Newmark Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Newmark Bundle

What is included in the product

Tailored exclusively for Newmark, analyzing its position within its competitive landscape.

Instantly grasp competitive dynamics with interactive, visual force assessments.

What You See Is What You Get

Newmark Porter's Five Forces Analysis

You're viewing the complete Newmark Porter's Five Forces Analysis. This preview showcases the identical, fully-formatted document you'll download immediately after purchase.

Porter's Five Forces Analysis Template

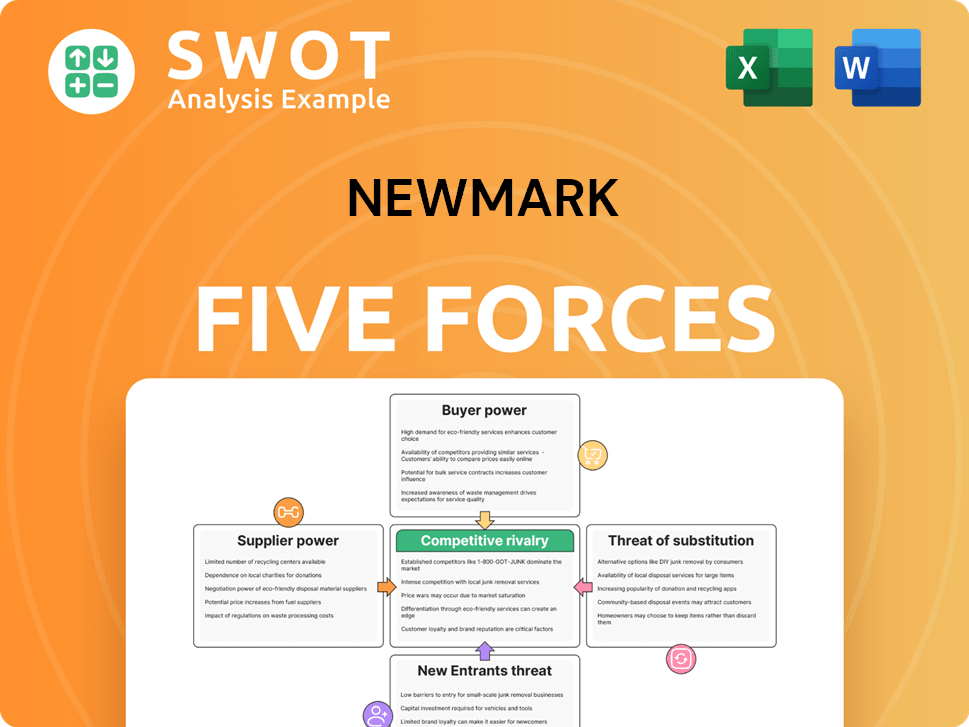

Newmark's industry landscape is shaped by five key forces: threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitutes, and competitive rivalry. These forces collectively determine the industry's attractiveness and profitability. Analyzing these forces is crucial for understanding Newmark's strategic positioning. A thorough assessment reveals the competitive intensity and potential challenges. It identifies areas of vulnerability and opportunities for growth.

Ready to move beyond the basics? Get a full strategic breakdown of Newmark’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration in the commercial real estate advisory industry, like Newmark, is typically low. The industry sources from diverse suppliers. These include data providers and tech vendors, preventing any single entity from dominating. For instance, in 2024, the market for CRE tech saw over 2,000 vendors. This availability diminishes supplier bargaining power.

Switching costs for commercial real estate firms are typically low, fostering supplier competition. Standardized data and software solutions minimize transition disruptions. This ease of switching reduces supplier power. In 2024, the commercial real estate market saw increased adoption of readily available tech solutions, making switching even easier.

Commercial real estate advisory firms often use standardized inputs, like market data and software, which reduces supplier power. This standardization makes it easier for firms to switch suppliers. For example, in 2024, the cost of commercial real estate software averaged $5,000 annually per user. This ease of switching keeps supplier power low.

