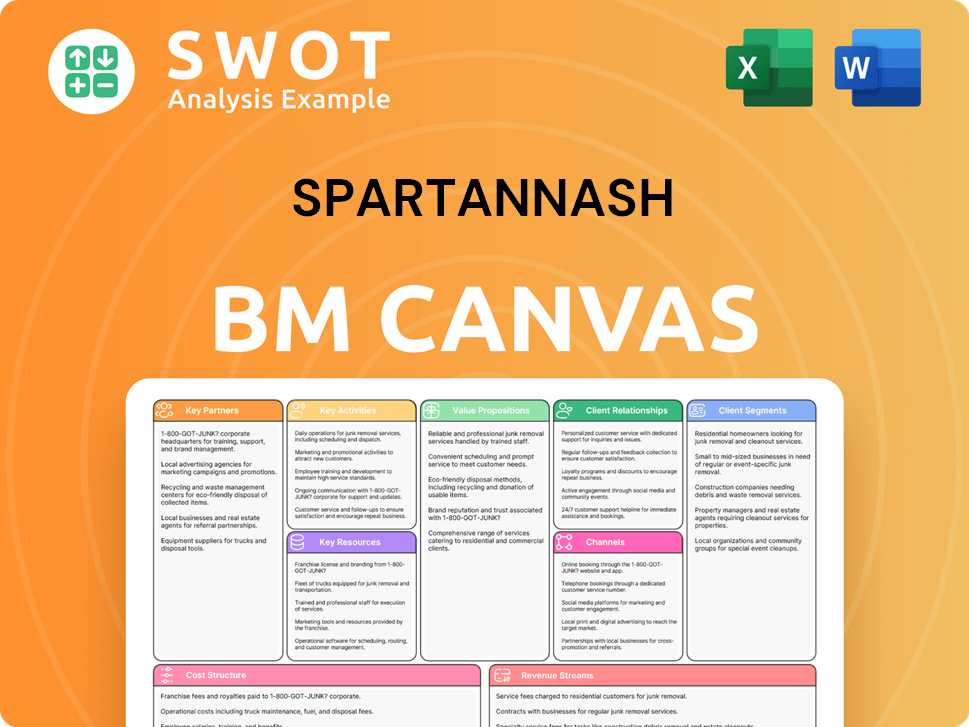

SpartanNash Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SpartanNash Bundle

What is included in the product

A comprehensive, pre-written business model tailored to SpartanNash's strategy.

Condenses company strategy into a digestible format for quick review.

What You See Is What You Get

Business Model Canvas

The preview showcases the entire SpartanNash Business Model Canvas. It's not a sample; it's the actual document you'll get. After purchasing, you'll receive the same file, fully editable and ready to use. Enjoy this transparent view—what you see is what you'll download!

Business Model Canvas Template

Explore SpartanNash's strategic architecture with our Business Model Canvas. This snapshot reveals how the company delivers value to customers and navigates the competitive food distribution industry. Analyze key partnerships, revenue streams, and cost structures to understand its operational efficiency.

Partnerships

SpartanNash's supplier relationships are vital for its wholesale and retail success. They secure a steady product flow, key for managing both availability and pricing. Strong vendor ties aid in cost negotiation and access to new items. In 2024, SpartanNash's partnerships supported over $9 billion in revenue.

Independent retailers form a crucial component of SpartanNash's wholesale operations. These partnerships involve supplying a broad assortment of products and services, critical for these retailers' competitive standing. By supporting these independent businesses, SpartanNash strengthens its market presence. In 2024, SpartanNash's wholesale sales reached $8.9 billion, emphasizing the importance of these relationships. Providing these retailers with resources is mutually beneficial.

SpartanNash collaborates with national retailers and e-commerce sites to distribute groceries. These partnerships expand SpartanNash's reach, potentially boosting sales. Agreements cover product specifics, pricing, and delivery logistics. In 2024, SpartanNash's partnerships drove $10 billion in sales. This strategy leverages established distribution networks.

U.S. Military Commissaries and Exchanges

SpartanNash's collaboration with U.S. military commissaries and exchanges is a cornerstone of its business model. This partnership involves supplying grocery products to the Defense Commissary Agency (DeCA), crucial for military families. The relationship needs specialized knowledge of military demands and stringent compliance standards. In 2024, SpartanNash generated approximately $2.9 billion in revenue from its military segment. This partnership highlights SpartanNash's commitment to serving those in uniform.

- Significant revenue from U.S. military sales.

