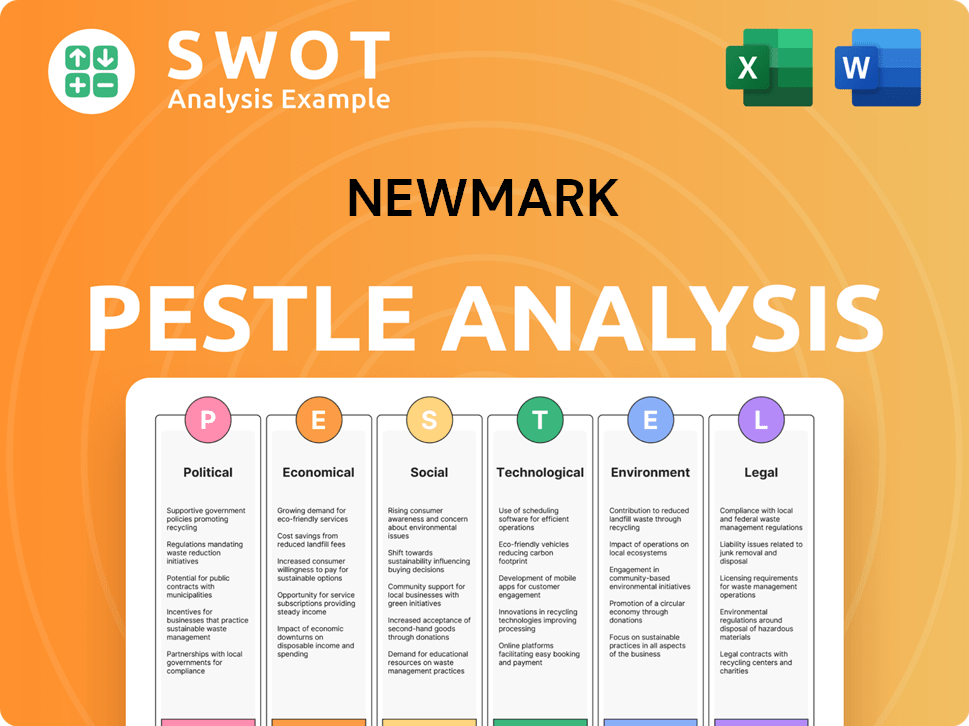

Newmark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Newmark Bundle

What is included in the product

Analyzes external factors impacting Newmark across Politics, Economics, Society, Technology, Environment, Law.

Neatly organized and easy to grasp, simplifying strategy sessions and decision-making processes.

Preview Before You Purchase

Newmark PESTLE Analysis

This preview showcases the complete Newmark PESTLE Analysis document.

The content is fully developed and professionally formatted.

What you see is the exact, ready-to-use file you’ll receive after purchase.

It is ready to download immediately after buying.

Everything visible is part of the finished document.

PESTLE Analysis Template

Navigate Newmark's future with our detailed PESTLE Analysis. Uncover crucial external forces shaping the real estate giant's strategy and performance. From economic shifts to technological advancements, understand the complete picture. Gain a competitive edge and refine your market approach with in-depth insights. Buy the full report now and empower your decisions!

Political factors

Changes in government regulations, like those seen in 2024 concerning environmental standards, directly affect Newmark's advisory role. Zoning law modifications can reshape development projects, as observed in several U.S. cities where density regulations are being updated. Land use policies, influenced by political agendas, impact property values and development feasibility; for example, in Q1 2024, new infrastructure projects in California altered land values. Building code updates, often tied to sustainability goals, influence construction costs and design choices, with an expected 5% rise in construction expenses anticipated by late 2024 due to new codes.

Political stability significantly impacts Newmark's operations. Geopolitical events, like the Russia-Ukraine war, caused market instability. Newmark's global reach exposes it to diverse political climates. The company must navigate varying regulations and potential disruptions. For example, in 2024, real estate investment in conflict zones dropped by 30%.

Government tax policies, encompassing property, corporate, and capital gains taxes, significantly influence real estate investment profitability. Alterations in these policies can reshape investor behavior and commercial property demand. For instance, the 2017 Tax Cuts and Jobs Act in the U.S. impacted real estate investments. These changes directly affect Newmark's advisory services.

Infrastructure Spending

Government infrastructure spending significantly impacts real estate markets. Investments in transportation and public facilities boost property values and attract development. For Newmark, this creates opportunities to provide services in areas undergoing infrastructure improvements. The U.S. government plans to invest heavily in infrastructure through 2025.

- The Bipartisan Infrastructure Law allocated $1.2 trillion.

- This includes funds for roads, bridges, and public transit.

- These investments are expected to boost real estate values.

Trade Policies and International Relations

Trade policies, including agreements and tariffs, significantly influence Newmark's clients. International relations play a crucial role in foreign investment in commercial real estate. For example, the U.S.-China trade tensions in 2024/2025 have impacted property values. Changes in these areas directly affect capital flow and demand.