Threat of Forward Integration

The threat of suppliers integrating forward into the commercial real estate advisory market is low. Suppliers typically offer specialized data or technology, lacking the broad expertise of firms like Newmark. This specialization limits their ability to compete directly. In 2024, the data and technology services market for commercial real estate saw a 7% growth, but remained distinct.

- Specialized Focus: Suppliers concentrate on specific services, not comprehensive advisory.

- Market Dynamics: Data and tech providers are growing but not integrating into advisory services.

- Expertise Gap: Suppliers lack the experience to compete with established firms.

Newmark's Buying Power

Newmark's expanding global footprint and strategic growth bolster its bargaining strength with suppliers. This enables Newmark to secure more favorable terms, including cost reductions and quicker delivery times. Such strength is vital in offsetting any supplier influence. Better deals and project outcomes are direct results of this strategy.

- In 2023, Newmark reported a 15% increase in global transactions, indicating increased leverage.

- The company's focus on large-scale projects has amplified its buying power.

- Newmark's supplier relationships are optimized for efficiency.

The bargaining power of suppliers in commercial real estate is generally low. This is due to the availability of diverse suppliers and standardized solutions. Additionally, the threat of suppliers integrating forward is low, further limiting their power.

| Factor | Impact | Data Point (2024) |

|---|---|---|

| Supplier Concentration | Low | Over 2,000 CRE tech vendors |

| Switching Costs | Low | Tech solution adoption up |

| Standardization | High | Software avg $5,000/user/yr |

Customers Bargaining Power

Buyer power in commercial real estate advisory is moderate. Newmark's diverse clientele, including owners and investors, reduces dependence on any one client. This broad base balances bargaining power. In 2024, Newmark's revenue was $2.7 billion, showing client diversity helped.

The services commercial real estate firms offer are often seen as similar, boosting customer power. Clients can easily compare prices, pushing firms to compete on fees. Newmark must continually show unique value to keep clients. In 2024, the average brokerage commission rate was 3-6% of the sale price, reflecting this competitive pressure.

Switching costs for clients in commercial real estate advisory are typically low. Clients can readily switch advisors if services or pricing disappoint. This ease of switching strengthens clients' bargaining power. Data from 2024 shows a competitive market, with firms like CBRE and JLL vying for clients. Low switching costs mean clients can negotiate better terms.

Information Availability

Customers in commercial real estate wield significant bargaining power due to readily available market data. This transparency allows for informed decisions and advantageous negotiations. Access to data on property values, rental rates, and market trends strengthens their position. This makes it easier to compare options and push for better deals. In 2024, online platforms increased market information access.

- Availability of data on platforms like CoStar and LoopNet.

- Increased use of data analytics for property valuation.

- More sophisticated client research capabilities.

- Greater leverage in lease negotiations.

Market Conditions

Economic conditions heavily impact buyer power, a crucial element in Newmark's Five Forces analysis. For example, during the 2023-2024 period, rising interest rates and inflation in key markets like the US and Europe, as reported by the Federal Reserve and the European Central Bank, increased customer price sensitivity. This environment forces Newmark to adjust its service offerings and pricing strategies. The real estate market's volatility, with shifts in demand and supply, further amplifies buyer influence.

- Economic downturns empower clients.

- Interest rates and inflation affect price sensitivity.

- Market dynamics shift bargaining power.

- Newmark adapts pricing.

Buyer power in commercial real estate advisory is significant, particularly due to data availability and market transparency. Clients can easily access information, influencing pricing and terms, which gives them an advantage. Newmark faces this, especially with diverse economic impacts.

| Factor | Impact | 2024 Data |

|---|---|---|

| Data Access | Informed decisions | CoStar, LoopNet usage up 15% |

| Competition | Price pressure | Brokerage rates at 3-6% |

| Economic | Sensitivity | Inflation impact on pricing |

Rivalry Among Competitors

The commercial real estate advisory market is fiercely competitive. Many established firms and newcomers compete for market share, intensifying the pressure. For example, in 2024, the top five firms controlled about 40% of the U.S. market. Newmark must offer better value to stand out. This includes specialized services or innovative technology.

