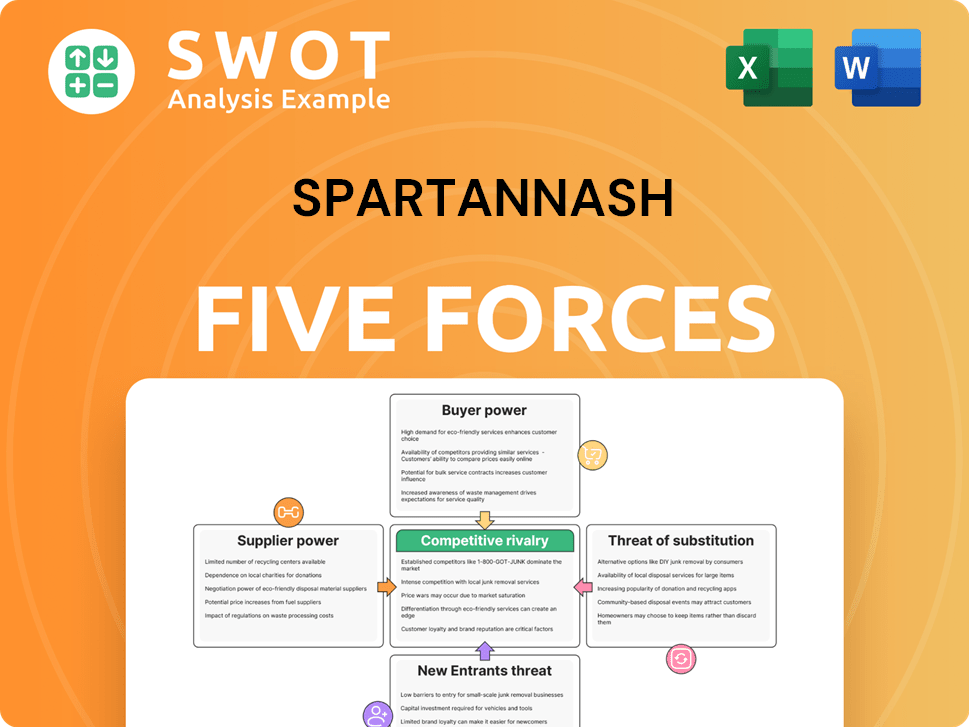

SpartanNash Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SpartanNash Bundle

What is included in the product

Analyzes competitive dynamics impacting SpartanNash, assessing supplier/buyer power, threats, and rivalry.

Customize Porter's Five Forces, reflecting evolving market conditions to highlight opportunities.

Full Version Awaits

SpartanNash Porter's Five Forces Analysis

This preview provides the SpartanNash Porter's Five Forces Analysis you'll receive. It's the complete, ready-to-use document. The analysis is fully formatted and ready for immediate application. You'll get instant access to this exact file upon purchase. No changes; it’s the final version.

Porter's Five Forces Analysis Template

SpartanNash operates in a dynamic grocery and food distribution market, facing pressures from various competitive forces. The threat of new entrants is moderate, given existing economies of scale and established brands. Buyer power is significant due to consumer choice and the availability of alternative retailers. Supplier power is moderate, influenced by the consolidation of major food suppliers. The threat of substitutes, particularly online grocery services, is a growing concern. Competitive rivalry is intense, with numerous established players vying for market share.

Ready to move beyond the basics? Get a full strategic breakdown of SpartanNash’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

SpartanNash sources products from a mix of suppliers, indicating a potentially consolidated base. This structure could give suppliers some bargaining power. Analyzing supplier concentration is key to gauging this leverage. In 2024, the company's cost of goods sold was significantly impacted by supplier pricing. Understanding these relationships is vital for financial strategy.

SpartanNash's contract with DeCA for private-label products, extending through 2025, shows a stable supplier relationship. This agreement, however, highlights some reliance on DeCA. In 2024, SpartanNash's sales to DeCA were a significant portion of its revenue. The contract's terms and profitability are key factors to watch.

Commodity price swings significantly influence supplier power, impacting SpartanNash's operational costs. The company actively manages these fluctuations using data analytics to optimize supply chain costs. In 2024, food prices saw varied impacts, with some commodities like wheat and corn experiencing price volatility. By leveraging data, SpartanNash aims to mitigate supplier power and maintain profitability.

