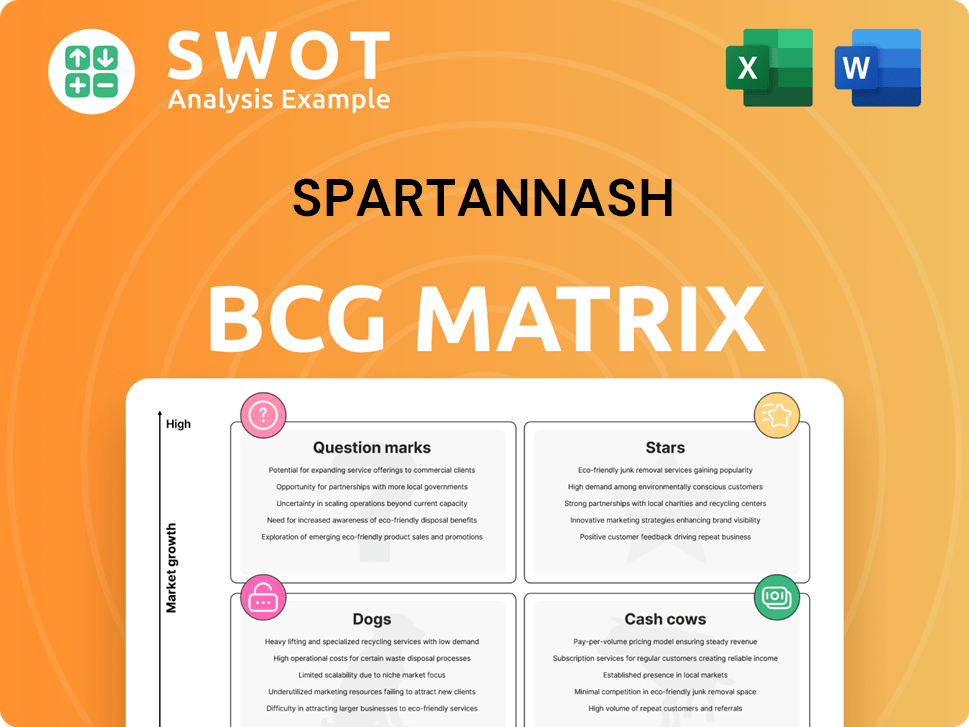

SpartanNash Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SpartanNash Bundle

What is included in the product

SpartanNash's BCG Matrix identifies strategic opportunities for each business unit. It guides investment, hold, or divest decisions.

Printable summary optimized for A4 and mobile PDFs, enabling convenient strategic reviews anywhere.

Preview = Final Product

SpartanNash BCG Matrix

The SpartanNash BCG Matrix you're previewing is identical to the purchased document. Expect a complete, ready-to-use analysis with no watermarks or placeholders—perfect for strategic planning. This version delivers full insights, enabling immediate application to your business goals.

BCG Matrix Template

SpartanNash’s BCG Matrix analyzes its diverse product portfolio, categorizing items as Stars, Cash Cows, Dogs, or Question Marks. This helps understand market share and growth potential. Analyzing these quadrants reveals strategic opportunities and threats. Identify areas for investment, divestment, and product development. The full report offers in-depth analysis and actionable recommendations for optimized resource allocation. Purchase the full BCG Matrix for comprehensive insights to drive strategic growth.

Stars

SpartanNash's retail segment is expanding, driven by strategic acquisitions. The company's retail sales in Q3 2024 reached $786.1 million, a 4.1% increase compared to the previous year. This growth indicates a solid position in a growing market, boosted by integrating acquisitions like Fresh Encounter and Markham.

SpartanNash's military commissary business represents a "Star" in its BCG matrix, offering consistent revenue. This segment excels due to steady demand and a unique market position. In 2024, SpartanNash generated over $1 billion in sales from this sector. This demonstrates its robust performance.

SpartanNash's private label brands are "Stars" in its BCG matrix, showing strong growth. The company's private brand penetration exceeded 27% in Q4 2024. Consumers are increasingly seeking value, boosting private label demand. This strategy helps SpartanNash capture market share effectively.

Strategic Initiatives

SpartanNash's strategic initiatives, like store remodels and Hispanic market expansion, are designed to boost growth and market position. These moves reflect a response to evolving consumer tastes. In 2024, the company is investing in store upgrades and broadening its reach. This demonstrates a forward-thinking strategy to adapt to changes.