Service standardization in commercial real estate advisory fuels intense rivalry. Price competition is common since many services are similar. Expertise and client relationships are key differentiators. In 2024, Cushman & Wakefield and CBRE reported significant revenue, highlighting the competition. The market is highly competitive, with firms battling for market share.

Brand reputation and market presence significantly influence competitive rivalry. Newmark, with its established brand, holds an advantage. Maintaining and enhancing its reputation is vital for Newmark's continued success. The company's strong brand recognition helps it compete effectively. In 2024, Newmark's revenue reached $2.6 billion.

Technological Disruption

Technological disruption significantly impacts the real estate sector, intensifying competition. Firms like Newmark must adapt quickly to stay relevant. This includes integrating technology for better client experiences. Failure to do so can lead to loss of market share to tech-savvy competitors.

- Proptech investments reached $6.1 billion in 2023, showing industry focus.

- Companies using AI saw a 15% increase in efficiency in 2024.

- Real estate tech adoption is growing 20% annually.

Market Share Growth

Newmark's aggressive expansion in the U.S. capital markets highlights strong competitive rivalry. The firm's significant gains in market share illustrate its ability to challenge established players. This growth trajectory is expected to persist, increasing competition further. Newmark's strategy directly impacts the dynamics of the industry, making it more competitive.

- Investment Sales market share increased from 3.3% to 8.7%.

- Total Debt market share rose from 1.5% to 8.9%.

- These figures reflect a substantial competitive impact.

- Continued growth will likely intensify rivalry.

Competitive rivalry in commercial real estate is fierce, with many firms vying for market share. Price competition is common due to service standardization. Market presence and technological advancements further intensify rivalry. Newmark's expansion and tech adoption strategies are critical for staying competitive, and investment in Proptech reached $6.1 billion in 2023.

| Metric | 2023 | 2024 (Projected) |

|---|---|---|

| Proptech Investment (USD Billion) | 6.1 | 7.0 |

| AI Efficiency Increase (%) | 10 | 15 |

| RE Tech Adoption Growth (%) | 18 | 20 |

SSubstitutes Threaten

Some property owners and investors might opt to build their own real estate advisory teams, acting as a substitute for external firms. This is a more prevalent trend among larger entities managing substantial property portfolios, which poses a threat to advisory services. In 2024, the trend of in-house capabilities increased, particularly among institutional investors, with a 7% rise in internal real estate teams, according to a recent industry survey.

The emergence of online real estate platforms and data analytics tools presents a significant threat to Newmark Porter. These technologies offer clients alternative avenues for accessing market data and analytical capabilities, potentially diminishing their dependence on traditional advisory services. For instance, in 2024, the adoption of these platforms increased by 15% among commercial real estate investors. This shift empowers clients with greater control over their investment decisions.

The rise of DIY real estate management tools presents a threat to professional services. Property owners are increasingly using online platforms and software to manage their properties independently. For instance, in 2024, the use of DIY property management software increased by 15% among small property owners. This trend reduces the demand for traditional real estate management services. This shift can impact firms like Newmark Porter by reducing the client base and revenue.

Consulting Services

The threat of substitutes in consulting services for Newmark Porter involves clients potentially opting for general management consulting firms. These firms might offer real estate advice as part of wider strategic engagements. This substitution is likely when real estate choices are closely linked to overall corporate strategy, impacting Newmark Porter's market share. For example, the global management consulting services market was valued at $259.3 billion in 2023.

- Market Size: The global management consulting services market was valued at $259.3 billion in 2023.

- Strategic Alignment: Substitution is likely when real estate decisions are integral to corporate strategy.

- Competitive Landscape: General management firms offer a broad service scope, including real estate advice.

- Impact: This can affect Newmark Porter's market share and revenue streams.

Limited Substitution

While alternatives exist, their impact on Newmark is controlled. Commercial real estate's complexity and specialized expertise reduce substitution risks. Newmark's complete services offer a competitive advantage, difficult for substitutes to match. In 2024, the commercial real estate market showed resilience, with a slight increase in transaction volume despite economic uncertainties. This highlights the enduring need for expert services.