Supplier Relationships

SpartanNash's ability to manage supplier power is crucial. The company serves over 8,000 independent grocery stores and national accounts. Strong relationships impact SpartanNash's negotiation leverage. This is vital for controlling costs and maintaining profitability, especially in a competitive market.

- Supplier diversity is key to reducing risks.

- Negotiating favorable terms can improve margins.

- Maintaining robust supply chain relationships is essential.

- Focus on operational efficiency to manage costs.

Data Analytics

Data analytics significantly impacts supplier relationships and negotiating power within the supply chain, as seen with SpartanNash. Advanced data exchange enables real-time updates and enhances information flow, which can lead to greater efficiency. In 2024, supply chain analytics spending is expected to reach $14.2 billion globally.

- Real-time data visibility reduces information asymmetry.

- Improved forecasting leads to better inventory management.

- Data-driven insights facilitate collaborative planning with suppliers.

- Analytics supports proactive risk management in supply chains.

SpartanNash navigates supplier power through diverse sourcing and data-driven strategies. Contracts, like the DeCA agreement, affect this dynamic. The company's success hinges on managing costs, especially with volatile commodity prices. Data analytics and strong supply chain relations are crucial.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Supplier Base | Concentration affects leverage | Cost of goods sold impacted by pricing. |

| DeCA Contract | Highlights supplier reliance | DeCA sales were a significant revenue portion. |

| Commodity Prices | Impact operational costs | Food price volatility; supply chain analytics spend reached $14.2B globally. |

Customers Bargaining Power

SpartanNash's wide customer base, including grocers and military commissaries, dilutes the influence of any single buyer. In 2024, the company's revenue was diversified across various channels. No single customer accounted for a large percentage of its sales, reducing their bargaining power. This distribution helps SpartanNash maintain pricing power and profitability. The company's diverse customer portfolio is a significant strength.

SpartanNash heavily relies on its partnership with the U.S. Defense Commissary Agency (DeCA). This strong relationship offers a consistent revenue stream. However, this creates dependency. Any shifts in military commissary operations or funding, like the 2024 budget cuts, could affect SpartanNash's financial health. In 2023, SpartanNash reported $2.9 billion in sales to the military channel.

Consumer loyalty is shifting, with value and affordability gaining importance for shoppers. Currently, only 55% of grocery shoppers remain loyal to their main store.

Retailers are enhancing loyalty programs to counter this trend, investing in store-brand innovation, and using advanced pricing strategies. They aim to retain customers and boost sales.

These efforts reflect the need to adapt to changing consumer preferences and intense competition in the retail market. The goal is to stay competitive.

Private Label Influence

The bargaining power of customers is significantly influenced by private label products. These labels are capturing more market share, with 84% of consumers planning to continue buying them even with increased purchasing power. Retailers are strategically positioning their brands as differentiated options, boosting customer choice.

- Private label market share growth signals increased customer power.

- Consumer loyalty to private labels remains strong, regardless of financial changes.

- Retailers' brand strategies offer broader customer alternatives.

E-commerce and Omnichannel Shopping

The rise of e-commerce and omnichannel shopping significantly boosts customer bargaining power. Consumers now have more choices, with 60% of U.S. consumers using multiple channels when shopping. They demand value and convenience, influencing pricing and service expectations. SpartanNash must evolve its strategies to address these sophisticated consumer demands.

- E-commerce growth: Online retail sales reached $1.1 trillion in 2023.

- Omnichannel shopping: 60% of consumers use multiple channels.

- Customer expectations: Value and convenience are key drivers.

- Impact on SpartanNash: Requires strategic adaptation.