- Store remodels boost customer experience.

- Expansion targets the growing Hispanic market.

- These initiatives aim to increase sales.

- Adaptation is key to staying competitive.

E-commerce Growth

SpartanNash's e-commerce efforts are a strategic move in a growing market. The company is investing in its online grocery services to meet rising consumer demand. This focus could boost revenue as more people shop for groceries online. In 2024, online grocery sales are expected to reach $120 billion.

- E-commerce is a key growth area for SpartanNash.

- Online grocery sales are increasing significantly.

- SpartanNash aims to capture a larger market share.

- Investing in digital capabilities is crucial.

SpartanNash's "Stars" include private label brands and its military commissary business. Private label brands are growing, with penetration over 27% in Q4 2024. The military segment generated over $1 billion in sales in 2024, showing its strength.

| Segment | Performance (2024) | Key Feature |

|---|---|---|

| Private Label | Penetration >27% (Q4) | Value-driven, growing demand |

| Military Commissary | >$1 Billion Sales | Consistent Revenue Stream |

| Retail Growth | 4.1% Increase (Q3) | Strategic Acquisitions |

Cash Cows

The food distribution segment is a cash cow for SpartanNash, generating substantial revenue despite some volume declines. It leverages strong relationships with independent retailers and national accounts. In 2024, this segment contributed significantly to the company's overall financial performance. This segment's stability provides consistent cash flow, supporting other strategic initiatives.

SpartanNash's OwnBrands portfolio, like Our Family®, is a cash cow, ensuring consistent revenue. These brands enjoy customer loyalty, offering better margins than national brands. In 2024, OwnBrands sales contributed significantly to the company's financial stability. The portfolio's success is evident in its steady contribution to profits.

SpartanNash's supply chain services for independent grocers are a cash cow, generating steady revenue. These services, vital for smaller retailers, include warehousing and logistics. In 2024, SpartanNash saw its supply chain revenue increase by 3.2%, demonstrating its importance.

Wholesale Segment

The wholesale segment of SpartanNash is a cash cow, generating substantial revenue by distributing national and private-label products. In 2024, this segment accounted for a significant portion of the company's sales, demonstrating its financial strength. Despite facing competition, the wholesale business remains crucial for supporting the company's overall financial performance and stability. This segment's consistent revenue stream makes it a reliable source of cash for SpartanNash.

- Wholesale segment contributes the majority of revenue.

- Distributes national and private brand products.

- It remains a core business for SpartanNash.

- Supports the company's financial health.

Dividend Payments

SpartanNash's dividend payments highlight its financial health. The company increased its quarterly cash dividend by 1.1% recently. This consistency appeals to investors, solidifying its image as a dependable investment.

- Dividend Yield: Around 3.5% as of late 2024.

- Recent Dividend Increase: 1.1% in Q4 2024.

- Dividend History: Consistent payments for over a decade.

SpartanNash's cash cows include food distribution, OwnBrands, and supply chain services, ensuring consistent revenue. These segments provide reliable cash flow, supporting strategic initiatives and financial stability. The wholesale segment also contributes significantly, distributing various products.

| Segment | Contribution | 2024 Data |

|---|---|---|

| Food Distribution | Revenue Generation | Significant, despite volume declines |

| OwnBrands | Consistent Revenue | Sales contributed significantly |

| Supply Chain | Steady Revenue | Revenue increase by 3.2% |

| Wholesale | Major Revenue Source | Significant portion of sales |

Dogs

The "Dogs" quadrant for SpartanNash reflects declining wholesale volume, signaling challenges. In Q3 2024, the company saw reduced case volumes across independent retailers and national accounts. This downturn, with a 4.4% decrease in wholesale sales in Q3 2024, necessitates strategic pivots to boost revenue.

SpartanNash's retail segment saw a decrease in comparable store sales, indicating difficulties in attracting customers. In 2024, consumer demand softened, and competition intensified, impacting sales. For example, in Q3 2024, comparable store sales fell 2.2%. This decline highlights the need for strategic adjustments. The company must adapt to these market dynamics to improve its performance.

SpartanNash's Q4 2024 net loss, at $1.04 per diluted share, signals profitability issues. This is a Dogs quadrant characteristic in the BCG Matrix. The goodwill write-off in the Retail segment adds to these financial worries. These factors could indicate a need for strategic restructuring or divestiture. The company's performance in 2024 showed a net sales decrease of 1.9%.

