Newmark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Newmark Bundle

What is included in the product

Delivers a strategic overview of Newmark’s internal and external business factors.

Provides focused data analysis for clear problem understanding.

Preview the Actual Deliverable

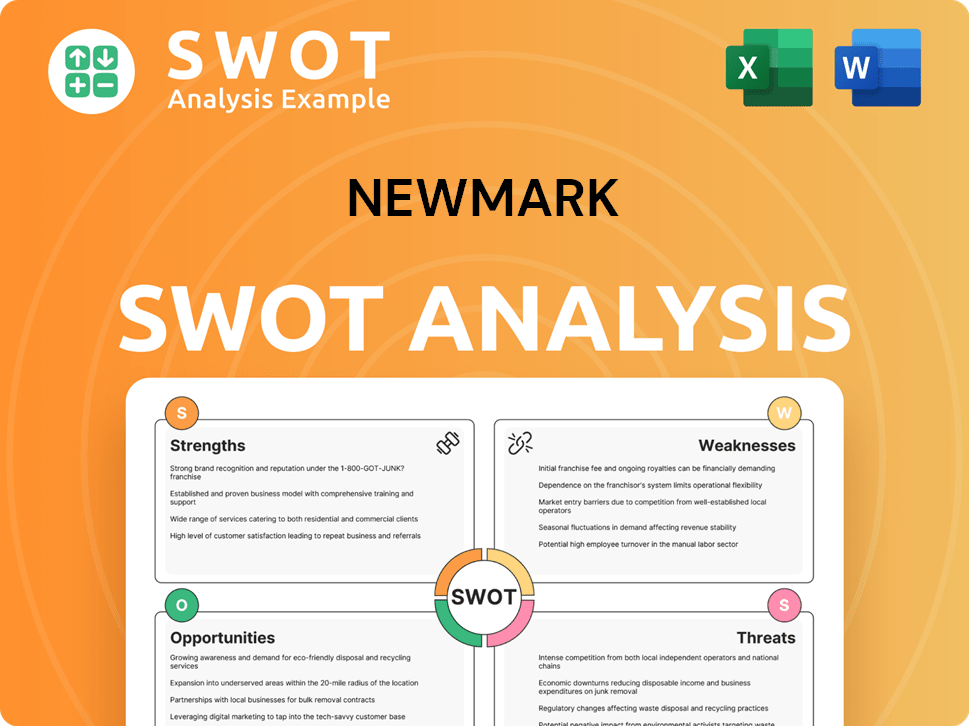

Newmark SWOT Analysis

You're seeing the complete Newmark SWOT analysis document here. This is not a sample—it’s the same professional report you’ll receive after your purchase.

SWOT Analysis Template

Uncover Newmark's strategic landscape! This overview spotlights strengths and weaknesses, with a glimpse into opportunities and threats.

We've revealed just a portion of the data, highlighting critical areas of the company's positioning and outlook.

For deeper strategic insights and actionable data, get the complete SWOT analysis.

Unleash in-depth research, detailed commentary, and an editable Excel matrix to fuel your business goals!

Purchase the full SWOT analysis to get a research-backed breakdown in Word and Excel, allowing strategic planning and effective decision-making.

Strengths

Newmark benefits from a broad global presence, operating in many countries. This expansive reach enables them to assist clients worldwide. Their diverse services, such as leasing and valuation, generate varied income. In Q1 2024, international revenues increased by 8.9% year-over-year, showing strong global performance.

Newmark, founded in 1929, boasts strong brand recognition. They are a top commercial real estate advisory firm worldwide. Newmark has a significant market share, especially in office brokerage. The company's strong market position supports its ability to attract clients and drive revenue. In 2024, Newmark's revenue was approximately $2.7 billion.

Newmark benefits from its seasoned professionals, leveraging their deep market understanding. The firm prioritizes attracting and retaining top talent, critical for expert advice. Newmark's revenue in Q1 2024 was $453.2 million, demonstrating the value of its skilled workforce. This focus on talent boosts its competitive advantage.

Investments in Technology and Data Analytics

Newmark's strategic investments in technology and data analytics are a significant strength. This focus allows them to optimize services and gain a competitive edge. They leverage tech to improve client insights and operational efficiency, which is crucial. Newmark's 2024 tech spending increased by 15%, reflecting its digital focus.

- Enhanced client insights and service delivery.

