SpartanNash Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SpartanNash Bundle

What is included in the product

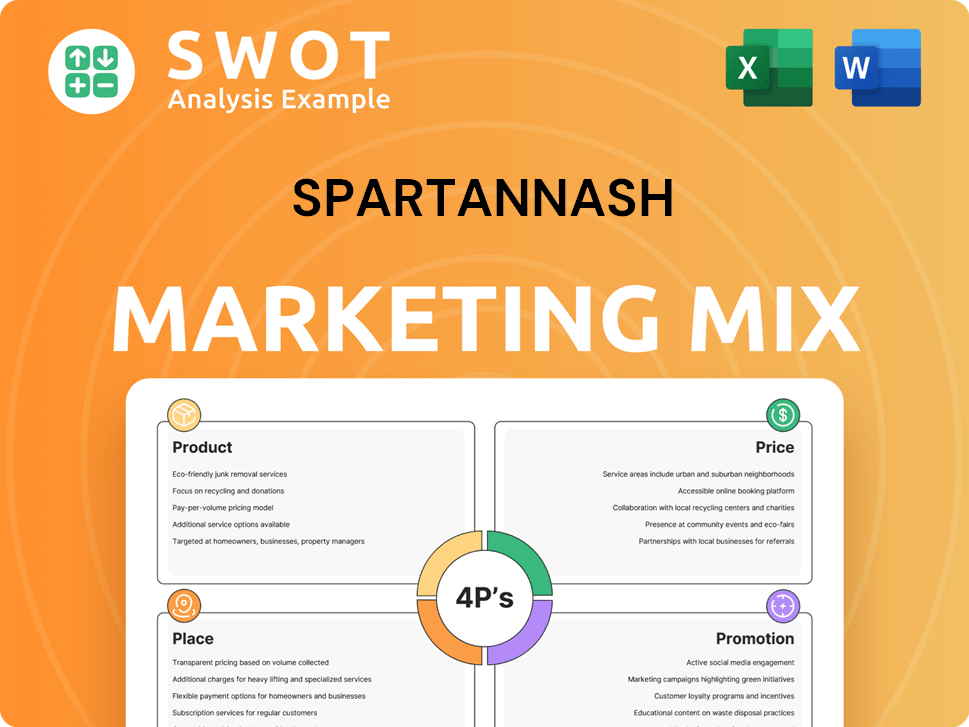

Offers a complete examination of SpartanNash's 4Ps: Product, Price, Place, and Promotion. A great tool for understanding their marketing tactics.

Serves as a clear, concise overview to communicate SpartanNash's strategy in marketing plans.

Full Version Awaits

SpartanNash 4P's Marketing Mix Analysis

You're seeing the complete SpartanNash Marketing Mix analysis, the same one you'll receive after purchase. There's no separate, stripped-down sample. This comprehensive analysis is instantly downloadable. Buy knowing this is the full, finished document.

4P's Marketing Mix Analysis Template

SpartanNash, a major player in grocery distribution, employs a complex marketing strategy. Their product offerings span various food categories, aiming to meet diverse consumer needs. Pricing is carefully calibrated, balancing competitiveness with profit margins in a cost-sensitive industry. Distribution involves an intricate network, leveraging stores and logistics for effective reach. Promotional efforts encompass ads and in-store campaigns, building brand awareness and driving sales.

Dive deeper into the full analysis of SpartanNash's 4Ps. Uncover strategic product decisions, pricing structures, distribution models, and promotional effectiveness. Obtain the comprehensive 4Ps marketing mix analysis—professionally crafted and ready for immediate application.

Product

SpartanNash excels in food distribution, a cornerstone of their business. They handle a broad spectrum of grocery items, covering all store sections. Their clients include independent stores and national chains. In 2024, their distribution segment generated $9.6 billion in revenue.

SpartanNash's grocery retail arm includes almost 200 stores under brands like Family Fare. These stores provide a wide assortment of groceries directly to consumers. In Q1 2024, retail sales were around $750 million, showing the segment's revenue power. This part of the business is crucial for customer engagement.

SpartanNash's product strategy centers on military supply, a key segment. They provide grocery products to U.S. military commissaries and exchanges worldwide. This includes a specialized supply chain tailored to military needs. The company has a contract extension for private label products through December 2025. In Q1 2024, military sales accounted for a significant portion of revenue.

