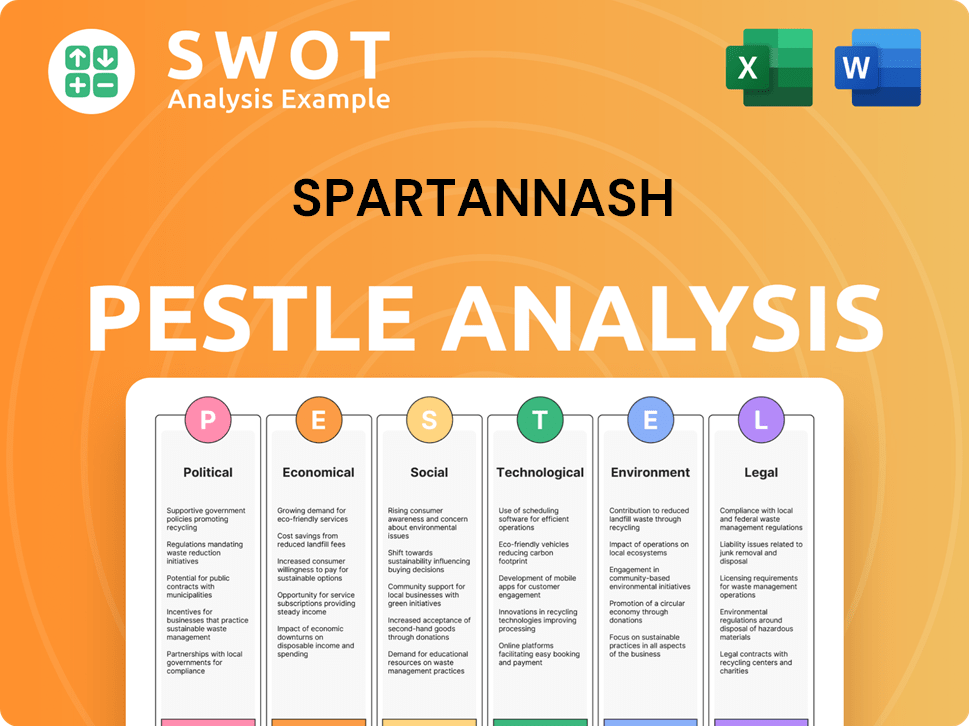

SpartanNash PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

SpartanNash Bundle

What is included in the product

Assesses how macro factors impact SpartanNash using PESTLE: Political, Economic, Social, Technological, Environmental, Legal.

Helps support discussions on external risk during planning sessions.

What You See Is What You Get

SpartanNash PESTLE Analysis

What you’re previewing here is the actual file—fully formatted and professionally structured. This SpartanNash PESTLE analysis covers key political, economic, social, technological, legal, and environmental factors.

PESTLE Analysis Template

Navigate the complexities of SpartanNash's market with our detailed PESTLE Analysis. Understand how macro-environmental factors impact their strategies. Explore the political, economic, social, technological, legal, and environmental forces. This insightful report equips you with essential knowledge. Download the complete analysis now and gain a competitive advantage!

Political factors

Government regulations heavily influence SpartanNash. Food safety standards, like those from the FDA, are critical. Labor laws, such as minimum wage, directly affect costs. For example, the U.S. Department of Labor reported over 10,000 violations in the food retail sector in 2024, impacting compliance strategies. Changes in land use policies also influence store development.

SpartanNash heavily relies on military commissary and exchange contracts. In 2024, approximately 20% of SpartanNash's revenue came from these government contracts. Changes in defense spending, like the potential for increased budgets in 2025, can significantly affect their earnings. Any shifts in military benefits policies also pose financial risks or opportunities.

Trade policies and tariffs significantly impact SpartanNash. In 2024, the US imposed tariffs on various imported goods. These tariffs can increase costs for SpartanNash. This affects the company's pricing strategies and supply chain. Changes in trade agreements directly influence the availability of products.

Political Stability and Geopolitical Events

Political stability and geopolitical events are critical for SpartanNash. Disruptions in regions where they source products or operate can significantly impact the supply chain. Adverse events, like trade wars or conflicts, could lead to higher costs or limit product access. Recent data shows supply chain disruptions increased costs by 10-15% for similar companies in 2023.

- Geopolitical instability can disrupt supply chains.

- Increased prices are a potential outcome of adverse events.

- Access to products sourced internationally may be reduced.

- Supply chain disruptions increased costs in 2023.

Lobbying and Political Contributions

SpartanNash, like other major corporations, likely engages in lobbying and political contributions to influence policies. These activities can impact regulations and legislation relevant to its operations. Examining political affiliations reveals how the company navigates the political environment. In 2023, the grocery industry spent approximately $150 million on lobbying efforts.