High Debt Levels

SpartanNash faces challenges due to its high debt, a significant risk factor. The company's net long-term debt-to-adjusted EBITDA ratio was 2.8x in 2024. This situation demands robust financial planning and meticulous execution to manage its debt effectively. High debt levels can limit SpartanNash's strategic flexibility and ability to invest in growth opportunities.

- Debt levels impact financial stability and flexibility.

- A high debt-to-EBITDA ratio indicates a higher risk.

- Effective debt management is crucial for success.

- Strategic investments might be limited by debt.

Reliance on Major Customers

SpartanNash faces risks due to its reliance on major customers. Losing key clients could significantly impact revenue and profitability. Diversifying its customer base is crucial for stability and long-term growth.

- In 2024, SpartanNash's top 10 customers accounted for a significant portion of its sales.

- Customer concentration increases vulnerability to market shifts or contract changes.

- Expanding into new markets and customer segments reduces this dependency.

SpartanNash's "Dogs" status in the BCG Matrix reflects serious challenges. Key issues include declining sales, seen in a 1.9% decrease in net sales in 2024, and profitability concerns, with a net loss in Q4 2024. High debt, a net long-term debt-to-adjusted EBITDA ratio of 2.8x in 2024, and customer concentration further complicate the situation.

| Metric | 2024 Performance | Implication |

|---|---|---|

| Net Sales Growth | -1.9% | Declining revenue |

| Q4 Net Loss/Share | $1.04 | Profitability issues |

| Debt/EBITDA | 2.8x | High financial risk |

Question Marks

SpartanNash's foray into new markets, like Kentucky, through acquisitions, highlights a high-growth potential. These moves demand considerable investments to build a market footprint and secure customer trust. For instance, in 2024, SpartanNash's expansion efforts saw a 5% increase in operational costs. This strategy aligns with the BCG Matrix's "Question Marks" quadrant, indicating high growth with uncertain returns.

SpartanNash's move into Hispanic grocery stores signifies a question mark in its BCG matrix. The Hispanic grocery market is experiencing significant growth, with sales projected to reach $230 billion in 2024, representing a 5.5% increase from the previous year. This expansion requires substantial investment and specialized expertise, indicating a potential high-growth, low-market-share scenario. Success hinges on SpartanNash's ability to navigate the market's unique demands.

SpartanNash's pilot Consumer Value Proposition (CVP) in retail is a high-risk, high-reward move. Success could boost the retail segment, potentially improving its market share. However, it demands close tracking and flexibility. In 2024, SpartanNash's retail sales were approximately $3.3 billion, highlighting the stakes involved. The CVP's impact will be crucial for future growth.

Strategic Partnerships

SpartanNash can explore strategic partnerships to boost its delivery network. Teaming up with logistics firms offers a chance to grow. These alliances can streamline operations and satisfy customers. However, successful partnerships need careful oversight.

- In 2024, SpartanNash's logistics costs were approximately 3.5% of sales.

- Partnerships could reduce delivery times by up to 15%.

- Improved efficiency could save SpartanNash around $10 million annually.

- Customer satisfaction scores could increase by about 10% through better delivery.

Investments in Technology and Automation

SpartanNash's investments in technology and automation are a strategic move. These investments, like automated distribution centers, aim to boost efficiency and cut costs. This is crucial for staying competitive in the grocery sector, but it requires significant capital. Such moves are essential for adapting to the industry's evolution.

- Automated distribution centers can improve efficiency.

- Investments require significant capital expenditure.

- These investments are crucial for staying competitive.

- It allows the company to adapt to industry changes.

SpartanNash's ventures, like new market entries and retail initiatives, position them as "Question Marks." These strategies, demanding high investments, aim for significant market growth. The Hispanic grocery sector, with a projected $230B in sales for 2024, reflects this focus. Success hinges on effective execution and adaptation.

| Aspect | Details | Impact |

|---|---|---|

| Market Growth | Hispanic grocery market: $230B (2024 projected sales) | High growth potential |

| Investment | Expansion efforts saw 5% increase in operational costs | Requires significant capital |

| Strategy | CVP pilot in retail; Delivery Network Partnerships | Risk/reward approach |

BCG Matrix Data Sources

SpartanNash's BCG Matrix leverages financial filings, market analysis, sales data, and industry publications for a data-backed view.