects a diluted loss per share of $0.00 to $0.02 for the first quarter of fiscal 2026, with adjusted diluted earnings per share anticipated to be $0.01 to $0.03. Leadership is confident in the progress, with a strengthened product lineup expected in Fall 2025.

For Q1 2026, the company anticipates a revenue decrease of 4% to 5%. Gross margin is expected to increase by 40 to 60 basis points. The company projects a diluted loss per share of $0.00 to $0.02 and adjusted diluted earnings per share of $0.01 to $0.03.

- Revenue decrease of 4% to 5% for Q1 2026.

- Gross margin increase of 40 to 60 basis points.

- Diluted loss per share of $0.00 to $0.02.

- Adjusted diluted earnings per share of $0.01 to $0.03.

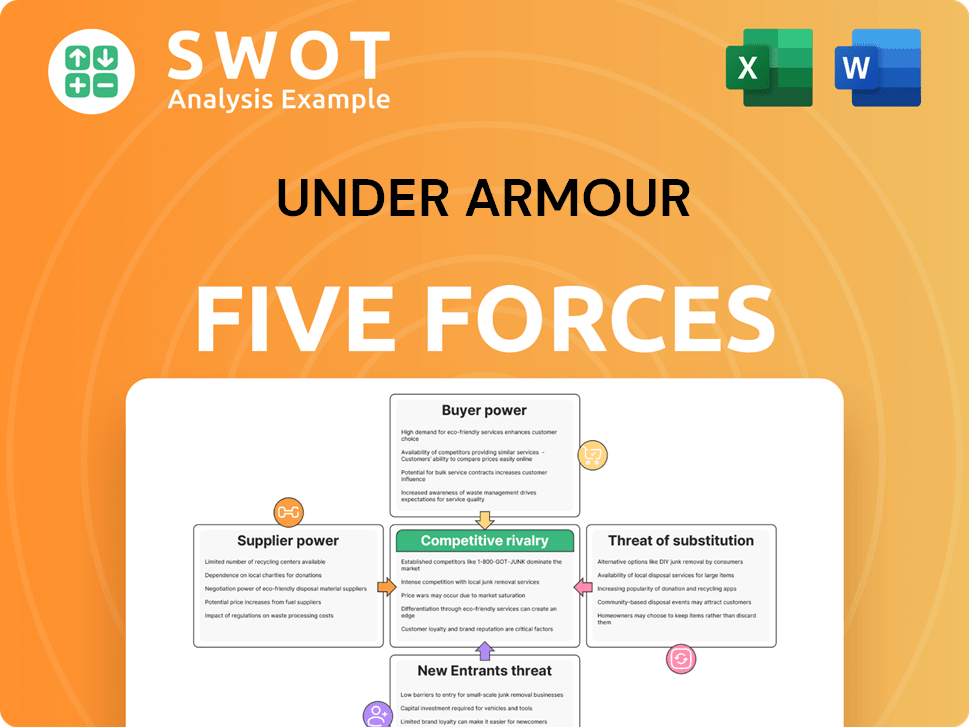

Under Armour Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Under Armour Company?

- What is Competitive Landscape of Under Armour Company?

- What is Growth Strategy and Future Prospects of Under Armour Company?

- What is Sales and Marketing Strategy of Under Armour Company?

- What is Brief History of Under Armour Company?

- Who Owns Under Armour Company?

- What is Customer Demographics and Target Market of Under Armour Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.