Rite Aid Bundle

Who Shops at Rite Aid?

In the ever-evolving retail pharmacy landscape, understanding Rite Aid SWOT Analysis is crucial for success. Identifying the Rite Aid customer profile and its Rite Aid target market is essential for strategic planning and market adaptation. This is especially true for a company like Rite Aid, which has undergone significant operational changes and restructuring in recent years.

This exploration delves into the intricacies of Customer demographics Rite Aid, examining the company's Rite Aid customer base and how it has shifted. We will analyze Rite Aid market analysis to uncover the Rite Aid consumer behavior, including age demographics, income levels, and geographic preferences. Understanding these elements is key to evaluating Rite Aid's ability to compete and thrive in a challenging market, considering factors like customer health interests and preferred pharmacy services.

Who Are Rite Aid’s Main Customers?

Understanding the customer demographics of Rite Aid is crucial for assessing its market position and future prospects. Historically, the company's target market has been broad, encompassing individuals of all ages seeking healthcare products and services. However, there's been a notable presence of older adults, who frequently require prescription medications and health-related items. Younger customers interested in wellness and preventive care also form a part of the Rite Aid customer profile.

Rite Aid primarily operates as a business-to-consumer (B2C) entity, serving individual customers through its drugstores. The company's customer base has been impacted by its financial restructuring and store closures. As of May 2025, Rite Aid operated approximately 1,240 stores across 15 states, significantly down from over 2,000 stores in 2023. This shift has altered the company's reach and the segments it can serve.

The company's recent focus has been on ensuring continuity of care for its loyal customers during its transition period, with stores remaining open to serve customers and facilitate prescription transfers to other pharmacies. For a deeper dive into the company's ownership structure, consider exploring the insights provided in this article about Owners & Shareholders of Rite Aid.

Rite Aid's customer base has historically included a wide range of ages. Older adults, who frequently require prescription medications and health-related items, have been a significant segment. The company also attracts younger customers interested in wellness and preventive care.

The geographic focus of Rite Aid has been in semi-rural and urban areas. Data from Esri: Tapestry Segmentation indicates that Rite Aid shoppers tend to come from 'Semirural' visitor segments. This suggests a customer base that may have fewer alternative pharmacy options, particularly in less densely populated areas.

Rite Aid customers' needs revolve around healthcare products, prescription fulfillment, and wellness services. The company aims to meet these needs through its pharmacy services, over-the-counter medications, and health and beauty products. The company's focus is on ensuring continuity of care for its loyal customers during its transition period.

Due to the ongoing restructuring and store closures, Rite Aid's market share by customer group has been in flux. The company's reduced store count, particularly in states like California, New York, and Pennsylvania, has significantly impacted its ability to serve its previous customer base. This has led to shifts in market share among competitors.

Rite Aid's customer base is characterized by a presence in semi-rural and urban audiences. The company's market analysis indicates that it serves a customer base that may have fewer alternative pharmacy options.

- Older adults are a significant segment due to their frequent need for prescriptions and health products.

- Younger customers are also attracted, seeking wellness and preventive care items.

- Store closures, particularly in key states, have led to a shift in the company's customer reach.

- The company is focused on maintaining care continuity during its transition period.

