Under Armour Bundle

Who Really Calls the Shots at Under Armour?

Understanding the dynamics of Under Armour SWOT Analysis is crucial for anyone looking to invest in or understand the sportswear giant. But who exactly steers the ship at Under Armour? Unraveling the company's ownership structure reveals key insights into its strategic direction and future prospects. From its humble beginnings to its current market position, knowing who owns Under Armour is essential.

The question of Under Armour ownership is more than just a matter of names on a stock certificate; it's about control, influence, and the future of a brand. Knowing who founded Under Armour and who the current major investors are is key to understanding its trajectory. This exploration examines the evolution of Under Armour's ownership, from its roots with Kevin Plank to the influence of institutional investors and the impact on Under Armour stock.

Who Founded Under Armour?

The story of Under Armour's beginning is rooted in the vision of Kevin Plank. Founded in 1996, the company emerged from Plank's initiative to revolutionize athletic apparel. His early efforts, fueled by personal investment, laid the groundwork for what would become a major player in the sports industry.

Kevin Plank, a former special teams captain at the University of Maryland, launched the company from his grandmother's basement. This humble beginning highlights the entrepreneurial spirit that drove the initial stages of Under Armour. Plank's hands-on approach and dedication to product development were crucial in the early days.

The early ownership structure of Under Armour was primarily centered on Kevin Plank. Initially, the company's growth was driven by Plank's personal investment and reinvestment of early sales. There is no publicly available detailed breakdown of specific equity splits or shareholding percentages for Plank or any early backers at the company's absolute inception.

The early phase of Under Armour's development saw Kevin Plank as the central figure, both as founder and primary investor. The company's initial funding came from Plank's savings and small loans, underscoring his commitment and belief in the product. The focus was on product development and market entry, with Plank maintaining significant control.

- Kevin Plank founded Under Armour in 1996.

- Early funding came from Plank's personal savings and small loans.

- The initial focus was on product development and market entry.

- Plank maintained virtually full control in the early stages.

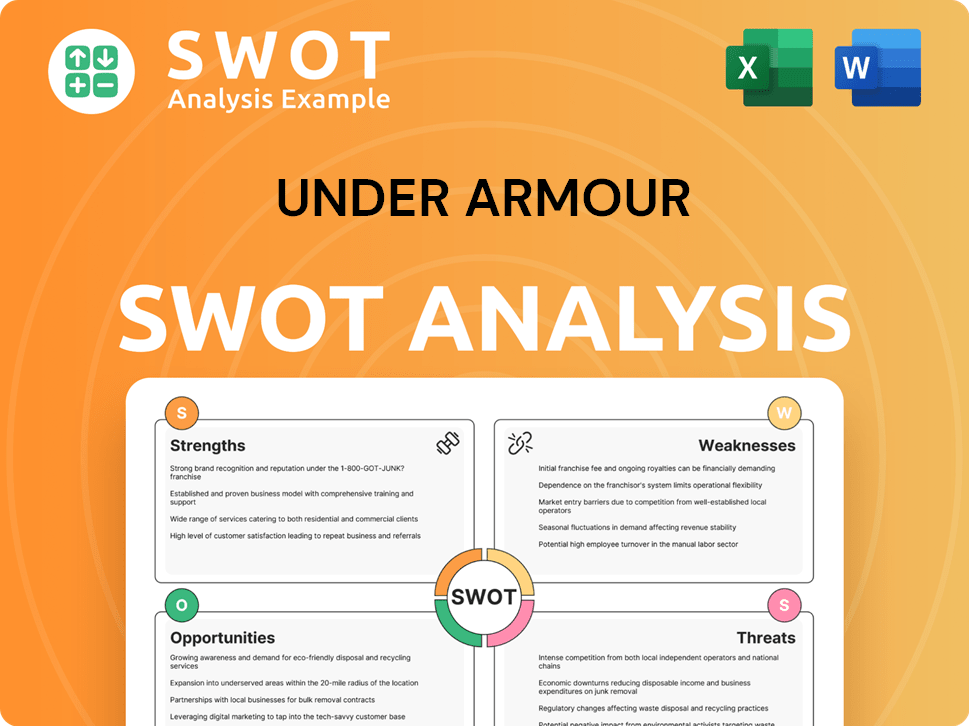

Under Armour SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Under Armour’s Ownership Changed Over Time?

The ownership structure of the company, has significantly evolved since its initial public offering (IPO) on November 18, 2005. The company began trading on the New York Stock Exchange under the ticker 'UA'. The IPO offered 11.5 million shares at $13 each, raising approximately $150 million. This transition moved ownership from primarily founder-held to a mix of public shareholders.