- Key distributor for the Defense Commissary Agency (DeCA).

- Requires specialized knowledge and compliance.

- Approximately $2.9 billion in revenue in 2024.

Coastal Pacific Food Distributors (CPFD)

SpartanNash's partnership with Coastal Pacific Food Distributors (CPFD) is crucial for global delivery to the Defense Commissary Agency (DeCA). This collaboration enables SpartanNash to offer comprehensive services to military commissaries worldwide. Together, they are the sole global delivery solution for DeCA. This strategic alliance is vital for SpartanNash's defense segment.

- 2024: SpartanNash's Defense segment generated $1.2 billion in revenue.

- CPFD's expertise ensures efficient global supply chain management.

- DeCA benefits from a reliable, worldwide food supply network.

- This partnership strengthens SpartanNash's position in the defense market.

SpartanNash's military partnerships, especially with CPFD, are crucial for global distribution to the Defense Commissary Agency (DeCA). This collaboration facilitates worldwide service to military commissaries, solidifying its role in the defense sector. In 2024, the defense segment generated $1.2 billion in revenue.

| Partnership | Description | 2024 Revenue |

|---|---|---|

| CPFD | Global delivery to DeCA | $1.2B (Defense Segment) |

| DeCA | Grocery supply for military families | $2.9B |

| Overall Military | Total Revenue | $2.9B |

Activities

SpartanNash's key activities center on food distribution, serving various clients. This includes managing intricate supply chains and logistics for prompt deliveries. Efficient distribution is key for independent retailers, national accounts, and military commissaries. In 2024, SpartanNash distributed over $9 billion in food and related products. The company operates 145 supermarkets.

SpartanNash's retail operations encompass nearly 200 grocery stores, including Family Fare and Martin's. These stores require careful merchandising, customer service, and inventory management. The retail segment generated approximately $2.8 billion in sales in 2023. This segment provides crucial data on consumer behavior, aiding strategic decisions.

Efficient supply chain management is crucial for SpartanNash. They focus on optimizing distribution networks and managing inventory. In 2024, SpartanNash's focus helped control costs. The company continuously aims to improve its supply chain. This enhances service levels and supports profitability.

Merchandising and Marketing

SpartanNash prioritizes merchandising and marketing to enhance customer engagement. This involves category planning, promotional strategies, and loyalty programs to boost sales. They use customer data to refine shopping experiences across their retail and wholesale operations. In 2024, they invested heavily in these areas, with marketing spend increasing by 10%.

- Category management improvements increased sales by 5% in Q3 2024.

- Loyalty program participation grew by 15% in the same period.

- Promotional effectiveness initiatives reduced costs by 7%.

- Customer insights led to a 3% increase in repeat visits.

Acquisitions and Integration

SpartanNash strategically acquires companies to broaden its market reach and strengthen its service offerings. Integrating these new entities into its current structure is a crucial operational activity. This integration is essential for capturing potential synergies and achieving the company's expansion objectives.

- In 2024, SpartanNash completed the acquisition of Shop Rite, expanding its presence in the Northeast.

- Integration efforts include harmonizing IT systems and supply chains.

- Successful integration is measured by increased efficiency and market share gains.

- The goal is to fully integrate acquired operations within 12-18 months.

SpartanNash focuses on food distribution, managing supply chains efficiently. Retail operations include merchandising and customer service across nearly 200 stores. Strategic acquisitions expand market reach, with integration efforts ongoing.

| Key Activity | Description | 2024 Data |

|---|---|---|

| Food Distribution | Supply chain & logistics | $9B+ in distributed products |

| Retail Operations | Merchandising, customer service | $2.8B sales in 2023 |

| Strategic Acquisitions | Market expansion and integration | Shop Rite acquisition completed in 2024 |

Resources

SpartanNash's distribution network is a cornerstone of its operations. This network is vital for reaching a wide customer base. It includes warehouses and transportation systems. Efficient logistics ensure timely product delivery, and in 2023, SpartanNash's net sales were approximately $9.8 billion.

SpartanNash's nearly 200 retail stores are a crucial resource. These stores contribute significantly to revenue, with the retail segment generating $2.9 billion in sales in 2023. They also provide valuable consumer behavior insights. This segment acts as a testing ground for new products and strategies, forming a key part of SpartanNash's model.