- Lobbying: SpartanNash likely lobbies on food safety and supply chain issues.

- Political Contributions: Contributions may support political candidates.

- Industry Impact: Lobbying influences regulations.

- Financial Impact: Political activities affect business costs.

SpartanNash faces significant political risks. Government contracts, particularly military ones, contribute substantially to revenue; 20% in 2024. Trade policies, like tariffs, affect costs and supply chains. Geopolitical instability disrupts operations and raises costs.

| Political Factor | Impact | Financial Implication |

|---|---|---|

| Government Regulations | Food safety, labor laws, land use | Affects compliance costs, store development |

| Military Contracts | Defense spending changes, policy shifts | Impacts revenue and earnings; ~20% in 2024 |

| Trade Policies | Tariffs, trade agreements | Alters costs and product availability |

Economic factors

Inflation significantly influences SpartanNash's operational costs, particularly in its wholesale and retail divisions. Increased expenses in areas like product sourcing, fuel, and utilities can squeeze profit margins if not carefully managed or passed on to consumers. In 2024, the U.S. inflation rate was around 3.1%, impacting grocery prices. Deflation, on the other hand, could affect pricing strategies and revenue streams. The company must adapt to these economic shifts to maintain profitability.

Consumer spending is crucial for SpartanNash's retail success. Disposable income, consumer confidence, and value-versus-premium product preferences directly affect sales. In 2024, U.S. retail sales grew, but inflation and economic uncertainty impacted consumer choices. Specifically, grocery sales saw shifts towards budget-friendly options, reflecting changing consumer behavior.

Economic growth significantly influences SpartanNash. A robust economy boosts employment and consumer spending. However, recessions can lead to reduced grocery spending. In 2023, US GDP growth was around 2.5%, influencing consumer behavior. Lower spending directly affects SpartanNash's profitability.

Interest Rates

Interest rates are a key economic factor affecting SpartanNash's financial strategy. Higher interest rates increase borrowing costs, potentially affecting investments in areas like distribution centers or acquisitions. Conversely, lower rates can make financing more attractive, influencing the company's leverage and profitability. For instance, the Federal Reserve held its benchmark interest rate steady in early 2024, influencing borrowing costs for companies like SpartanNash. The prime rate was at 8.50% as of May 2024.

- Borrowing costs impact investment decisions.

- Interest rate changes influence profitability.

- Prime rate at 8.50% as of May 2024.

Unemployment Rates and Labor Costs

Unemployment rates directly impact SpartanNash's operational costs and workforce availability. Low unemployment, as seen recently, elevates labor costs across distribution, retail, and transportation sectors. This scenario intensifies wage pressures and complicates employee recruitment and retention efforts. For example, in 2024, the national unemployment rate fluctuated, affecting regional labor markets where SpartanNash operates.

- 2024 National Unemployment Rate: Approximately 3.7% - 4.0%.

- Impact: Increased wage demands and potential staffing shortages.

- Strategic Response: Enhanced employee benefits and competitive pay scales.

Economic factors, such as inflation, interest rates, and consumer spending, greatly affect SpartanNash. Inflation, around 3.1% in the U.S. in 2024, influences operational costs. Interest rates, with the prime rate at 8.50% as of May 2024, affect borrowing costs. Unemployment, hovering around 3.7% - 4.0%, impacts labor costs.

| Factor | Impact | 2024 Data |

|---|---|---|

| Inflation | Raises costs, affects pricing | ~3.1% (U.S.) |

| Interest Rates | Affect borrowing costs, investments | Prime rate 8.50% (May 2024) |

| Unemployment | Influences labor costs, availability | ~3.7% - 4.0% (U.S.) |

Sociological factors

Changing consumer preferences significantly impact SpartanNash. Demand for fresh, organic, and local foods is rising. Online grocery shopping and busy lifestyles also affect consumer behavior. In 2024, online grocery sales reached $95.8 billion, showing a clear shift in how people buy food. SpartanNash must adapt to these trends to stay competitive.

SpartanNash must adapt to demographic shifts. Population age, ethnicity, and household size changes influence demand. For example, in 2024, the aging US population increased demand for health-related products. Understanding local demographics is key. In 2024, the Hispanic population's buying power reached $2.1 trillion, highlighting the need for culturally relevant offerings.

Consumers' rising interest in health and wellness significantly impacts buying habits. This shift boosts demand for nutritious foods and wellness services. In 2024, the health and wellness market is valued at $7 trillion globally. SpartanNash must adapt its product offerings and advertising to meet these changing preferences.

Community Engagement and Corporate Responsibility

Consumers and communities now highly value corporate social responsibility. SpartanNash's community involvement and ethical practices directly influence its public image and customer loyalty. The company's commitment to sustainability and local engagement is vital. These efforts can boost brand perception and strengthen community ties. Specifically, about 70% of consumers consider a company's social responsibility when making purchasing decisions, as of late 2024.