- Improved operational efficiency and cost savings.

- Increased competitiveness in the market.

- Data-driven decision-making capabilities.

Strong Performance in Key Business Segments

Newmark's strengths include robust performance in key segments. Recent financial results show strong revenue growth in Capital Markets and Leasing. This resilience indicates effective income generation, even amid market uncertainties. Newmark's strategic focus on these areas contributes to its overall financial health.

- Capital Markets revenue grew significantly in 2024.

- Leasing segment also showed strong growth.

- This demonstrates the company's market adaptability.

Newmark's global reach, seen in its 8.9% international revenue increase in Q1 2024, highlights its strong market presence. A robust brand, established in 1929, and significant market share boost client attraction, with 2024 revenue around $2.7 billion. Key strengths also lie in its skilled professionals and strategic tech investments, including a 15% rise in tech spending in 2024.

| Strength | Description | Data |

|---|---|---|

| Global Presence | Operates worldwide, assisting global clients. | International revenue up 8.9% (Q1 2024) |

| Brand Recognition | Well-known, top commercial real estate advisory firm. | 2024 Revenue: ~$2.7B |

| Expertise | Seasoned professionals and investments in technology. | 2024 tech spending +15% |

Weaknesses

Newmark's revenue is vulnerable to economic shifts. The commercial real estate market is cyclical. Downturns can hit leasing and capital markets. For example, in 2023, transaction volumes decreased. This sensitivity poses financial risks.

Newmark's revenue heavily relies on the commercial real estate market. This dependency makes the company susceptible to market fluctuations. Rising interest rates, for example, could decrease real estate transactions. In 2024, the commercial real estate market showed signs of slowing down. This market volatility can hinder Newmark's consistent financial performance.

Newmark faces hurdles in sustaining revenue growth amidst market volatility. Its historical revenue growth has shown variability, reflecting industry cycles. For instance, Q1 2024 revenue was $751.6 million. This inconsistency poses a risk. Maintaining consistent growth in a cyclical market is difficult.

High Beta and Stock Volatility

Newmark's high beta signals greater volatility. This means its stock price can fluctuate more than the overall market. For example, in 2024, Newmark's beta was around 1.5, suggesting it moved 1.5 times as much as the market. Such volatility can lead to larger potential gains but also greater losses, which may deter risk-averse investors.

- High Beta: Indicates higher volatility.

- Market Sensitivity: Stock price swings more than the market.

- Investor Risk: May deter risk-averse investors.

- 2024 Beta: Approximately 1.5.

Dependence on Transactional Revenues

Newmark's reliance on transactional revenues presents a key weakness. A substantial part of their income is tied to the volume of deals. This makes them vulnerable to market fluctuations. For example, in 2023, a market slowdown impacted brokerage revenues.

- Transactional revenue dependence makes Newmark susceptible to market volatility.

- Slower transaction volumes can lead to reduced financial performance.

Newmark’s high beta highlights greater stock volatility, potentially deterring investors. Transactional revenue dependence exposes them to market downturns, affecting financial outcomes. Revenue growth inconsistency poses another challenge amid market fluctuations.

| Weakness | Description | Impact |

|---|---|---|

| High Beta | Stock's volatility exceeds market. | Investor risk increases. |

| Transactional Revenue Reliance | Significant deal volume dependence. | Market slowdown affects financials. |

| Inconsistent Growth | Variable revenue, e.g., Q1 2024 was $751.6M | Growth is hard to sustain. |

Opportunities

As economies rebound, Newmark can leverage growing demand for commercial real estate services. Increased market activity, especially in sectors like industrial, offers revenue growth opportunities. In Q1 2024, industrial saw strong leasing activity. This aligns with Newmark's strategic focus. This market recovery boosts their potential for increased profitability.

The rising emphasis on sustainability and tech in real estate presents Newmark opportunities. They can provide specialized consulting, focusing on green building practices. In 2024, sustainable building saw a 15% growth. Newmark could also leverage tech platforms. This helps meet changing client demands efficiently.

Newmark can broaden its reach by tapping into emerging markets. This includes expanding services in growing sectors like tech, remote work, and specialized properties. For instance, student housing saw a 5.5% increase in 2024, indicating potential growth. The tech sector's real estate needs are also rising.

