Vivendi Bundle

Decoding Vivendi: How Does This Media Giant Thrive?

Vivendi, a global leader in media and content, shapes the entertainment and communications landscape. With a diverse portfolio including Canal+, Havas, and Gameloft, the Vivendi SWOT Analysis unveils the strategic maneuvers of this media powerhouse. Its strategic acquisitions and diversified holdings highlight its robust market standing and global reach, making it a critical entity for understanding the dynamics of the modern media landscape.

For investors and industry observers alike, understanding the Vivendi company and its business model is paramount. This exploration delves into Vivendi's core operations, revenue streams, and competitive advantages, providing essential insights into how this media conglomerate operates. Discover how Vivendi, with its influence in television, film, and video games, continues to shape the global content economy and its future strategy and outlook.

What Are the Key Operations Driving Vivendi’s Success?

The Vivendi company operates as a global media and communications conglomerate, creating value through a diverse portfolio of businesses. Its core activities span across pay-TV, film production, advertising, publishing, and mobile gaming. This integrated approach allows for significant synergies and market differentiation, enhancing its competitive position in the media industry.

The Vivendi business model centers on a synergistic ecosystem, leveraging its various divisions to offer comprehensive entertainment and information services. This includes content creation, distribution, and marketing, catering to both consumers and businesses. The company's strategy emphasizes cross-promotion and leveraging assets across its portfolio to maximize revenue and market reach.

Vivendi's value proposition lies in its ability to provide a wide array of media and communication services. This includes premium content, advertising solutions, and publishing services. The company aims to enhance customer benefits through bundled offerings and innovative content delivery, solidifying its position in the global media landscape.

Canal+ Group is a key division offering pay-TV services, film production, and distribution. It leverages advanced broadcasting infrastructure and digital platforms for content delivery. The group's extensive networks are crucial for market penetration and reach.

Havas operates as a global communications and advertising group. It utilizes a global network of agencies, creative talent, and data analytics for advertising and communication campaigns. Havas helps businesses with marketing, advertising, and communication solutions.

Lagardère encompasses publishing (Hachette Livre) and travel retail. Its publishing arm involves content acquisition, editorial processes, and global distribution. The travel retail segment manages retail operations in airports and train stations.

Gameloft is a leading mobile video game developer. It focuses on technology development for game creation and distribution through app stores and partnerships. Gameloft provides engaging entertainment to a wide audience.

Vivendi's operational processes are multifaceted, involving content creation, distribution, and marketing. The company's supply chain includes content creators, technology providers, media buyers, and retail partners. Partnerships and distribution networks are critical for market penetration.

- Content Creation: Development of original content for pay-TV, film, and mobile gaming.

- Distribution: Utilizing broadcasting infrastructure, digital platforms, and retail networks.

- Marketing & Advertising: Employing a global network of agencies for advertising campaigns.

- Publishing: Managing content acquisition, editorial processes, and global distribution.