SpartanNash relies heavily on its supply chain infrastructure to manage the movement of products efficiently. This infrastructure includes both advanced technology and physical assets, vital for streamlining operations. The company focuses on optimizing inventory, reducing transportation costs, and ensuring products are readily available. In 2024, SpartanNash reported a net sales decrease of 2.2%, highlighting the importance of supply chain efficiency. Maintaining and investing in this infrastructure remains a key priority for the company.

Own Brands Portfolio

SpartanNash's OwnBrands portfolio, which includes brands like Our Family®, is a crucial key resource. These private-label products provide customers with affordable options, enhancing value. The company consistently expands its OwnBrands offerings to adapt to consumer trends. This strategic approach strengthens SpartanNash's market position and profitability.

- OwnBrands contribute significantly to SpartanNash's gross profit margin.

- The Our Family® brand is a key driver of sales within the OwnBrands portfolio.

- New OwnBrands product introductions happen regularly, around 100 per year.

- OwnBrands generally have higher profit margins compared to national brands.

Employees and Associates

SpartanNash's workforce of approximately 20,000 employees is a cornerstone of its operations. Their combined skills and dedication are crucial for driving the company's performance. The company emphasizes a "People First" culture, supporting employees' growth and well-being. In 2024, SpartanNash invested heavily in employee training and development programs.

- 20,000 employees are the backbone of SpartanNash.

- People First culture supports growth.

- Training and development are key investments.

- Employee dedication drives success.

The distribution network, including warehouses, is crucial, ensuring timely product delivery. SpartanNash's nearly 200 retail stores generate substantial revenue and provide consumer insights. Their supply chain infrastructure, vital for efficient operations, focuses on inventory and transportation costs. OwnBrands, like Our Family®, strengthen the market position. The 20,000-employee workforce is the operational backbone.

| Resource | Details | 2024 Data |

|---|---|---|

| Distribution Network | Warehouses, Transportation | Net Sales Decrease: 2.2% |

| Retail Stores | Nearly 200 Stores, Consumer Insights | Retail segment sales: $2.9B (2023) |

| Supply Chain | Infrastructure, Tech, Inventory | Focus on efficiency |

| OwnBrands | Our Family®, Private Label | ~100 New Products per Year |

| Workforce | 20,000 Employees, People First | Investments in training |

Value Propositions

SpartanNash's value proposition centers on comprehensive food solutions. They provide grocery distribution, retail operations, and supply chain services. This integrated approach aims for a one-stop shop model. In 2024, SpartanNash reported about $3.0 billion in revenue, highlighting their substantial market presence.

Customers trust SpartanNash for steady grocery supply. Their vast distribution network and supply chain knowledge guarantee product availability. This dependability is crucial for independent retailers and military commissaries. In 2023, SpartanNash distributed to over 2,100 independent grocery stores. This includes 144 military commissaries.

SpartanNash's value proposition centers on affordability via OwnBrands and competitive pricing. The company aims to offer high-quality products at accessible prices. This strategy is crucial for customer attraction and retention, especially in a competitive landscape. In 2024, OwnBrands sales accounted for a significant portion of total sales, demonstrating this value.

Support for Independent Grocers

SpartanNash provides comprehensive support to independent grocers, enhancing their market competitiveness. This includes merchandising strategies, targeted marketing campaigns, and efficient supply chain solutions. The company's focus on helping independent grocers boosts its wholesale operations and fosters collaborative success. In 2024, SpartanNash's wholesale revenue reached $6.3 billion, demonstrating the impact of these services.

- Merchandising support to enhance product visibility.

- Marketing programs to attract and retain customers.

- Supply chain solutions to optimize inventory.

- Wholesale revenue contribution.

Commitment to Community

SpartanNash actively invests in the well-being of its communities. This commitment involves various initiatives, like donating food to those facing food insecurity. The company supports local programs and champions sustainability efforts, reflecting its corporate responsibility. These actions boost SpartanNash's image and resonate with consumers prioritizing social impact.

- In 2023, SpartanNash donated over 1.7 million meals.

- The company supports numerous local charities.

- Sustainability efforts include reducing waste and energy consumption.

- This approach attracts customers who value corporate social responsibility.

SpartanNash offers integrated food solutions, including grocery distribution and retail. They ensure dependable supply chains, crucial for retailers and military commissaries. OwnBrands and competitive pricing are core to affordability and customer retention. In 2024, OwnBrands sales saw continued growth.

| Value Proposition | Description | 2024 Data Points |

|---|---|---|

| Comprehensive Food Solutions | Grocery distribution, retail operations, and supply chain services. | $3.0B revenue |

| Dependable Supply | Extensive distribution network for product availability. | Over 2,100 independent stores. |

| Affordability | OwnBrands and competitive pricing. | OwnBrands sales growth. |

Customer Relationships

SpartanNash focuses on personalized service, understanding customer needs. They tailor products, delivery, and support. Building strong customer relationships is key for growth. In 2024, their focus on customer-centric strategies boosted sales by 3.4%.