- U.S. commercial real estate saw a 6.5% decline in foreign investment during 2023 due to global uncertainties.

- Newmark reported a decrease in transaction volume in regions affected by trade disputes in Q4 2024.

- Tariff implementations can increase costs for businesses, affecting their real estate needs.

Political factors shape Newmark's advisory work through regulatory changes, affecting zoning and building codes, with an estimated 5% rise in construction costs by late 2024. Political stability is crucial, as geopolitical events such as the Russia-Ukraine conflict caused market instability, reducing real estate investment in conflict zones by 30% in 2024.

Government policies like tax changes and infrastructure spending also significantly impact the real estate market and Newmark's services; for example, the Bipartisan Infrastructure Law allocated $1.2 trillion, which is expected to boost property values.

Trade policies, influenced by global relations and tariffs, affect client investments; a 6.5% decline in U.S. foreign investment in commercial real estate was seen in 2023 due to global uncertainties.

| Political Factor | Impact on Newmark | 2024/2025 Data |

|---|---|---|

| Regulations & Zoning | Advisory Services, Project Viability | 5% rise in constr. costs (est. late 2024) |

| Political Stability | Market Stability, Global Reach | 30% drop in conflict zone inv. (2024) |

| Government Spending | Property Valuation, Development | $1.2T Bipartisan Infrastructure Law |

| Trade Policies | Client Investments, Market Demand | 6.5% decline in foreign inv. (2023) |

Economic factors

Interest rate changes heavily influence real estate financing costs. Higher rates increase borrowing expenses, potentially curbing investment and development. In Q1 2024, the average U.S. 30-year fixed mortgage rate was around 6.8%. Newmark's capital markets arm feels these impacts directly.

Inflation significantly impacts Newmark's operational costs, including construction and maintenance. High inflation erodes investor and tenant purchasing power, affecting property values. In Q1 2024, the U.S. inflation rate was about 3.5%, influencing real estate decisions. Newmark must adjust valuations and advisory services to reflect these inflationary trends, safeguarding profitability.

Economic growth and recession risks are critical for commercial real estate. Strong economies boost demand for office and retail spaces. A downturn can increase vacancies and lower transaction values. In 2024, the US GDP grew by 3.1%, but recession risks remain. Newmark's success hinges on navigating these cycles.

Availability of Capital and Credit Conditions

The availability of capital and credit conditions significantly affect real estate activities, influencing Newmark's operations. Tight credit can hinder investment and development, crucial for Newmark's capital markets and advisory services. Loan maturity is a current market challenge. For example, in Q1 2024, commercial real estate loan delinquencies rose to 1.4%.

- Rising interest rates and reduced lending activity impact Newmark's revenue.

- Shorter loan terms pose a risk, potentially increasing refinancing needs.

- Access to capital is essential for sustaining property transactions.

Employment Rates and Consumer Spending

Employment rates significantly shape demand for office spaces, and consumer spending heavily impacts retail and industrial sectors. A strong commercial real estate market typically arises from high employment and robust consumer spending, which directly benefits Newmark's leasing and advisory services. For instance, the U.S. unemployment rate was at 3.9% in April 2024, reflecting a stable job market. Retail sales also showed resilience with a 0.7% increase in March 2024, indicating healthy consumer activity.

- U.S. unemployment rate: 3.9% (April 2024)

- Retail sales increase: 0.7% (March 2024)

- Consumer confidence: stable (early 2024)

- Commercial real estate growth: positive outlook (2024/2025)

Economic factors heavily influence Newmark's operations, especially interest rates and inflation. The U.S. 30-year fixed mortgage rate was ~6.8% in Q1 2024. Economic growth, reflected by 3.1% GDP growth in 2024, impacts property demand.

Capital availability, with commercial real estate loan delinquencies rising to 1.4% in Q1 2024, also shapes activities. Strong employment, a 3.9% rate in April 2024, and retail sales, up 0.7% in March 2024, support the commercial real estate market.

| Metric | Data | Impact on Newmark |

|---|---|---|

| Mortgage Rate (Q1 2024) | ~6.8% | Affects financing costs and investment |

| U.S. Inflation Rate (Q1 2024) | ~3.5% | Influences operational costs, property values |

| U.S. GDP Growth (2024) | 3.1% | Affects demand for office/retail spaces |

| Commercial Real Estate Loan Delinquencies (Q1 2024) | 1.4% | Impacts investment and development |

Sociological factors

Changes in population demographics, like age distribution and migration, significantly impact commercial property demand. For example, the U.S. population is aging, with those 65+ growing. This impacts healthcare and senior housing needs. Understanding these shifts is critical for advising clients effectively. In 2024, the over-65 population in the U.S. is approximately 58 million, a key factor for Newmark to consider.

