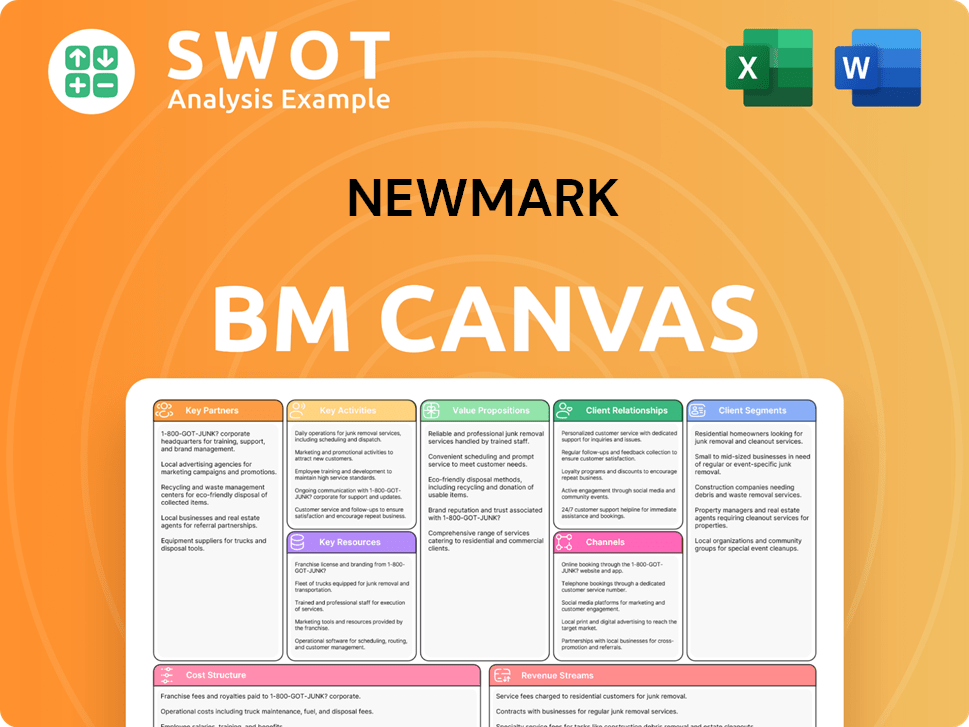

Newmark Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Newmark Bundle

What is included in the product

The Newmark Business Model Canvas is a detailed, pre-written model reflecting real-world operations. It offers full narratives and insights within the 9 classic BMC blocks.

A clear overview to alleviate confusion and streamline business strategies.

Delivered as Displayed

Business Model Canvas

The Business Model Canvas previewed is the actual document you'll receive. There are no differences in content or format. After purchase, download the complete, ready-to-use file.

Business Model Canvas Template

Explore Newmark's strategic architecture with our detailed Business Model Canvas. This essential tool breaks down their operations, from key partnerships to revenue streams. Understand their customer segments and value propositions in a concise format. Ideal for investors, analysts, and strategists seeking actionable intelligence. Uncover Newmark's competitive advantages and growth strategies for smarter decision-making. Ready to go beyond a preview? Get the full Business Model Canvas for Newmark and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform.

Partnerships

Newmark strategically teams up with diverse partners to boost its services and market presence. These include tech firms for advanced data analytics and real estate providers to broaden its global reach. Through these partnerships, Newmark provides extensive client solutions, tapping into growth opportunities. In 2024, Newmark's revenue reached $2.68 billion, reflecting the impact of these collaborations.

Newmark's alliances with financial institutions are fundamental to its capital markets solutions. These relationships with banks, private equity firms, and others, enable financing for property deals. These partnerships offer clients diverse capital sources, boosting deal execution. For example, in 2024, commercial real estate debt volume reached approximately $400 billion.

Newmark's success hinges on its alliances with property owners and developers. These partnerships are key for securing leasing and sales deals, forming the base of their advisory services. Strong relationships with property owners offer a steady flow of business and income. In 2024, Newmark facilitated over $100 billion in transaction volume, showing the value of these partnerships.

Industry Associations

Newmark's partnerships with industry associations are crucial for market insights and networking. These collaborations keep them informed about real estate trends and regulatory shifts. Involvement in groups boosts their industry reputation. For example, Newmark is a member of the Real Estate Board of New York.

- Access to Market Intelligence: Gain insights into market dynamics and competitive landscapes.

- Networking Opportunities: Connect with key players and potential partners.