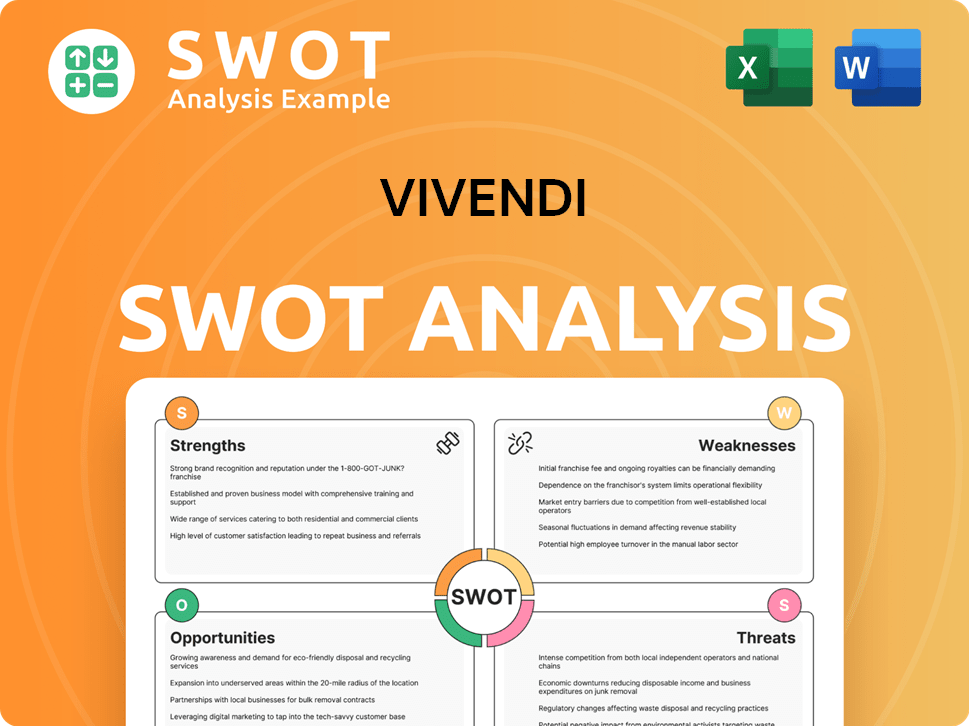

Vivendi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Vivendi Make Money?

The Vivendi company operates through a diverse range of revenue streams, reflecting its extensive portfolio of media and content businesses. These streams include subscriptions, advertising, content sales, and publishing. Understanding how Vivendi generates revenue is key to grasping its business model and market position.

In the first quarter of 2024, Vivendi reported revenues of €4.282 billion, showcasing its significant financial footprint. The company's ability to generate revenue is a direct result of its strategic investments and operational efficiency across its various subsidiaries.

Canal+ Group primarily relies on subscriptions to its pay-TV services, boasting 26.5 million subscribers globally as of March 31, 2024. Havas generates revenue through advertising and communication services, while Lagardère's revenue comes from book sales and travel retail. Gameloft monetizes its mobile games through in-app purchases and advertising.

Vivendi employs several key monetization strategies to maximize revenue and maintain a competitive edge in the media industry. These strategies are crucial for sustaining and expanding its market presence. For more insights into the company's structure, consider reading about Owners & Shareholders of Vivendi.

- Bundled services, particularly within Canal+ Group, encourage higher subscriber retention.

- Cross-selling opportunities exist across divisions, such as Havas clients using Vivendi's content platforms.

- Licensing agreements for films, TV shows, and game franchises generate additional revenue.

- Strategic acquisitions, like the increased stake in Lagardère, have expanded revenue sources.