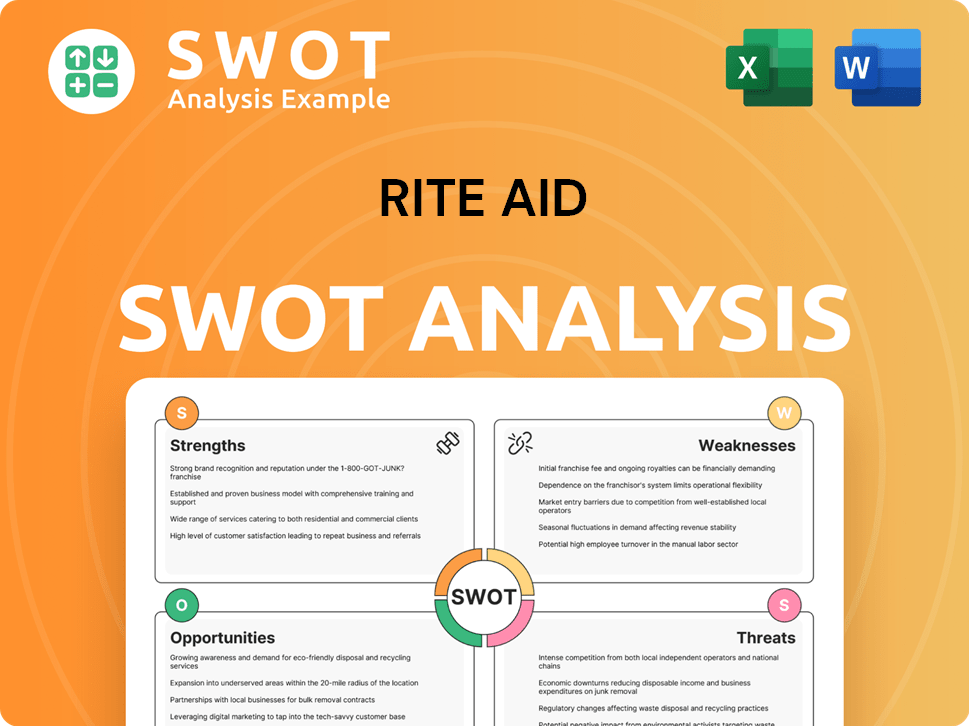

Rite Aid SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Rite Aid’s Customers Want?

Historically, customers of Rite Aid have prioritized convenience, quality, and personalized care. Their primary needs revolve around easy access to prescription medications, a wide selection of health and beauty aids, personal care items, and general merchandise. The accessibility of stores has been a key factor in meeting both pharmaceutical and retail needs for the Rite Aid customer base.

Understanding Rite Aid customer profile involves recognizing the importance of pharmacist expertise and the evolving expectations of different generations. The company has adapted its approach to meet the demands of its customers, focusing on personalized care and leveraging data to understand changing behaviors. This includes an omnichannel strategy that provides options like in-store shopping, online ordering, and home delivery.

The company's approach is also shaped by consumer expectations for convenience and flexibility, which is reflected in its omnichannel approach. This strategy includes in-store shopping, online orders, and home delivery through partners like Amazon, DoorDash, and Instacart, demonstrating a commitment to meeting diverse customer needs.

A December 2024 survey commissioned by Rite Aid revealed key insights into customer awareness and utilization of pharmacist expertise. A majority (62%) viewed their pharmacist as a crucial part of their health and wellness care team.

Many customers were unaware of the full range of services offered by pharmacists. Only 30% knew pharmacists could prescribe certain medications in select states, and 27% knew about medication therapy management.

Gen Z and Millennial respondents showed more health-conscious preferences, utilizing pharmacists for newer clinical services. Older generations used pharmacists more for traditional services, highlighting customer demographics Rite Aid.

More than two-thirds of respondents (68%) reported taking multiple medications or supplements. Less than half (46%) had discussed potential interactions with a pharmacist, showing a critical pain point in medication management.

Rite Aid has embraced an omnichannel approach, offering in-store shopping, online orders, and home delivery through partnerships. This approach aims to meet the diverse needs of its customers by providing convenience and flexibility.

The company tailors its marketing and customer experiences by emphasizing personalized care. Data is leveraged to understand shifting customer behaviors, enabling targeted strategies.

The Rite Aid target market values convenience, quality, and personalized care. The company's strategy focuses on meeting these needs through pharmacist expertise, an omnichannel approach, and personalized services. Understanding Rite Aid market analysis is crucial for adapting to changing customer behaviors and preferences.

- Pharmacist services are highly valued, with unmet needs in awareness and utilization.

- Generational differences exist in pharmacy service preferences, with younger generations embracing newer clinical services.

- Medication management presents a critical area for improvement, as many customers do not discuss potential interactions with pharmacists.

- Rite Aid's omnichannel approach and personalized care initiatives are designed to enhance customer experience and satisfaction.

- For more insights, you can read about the Marketing Strategy of Rite Aid.