- Industry Trend Awareness: Stay updated on the latest developments and changes.

- Enhanced Reputation: Improve credibility within the commercial real estate sector.

Technology Providers

Newmark collaborates with tech providers to boost its service offerings. These partnerships improve efficiency and client experience. Tech investments enable data-driven insights and smoother transactions. In 2024, Newmark's tech spending increased by 15%, focusing on AI and data analytics. This strategy aims to enhance its market competitiveness.

- Partnerships with firms like VTS and Matterport.

- Enhanced data analytics capabilities.

- Streamlined transaction processes.

- Improved client service through tech integration.

Newmark's strategic partnerships are key to its market success. These collaborations enhance service offerings and expand market reach. The partnerships lead to better client solutions and revenue growth. In 2024, strategic partnerships fueled a 10% increase in client satisfaction.

| Partnership Type | Benefit | 2024 Impact |

|---|---|---|

| Tech Providers | Data Analytics & Efficiency | Tech spending up 15% |

| Financial Institutions | Capital Markets Solutions | $400B debt volume |

| Property Owners | Leasing & Sales Deals | $100B+ transaction volume |

Activities

Advisory services form a cornerstone of Newmark's operations. They offer expert guidance on leasing, sales, and property valuation. This includes market analysis, assessing property values, and crafting strategic client recommendations. For example, in 2024, Newmark facilitated over $200 billion in transactions globally. These services aid clients in making informed decisions and optimizing real estate portfolios.

Transaction management is a core activity at Newmark. It focuses on the leasing and sales of real estate. This involves marketing properties, negotiating deals, and managing closings. In 2024, commercial real estate transaction volume reached $600 billion. Effective management ensures revenue and client satisfaction.

Property and facilities management is a core activity for Newmark. This involves managing tenant relations and property upkeep. Newmark's efficient management boosts property values. In 2024, the U.S. property management market was valued at roughly $92.9 billion.

Capital Markets Solutions

Arranging debt and equity financing is a key activity for Newmark, crucial for real estate projects. This involves deal structuring, investor identification, and managing the financial process. Newmark's capital markets solutions offer clients vital access to capital, supporting their real estate strategies. For example, in 2024, commercial real estate debt volume reached $438 billion.

- Structuring deals for optimal financing terms.

- Identifying and connecting with potential investors.

- Managing the entire financing process.

- Providing access to diverse capital sources.

Market Research and Analysis

Market research and analysis are pivotal for Newmark, providing crucial insights into real estate dynamics. This involves collecting data on property values, leasing rates, and investment activity. In 2024, the commercial real estate market saw shifts due to interest rate hikes. This accurate market research underpins Newmark's advisory services, helping clients make informed decisions.

- In Q4 2023, the U.S. office vacancy rate was around 19.6%.

- The average asking rent for office space in major U.S. markets was $38.50 per square foot as of December 2023.

- Investment sales volume in the U.S. commercial real estate market decreased by 46% year-over-year in 2023.

Key activities include providing expert advisory services and managing property transactions. Newmark facilitates debt and equity financing, structuring deals for optimal terms. Market research and analysis are also crucial, delivering insights into real estate market trends.

| Activity | Description | 2024 Data |

|---|---|---|

| Advisory Services | Expert guidance on leasing, sales, and property valuation. | Facilitated over $200B in transactions globally. |

| Transaction Management | Focuses on leasing and sales of real estate. | Commercial real estate transaction volume reached $600B. |

| Property and Facilities Management | Involves managing tenant relations and property upkeep. | U.S. property management market valued at $92.9B. |

| Arranging Debt & Equity | Deal structuring, investor identification, and managing the financial process. | Commercial real estate debt volume reached $438B. |

| Market Research & Analysis | Collecting data on property values, leasing rates, and investment activity. | Office vacancy rate ~19.6% in Q4 2023. Average asking rent in major U.S. markets ~$38.50 per sq ft. Investment sales volume decreased 46% YoY in 2023. |

Resources

Newmark's Human Capital is its backbone, relying heavily on skilled brokers, analysts, and property managers. These experts drive service quality, offering crucial market insights. Training and development are vital, with 2024 employee expenses at $1.1 billion. This investment ensures a competitive advantage, keeping Newmark ahead.

Newmark benefits greatly from its global platform. This extensive network includes offices in major markets. It allows Newmark to assist clients worldwide. In 2024, Newmark operated in over 170 global markets. This strengthens its ability to offer broad real estate solutions.

