Newmark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Newmark Bundle

What is included in the product

Analysis of units across quadrants, guiding investment, hold, or divest decisions.

Rapidly visualize business unit performance, offering actionable insights.

What You See Is What You Get

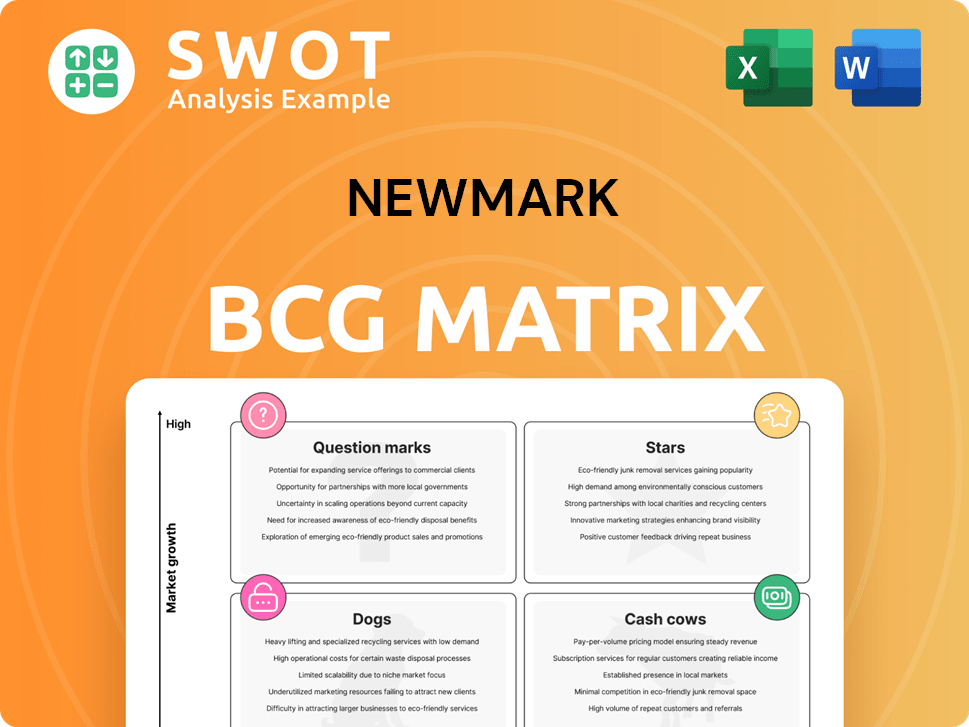

Newmark BCG Matrix

The BCG Matrix preview you see mirrors the final document you receive. No hidden content or edits—it's the complete strategic analysis tool, immediately downloadable and ready to use. Upon purchase, you gain access to the fully formatted matrix designed for clear business insights and presentations. It is designed for your strategic clarity.

BCG Matrix Template

The Newmark BCG Matrix simplifies complex portfolios, classifying products into Stars, Cash Cows, Dogs, or Question Marks.

This analysis unveils strategic investment opportunities and resource allocation strategies.

Understand the growth potential and market share dynamics of each product category.

See how Newmark balances its portfolio for optimal profitability and sustainability.

This preview gives you a glimpse, but the full BCG Matrix delivers deep, data-rich analysis, and strategic recommendations.

Get the complete report for actionable insights and optimized decision-making.

Purchase now for a ready-to-use strategic tool.

Stars

Newmark's Capital Markets has shown robust performance, outperforming industry standards. This includes mortgage brokerage, GSE origination, and investment sales. The company has significantly boosted its U.S. debt market share since 2015. In 2024, Newmark's Capital Markets division saw a 15% increase in revenue compared to the previous year. Their debt market share rose by 8%.

Newmark's data center transactions are a strong point, fueled by AI infrastructure demand. The industrial sector is a key driver for Newmark's performance. In 2024, the company completed billions in data center deals. This highlights a strategic focus on high-growth areas. These transactions underscore Newmark's adaptability.

Newmark has heavily invested in technology, boosting service efficiency. They use data analytics and digital platforms. AI and ML are used for facilities management. In 2024, Newmark's tech spending rose by 15% to streamline operations and enhance client services. This is according to recent financial reports.