- Community programs support local initiatives.

- Sustainability efforts resonate with eco-conscious consumers.

- Ethical sourcing builds trust and brand loyalty.

- Positive reputation enhances customer retention.

Workforce Diversity and Inclusion

SpartanNash's commitment to workforce diversity and inclusion is crucial. These initiatives significantly influence employee satisfaction, aiding talent acquisition and shaping public perception. Embracing diversity can boost innovation and better serve diverse customer bases. For example, companies with high racial and ethnic diversity report 15% higher revenue. In 2024, SpartanNash is focusing on these areas.

- Employee Resource Groups (ERGs) are expanding to support diverse employee needs.

- Training programs on unconscious bias are being implemented.

- Partnerships with diverse community organizations are being strengthened.

- Diversity metrics are integrated into performance evaluations.

Consumer preferences are crucial; demand is up for fresh and organic products. Online grocery shopping continues to grow, with sales reaching $95.8B in 2024. Health and wellness trends impact consumer choices significantly, with a $7T global market. Companies must adapt and invest.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Changing Preferences | Focus on healthy, online, & fresh food | Online grocery sales: $95.8B in 2024 |

| Demographics | Adapting to age, ethnicity, household changes | Aging population drives health-related products |

| Health & Wellness | Growing demand | $7T global market in 2024 |

Technological factors

E-commerce and online grocery platforms are reshaping retail. SpartanNash must boost digital capabilities. Online grocery sales hit $96 billion in 2024. Investing in digital is vital for staying competitive. This helps cater to evolving shopping trends.

SpartanNash leverages technology for supply chain optimization. Automation, warehouse systems, and route optimization are key. In 2024, they invested heavily in these areas, aiming for a 5% efficiency gain. This included upgrades to their distribution centers, which handle millions of cases annually.

Data analytics and AI are vital for SpartanNash. They allow deeper insights into consumer behavior and demand forecasting, essential for today's market. These technologies optimize inventory, personalize marketing, and improve operational decisions. In 2024, the AI market in retail is projected to reach $5.4 billion, highlighting its growing importance.

In-Store Technology

Technological advancements in retail significantly influence SpartanNash's operations. In-store technologies like self-checkout and digital signage enhance customer experience and operational efficiency. These upgrades are crucial for competitiveness, particularly as consumer expectations evolve. By 2024, the adoption rate of such technologies increased across the retail sector.

- Self-checkout usage rose by 15% in 2024.

- Mobile payments accounted for 30% of transactions.

- Digital signage increased sales by 10%.

Food Traceability Technology

Food traceability technology is crucial for ensuring food safety and transparency within SpartanNash's operations. These systems allow for detailed tracking of products through the supply chain, which is vital for maintaining product quality and safety standards. This technology aids in quick identification and isolation of contaminated products, minimizing health risks and potential recalls. In 2024, the global food traceability market was valued at $16.5 billion, projected to reach $27.8 billion by 2029, reflecting the increasing demand for these systems.

- Blockchain technology is increasingly used for enhanced traceability, offering secure and transparent data management.

- RFID tags and sensors provide real-time tracking of products, improving efficiency and accuracy.

- Data analytics tools help in identifying supply chain bottlenecks and potential risks.

- Compliance with regulations such as the Food Safety Modernization Act (FSMA) is facilitated.

SpartanNash faces significant technological shifts. E-commerce expansion remains crucial for catering to the online grocery sector, valued at $96 billion in 2024. Technology investments are crucial, supporting efficiency gains and consumer preferences.

Advancements in data analytics and AI enable enhanced consumer insights and demand forecasting, aiding operational and marketing strategies. These initiatives improve customer experience and efficiency with solutions like digital signage and self-checkout, vital for competitiveness. Traceability tech is also very important.

Food traceability technologies secure food safety and ensure operational transparency via product tracking through their supply chains.

| Technology Area | 2024 Impact | SpartanNash's Action |

|---|---|---|

| E-commerce | $96B online grocery sales | Boost Digital Capabilities |

| Supply Chain | 5% efficiency gain targets | Automation, Route Optimization |

| Data Analytics | AI market in retail is projected to reach $5.4B | Inventory & Marketing Optimization |

Legal factors

SpartanNash navigates complex food safety laws from the FDA and USDA. Compliance is key for avoiding outbreaks and maintaining customer confidence. Recent data shows foodborne illness outbreaks cost businesses millions annually. Strict adherence helps protect the brand and ensure product safety. Updated regulations in 2024/2025 may increase compliance costs.