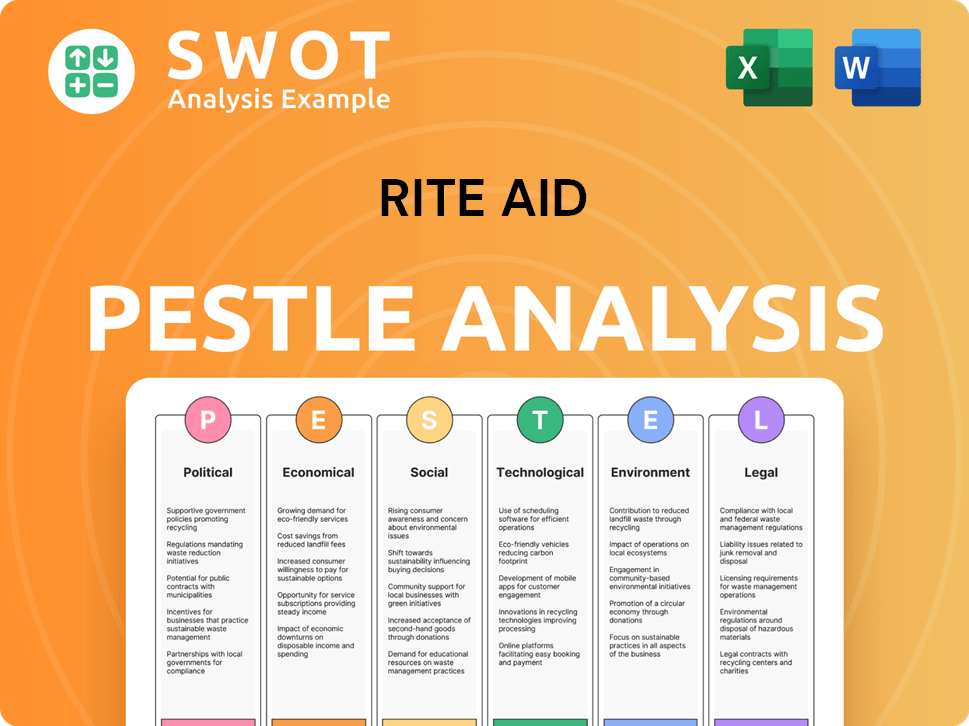

Rite Aid PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Rite Aid operate?

The geographical market presence of the company has significantly shifted, especially in 2024 and 2025, due to extensive store closures and bankruptcy proceedings. As of May 2025, the company operated approximately 1,240 stores across 15 U.S. states. This represents a considerable reduction from its earlier footprint.

Historically, the company had a strong presence in several key states. California, Pennsylvania, New York, and Michigan were among the states with the highest number of locations. The company's strategic realignment involved focusing on saturated or high-demand markets, but ongoing closures reflect a substantial reduction in its physical footprint.

The company has been actively selling its assets, including store fixtures, real estate, and pharmacy data, to other pharmacy chains. This strategic withdrawal from certain areas aims to facilitate an orderly wind-down of operations. The geographic distribution of sales and growth has been severely impacted by these closures.

California led with 359 locations as of November 2024, though many have been or are being shut down. Pennsylvania, the company's headquarters state, had a strong presence with 310 locations as of November 2024.

The ongoing closures, including dozens in New York and Pennsylvania, reflect a substantial reduction in its physical footprint. The company has also been actively selling its assets to other pharmacy chains. This includes store fixtures, real estate, and pharmacy data.

The geographic distribution of sales and growth has been severely impacted by these closures. Q1 2025 visits to stores dropped by 37.2% year-over-year, reflecting the impact of reduced store numbers and changing consumer behavior.

The company's strategic realignment has involved focusing on saturated or high-demand markets. This shift is a response to changing market dynamics and financial pressures. The company is adapting to maintain its market share.

The company's geographic target market is primarily concentrated on the East and West coasts of the United States, with a significant presence in states like California, Pennsylvania, New York, and Michigan. The company's strategy involves adapting to market changes.

- California: A key market with a high number of locations, though many are closing.