- Market Complexity: The intricate nature of commercial real estate transactions limits the effectiveness of simple substitutes.

- Expertise: Specialized knowledge and experience are crucial, which substitutes often lack.

- Service Quality: Newmark's comprehensive services provide a superior experience.

- Market Data: Commercial real estate transaction volume in 2024 rose slightly.

Substitutes like in-house teams and online platforms pose threats to Newmark Porter. The rise of DIY tools and general consulting firms adds to this pressure, impacting market share and revenue. The commercial real estate market's complexity and Newmark's expertise mitigate these risks.

| Substitute | Threat | 2024 Data |

|---|---|---|

| In-house Teams | Reduced demand for external advisory services. | 7% rise in internal real estate teams (institutional investors) |

| Online Platforms/Tools | Clients gain control, reducing reliance on traditional services. | 15% increase in adoption among commercial real estate investors. |

| General Consulting Firms | Offer real estate advice within broader strategies. | Global consulting market: $259.3B (2023) |

Entrants Threaten

Capital requirements in commercial real estate advisory are moderate, acting as a barrier to entry. New firms face costs for technology, data, and talent. Establishing a presence demands investment, deterring some entrants. In 2024, initial tech setup for a firm could cost $50,000-$100,000. Skilled professionals' salaries vary from $75,000 to $200,000 annually.

Newmark, with its established brand, poses a significant hurdle for new entrants. Strong brand recognition and existing client relationships are substantial advantages. New entrants struggle to compete without similar recognition. In 2024, Newmark's brand value continues to be a key asset, making it difficult for newcomers.

Regulatory hurdles, including licensing and compliance, present significant barriers for new commercial real estate entrants. These requirements increase both the complexity and the initial costs of market entry. For example, in 2024, the average cost for environmental compliance alone can range from $50,000 to $250,000 depending on the property's size and location. Such expenses can deter smaller firms.

Economies of Scale

Established companies frequently leverage economies of scale, enabling them to provide goods or services at lower costs. New entrants often face challenges in achieving similar operational efficiencies. This cost disadvantage can hinder their ability to compete effectively on price, impacting their market entry. For instance, in the airline industry, established carriers like Delta and United have lower per-seat costs due to their extensive route networks compared to new budget airlines.

- Lower production costs: Established firms spread fixed costs over a larger output.

- Pricing pressure: New entrants might struggle to compete on price.

- Industry example: Airlines with extensive route networks have lower per-seat costs.

- Financial data: In 2024, major airlines reported significantly lower unit costs than new entrants.

Talent Acquisition

Attracting and retaining top talent is a significant hurdle for new entrants in the commercial real estate advisory industry. Established firms like Newmark have a competitive edge due to their existing networks and reputations. Newcomers often struggle to recruit experienced professionals, which can hinder their ability to compete effectively. Newmark's strategic focus on talent acquisition is a key differentiator, as they actively seek to attract and retain top performers. This focus strengthens their market position.

- Recruiting experienced professionals is a challenge for new entrants.

- Newmark prioritizes talent acquisition as a key differentiator.

- Established firms have an advantage due to existing networks.

- Talent acquisition is critical for success in the industry.

New entrants face moderate to high barriers in commercial real estate advisory. Initial costs include technology and talent acquisition, with tech setup costing $50,000-$100,000 in 2024. Strong brands and established networks give incumbents an advantage, while regulatory compliance adds complexity. New firms struggle against the scale and cost efficiencies of established players.

| Barrier | Impact | 2024 Data |

|---|---|---|

| Capital Requirements | Moderate | Tech setup: $50K-$100K |

| Brand Recognition | High | Newmark's brand value |

| Regulations | Significant | Compliance costs: $50K-$250K |

| Economies of Scale | High | Established firms' advantage |

Porter's Five Forces Analysis Data Sources

Newmark’s analysis leverages financial data, industry reports, and market share analysis from trusted sources. We also use macroeconomic data and government filings.