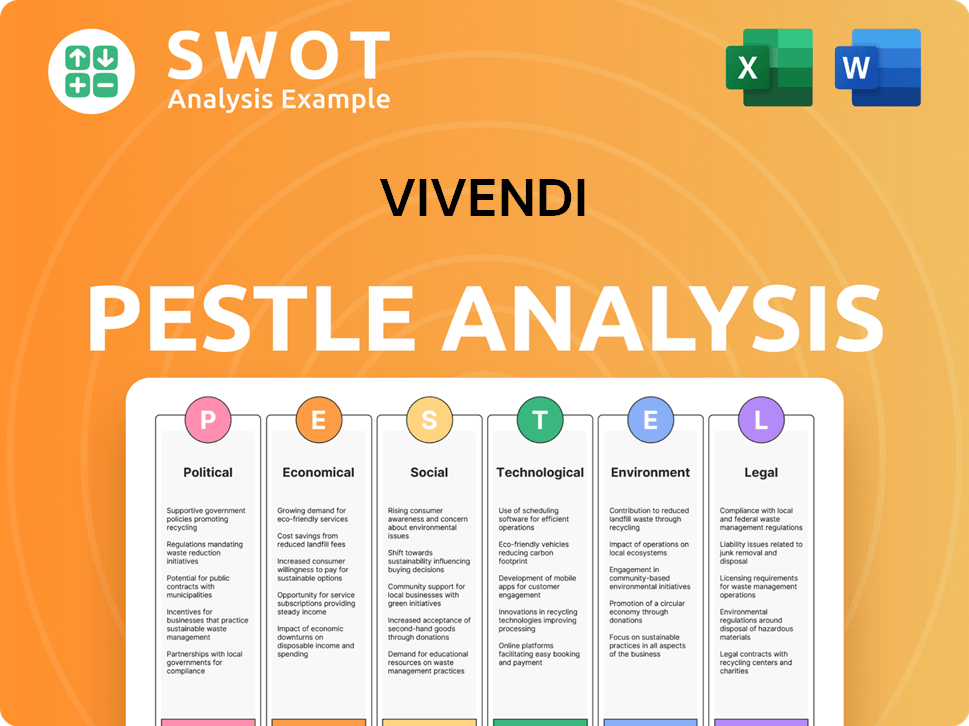

Vivendi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Vivendi’s Business Model?

The operational and financial trajectory of the Vivendi company has been significantly shaped by strategic milestones and adaptive responses to market dynamics. A key strategic move has been the company's continued focus on strengthening its global content and media ecosystem through targeted acquisitions. The full consolidation of Lagardère in 2023 stands out as a major milestone, significantly expanding Vivendi's footprint in publishing and travel retail. This acquisition has bolstered its content offerings and diversified its revenue streams, with Lagardère contributing substantially to Vivendi's financial results. Exploring the Competitors Landscape of Vivendi provides additional context.

Vivendi has also demonstrated its ability to navigate operational challenges, such as the evolving landscape of media consumption and increased competition from streaming services. Its response has involved investing in original content, expanding its international reach for Canal+ Group, and developing digital platforms to enhance user experience. For instance, Canal+ Group's subscriber base reached 26.5 million worldwide as of March 31, 2024, demonstrating successful international expansion.

The Vivendi business model is built on a diversified portfolio of media and content assets, allowing it to generate revenue from various sources. The company’s strategic moves have been geared towards enhancing this portfolio and expanding its global reach. Vivendi's main activities include content creation, distribution, and marketing across various platforms, including television, film, music, and publishing. Understanding how Vivendi makes money involves analyzing its revenue streams from these diverse sectors.

The full consolidation of Lagardère in 2023 was a major milestone, expanding Vivendi's footprint in publishing and travel retail. This acquisition diversified revenue streams and strengthened content offerings. Vivendi has consistently adapted to market changes through strategic acquisitions and investments.

Vivendi has focused on strengthening its global content and media ecosystem through targeted acquisitions. Investing in original content and expanding the international reach of Canal+ Group are key strategies. Developing digital platforms to enhance user experience is also a priority.

Vivendi's strong brand portfolio, including Canal+, Havas, and Hachette Livre, provides significant brand strength. Economies of scale across diverse operations enable cost efficiencies. An integrated ecosystem creates powerful network effects, benefiting each business unit.

Canal+ Group's subscriber base reached 26.5 million worldwide as of March 31, 2024. Vivendi's revenue breakdown is diversified across its various business segments. The company's market capitalization reflects its position in the media industry.

Vivendi's competitive advantages are multifaceted, including its strong brand portfolio and economies of scale. The integrated ecosystem allows for mutual benefit across business units, enhancing its market position. Vivendi’s ability to adapt to new trends, such as digital consumption, is crucial for maintaining its competitive edge.

- Strong brand portfolio (Canal+, Havas, Hachette Livre) provides significant brand strength.

- Economies of scale across diverse operations, enabling cost efficiencies.

- Integrated ecosystem creates powerful network effects.

- Adaptation to digital consumption and localized content.