Private Label Brands

SpartanNash's private label brands are a key element of its product strategy. They include brands like Our Family® and Fresh & Finest. These brands offer diverse product options, aiming to increase customer choice. SpartanNash plans to introduce 1,000 new store brand products by 2025, enhancing its market presence.

- Increased private label sales can boost profit margins.

- Private label brands offer competitive pricing.

- Product expansion supports customer loyalty.

- By 2024, private label sales accounted for a significant portion of overall revenue.

Value-Added Services

SpartanNash enhances its product offerings with value-added services, supporting independent grocers with operational insights and solutions, crucial for their success. They also operate pharmacies and fuel centers, boosting customer convenience and driving additional revenue. These services are integral to their business model, which supports a network of over 2,100 independent grocery stores across the U.S. and provides services to 147 corporate-owned stores. In 2024, SpartanNash reported a revenue of approximately $9.9 billion, demonstrating the significance of these services.

- Operational support for independent grocers helps them compete effectively.

- Pharmacies and fuel centers provide added convenience and revenue streams.

- These services are crucial for supporting a large network of stores.

- Value-added services contributed to approximately $9.9 billion in revenue in 2024.

SpartanNash's product strategy centers around its food distribution, retail operations, and military supply chains. It also utilizes private label brands. The goal is to introduce new products to expand choices.

| Segment | Description | 2024 Revenue |

|---|---|---|

| Distribution | Food supply chain for groceries. | $9.6B |

| Retail | Grocery stores, like Family Fare. | $750M (Q1) |

| Military | Supplies to U.S. military. | Significant |

Place

SpartanNash's global supply chain distributes products worldwide. It serves wholesale customers across all U.S. states and internationally. In 2024, they operated 148 retail stores. The company relies on distribution centers and a transportation fleet.

SpartanNash's retail strategy includes nearly 200 grocery stores across several states, offering direct consumer access. These physical locations are crucial for sales and brand visibility. Acquisitions in 2024, like the purchase of Martin's Super Markets, have boosted its Midwest presence. The company's retail sales for Q1 2024 were $785.7 million.

SpartanNash strategically positions itself in military commissaries and exchanges, a critical distribution channel. They provide food and other products to these specific locations, both domestically and internationally. In 2024, military sales accounted for a significant portion of SpartanNash's revenue. The company is a leading food distributor to U.S. military commissaries and exchanges.

E-commerce Platforms

SpartanNash leverages its robust supply chain to support e-commerce platforms, expanding its reach into the digital grocery market. This strategic move allows the company to offer its products through online channels, catering to evolving consumer preferences. In 2024, the online grocery market in the US is estimated to reach $118.3 billion, highlighting the importance of this channel. SpartanNash is actively working to improve the online customer experience, enhancing its competitive edge.

- Online grocery sales in the US are projected to grow.

- SpartanNash is adapting to digital consumer behavior.

- Enhancing the online customer experience is a priority.

Partnerships with Independent Retailers

SpartanNash collaborates extensively with independent grocery retailers, significantly broadening its distribution network. This strategy ensures product availability across diverse communities. They offer vital support services to these partners, enhancing their operational efficiency. This partnership model is a key element of their marketing approach.

- In 2024, SpartanNash served approximately 2,100 independent grocery stores.

- These partnerships account for a significant portion of SpartanNash's revenue, with a reported $9.8 billion in net sales for 2024.

SpartanNash uses varied channels, like stores (148 in 2024), for visibility. Military and independent retailers expand their reach. Digital channels are also key; US online grocery sales could hit $118.3B in 2024.

| Channel | Description | 2024 Impact |

|---|---|---|

| Retail Stores | Direct consumer access in select states, incl. recent acquisitions. | $785.7M Q1 2024 retail sales. |

| Military Sales | Distribution to commissaries and exchanges. | Significant revenue share. |

| E-commerce | Online grocery platforms. | US market est. $118.3B in 2024. |

Promotion

SpartanNash boosts its brand through digital marketing and social media. They share recipes and health tips to connect with followers. This strategy highlights SpartanNash's products directly. In 2024, digital ad spending in the US is projected to reach $250 billion, impacting retail promotions significantly. Social media engagement is crucial.

In-store promotions and events are a key element of SpartanNash's marketing strategy, driving customer engagement. They include in-store fundraising for charities, enhancing community relations. Store layouts highlight fresh produce and value offerings. In 2024, SpartanNash increased promotional spending by 8%, boosting foot traffic. These activities aim to create a positive shopping experience.