Strategic Partnerships and Collaborations

Newmark can boost its capabilities by teaming up with tech companies and service providers. These partnerships can improve services, expand market presence, and open doors to new growth opportunities. For example, in 2024, strategic alliances helped Newmark increase its revenue by 8% in specific sectors. Collaborations with PropTech firms also allowed Newmark to integrate innovative solutions, which is crucial for staying competitive.

- Revenue increase of 8% due to strategic alliances (2024).

- Integration of innovative PropTech solutions.

- Expansion into new market segments.

- Enhanced service offerings.

Significant Volume of Maturing CRE Debt

A large volume of commercial real estate (CRE) debt is maturing, creating opportunities for Newmark. This trend boosts its capital markets business, offering advisory, restructuring, and financing services. In 2024, over $400 billion in CRE debt matured, presenting a substantial market for Newmark. The firm can capitalize on this by assisting with refinancing and debt solutions.

- Over $400B CRE debt matured in 2024.

- Newmark provides advisory and financing services.

- Opportunity for restructuring and refinancing.

- Capital markets business benefits.

Newmark can leverage the rebound in commercial real estate markets and growing sectors like industrial to boost revenue and profitability, as industrial leasing was strong in Q1 2024.

They can capitalize on sustainability trends by offering green building practices consulting, which saw a 15% growth in 2024, and utilize tech platforms.

Opportunities also lie in expanding services into emerging markets and forming strategic partnerships that enhanced revenue by 8% in specific sectors in 2024. Maturing CRE debt (over $400B in 2024) fuels their capital markets business.

| Opportunity | Description | Data |

|---|---|---|

| Market Growth | Leverage market recovery and expanding sectors. | Industrial leasing Q1 2024: Strong activity |

| Sustainability & Tech | Offer specialized consulting and tech solutions. | Sustainable building growth (2024): 15% |

| Strategic Alliances | Form partnerships and expand market presence. | Revenue increase from alliances (2024): 8% |

Threats

Economic volatility poses a significant threat. Uncertainty can diminish demand for commercial real estate services. This directly affects Newmark's revenue and profitability. For instance, in Q4 2023, macroeconomic headwinds impacted deal volumes. This led to a revenue decrease of 12% year-over-year.

Newmark faces fierce competition in commercial real estate. Established firms and new entrants alike vie for market share, creating pricing pressures. This competition can squeeze profit margins, affecting financial performance. In 2024, CBRE and JLL, key rivals, reported strong revenue, intensifying the fight for deals.

Regulatory shifts in real estate, zoning, and environmental laws are threats. Newmark's operations and client deals could suffer from these changes. Stricter environmental rules might increase project costs. In 2024, compliance costs in the real estate sector rose by an average of 7%. These changes require constant adaptation.

Technological Disruption

Technological advancements pose a threat to Newmark's operations. Disruptive technologies, like AI and blockchain, could change real estate practices. Newmark must invest in tech to stay competitive. Failure to adapt may lead to market share loss. In 2024, proptech investment hit $10.7B, highlighting the need for tech focus.

- Increased competition from proptech companies.

- Risk of outdated systems and processes.

- Need for significant investment in technology.

- Potential for data security and privacy issues.

Geopolitical Headwinds and Global Trade Uncertainty

Geopolitical instability and trade uncertainties pose significant threats to Newmark. Tariffs and trade wars can disrupt global commerce, potentially decreasing demand for commercial real estate. This could lead to reduced investment and slower growth in key markets. The IMF projects global trade growth of 3.3% in 2024, a slight increase from 2.6% in 2023, highlighting the ongoing volatility.

- Trade tensions can increase operational costs.

- Economic slowdowns can curb real estate demand.

- Geopolitical events can create market volatility.

Newmark's operations face substantial threats.

These include economic instability impacting demand and technological disruption requiring significant investment.

Increased competition from established firms and proptech companies puts pressure on margins; 2024 proptech investment reached $10.7B.

| Threats | Impact | 2024 Data |

|---|---|---|

| Economic Volatility | Reduced Demand & Revenue | Q4 Revenue down 12% YoY |

| Intense Competition | Margin Squeeze | CBRE, JLL reported strong revenue |

| Regulatory Changes | Increased Compliance Costs | Sector costs up 7% |

SWOT Analysis Data Sources

Newmark's SWOT relies on financial reports, market analysis, and expert opinions, all contributing to dependable strategic assessments.