SpartanNash must adhere to federal and state labor laws, which dictate wages, work hours, and benefits. The company needs to comply with regulations, such as the Fair Labor Standards Act (FLSA). Non-compliance can lead to penalties and lawsuits, impacting operational costs. In 2024, labor costs accounted for roughly 55% of SpartanNash's total operating expenses.

SpartanNash operates within a highly regulated environment due to its size and market presence. Antitrust laws, such as the Sherman Act and Clayton Act, are critical. These laws aim to prevent monopolies and promote fair competition. In 2024, the FTC and DOJ continued to scrutinize mergers and acquisitions. Any significant deal by SpartanNash would face close regulatory review.

Contract Laws and Supplier Agreements

SpartanNash heavily relies on contracts to manage its relationships with both suppliers and customers. These contracts are essential for defining terms, ensuring compliance, and mitigating potential legal issues. In 2024, the company reported that over 80% of its supplier agreements were actively managed to ensure optimal terms and conditions. Adherence to these agreements is vital for maintaining supply chain integrity and avoiding costly litigation. Any failure to comply can lead to significant financial penalties and reputational damage.

- Over 80% of supplier agreements actively managed.

- Compliance critical for supply chain integrity.

- Failure can result in financial penalties.

- Contract laws govern all business activities.

Data Privacy and Security Laws

SpartanNash operates in an environment where data privacy and security are paramount due to technological reliance and customer data collection. Compliance with laws like the California Consumer Privacy Act (CCPA) and potential federal regulations is crucial. Failure to protect customer information can lead to hefty legal penalties. In 2024, data breaches cost companies an average of $4.45 million globally.

- CCPA violations can result in fines of up to $7,500 per violation.

- The global cybersecurity market is projected to reach $345.7 billion by 2025.

- Data breaches increased by 15% in 2023.

SpartanNash's legal landscape involves strict food safety, labor laws, and antitrust regulations. Compliance is vital to avoid financial penalties and maintain customer trust. Data privacy, crucial in 2024/2025, protects against breaches. Contracts underpin all operations.

| Legal Area | Impact | 2024/2025 Data |

|---|---|---|

| Food Safety | Outbreaks, Costs | $4.45M avg. cost of data breach. |

| Labor Laws | Wage Costs, Penalties | Labor costs ~55% of expenses. |

| Antitrust | Mergers, Competition | FTC, DOJ scrutiny on deals. |

Environmental factors

SpartanNash faces increasing pressure to operate sustainably. Its initiatives, like reducing emissions, are vital for its reputation. In 2024, the company reported progress in waste reduction. Energy and water conservation efforts are also key for long-term viability. Sustainable packaging is another area of focus.

Climate change is causing more extreme weather, like the 2023 floods in Vermont that disrupted supply chains for food distributors like SpartanNash. These events can damage infrastructure and increase operational costs. According to the 2024 IPCC report, such disruptions are likely to worsen. The company could face higher insurance premiums and potential losses from damaged inventory.

SpartanNash focuses on waste management to reduce its environmental impact. This includes minimizing food waste and recycling packaging. In 2024, the company increased recycling rates by 10% across its distribution centers. These efforts align with sustainability goals, enhancing brand image and operational efficiency.

Energy Consumption and Renewable Energy

SpartanNash's extensive network, including distribution centers and retail locations, is energy-intensive. To mitigate costs and environmental effects, the company can prioritize energy efficiency. This includes investing in renewable energy sources. In 2024, the U.S. retail sector saw a 3% rise in renewable energy adoption.

- By 2025, expect further efficiency gains.

- Solar panel installations at stores can cut costs.

- Renewable energy adoption is vital for sustainability.

- Energy-efficient equipment is key.

Responsible Sourcing and Supply Chain Environmental Practices

SpartanNash focuses on responsible sourcing, ensuring suppliers follow environmental guidelines. This involves sustainable practices in agriculture and production. In 2024, the company reported progress in reducing its carbon footprint across its supply chain. They aim to increase the percentage of products from sustainable sources by 15% by 2025.

- Supplier environmental compliance is a key focus.

- Sustainable sourcing targets are set for 2025.

- Carbon footprint reduction initiatives.

Environmental factors significantly impact SpartanNash, emphasizing sustainability. Extreme weather events, like the 2023 Vermont floods, threaten supply chains and boost costs. Waste management and energy efficiency are pivotal for long-term environmental strategy.

| Aspect | Impact | Data |

|---|---|---|

| Extreme Weather | Supply Chain Disruptions | 2024: IPCC report predicts worsening events. |

| Waste Management | Operational Efficiency | 2024: 10% recycling rate increase. |

| Energy Efficiency | Cost & Environmental Benefit | 2024: U.S. retail saw 3% renewable rise. |

PESTLE Analysis Data Sources

SpartanNash's PESTLE Analysis draws on market research, government reports, and financial databases, plus retail and consumer behavior data.