Urbanization and suburbanization significantly influence commercial real estate demand. Recent data shows a 2% increase in urban population density. This trend impacts property values and vacancy rates. For example, in 2024, suburban office vacancy rates were 18%, while urban rates were 14%.

Evolving lifestyles, including the rise of remote and hybrid work, significantly impact demand for office space. This shift compels real estate firms like Newmark to adapt. Specifically, 2024 data shows a 15% decrease in office occupancy rates in major US cities. Newmark must advise on diverse workspace solutions to stay competitive.

Consumer Preferences and Behavior

Consumer preferences and behaviors significantly affect retail and hospitality. E-commerce growth has reshaped demand for physical retail; Newmark must advise clients on adapting. In 2024, online retail sales hit $1.1 trillion, impacting brick-and-mortar stores. Newmark's strategies must evolve to address these shifts.

- E-commerce sales reached $1.1 trillion in 2024.

- Changing consumer demands influence retail strategies.

- Newmark adapts to advise clients effectively.

Social Equity and Inclusion

Social equity and inclusion are increasingly vital in real estate. This growing focus influences development and investment decisions, with clients now prioritizing projects addressing social concerns. Newmark's advisory services and deal types are adapting to these shifts. For example, in 2024, ESG-focused real estate investments saw a 15% increase.

- ESG investments are up 15% in 2024.

- Clients seek socially responsible projects.

- Newmark adapts services to meet needs.

- Social factors drive investment choices.

Demographic changes, like an aging population, drive specific real estate demands. Urbanization affects property values, with differing vacancy rates between urban and suburban areas. Evolving lifestyles and remote work significantly reshape the need for office spaces; the retail sector shifts due to e-commerce. Social equity and inclusion are also crucial in shaping decisions.

| Factor | Impact | 2024 Data |

|---|---|---|

| Aging Population | Healthcare/Senior Housing | 58M over 65 in US |

| Urbanization | Property Values/Vacancy | Urban vacancy at 14% |

| Remote Work | Office Space Demand | 15% drop in office |

Technological factors

The rise of PropTech reshapes real estate. Data analytics, AI, and digital platforms are key. Newmark must use tech to stay competitive. PropTech investments surged, with $12.6 billion in 2023. Digital tools can boost efficiency and client service.

The surge in data analytics offers Newmark crucial insights. Data analysis reveals market trends and boosts property performance analysis. For example, using predictive analytics, Newmark could forecast rent growth with 85% accuracy. This aids in superior investment advice and service enhancements.

Building technologies, including smart systems and eco-friendly designs, are reshaping property development. Newmark must integrate these for client satisfaction and compliance. The global smart building market is projected to reach $130.5 billion by 2024. Energy-efficient buildings can reduce operational costs significantly.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are paramount in real estate, especially with Newmark's handling of sensitive information. The real estate sector faces growing cyber threats; in 2024, the average cost of a data breach in the US real estate sector was approximately $4.5 million. Newmark must implement robust measures to protect client and property data. Maintaining trust requires proactive cybersecurity strategies.

- Data breaches cost the real estate sector millions annually.

- Cybersecurity investments are crucial for protecting sensitive information.

- Client trust hinges on secure data handling practices.

Virtual Reality and Augmented Reality

Virtual reality (VR) and augmented reality (AR) are transforming real estate experiences. Newmark can offer virtual property tours to clients. These technologies enhance marketing and sales, especially for remote clients. The global AR and VR market is projected to reach $86.2 billion by 2025.

- VR/AR offers immersive property views.

- Enhances client engagement.

- Boosts marketing reach.

- Market growth by 2025.

Newmark must adopt new tech to thrive. Key are data analytics and AI-driven tools. They must invest in cybersecurity. By 2025, the AR/VR market will reach $86.2 billion, thus enhancing their competitiveness.

| Technology Factor | Impact on Newmark | Financial Data/Statistics (2024/2025) |

|---|---|---|

| PropTech Adoption | Boosts efficiency, client service. | PropTech investment: $12.6B (2023); $14B (projected 2025) |

| Data Analytics | Insights, improved investment advice. | Predictive analytics: 85% accuracy rent growth; Data breach cost: $4.5M (US, 2024) |

| Building Tech | Client satisfaction, eco-compliance. | Smart building market: $130.5B (2024). |

| Cybersecurity | Protects data, client trust. | Cybersecurity investment focus due to data breaches |

| VR/AR | Enhanced marketing, sales. | AR/VR market: $86.2B (2025 projected). |

Legal factors

Newmark faces intricate real estate laws across different areas, impacting property deals and development. Compliance is crucial for legal operations and deal feasibility. For instance, in 2024, regulatory changes in New York City affected zoning laws, influencing several projects. Any shifts in these rules can significantly alter property values.