- Pennsylvania: The company's headquarters state, with a substantial presence.

- New York and Michigan: Representing a balanced distribution across East Coast and Midwest regions.

- Other States: Ohio, Washington, New Jersey, Oregon, New Hampshire, and Virginia also have locations.

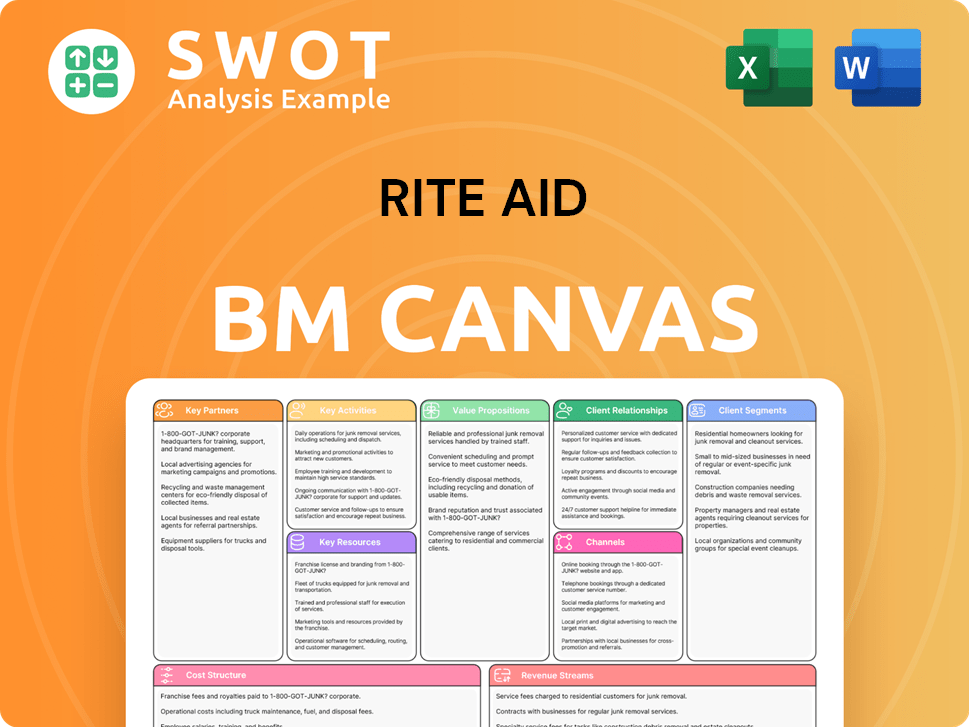

Rite Aid Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Rite Aid Win & Keep Customers?

Rite Aid's customer acquisition and retention strategies have historically focused on providing accessible healthcare services and retail products. The company aimed to foster customer loyalty through its physical store presence and various promotional programs. These strategies were significantly impacted by recent financial challenges, including bankruptcy filings and widespread store closures, which have altered the company's approach.

Before the recent changes, Rite Aid utilized a multi-faceted approach to attract and retain customers. This included a loyalty program, omnichannel services, and data-driven marketing initiatives. These efforts were designed to cater to diverse customer preferences and needs, aiming to build strong customer relationships and drive repeat business. However, the current focus has shifted due to the changing business landscape.

As of June 2025, Rite Aid Rewards points were no longer being issued, and gift cards were no longer honored, reflecting a shift in focus. The company is now prioritizing the smooth transfer of customer prescriptions to other pharmacies. This transition marks a significant change in how Rite Aid engages with its customer base.

The Rite Aid Rewards program, which ended on June 5, 2025, allowed customers to earn points on purchases. Customers earned points for eligible purchases in-store, online, and via the mobile app. Points could be converted into 'BonusCash' for future discounts. The program also included 'Rite Aid Rewards 65+' for customers aged 65 and over, offering 5X points on the first Wednesday of each month.

Rite Aid offered omnichannel services to cater to diverse customer preferences. These services included in-store shopping, in-store pick-up, and delivery services through partners like Amazon, DoorDash, and Instacart. This approach aimed to provide convenience and accessibility to customers, allowing them to shop in the way that best suited their needs. The company sought to meet the needs of its diverse customer demographics Rite Aid.