SpartanNash has deployed targeted digital campaigns, particularly for hiring events. These campaigns leverage geo-targeting to pinpoint specific audiences, optimizing reach. This approach reflects a strategic effort to tailor communications for distinct business objectives. In 2024, they increased digital ad spend by 15% to enhance campaign effectiveness.

Highlighting Value and Quality

SpartanNash's promotional strategy focuses on highlighting value and quality to attract customers. Their messaging emphasizes the high quality of their private-label brands, often positioning them as superior to national brands. This strategy is supported by aggressive price reductions on numerous products. For example, in 2024, SpartanNash increased its private label sales by 5%, demonstrating the effectiveness of this approach.

- Private label sales increased 5% in 2024.

- Price reductions are a key promotional tactic.

- Focus on value and quality in messaging.

Community Involvement and ESG

SpartanNash actively showcases its community involvement and commitment to Environmental, Social, and Governance (ESG) principles. This includes efforts to reduce food waste and address food insecurity, aligning with consumer values. Highlighting these initiatives boosts their brand image and resonates with socially conscious shoppers. ESG-focused funds saw inflows of $1.6 billion in Q1 2024, signaling growing investor interest.

- SpartanNash has donated over 27 million pounds of food since 2019.

- In 2024, 70% of consumers are willing to pay more for sustainable products.

SpartanNash's promotion strategy uses digital marketing, in-store events, and targeted campaigns. Digital ad spend rose in 2024. Community involvement and private-label emphasis also drive promotions.

| Promotion Focus | Tactics | 2024 Data |

|---|---|---|

| Digital Marketing | Social media, geo-targeted ads | Ad spend up 15%, targeting events. |

| In-Store | Fundraising, store layouts | Promotional spending rose 8%. |

| Value & Quality | Price reductions, private labels | Private label sales grew 5%. |

Price

SpartanNash uses different pricing strategies for retail and wholesale. This includes setting prices for many products. Their pricing strategy is refined by a specific system. In 2024, the company's gross profit margin was around 14.5% demonstrating effective pricing.

SpartanNash prioritizes value for shoppers, reflected in its pricing strategies. This is evident through reduced prices on many retail products. The grocery store modernization strategy further underscores this focus. In Q4 2024, SpartanNash reported a 1.6% decrease in comparable sales, partly due to competitive pricing. The company aims to attract customers by offering competitive prices.

SpartanNash faces fierce competition, impacting its pricing strategy. To stay competitive, they must monitor and respond to rivals' prices. Intense competition often results in price wars and thinner margins. For example, in 2024, the grocery sector saw price adjustments by major players like Kroger and Albertsons.

Pricing for Private Label Brands

Private label brands, like those offered by SpartanNash, are typically priced to be competitive. This approach allows SpartanNash to provide value-driven options for consumers seeking quality products without the premium price tag. In 2024, private label sales in the U.S. grocery sector accounted for approximately 20% of total sales, highlighting their importance. This strategy attracts budget-conscious shoppers and drives volume.

- Competitive Pricing: Private label brands are often priced lower than national brands.

- Value Proposition: Offers high-quality products at affordable prices.

- Market Share: Private label brands hold a significant share of the grocery market.

- Consumer Appeal: Attracts price-sensitive consumers.

Impact of Acquisitions on Pricing

SpartanNash's acquisitions, like the 2024 purchase of ShopRite stores, directly impact pricing. Integrating new stores and supply chains requires strategic pricing adjustments. This can involve harmonizing prices across different retail locations. The goal is to maintain competitiveness.

- ShopRite acquisition in 2024, potential pricing adjustments.

- Integration of new supply chains.

SpartanNash's pricing strategies, key to its marketing mix, balance retail and wholesale needs. The company uses various strategies, aiming for value, seen in reduced retail prices, affecting sales; comparable sales decreased by 1.6% in Q4 2024. Competitive pressures, like from Kroger and Albertsons in 2024, drive careful price adjustments and private label brands are priced competitively, and account for about 20% of the US grocery market.

| Pricing Strategy | Description | Impact |

|---|---|---|

| Retail | Competitive prices. | 1.6% decrease in sales. |

| Wholesale | Profit margins maintained | 2024 gross margin around 14.5% |

| Private Label | Value-driven options. | Approximately 20% of U.S. sales in 2024 |

4P's Marketing Mix Analysis Data Sources

SpartanNash's 4P analysis uses public company data, SEC filings, and earnings calls. We include competitor strategies, industry reports, and sales data for insights.