Customer bargaining power varies for SpartanNash. Strong relationships with diverse grocers and DeCA balance buyer influence. E-commerce and private labels boost customer options. Retailers enhance loyalty via brands.

| Aspect | Data Point | Implication |

|---|---|---|

| Private Label Share | 84% of consumers will continue using private labels | Increases customer choice and price sensitivity |

| Omnichannel Shopping | 60% of U.S. consumers use multiple shopping channels. | Heightens consumer demands for value and convenience |

| E-commerce Sales (2023) | $1.1 trillion | Offers more customer choices, impacting bargaining power |

Rivalry Among Competitors

The grocery and food distribution sectors are fiercely competitive. Discounters, like Aldi, and mass retailers, such as Walmart, are expanding their market share. SpartanNash contends with established supermarkets, discount grocers, and major retailers. In 2024, Walmart's U.S. grocery sales reached $109 billion, underscoring the intensity of the competition. This environment demands constant innovation and efficiency.

The grocery industry is experiencing a surge in mergers and acquisitions (M&A). Larger grocers leverage their scale for better buying power and operational efficiencies. SpartanNash has been strategically acquiring companies; for example, in 2024, it acquired ShopRite stores. This expansion helps SpartanNash grow its retail presence and market share.

Boosting private brand penetration is a major competitive strategy for SpartanNash. At the end of Q4 2024, SpartanNash's private brand penetration exceeded 27%. This focus helps attract value-seeking shoppers. Retailers aim to provide indulgence at better prices through private brands.

Focus on Value

Competitive rivalry in the grocery sector is intense, with SpartanNash facing pressure to offer competitive pricing. Consumers are increasingly price-sensitive, seeking cheaper brands and deals across multiple retailers. Retailers are actively competing with discounters, focusing on value and adapting to health trends. For example, in 2024, Walmart's grocery sales grew significantly, highlighting the price war.

- Walmart's grocery sales growth in 2024 reflects the impact of competitive pricing.

- Consumers' focus on cost drives the need for value propositions.

- Retailers must balance price with health and wellness offerings.

- SpartanNash competes by optimizing its pricing and product mix.

Service Channel Growth

SpartanNash faces intense competition in the foodservice channel. This channel is expected to keep growing faster than retail. Major broadline distributors are gaining market share. They utilize their size to improve resources and technology. These distributors are going after profitable independent operators with their own brands.

- Foodservice sales rose 6.7% in 2023, exceeding retail.

- Sysco and US Foods control about 60% of the broadline market.

- Independent operators offer higher profit margins.

- Private label brands offer competitive advantages.

Intense competition marks the grocery industry. Retailers battle for market share, with pricing a key differentiator. SpartanNash contends with major players like Walmart, whose 2024 grocery sales hit $109B. This environment demands robust strategies to maintain competitiveness.

| Metric | 2023 | 2024 (Projected/Actual) |

|---|---|---|

| Walmart U.S. Grocery Sales (USD Billions) | 101 | 109 |

| SpartanNash Private Brand Penetration | 25% | 27%+ (Q4) |

| Foodservice Channel Growth | 6.7% | Continuing to outpace retail |

SSubstitutes Threaten

The online grocery market is expanding, presenting a substitute threat. In 2023, U.S. online grocery sales hit $187.4 billion. Platforms like Instacart and Amazon Fresh offer direct-to-consumer options. SpartanNash must compete with these alternatives to maintain market share.

Meal kits and prepared foods are a significant threat, offering convenient alternatives to traditional grocery shopping. Consumers increasingly seek quick and easy meal solutions. According to Statista, the U.S. meal kit delivery services market generated $1.58 billion in revenue in 2023. SpartanNash is entering this market with Chef-Inspired Freedom's Choice prepared foods to capitalize on this trend.

The restaurant and foodservice industry presents a significant threat to SpartanNash. Eating out serves as a direct substitute for grocery shopping. The foodservice industry is projected to grow by 1.0% in 2025. Operators must innovate with unique offerings to maintain margins and customer loyalty. In 2024, the industry saw fluctuations, emphasizing the need for adaptation.

Discount Grocers

Discount grocers pose a significant threat by providing lower-priced alternatives to SpartanNash's offerings. Consumers are increasingly prioritizing value, shifting away from traditional brand loyalty. This trend is evident, with approximately 35% of consumers now choosing private-label options over national brands. This shift puts pressure on SpartanNash to compete on price or differentiate its products effectively.

- Increased competition from lower-priced alternatives.

- Changing consumer preferences towards value.

- Growth of private-label brands.