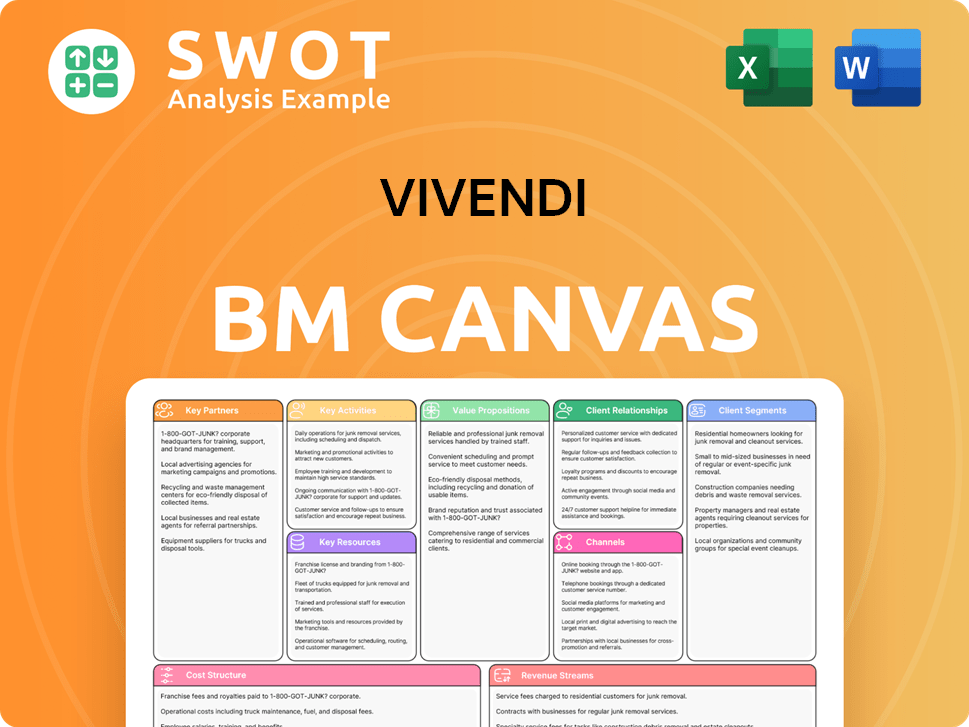

Vivendi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Vivendi Positioning Itself for Continued Success?

The Vivendi company holds a strong position in the global media and content industry, competing with major players like Bertelsmann and Comcast. Its diverse portfolio includes pay-TV through Canal+ Group, advertising and communications via Havas, and publishing with Lagardère (Hachette Livre). The company's extensive global reach, with operations and partnerships across numerous countries, contributes to a broad customer base and strong brand loyalty.

Despite its robust market position, Vivendi faces several challenges. These include regulatory changes, competition from streaming services, and technological disruptions. Consumer preferences are also shifting, requiring Vivendi to adapt its content offerings and digital strategies to maintain its competitive edge. For example, in 2023, Canal+ Group saw its subscriber base grow, but it also faced increased competition in key markets.

Vivendi's market share is significant in pay-TV, advertising, and publishing. The company's global presence allows it to reach a wide audience. Its diversified business model helps it manage risks across different sectors.

Regulatory changes, especially in Europe, can impact Vivendi's operations. Competition from streaming services and digital advertising platforms poses a threat. Technological advancements and changing consumer preferences require constant adaptation.

Vivendi is focused on international expansion, particularly for Canal+ Group. Investments in original content remain a priority. The company aims to leverage data and technology in its advertising and communication services.

In 2024, Vivendi is expected to continue its strategic acquisitions and organic growth. The company aims to adapt to market dynamics to maintain its competitive edge. Vivendi's revenue breakdown shows a diversified income stream across its various segments.

Vivendi's future strategy emphasizes international expansion, particularly for its Canal+ Group, focusing on high-growth markets. Investments in original content production are a priority to attract and retain subscribers. Havas is leveraging data and technology to enhance its advertising and communication services. To learn more about Vivendi's growth strategy, read the Growth Strategy of Vivendi.

- Focus on international expansion for Canal+ Group.

- Investments in original content production.

- Leveraging data and technology in advertising and communication.

- Strategic acquisitions and organic growth.

Vivendi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Vivendi Company?

- What is Competitive Landscape of Vivendi Company?

- What is Growth Strategy and Future Prospects of Vivendi Company?

- What is Sales and Marketing Strategy of Vivendi Company?

- What is Brief History of Vivendi Company?

- Who Owns Vivendi Company?

- What is Customer Demographics and Target Market of Vivendi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.