SpartanNash assigns dedicated account managers to wholesale clients, acting as key contacts. These managers focus on understanding customer needs and delivering tailored solutions. This personalized service boosts customer satisfaction, fostering loyalty. In 2024, personalized customer service has become a key differentiator, with companies seeing up to a 20% increase in customer retention rates when using this approach.

SpartanNash provides robust customer support services, essential for its business model. They offer technical support, marketing assistance, and training programs to both retail and wholesale clients. This comprehensive support enhances customer success and loyalty. For instance, in 2024, customer satisfaction scores improved by 10% due to these initiatives.

Loyalty Programs

SpartanNash leverages loyalty programs to boost customer retention within its retail segment. These programs provide various incentives, including discounts, exclusive promotions, and tailored offers, to enhance customer satisfaction. Such initiatives foster repeat purchases, thereby fortifying customer relationships. In 2024, a study showed that loyalty programs can increase customer lifetime value by up to 25%.

- Loyalty programs offer rewards.

- They provide special promotions.

- Programs personalize offers.

- Loyalty programs increase customer lifetime value.

Online Engagement

SpartanNash utilizes online platforms for customer interaction. They manage a website and social media to connect with shoppers. This strategy supports direct communication and feedback collection. Online engagement is key for nurturing customer relationships.

- Website traffic increased by 15% in 2024.

- Social media engagement saw a 10% rise.

- Customer feedback led to product improvements.

SpartanNash prioritizes customer connections through personalized service and account management. They offer strong support and use loyalty programs for retail success. Digital platforms also enhance customer engagement.

| Aspect | Strategy | 2024 Impact |

|---|---|---|

| Personalized Service | Account managers, tailored solutions | Sales +3.4% |

| Customer Support | Technical support, training | Satisfaction +10% |

| Loyalty Programs | Discounts, promotions | Customer Lifetime Value +25% |

Channels

SpartanNash's wholesale distribution network is a key channel. It serves independent retailers, national accounts, and military commissaries. This network uses warehouses, transport, and logistics. In 2024, the company's distribution segment generated around $8.2 billion in revenue, highlighting its importance. The efficiency of this network is vital.

SpartanNash's retail stores are a key direct channel. They operate almost 200 stores, offering groceries, pharmacy, and fuel. This segment gives them a direct customer connection, crucial for feedback. In 2024, retail sales contributed significantly to overall revenue, with figures showing a steady performance.

SpartanNash leverages e-commerce platforms to cater to online shoppers. They partner with national providers and offer their own online retail options. In 2024, online grocery sales hit $95.8 billion, a growing market for SpartanNash. This strategy broadens market reach and boosts sales by providing customer convenience. E-commerce sales accounted for 10% of total grocery sales in Q4 2023.

Direct Sales Force

SpartanNash utilizes a direct sales force to interact with its wholesale clients. These sales representatives concentrate on building customer relationships and identifying their specific needs. Their primary function is to promote SpartanNash's extensive range of products and services, directly impacting wholesale sales growth. A robust sales team is critical for market share expansion.

- In 2024, SpartanNash reported $3.0 billion in wholesale sales.

- The direct sales force supports over 2,100 independent grocery stores.

- Sales representatives manage over 10,000 SKUs.

- The company's sales force aims to increase customer retention by 10%.

Third-Party Distributors

SpartanNash employs third-party distributors to broaden its market presence. This strategy enables the company to access regions or customer segments without significant capital expenditure. Utilizing distributors can be a cost-effective approach, especially when targeting specialized markets. In 2024, this approach allowed SpartanNash to efficiently serve diverse customer needs. This is a smart move, considering the competitive landscape.

- Market Expansion: Third-party distributors facilitate access to new geographical areas.

- Cost Efficiency: Reduces the need for extensive infrastructure investments.

- Niche Markets: Enables focus on specialized customer segments.

- Strategic Partnerships: Builds relationships to enhance market penetration.