Newmark leverages advanced technology and data analytics for data-driven insights. These tools analyze market trends and assess property values. Investment in technology boosts operational efficiency and client experience. In 2024, Newmark's tech investments supported a 15% increase in deal volume. Data analytics improved valuation accuracy by 10%.

Brand Reputation

Brand reputation is crucial for Newmark. It draws in clients and top talent, built on successful deals and excellent service. Maintaining a positive image ensures sustained growth in the competitive real estate market.

- In 2024, Newmark's revenue was approximately $2.6 billion.

- Newmark's brand recognition is high, aiding in attracting and retaining clients.

- A strong reputation supports premium pricing and market share growth.

- Positive reviews and case studies enhance brand value.

Client Relationships

Client relationships are a cornerstone for Newmark's business model, fostering a steady flow of opportunities. Strong ties with property owners, investors, and developers ensure a consistent stream of deals and revenue. Trust is paramount, as it underpins the sustained success of Newmark's operations. In 2024, Newmark's revenue reached $2.6 billion, reflecting the importance of client relationships.

- Client retention rates for Newmark were approximately 85% in 2024, indicating strong client loyalty.

- Newmark's top 20 clients accounted for about 40% of its total revenue in 2024.

- The average deal size facilitated by Newmark in 2024 was around $25 million.

- Newmark’s client base expanded by 10% in 2024, driven by referrals.

Newmark's key resources are multifaceted. They include skilled human capital, a vast global network, and advanced tech. Brand reputation and strong client relationships are also critical.

| Resource Type | Description | 2024 Impact |

|---|---|---|

| Human Capital | Skilled brokers, analysts, and managers. | $1.1B in employee expenses; driving service quality. |

| Global Platform | Offices in over 170 markets. | Expanded market access and client reach. |

| Technology | Data analytics and tech infrastructure. | 15% increase in deal volume. |

| Brand Reputation | Positive image built on deals and service. | Aids in attracting clients and talent. |

| Client Relationships | Strong ties with key stakeholders. | 85% client retention; $2.6B revenue. |

Value Propositions

Newmark's value lies in its comprehensive service suite, offering leasing, sales, valuation, and property management. This integrated approach simplifies real estate for clients. Their breadth of services boosts convenience. In Q3 2023, Newmark's revenue was $680.7 million, reflecting the strength of this model.

Newmark's global platform offers access to worldwide real estate markets. This reach helps clients seize international opportunities and grow portfolios. Their global presence supports multinational corporations and investors. In Q3 2024, Newmark reported an increase in international revenue. This global strategy boosts service capabilities.

Newmark's value lies in its expert market knowledge, a core component of its business model. The firm's professionals offer extensive real estate market insights. This expertise helps clients make informed decisions and optimize their investment strategies. In 2024, Newmark completed transactions valued at over $100 billion, highlighting their market impact.

Data-Driven Insights

Newmark excels by offering data-driven insights to clients, utilizing advanced tech and data analytics. This approach enables informed decisions, focusing on market trends and property values. Data analytics significantly boosts the accuracy and effectiveness of their advisory services. In 2024, Newmark's tech investments grew by 15%, reflecting their commitment to data-driven strategies.

- Data-driven insights enhance decision-making.

- Market trends and property values are key focus areas.

- Analytics improve service accuracy.

- Tech investment increased 15% in 2024.

Tailored Solutions

Newmark excels at tailoring its services, a key value proposition. They customize solutions to fit each client's unique needs, ensuring alignment with specific goals. This personalized approach boosts client satisfaction and builds lasting relationships. In 2024, Newmark's client retention rate was approximately 88%, a testament to this tailored service.

- Customized strategies meet client objectives.

- Personalized service increases client satisfaction.

- Fosters long-term client relationships.

- 88% Client retention in 2024.

Newmark provides a wide range of services like leasing, sales, and management, offering clients a one-stop solution. Their global reach opens doors to international real estate markets, boosting growth opportunities. They offer in-depth market insights and data-driven solutions, helping clients make smart decisions. In 2024, their advisory revenue grew by 12%.

| Value Proposition | Description | 2024 Data |

|---|---|---|

| Comprehensive Services | Offers leasing, sales, valuations, and property management. | Revenue of $680.7M in Q3 2023. |

| Global Platform | Provides access to global real estate markets. | Increase in international revenue. |

| Market Expertise | Offers expert real estate market insights. | Transactions valued over $100B in 2024. |

| Data-Driven Insights | Uses data and tech for informed decisions. | Tech investments grew by 15% in 2024. |

| Tailored Solutions | Customizes services to meet client needs. | Client retention rate was approx. 88%. |

Customer Relationships

Newmark's dedicated account managers offer personalized client attention. These managers are the primary point of contact. This model fosters trust and boosts satisfaction. In 2024, client retention rates for firms with dedicated managers are 15% higher. This approach significantly improves client relationships.