Marketing efforts included building authentic relationships with customers, such as the 'It Means More' ad campaign in February 2024. The company also emphasized data-driven decision-making to optimize store formats and inform marketing and merchandising decisions. Initiatives like the 'Endless Aisle' program enhanced convenience and accessibility. Understanding the Rite Aid customer profile was crucial for these efforts.

Due to financial difficulties, Rite Aid has shifted its focus. As of May 6, 2025, Rite Aid Rewards points were no longer issued. As of June 5, 2025, gift cards were no longer honored, and returns/exchanges were not accepted. The company is now concentrating on facilitating the transfer of customer prescriptions to other pharmacies. This represents a significant change in Rite Aid's target market strategy.

Rite Aid's strategies included a rewards program, an omnichannel approach, and data-driven marketing. These aimed to enhance customer loyalty and convenience. The company's focus has shifted towards prescription transfers due to financial challenges.

- Rite Aid Rewards: A loyalty program offering points for purchases.

- Omnichannel Services: In-store shopping, pick-up, and delivery options.

- Data-Driven Marketing: Using data to optimize store formats and marketing.

- 'Endless Aisle' Program: Allowing product delivery for items unavailable in-store.

For more insights into the company's overall strategy, consider reading about the Growth Strategy of Rite Aid.

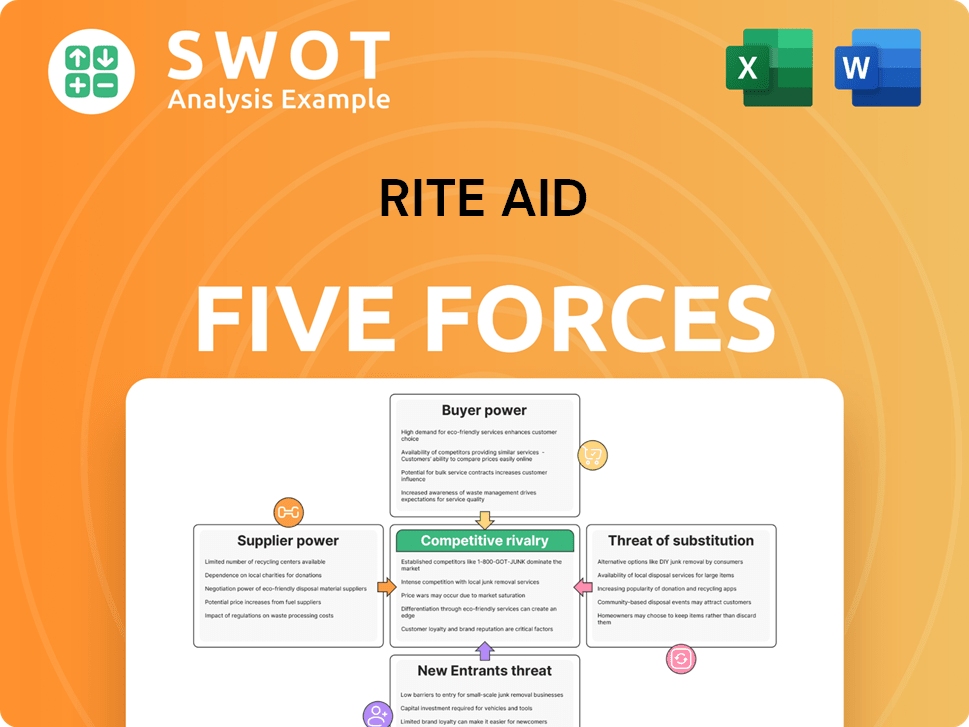

Rite Aid Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Rite Aid Company?

- What is Competitive Landscape of Rite Aid Company?

- What is Growth Strategy and Future Prospects of Rite Aid Company?

- How Does Rite Aid Company Work?

- What is Sales and Marketing Strategy of Rite Aid Company?

- What is Brief History of Rite Aid Company?

- Who Owns Rite Aid Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.