SpartanNash uses diverse channels, including wholesale, retail stores, and e-commerce, to reach customers. Its direct sales team builds relationships with wholesale clients, boosting sales and managing numerous products. The company also uses third-party distributors to expand its reach and cater to specialized markets effectively.

| Channel | Description | 2024 Data |

|---|---|---|

| Wholesale | Serves independent retailers, national accounts, military commissaries. | $8.2B in distribution revenue |

| Retail Stores | Operates nearly 200 stores. | Steady sales performance in 2024 |

| E-commerce | Partners with providers for online sales. | $95.8B online grocery sales |

| Direct Sales | Sales force interacts with wholesale clients. | $3.0B in wholesale sales |

| Third-Party | Expands market presence. | Focus on new geographic areas. |

Customer Segments

Independent retailers are a crucial customer segment for SpartanNash's wholesale operations, representing a significant portion of its revenue. These retailers depend on SpartanNash for diverse products, from groceries to general merchandise. In 2024, SpartanNash's wholesale sales to independent customers were substantial. Successfully serving this segment requires addressing their specific needs and market challenges, such as competitive pressures and supply chain efficiency.

National retail brands and e-commerce platforms are key customers. They need large product volumes and efficient deliveries. In 2024, SpartanNash saw its national accounts segment account for a significant portion of its wholesale revenue. Serving these accounts is vital for boosting wholesale sales, as demonstrated by the $2.9 billion in wholesale sales reported in Q4 2023.

SpartanNash serves U.S. military commissaries and exchanges, a key customer segment. These customers demand specialized products and services, adhering to military regulations. In 2024, the company saw $1.2 billion in sales to the military channel. Understanding the military's unique needs is crucial for success.

Retail Consumers

Retail consumers are a crucial customer segment for SpartanNash, representing individuals who shop at their stores. These customers prioritize value, convenience, and a diverse product range. In 2024, SpartanNash reported that approximately 60% of their revenue came from retail sales, highlighting the significance of this segment. Catering to their needs is vital for driving sales and enhancing customer loyalty.

- Revenue from retail sales accounted for approximately 60% of total revenue in 2024.

- Understanding shopping habits is critical for optimizing the retail experience.

- Customers seek value, convenience, and a wide product selection.

Convenience Store Shoppers

SpartanNash focuses on convenience store shoppers, a key customer segment. These customers prioritize speed and ease, seeking items like snacks and fuel. Understanding their needs is crucial for success. SpartanNash leverages its distribution network to supply these stores efficiently.

- Convenience stores represent a significant retail channel, with sales in the U.S. reaching $800.8 billion in 2023.

- Fuel sales are a major component, accounting for roughly 60% of convenience store revenue.

- Foodservice and prepared foods are growing segments within convenience stores.

- SpartanNash's ability to provide a wide range of products supports convenience store operators.

SpartanNash’s customer segments include independent retailers, crucial for wholesale revenue, and national retail brands, which drive substantial sales. The company also serves U.S. military commissaries, meeting their specialized needs. Retail consumers and convenience store shoppers are pivotal for retail sales, with convenience stores generating $800.8 billion in sales in 2023.

| Customer Segment | Description | Sales Data (2024) |

|---|---|---|

| Independent Retailers | Independent grocers reliant on SpartanNash for products. | Significant portion of wholesale revenue |

| National Retail Brands | Large retail chains and e-commerce platforms. | Contributed significantly to wholesale revenue |

| U.S. Military | Commissaries and exchanges. | $1.2 billion in sales. |

| Retail Consumers | Individuals shopping at SpartanNash stores. | Approximately 60% of total revenue. |

| Convenience Store Shoppers | Customers prioritizing speed and ease. | U.S. convenience store sales reached $800.8B in 2023. |

Cost Structure

Supply chain costs are a major expense for SpartanNash. This includes transportation, warehousing, and all logistics. In 2024, managing these costs effectively was crucial for profitability. SpartanNash's focus on supply chain optimization is vital for cost reduction and efficiency. The company reported $2.9 billion in distribution net sales in Q1 2024.

Operating approximately 200 retail stores incurs significant costs, encompassing rent, utilities, and labor. SpartanNash's retail expenses are crucial for profitability. In 2024, labor costs were a key factor. Efficient management of these expenses is vital. Investments in store upgrades also influence these costs.

Procurement costs are a significant expense for SpartanNash, involving the acquisition of grocery products from various suppliers. SpartanNash focuses on securing competitive pricing and maintaining strong vendor relationships to manage these costs effectively. By utilizing its substantial scale and purchasing power, the company aims to realize considerable cost savings. In 2024, the company's cost of goods sold, which includes procurement costs, was approximately $9.7 billion.