As of early 2025, the major stakeholders include a mix of institutional investors, mutual funds, index funds, and individual insiders. For instance, as of March 2025, institutional ownership in the company (UA) was approximately 75.38% of outstanding shares. Major institutional holders often include large asset management firms and investment funds. Understanding the Revenue Streams & Business Model of Under Armour can provide additional context to the company's financial performance and the impact of its ownership structure.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | November 18, 2005 | Diversified ownership; transition from founder-held to public shareholders. |

| Secondary Stock Offerings | Various Dates | Further dilution of founder's stake; increased public float. |

| Institutional Investment | Ongoing | Increased institutional ownership; greater scrutiny on financial performance. |

Kevin Plank, the founder, remains a significant individual shareholder. His ownership stake, while diluted since the IPO, still grants him considerable influence, particularly through his control of Class B shares which carry enhanced voting rights (10 votes per share compared to 1 vote per share for Class A shares). This dual-class share structure ensures that Plank retains substantial voting power, allowing him to guide the company's strategic direction. Other significant individual shareholders typically include current and former executives and board members. The evolution of ownership has seen a gradual increase in institutional holdings, a common trend for publicly traded companies, impacting company strategy by increasing scrutiny on financial performance and corporate governance.

The company's ownership structure has evolved significantly since its IPO in 2005. The founder, Kevin Plank, still holds a significant influence through his Class B shares. Institutional investors hold a substantial percentage of the company's stock.

- The IPO in 2005 marked a major shift in ownership.

- Institutional investors now hold a majority of the shares.

- Kevin Plank retains significant control through his voting rights.

- Understanding the ownership structure is vital for assessing the company's direction.

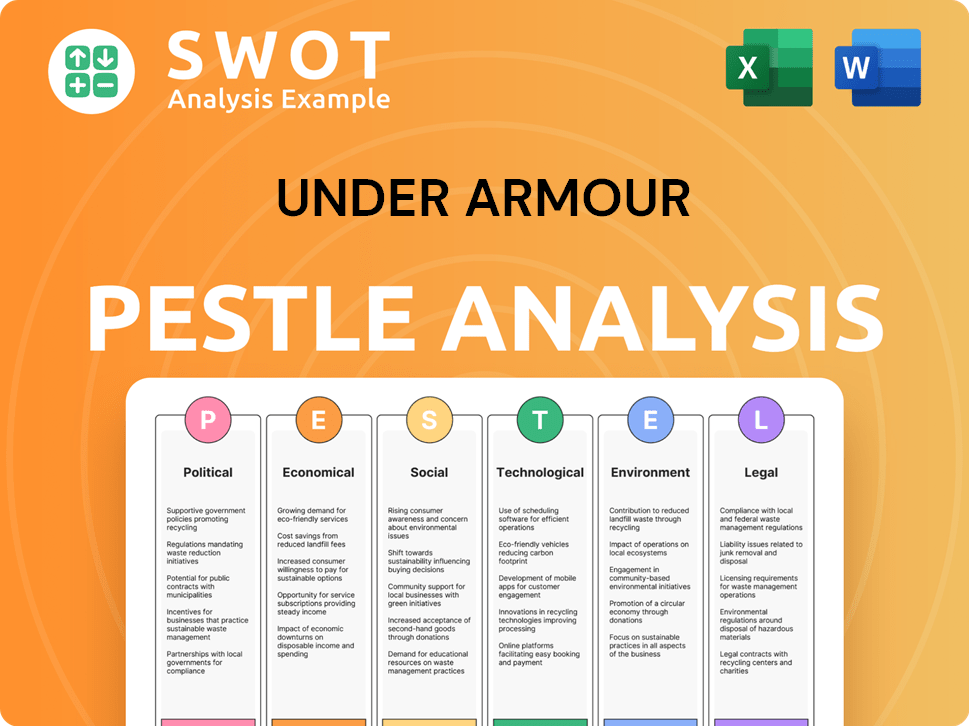

Under Armour PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Under Armour’s Board?

As of early 2025, the Board of Directors of Under Armour plays a critical role in the company's governance. The board's composition includes a mix of independent directors, company executives, and representatives aligned with major shareholders. Kevin Plank, the Executive Chairman and Brand Chief, holds a significant position on the board and wields substantial voting power due to his Class B shares. The board's structure reflects a balance between independent oversight and the influence of the founder, shaping strategic decisions and leadership appointments.

The company's ownership structure is influenced by its dual-class share system. Plank's Class B shares carry 10 votes per share, while the Class A shares traded publicly carry one vote per share. This structure ensures Plank maintains a controlling interest in the company's voting decisions, even if his economic ownership percentage is lower than other large institutional investors. Discussions and scrutiny around dual-class share structures have occurred, with some advocating for a one-share-one-vote system to enhance shareholder democracy. However, Under Armour has maintained this structure, underscoring Plank's continued vision and control over the company's long-term direction. Understanding the Target Market of Under Armour is also crucial for comprehending the company's strategic decisions.

| Director | Title | Notes |

|---|---|---|

| Kevin Plank | Executive Chairman and Brand Chief | Founder, significant voting power. |

| Stephanie Linnartz | President and CEO | Oversees day-to-day operations. |

| Mohamad Ali | Lead Independent Director | Provides independent oversight. |

The board is a mix of independent directors and company executives. Kevin Plank, the founder, holds significant voting power through Class B shares. This dual-class structure allows Plank to maintain control over the company's strategic direction.

- Kevin Plank's Class B shares have 10 votes per share.

- Class A shares have one vote per share.