Newmark, as a real estate giant, depends on legally binding contracts for various operations. These include client agreements, property sales, and service delivery. A solid grasp of contract law is crucial for Newmark to minimize legal issues.

Lending and financing regulations are critical for Newmark. These rules, especially those affecting mortgages, shape the real estate market. In 2024, regulatory changes could impact funding costs. For example, the Federal Reserve's actions on interest rates can alter mortgage rates, influencing Newmark's deals. These shifts directly affect the company's financial performance.

Environmental Regulations and Compliance

Newmark faces growing environmental regulations tied to buildings and land use. These regulations, focusing on energy efficiency and emissions, impact both Newmark and its clients. Non-compliance can lead to penalties and legal issues. For instance, the U.S. Green Building Council reported a 10% increase in LEED-certified projects in 2024.

- LEED certification costs can range from $2,000 to $20,000, depending on project size.

- The EPA estimates that buildings account for 39% of total U.S. energy consumption.

- The US government has set a target to achieve a 50-52% reduction from 2005 levels in economy-wide net greenhouse gas pollution by 2030.

Labor Laws and Employment Regulations

Newmark, operating globally, must comply with diverse labor laws and employment regulations. These regulations impact hiring, employee relations, and costs across different regions. For example, the European Union's GDPR significantly affects data handling in HR. Compliance costs are rising; in 2024, U.S. companies spent an average of $4,700 per employee on compliance.

- Compliance with the Fair Labor Standards Act (FLSA) is crucial in the US.

- The costs of non-compliance, including fines and legal fees, are substantial.

- Changes in regulations in 2024-2025 will require continuous adaptation.

- Employee relations are impacted by unionization efforts.

Newmark must adhere to intricate real estate, contract, and lending regulations, impacting deal viability and operations. Environmental laws focused on energy efficiency also influence its strategies, with LEED certification costing up to $20,000. Furthermore, global operations require compliance with diverse labor laws and employment rules.

| Regulation Type | Impact | 2024/2025 Data |

|---|---|---|

| Real Estate Laws | Affects property deals | NYC zoning law changes. |

| Lending & Financing | Influences market | Fed actions alter mortgage rates. |

| Environmental Regs | Impact buildings, land | 10% increase in LEED projects. |

Environmental factors

Climate change intensifies extreme weather, increasing property risks. In 2024, insured losses from U.S. weather disasters hit $60 billion. Newmark must evaluate climate-related impacts. This involves assessing property values and insurance costs. Clients need advice on these evolving risks.

Sustainability is crucial; green buildings are gaining popularity due to environmental concerns. Clients now prefer eco-certified properties, impacting investment choices. The green building market is projected to reach $814 billion by 2025, reflecting rising demand. LEED certifications and energy efficiency are key factors in real estate decisions.

Commercial buildings are major energy users. In 2024, buildings accounted for roughly 40% of U.S. energy consumption. Regulations and market trends boost building efficiency. Newmark's services must manage energy consumption. Energy-efficient buildings often have higher valuations and lower operational costs.

Resource Scarcity and Waste Management

Resource scarcity and waste management are significant environmental factors. Sustainable building practices are increasingly influenced by concerns about resource scarcity and the need for effective waste management. This impacts material choices and building designs, with a push toward circular economy models. For example, the construction sector accounts for roughly 40% of global resource consumption. Effective waste management can reduce landfill waste by up to 70%.

- Construction sector accounts for roughly 40% of global resource consumption.

- Effective waste management can reduce landfill waste by up to 70%.

Environmental Regulations and Reporting

Environmental regulations are constantly changing, pushing companies to report their environmental impact and carbon footprint. Newmark and its clients must adhere to these reporting rules and create plans to lessen their environmental effects. In 2024, the global green building materials market was valued at $367.4 billion, and is projected to reach $659.6 billion by 2032. This includes sustainable practices that Newmark can use.

- The global green building materials market was valued at $367.4 billion in 2024.

- The market is projected to reach $659.6 billion by 2032.

Environmental factors significantly affect the real estate industry. Climate change and extreme weather lead to property risk assessments, influencing insurance costs; in 2024, weather disasters cost the U.S. $60 billion in insured losses. Sustainability trends, like the green building market, valued at $367.4 billion in 2024, and growing to $659.6 billion by 2032, drive client preferences.

| Factor | Impact | Data (2024) |

|---|---|---|

| Climate Change | Property risks, insurance costs | $60B in insured losses (U.S.) |

| Sustainability | Green building demand, eco-certifications | $367.4B green building market |

| Regulations | Reporting, carbon footprint plans | Growing market by 2032 to $659.6B |

PESTLE Analysis Data Sources

Newmark's PESTLEs integrate data from economic forecasts, regulatory updates, and market analyses. Each insight is supported by global financial institutions, governmental reports and specialized research publications.