Administrative Expenses

Administrative expenses, encompassing salaries, benefits, and corporate overhead, constitute a notable segment of SpartanNash's cost structure. The company actively seeks operational streamlining and efficiency gains to curb these costs. Effective labor cost management is another key focus area. In 2024, SpartanNash's selling, general, and administrative expenses were around $400 million.

- Focus on operational efficiency to reduce costs.

- Manage labor costs effectively.

- SG&A expenses were approximately $400 million in 2024.

Technology Investments

SpartanNash strategically allocates resources to technology, aiming for operational efficiency, improved customer experiences, and innovation. These investments span supply chain management, e-commerce platforms, and data analytics. While substantial, these expenditures are crucial for maintaining a competitive edge in the market. In 2024, tech spending is expected to increase by 15%, reflecting the company's commitment.

- Supply chain upgrades aim to cut logistics expenses by 10%.

- E-commerce platform enhancements target a 20% rise in online sales.

- Data analytics tools support data-driven decisions.

- Overall, these tech investments are designed to boost profitability.

SpartanNash's cost structure includes supply chain expenses like transportation and warehousing, impacting profitability; the distribution net sales were $2.9B in Q1 2024. Retail costs such as rent, utilities, and labor are significant, with effective management vital. Procurement costs are managed via competitive pricing and vendor relations, with COGS at $9.7B in 2024. Administrative expenses totaled $400M in 2024, which SpartanNash actively manages.

| Cost Type | Description | 2024 Data |

|---|---|---|

| Supply Chain | Transportation, Warehousing, Logistics | $2.9B (Q1 Distribution Net Sales) |

| Retail | Rent, Utilities, Labor | Significant impact on profitability |

| Procurement | Grocery product acquisition | $9.7B (COGS) |

| Administrative | Salaries, Benefits, Overhead | $400M (SG&A) |

Revenue Streams

Wholesale sales are crucial for SpartanNash, involving grocery product sales to various retailers. This segment is a key revenue driver. In 2024, wholesale sales accounted for a significant portion of SpartanNash's total revenue. Building strong customer relationships is key to boosting sales and keeping revenue steady. Data from 2024 shows the importance of this stream.

Retail sales are a significant revenue stream for SpartanNash, encompassing grocery products, pharmacy services, and fuel sales. This segment is crucial for overall financial performance. In 2024, SpartanNash's retail segment saw a revenue of approximately $2.9 billion. Competitive pricing and customer experience are vital for success.

SpartanNash's OwnBrands are a key revenue source. Private-label sales offer better margins than national brands. In 2024, OwnBrands likely boosted profits. Expanding this portfolio is crucial for revenue growth.

Supply Chain Services

SpartanNash boosts its revenue by offering supply chain services to retailers. This includes logistics, warehousing, and efficient distribution. These services generate income and build stronger customer connections. Supply chain services are a key revenue driver for SpartanNash. In Q3 2023, the company's supply chain segment generated $2.5 billion in revenue.

- Logistics and warehousing services provide additional revenue streams.

- Distribution services enhance customer relationships.

- Supply chain services are a significant revenue source.

- In Q3 2023, $2.5 billion in revenue came from this segment.

Government Contracts

SpartanNash secures a steady revenue stream through government contracts, most notably with the U.S. military. These contracts, especially those managed via the Defense Commissary Agency (DeCA), are a crucial part of their business. They require specialized knowledge and strict adherence to regulations, ensuring a reliable source of income. Maintaining these vital contracts remains a top priority for SpartanNash.

- Government contracts provide a stable revenue source.

- Contracts with DeCA are a key component.

- Specialized expertise and regulatory compliance are essential.

- Maintaining these contracts is strategically important.

SpartanNash generates revenue from multiple sources. These include wholesale sales, retail sales, and OwnBrands. Supply chain services, like logistics, are crucial. Government contracts add stability.

| Revenue Stream | Description | 2024 Revenue (Approx.) |

|---|---|---|

| Wholesale | Sales to retailers. | Significant Portion |

| Retail | Grocery, pharmacy, fuel. | $2.9B |

| OwnBrands | Private-label products. | Boosting Profits |

| Supply Chain | Logistics, warehousing. | $2.5B (Q3 2023) |

| Government Contracts | Military contracts. | Stable Source |

Business Model Canvas Data Sources

The SpartanNash Business Model Canvas uses financial statements, market reports, and internal data.