Convenience Stores

Convenience stores pose a threat to SpartanNash by providing easy access to groceries and essentials. SpartanNash is actively growing in the convenience store sector, which is a strategic move to capitalize on this trend. The appeal of fuel centers for customers further enhances the attractiveness of convenience stores. In 2024, the convenience store market in the U.S. is projected to generate over $800 billion in sales, showcasing its significant impact.

- Market Size: U.S. convenience store sales are forecast to exceed $800 billion in 2024.

- Strategic Focus: SpartanNash is expanding within the convenience store channel.

- Customer Attraction: Fuel centers add to convenience stores' appeal.

Substitute products significantly challenge SpartanNash's market position. Online grocery sales in the U.S. hit $187.4B in 2023, with platforms like Instacart. Meal kits, a $1.58B market in 2023, offer convenience. Discount grocers and convenience stores also pose threats.

| Threat | Market Data | Impact on SpartanNash |

|---|---|---|

| Online Grocery | $187.4B sales in 2023 (U.S.) | Competition with platforms like Instacart |

| Meal Kits | $1.58B market in 2023 (U.S.) | Shift towards convenience |

| Discount Grocers | 35% private-label preference | Pressure to compete on price |

Entrants Threaten

High capital requirements pose a significant barrier to entry in food distribution. SpartanNash, for example, needs around $250 million for distribution centers and retail stores. This substantial investment limits new competitors. The industry's capital-intensive nature deters new entrants.

SpartanNash's existing partnerships with suppliers and retailers pose a significant barrier to new entrants. The company has strong relationships with over 8,000 independent grocery stores, providing a solid distribution network. Building similar relationships requires time and resources, making it difficult for new competitors to quickly establish themselves. This established network gives SpartanNash a competitive edge in the market. In 2024, SpartanNash's revenue reached $9.6 billion, which is proof of their strong distribution network.

Larger grocers possess significant advantages due to economies of scale, enabling them to negotiate better deals with suppliers and streamline operations. SpartanNash, aiming for positive same-store sales growth in 2025, is focused on enhancing retail operations and store expansion. This strategy aims to improve its competitive position against larger entrants. In 2024, SpartanNash's net sales were $9.8 billion, showing its commitment to growth. These enhancements are crucial for competing effectively.

Supply Chain Expertise

A significant threat for SpartanNash is the challenge posed by new entrants in building their supply chain expertise. SpartanNash's global supply chain network, a core competency, is difficult to replicate. New competitors would need substantial time and resources to develop comparable supply chain capabilities. This includes establishing relationships with suppliers and mastering logistics. The complexity of this undertaking creates a barrier to entry.

- SpartanNash operates distribution centers across the United States, with a significant presence in the Midwest.

- Developing a supply chain network involves managing transportation, warehousing, and inventory, which can be capital-intensive.

- New entrants often face higher costs and inefficiencies initially due to a lack of established infrastructure and experience.

- In 2024, supply chain disruptions continue to impact the food industry, highlighting the importance of established networks.

Regulatory Hurdles

The food industry faces significant regulatory hurdles, making it challenging for new companies to enter the market. Strict compliance with regulations is essential, adding to the initial investment and operational costs. Traceability and transparency are increasingly important, with initiatives such as FSMA 204. These factors increase the complexity for new entrants, potentially deterring them from competing.

- FSMA 204 compliance requires detailed record-keeping.

- Regulatory compliance adds to startup costs.

- Transparency is key for consumer trust.

- New entrants face high barriers.

The threat of new entrants for SpartanNash is moderate, due to high barriers. These include substantial capital requirements, such as the $250 million needed for distribution centers and retail stores. Established supplier and retailer relationships, alongside regulatory hurdles, further limit new competitors.

| Barrier | Description | Impact on SpartanNash |

|---|---|---|

| Capital Needs | High initial investment for infrastructure. | Limits new competitor entry. |

| Existing Networks | Established relationships with suppliers and stores. | Provides competitive advantage. |

| Regulations | Strict compliance and transparency requirements. | Adds to complexity and costs for new entrants. |

Porter's Five Forces Analysis Data Sources

This analysis utilizes financial statements, market research, and industry reports, complemented by competitor data and regulatory filings for a robust competitive landscape.