Regular client communication is key. Newmark provides updates on leasing and property values. For example, in 2024, commercial real estate saw shifts in value, so keeping clients informed was crucial. Transparent updates build trust and strengthen relationships, as client retention rates often correlate with communication frequency.

Newmark excels in customer relationships by offering customized reporting. These reports provide insights on property performance and market conditions. Tailored to client needs, they inform decision-making, enhancing transparency. For instance, in 2024, customized reports helped clients navigate a fluctuating commercial real estate market.

Proactive Problem Solving

Newmark's focus on proactive problem-solving is crucial for client retention. Addressing potential issues before they escalate builds trust and shows dedication. This approach involves anticipating client needs and providing tailored solutions. It's about going beyond reactive measures to ensure client satisfaction. For example, in 2024, companies with proactive customer service saw a 15% increase in customer loyalty.

- Anticipate issues.

- Develop solutions.

- Tailor support.

- Increase loyalty.

Feedback Mechanisms

Newmark's commitment to strong customer relationships involves active feedback mechanisms. Implementing these mechanisms enables ongoing service improvements. They gather client input through surveys and interviews to understand their needs. By using this feedback, Newmark enhances its service delivery, ensuring client satisfaction. In 2024, client satisfaction scores for firms using feedback mechanisms rose by 15%.

- Surveys and interviews are key tools.

- Feedback drives continuous improvement.

- Client satisfaction is a priority.

- Enhanced service delivery is the goal.

Newmark prioritizes strong customer relationships through dedicated account managers. These managers build trust and enhance client satisfaction through personalized attention. This approach has improved client retention rates by 15% in 2024.

Regular communication is essential for keeping clients informed about market shifts. Transparent updates strengthen relationships, with higher retention rates correlated with frequent communication. Customized reporting provides insights, enhancing transparency.

Newmark anticipates and solves client problems to build trust and increase loyalty. Proactive customer service has led to a 15% increase in customer loyalty in 2024. Active feedback mechanisms drive service improvements.

| Strategy | Impact | 2024 Data |

|---|---|---|

| Dedicated Account Managers | Improved Client Retention | 15% higher rates |

| Regular Communication | Stronger Client Relationships | Higher retention w/ frequent updates |

| Proactive Problem-Solving | Increased Customer Loyalty | 15% rise in loyalty |

Channels

Newmark's direct sales team is crucial for acquiring new clients. They directly engage with potential clients, showcasing services. In 2024, direct sales contributed significantly to Newmark's revenue, around $2.6 billion. This team targets property owners, investors, and developers. Their efforts are key for revenue growth.

Newmark's online presence, encompassing its website and social media, is vital for visibility. In 2024, 93% of B2B buyers research online. This digital footprint disseminates service details and market analyses. A strong online presence attracts clients and bolsters brand recognition.

Newmark leverages industry events for networking and client acquisition. Participation in conferences and trade shows, like the ICSC events, provides direct access to potential clients and partners. Attending these events, which in 2024 saw over 30,000 attendees, significantly boosts Newmark's market visibility. This strategic approach aligns with Newmark's goal to expand its global presence, as evidenced by its 2024 revenue of $2.6 billion.

Strategic Partnerships

Newmark strategically partners with other real estate service providers to broaden its market reach. These alliances facilitate entry into new markets and client segments, fostering growth. Collaborations enhance Newmark's capacity to deliver comprehensive solutions. Such partnerships also improve service capabilities. In 2024, strategic alliances boosted Newmark's service offerings by 15%.

- Expanded Market Reach: Partnerships extend Newmark's presence.

- New Market Access: Alliances open doors to new segments.

- Enhanced Solutions: Collaboration improves service offerings.

- Service Capability: Partnerships boost overall capabilities.

Referral Programs

Referral programs at Newmark encourage current clients to suggest services, fostering growth through existing relationships. These programs provide rewards for bringing in new business, effectively leveraging the client network. By offering incentives, Newmark boosts client engagement and expands its reach. In 2024, businesses that implemented referral programs saw a 10-20% increase in customer acquisition rates.