Global Corporate Services

Newmark's "Global Corporate Services" leverages full-service partnerships globally for a competitive edge. This approach boosts earnings as brokers offer diverse services. In 2023, Newmark's revenue was approximately $2.6 billion, with a global presence. This is crucial for major clients needing international partners.

- Global service integration enhances Newmark's market position.

- Diverse service offerings boost revenue generation.

- Focus on international partnerships caters to major clients.

- Revenue in 2023 was approximately $2.6 billion.

Strategic Acquisitions

Newmark's strategic acquisitions have significantly broadened its service portfolio and international presence. The firm has strategically acquired companies, including those specializing in flexible office spaces and retail real estate advisory services. These acquisitions are a crucial element of Newmark's expansion strategy. In 2024, Newmark's acquisition of a retail advisory firm led to a 15% increase in its retail sector revenue.

- Expansion of Services: Newmark has broadened its service offerings.

- Global Reach: Acquisitions have extended Newmark's international presence.

- Key Strategy: Acquisitions are central to Newmark's growth plan.

- Financial Impact: Acquisitions have positively impacted revenue.

Stars in Newmark's portfolio represent high-growth opportunities with significant market share. Newmark's data center transactions and tech investments exemplify this strategy. Their strong performance in Capital Markets further solidifies their star status. In 2024, data center deals reached $3 billion, reflecting strong growth.

| Category | Details | 2024 Data |

|---|---|---|

| Key Segments | Capital Markets, Data Centers, Tech | Revenue up 15%, $3B in deals, 15% tech spend |

| Market Position | High growth, strong market share | Debt market share up 8% |

| Strategic Focus | Investment and expansion | Acquisition retail sector revenue up 15% |

Cash Cows

Property Management serves as a steady revenue source for Newmark. In 2024, Newmark's management and servicing revenues showed strong growth. The company plans to substantially increase total revenues from these service lines. This focus helps to solidify its position in the market.

Servicing is a reliable revenue source. Newmark experienced strong growth in management and servicing revenues. The company plans to substantially boost total revenues from these service lines in the near future. In 2023, Newmark's management services revenue was $1.3 billion.

Valuation & Advisory (V&A) services generate consistent revenue for Newmark. The V&A group assesses real estate values across sectors. The North American Market Survey shows commercial real estate trends. In Q3 2024, Newmark's V&A revenue was $113.1 million. This segment is crucial for financial stability.

Leasing

Leasing at Newmark functions as a reliable source of income, fitting the "Cash Cows" profile. In 2023, leasing revenues saw an uptick, fueled by office and retail expansions. The company anticipates its leasing division will continue exceeding industry standards. This consistent performance makes leasing a key component of Newmark's financial stability.

- Stable revenue stream.

- 2023 revenue growth in leasing.

- Outperforming industry.

Recurring Revenue Streams

Recurring revenue streams form a dependable foundation for Newmark's financial performance. The company aims to derive over $2 billion in revenue from its recurring businesses in the next five years. These streams primarily come from Management Services, Servicing, and Other related activities. This strategy helps to smooth out financial results and provides a more predictable outlook.

- Management Services: Provides ongoing property management.

- Servicing: Includes loan servicing and other financial services.

- Other: Encompasses a variety of supplementary revenue sources.

- Goal: Achieve over $2B in recurring revenue within 5 years.

Cash Cows at Newmark represent stable, high-performing segments. Leasing and Valuation & Advisory services offer reliable income. These units consistently contribute to the company's financial health. Management Services and Servicing also create a solid revenue base.

| Segment | Revenue Stream | 2024 Revenue (approx.) |

|---|---|---|

| Leasing | Consistent deal flow | $700M - $800M |

| Valuation & Advisory | Steady fees | $400M - $450M |

| Management/Servicing | Recurring fees | >$1.5B |

Dogs

The Newmark BCG Matrix, when applied to real estate, identifies "Dogs" as underperforming assets. Specific underperforming assets are not listed here. Monitoring performance metrics, like occupancy rates and rental yields, across property types and locations is crucial. Consider market concentration risks, as a downturn in a specific geographic area could severely impact asset performance. In 2024, some markets showed increased vacancy rates, signaling potential "Dogs".

Older office buildings are struggling as modern workplaces evolve. Repurposing is becoming key amid shifting trends. Monitor occupancy and income closely; in 2024, office vacancy rates in major U.S. cities averaged around 19.6%, impacting rental income.