- The board balances independent oversight with founder influence.

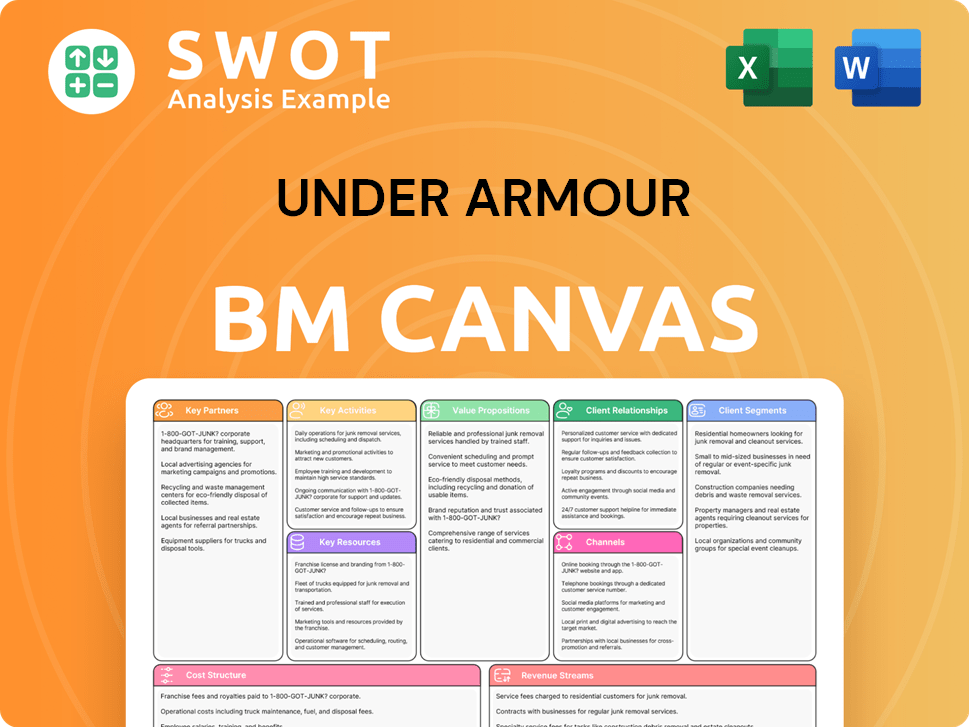

Under Armour Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Under Armour’s Ownership Landscape?

Over the past few years (2022-2025), the Under Armour ownership structure has seen shifts influenced by market dynamics and company performance. While Kevin Plank retains significant voting control through Class B shares, the composition of institutional ownership has evolved. The company has also engaged in share buyback programs, impacting the ownership percentages of remaining shareholders. For instance, in February 2023, Under Armour authorized a share repurchase program for up to $500 million of its Class C common stock. This reflects a strategic move to manage capital and potentially increase shareholder value.

Industry-wide trends, such as increased institutional ownership and the rise of passive investing, have also influenced Under Armour. Founder dilution, a natural outcome of public offerings, has occurred, but Plank's dual-class share structure mitigates the loss of control. Leadership changes, including the appointment of new CEOs, can also subtly influence ownership dynamics as new executives may receive equity compensation. Stephanie Linnartz was appointed President and CEO in February 2023 and resigned in January 2024, with Kevin Plank re-assuming the role of interim CEO. These transitions can affect investor confidence and, consequently, ownership trends. These changes are part of the ongoing evolution of the company's ownership landscape.

| Metric | Details | Data |

|---|---|---|

| Share Repurchase Program | Authorized in February 2023 | Up to $500 million of Class C common stock |

| CEO Transition | Stephanie Linnartz appointed CEO in February 2023, resigned in January 2024. | Kevin Plank re-assumed the role of interim CEO |

| Institutional Ownership | Significant influence | Varies, but a key factor in stock performance |

These developments highlight the dynamic nature of Under Armour's ownership. The interplay of founder control, institutional investment, and strategic decisions like share buybacks shapes the company's ownership landscape. While no immediate privatization is indicated, ongoing strategic reviews and market performance will continue to influence Under Armour’s ownership structure.

The ownership structure is influenced by Kevin Plank's control through Class B shares. Institutional investors hold significant stakes. Share buyback programs also play a role in the ownership dynamics.

Leadership transitions, such as the appointment and resignation of CEOs, can impact investor confidence. Kevin Plank's return as interim CEO reflects the company's strategic direction. These changes can influence the stock.

Share buyback programs reduce the number of outstanding shares. This can increase the ownership percentage of remaining shareholders. Under Armour authorized a $500 million share repurchase program in February 2023.

Increased institutional ownership and passive investing impact Under Armour. Founder dilution is a natural consequence of public offerings. These factors shape the company's ownership landscape.

Under Armour Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Under Armour Company?

- What is Competitive Landscape of Under Armour Company?

- What is Growth Strategy and Future Prospects of Under Armour Company?

- How Does Under Armour Company Work?

- What is Sales and Marketing Strategy of Under Armour Company?

- What is Brief History of Under Armour Company?

- What is Customer Demographics and Target Market of Under Armour Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.