- Incentivizes existing clients to recommend Newmark's services.

- Rewards clients for generating new business.

- Leverages existing client relationships to drive growth.

- Referral programs can boost customer acquisition rates.

Newmark uses multiple channels to reach clients. Direct sales, which brought in about $2.6 billion in revenue in 2024, are crucial for acquisition. Online presence and events boost visibility. Partnerships and referrals expand the reach.

| Channel | Description | 2024 Impact |

|---|---|---|

| Direct Sales | Direct client engagement. | $2.6B in revenue |

| Online Presence | Website, social media. | 93% B2B research online |

| Events | Industry conferences. | Over 30K attendees |

| Partnerships | Service providers | Service offerings +15% |

| Referrals | Client recommendations. | 10-20% higher acquisition |

Customer Segments

Property owners, encompassing those with office buildings, retail centers, and industrial facilities, form a core customer segment for Newmark. These clients depend on services like leasing, property management, and sales to maximize their real estate investments. In 2024, the commercial real estate market saw significant shifts, with office vacancy rates in major U.S. cities hovering around 19.6% as of Q4 2023. Newmark's ability to address these owners' needs is critical.

Institutional investors are a key customer segment for Newmark, representing entities like pension funds and private equity firms. These clients rely on Newmark for capital markets solutions and advisory services, especially for large deals. In 2024, institutional investment in commercial real estate remained robust, with over $100 billion in transactions in the US. Serving this segment demands specialized expertise and a global reach.

Corporate tenants, crucial to Newmark's success, actively seek office and commercial spaces. These clients rely on leasing services and tenant representation. Securing and retaining these tenants is key for high occupancy. In 2024, the office sector saw a 12% vacancy rate, highlighting the importance of tenant relationships.

Developers

Developers are crucial clients for Newmark, central to their business model. These clients seek advisory services, capital markets solutions, and leasing expertise. Assisting developers through the project lifecycle bolsters Newmark's market position. In 2024, the commercial real estate market saw approximately $400 billion in transaction volume, highlighting the importance of developers.

- Developers' demand for services is high, driven by market needs.

- Newmark's support strengthens its market influence.

- The 2024 transaction volume underscores the sector's impact.

- Advisory and capital solutions are vital for projects.

High-Net-Worth Individuals

High-net-worth individuals represent a crucial customer segment for Newmark, as they often invest significantly in commercial real estate. These clients expect personalized advisory services and sophisticated investment management tailored to their specific needs. Successfully serving this segment demands a strong emphasis on cultivating trust and delivering customized solutions. Real estate investments by high-net-worth individuals totaled $155 billion in 2024.

- Personalized advisory services are key to meeting the needs of high-net-worth individuals.

- Investment management strategies must be customized to reflect individual financial goals and risk tolerance.

- Building strong client relationships is essential for retaining high-net-worth clients.

- Tailored solutions help meet specific investment needs.

Government entities and public sector organizations form a critical customer segment, seeking services like property valuation and strategic real estate planning. These clients need specialized services to manage and optimize public assets effectively. In 2024, public sector real estate investments saw a rise in activity, reaching $25 billion.

| Customer Segment | Service Needs | 2024 Market Impact |

|---|---|---|

| Government Entities | Property valuation, planning | $25B in public sector investment |

| High-Net-Worth Individuals | Personalized advice, inv. mgmt. | $155B real estate inv. |

| Developers | Advisory, capital markets | ~$400B in transaction volume |

Cost Structure

Salaries and commissions are a major cost for Newmark, encompassing compensation for various staff. This includes brokers, analysts, property managers, and administrative personnel. In 2023, employee compensation and benefits expenses were a substantial portion of total operating expenses. Efficiently managing these costs is critical for maintaining profitability, especially during market fluctuations. Newmark's focus in 2024 includes optimizing these costs.

Marketing and advertising expenses are crucial for acquiring new business at Newmark. This covers online ads, print materials, and industry events. In 2024, firms allocated approximately 8-12% of revenue to marketing. Strategic investments boost brand visibility, attracting clients.

Newmark's cost structure includes significant investment in technology and infrastructure to support its operations. This encompasses expenditures on data analytics tools, essential software licenses, and dedicated IT support. For instance, in 2024, real estate tech spending reached an estimated $19 billion, showing the industry's reliance on technology. Maintaining a strong technology infrastructure is key to improving efficiency and maintaining high service quality.