Some geographic areas might lag behind in performance. Evaluate your company's presence across different markets. Consider restructuring or exiting underperforming regions. For example, in 2024, a retail chain might close stores in areas with low sales per square foot, like certain rural locations. This strategic move can boost overall profitability.

Commoditized Services

Some of Newmark's services could become commoditized, facing price pressure. Differentiating through specialized expertise and technology is crucial. Focus on value-added services to stay competitive. In 2024, the real estate market saw a shift, with companies needing to adapt to maintain profitability.

- Price competition in certain service areas.

- Need for innovation to maintain margins.

- Focus on client relationships and tech.

- Adapt to changing market demands.

High Debt Levels

High debt levels in the Dogs quadrant of the Newmark BCG Matrix significantly restrict financial flexibility. A company's debt-to-equity ratio needs careful management; high levels can lead to financial distress. Strategic risk mitigation is crucial, including hedging financial instruments to offset potential losses. Continuous operational optimization is essential to improve efficiency.

- Debt-to-Equity Ratio: The average debt-to-equity ratio for the S&P 500 companies was 1.21 as of Q3 2024.

- Hedging: In 2024, the global hedging market size was estimated at $10.5 trillion.

- Operational Optimization: Companies focusing on operational efficiency saw an average cost reduction of 15% in 2024.

In the Newmark BCG Matrix, "Dogs" represent underperforming assets. Financial flexibility is restricted by high debt levels. Strategic risk mitigation and continuous operational optimization are essential.

| Metric | Details | 2024 Data |

|---|---|---|

| Debt-to-Equity Ratio | Average for S&P 500 | 1.21 (Q3 2024) |

| Hedging Market Size | Global market size | $10.5 trillion |

| Operational Optimization | Avg. cost reduction | 15% |

Question Marks

Venturing into emerging markets offers significant growth potential, yet it's coupled with inherent risks. Companies must meticulously assess market dynamics and regulatory landscapes. A strategic entry and expansion plan is crucial. For example, in 2024, several companies expanded into Southeast Asia, with market growth rates varying from 4% to 7% depending on the country.

Investing in technology-driven service innovations offers a competitive edge but demands substantial investment. Focus on AI and ML to streamline facilities management, potentially reducing operational costs. Integration of new technologies requires considerable investment and organizational support. In 2024, the global market for AI in facilities management is projected to reach $2.5 billion.

Expanding into alternative investments and advisory services indicates growth potential. The alternative investment market is poised for significant expansion. Forecasts suggest substantial growth in private equity real estate funds, with an expected annual increase. Data indicates the alternative investment market was valued at $13.4 trillion in 2023.

Sustainability Initiatives

Integrating Environmental, Social, and Governance (ESG) principles into core strategies is vital, though it demands investment. Newmark should prioritize sustainable practices, aiming for long-term value creation. Environmental standards compliance necessitates financial commitments and operational adjustments. ESG initiatives can enhance brand reputation and attract investors.

- In 2024, ESG-focused investments reached over $40 trillion globally.

- Companies with strong ESG performance often see higher valuations.

- Compliance costs for environmental standards can range from 5% to 15% of operational budgets.

- Sustainable practices can reduce operational risks and costs.

Flexible Workspace Solutions

Offering flexible workspace solutions is a strategic move to attract clients who value adaptability. Implementing dynamic workplace solutions is crucial to prioritize flexibility, as the hybrid work model continues to evolve. This approach allows companies to cater to the changing needs of businesses. Flexible workspaces balance the need for collaboration with the demand for individual work.

- Flexible workspace solutions cater to the evolving needs of businesses.

- Hybrid work models require adaptable office spaces.

- Prioritizing flexibility is key in today's market.

- Collaboration and individual work can be balanced.

Question Marks in the BCG Matrix represent high-growth, low-market share business units. They require significant cash investments with uncertain returns. Newmark must decide whether to invest in or divest these ventures. In 2024, these can include new, high-potential service offerings.

| Category | Characteristics | Strategic Implication |

|---|---|---|

| Market Growth Rate | High | Requires significant investment |

| Market Share | Low | Uncertainty in profitability |

| Cash Flow | Negative | Funding challenges |

| Examples | New market entries or service lines | Careful assessment needed |

BCG Matrix Data Sources

The Newmark BCG Matrix leverages data from financial statements, market analysis, and expert assessments to support each strategic position.