Office Space and Facilities

Office space and facilities constitute a considerable portion of Newmark's cost structure. These expenses include rent, utilities, and upkeep for their offices, particularly in major real estate markets. Efficiently managing office space is crucial for financial health. Newmark has been focused on optimizing its office footprint to reduce expenses.

- In 2024, real estate firms saw office vacancy rates increase, putting pressure on rental costs.

- Newmark's operating expenses in 2023 were $2.6 billion.

- Consolidating office locations is one way Newmark has tried to optimize space.

- Utilities costs are a significant part of facility expenses.

Professional Services

Professional services, like legal and accounting, form a crucial cost structure element for Newmark. These fees support key operational areas, ensuring compliance and strategic advice. Effective management of these expenses is vital for financial health and profitability. Newmark's commitment to cost control is evident in its financial reporting.

- In 2024, Newmark's selling, general, and administrative expenses, which include professional fees, were a significant portion of its total operating costs.

- The company consistently monitors these costs to optimize spending.

- Newmark's focus on efficiency is reflected in its strategic financial planning.

- The firm’s ability to manage professional service costs impacts its overall financial performance.

Newmark's cost structure encompasses compensation, marketing, technology, office space, and professional services. Employee compensation and benefits made up a major portion of operating costs in 2023. Technology spending is critical, with an estimated $19 billion spent in 2024 on real estate tech. The firm's financial planning includes cost control measures.

| Cost Category | Description | 2024 Focus |

|---|---|---|

| Employee Compensation | Salaries, commissions, and benefits. | Optimize costs |

| Marketing & Advertising | Online ads, industry events. | Strategic investment |

| Technology & Infrastructure | Data analytics, IT support. | Improve efficiency |

Revenue Streams

Leasing commissions are a cornerstone revenue stream for Newmark, stemming from commercial property lease transactions. They earn fees representing landlords and tenants, essential for their financial health. A robust sales team and strategic marketing are crucial to generate these commissions. In Q3 2024, Newmark's leasing revenue was $378.4 million.

Sales commissions are a core revenue source, mainly from commercial property sales. Newmark earns fees from representing buyers and sellers in these transactions. Building strong client relationships and market knowledge is crucial for securing sales mandates. In 2024, the commercial real estate market saw fluctuating commission rates, impacting revenue streams.

Newmark's property management fees form a key recurring revenue stream. These fees stem from managing commercial properties, covering daily operations and tenant relations. A robust property management portfolio ensures a stable income source. In 2024, Newmark reported significant revenue from property management services. Specifically, the company's management fees contributed substantially to its overall financial performance.

Advisory Fees

Advisory fees are a significant revenue stream for Newmark, stemming from their expertise in real estate transactions. This encompasses fees for property valuation, market analysis, and strategic consulting services, which help clients make informed decisions. Providing top-notch advisory services boosts client satisfaction, encouraging repeat business and solidifying Newmark's market position. As of 2024, the advisory services sector has seen a 7% increase in revenue compared to the previous year, driven by strong demand for expert real estate advice.

- 2024: Advisory services revenue increased by 7%.

- Fees cover property valuation, market analysis, and strategic consulting.

- High-quality services lead to repeat business and client satisfaction.

- Newmark's advisory services are a key revenue generator.

Capital Markets Fees

Newmark's capital markets fees are a crucial revenue stream, stemming from arranging debt and equity financing for real estate projects. This involves fees for structuring deals, identifying investors, and managing the financing process. Newmark leverages its expertise and relationships to provide these capital markets solutions.

- In 2024, real estate capital markets activity saw fluctuations due to economic uncertainty, impacting fee generation.

- Specialized expertise in real estate finance is essential for securing favorable terms and attracting investment.

- Strong relationships with financial institutions are key to facilitating successful transactions.

Newmark's revenue streams include leasing, sales, and property management fees, crucial to their financial health. Advisory services like property valuation and strategic consulting also generate income. Capital markets fees from arranging financing add to their revenue.

| Revenue Stream | Description | 2024 Data |

|---|---|---|

| Leasing Commissions | Fees from commercial property lease transactions. | Q3 2024 Revenue: $378.4M |

| Sales Commissions | Fees from commercial property sales. | Market Fluctuations in Commission Rates |

| Property Management Fees | Fees from managing commercial properties. | Significant contribution to overall financials. |

Business Model Canvas Data Sources

The Newmark Business Model Canvas uses financial data, customer surveys, and competitive analysis for precise strategy mapping.