ACCO Brands Bundle

How well do you know the ACCO Brands SWOT Analysis?

Journey back in time to uncover the remarkable ACCO Brands history, a story of innovation and adaptation spanning over a century. From humble beginnings producing paper clips, this business products giant has shaped how we organize information in offices and beyond. Explore the key milestones and strategic decisions that propelled ACCO Brands to its current global prominence.

The ACCO Brands company story is a compelling case study in corporate evolution, showcasing how a business can thrive through product innovation and strategic acquisitions. Understanding the ACCO Brands company timeline provides valuable insights into the office supplies market and the forces that drive success in a competitive landscape. This exploration will reveal the significant milestones and key events that have defined ACCO Brands' past and present, offering a glimpse into its future.

What is the ACCO Brands Founding Story?

The story of ACCO Brands history is a composite of several key businesses that emerged in the late 1800s and early 1900s. These companies, which would eventually form the foundation of ACCO Brands, each played a significant role in shaping the office supply industry. Their innovations addressed fundamental needs in organizing information, setting the stage for the modern office environment.

One of the earliest predecessors was Wilson Jones, established in 1893. It was a pioneer in office products, notably in the realm of ring binders. The American Clip Company (ACCO), founded in 1903 by Fred J. Kline in Long Island, New York, is the direct namesake. Kline initially focused on manufacturing paper clips, recognizing the need for efficient paper fastening solutions. The company's name evolved over time, becoming the American Clip Company in 1910 and officially adopting 'ACCO' in 1922.

Another key entity in the ACCO Brands company lineage was the Swingline Company, founded in 1925 by Jack Linsky. Swingline revolutionized stapling with innovative designs. These companies, with products like the paper clip, ring binder, and stapler, became essential for organizing information and formed the cornerstones of the modern office. Understanding the ACCO Brands history provides insight into the evolution of office supplies and the development of the company.

The foundational story of ACCO Brands is marked by the establishment of several key companies.

- Wilson Jones, established in 1893, was an early innovator in office products like ring binders.

- The American Clip Company (ACCO), founded in 1903, focused on manufacturing paper clips.

- The Swingline Company, founded in 1925, revolutionized stapling technology.

- These companies addressed fundamental needs in organizing information, becoming cornerstones of the modern office.

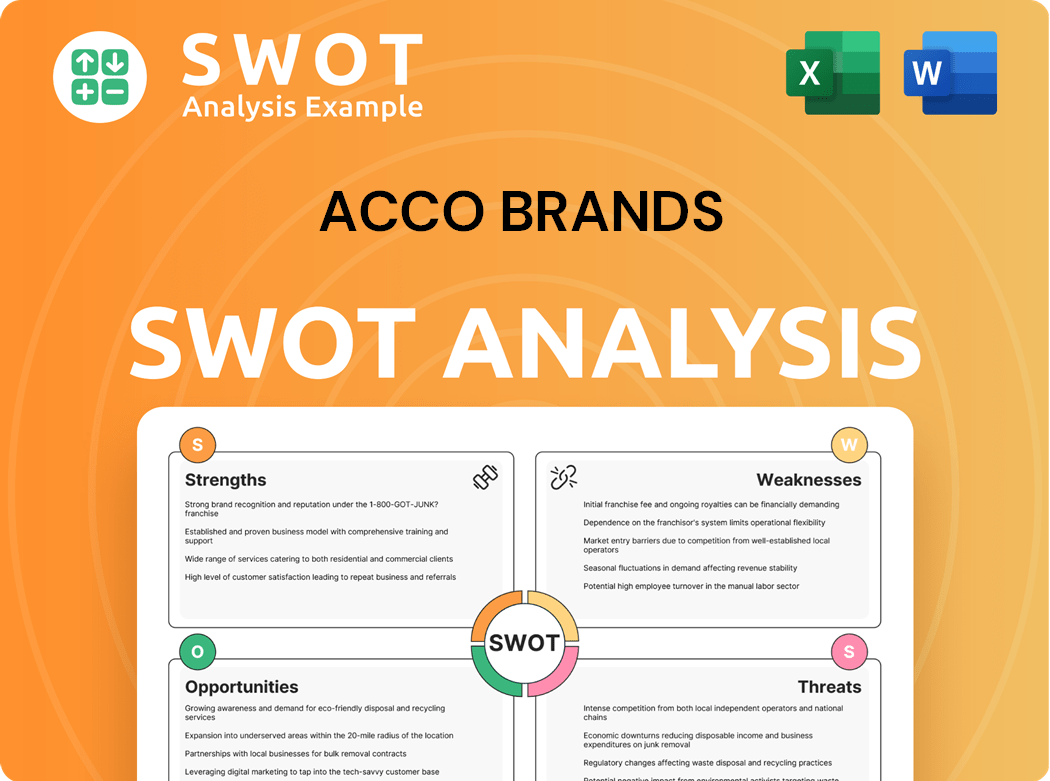

ACCO Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ACCO Brands?

The early growth and expansion of ACCO Brands were marked by both organic product development and strategic acquisitions. This strategy laid the foundation for its global presence. The company quickly expanded internationally, establishing offices in Canada and England. This period was also characterized by acquiring European brands, which broadened its market reach and product offerings.

In the mid-1920s, ACCO Brands began its international expansion by opening offices in Canada and England. This move was crucial for establishing a global footprint and accessing new markets. The company's early international ventures were a key step in its growth strategy, setting the stage for future acquisitions and global brand recognition.

ACCO Brands strategically acquired European brands such as Rexel and NOBO to expand its product offerings and market presence. These acquisitions were vital in diversifying its portfolio and increasing its competitiveness in the office supplies and business products sectors. The integration of these brands helped ACCO Brands to cater to a broader customer base.

A pivotal moment occurred in 2005 when ACCO World merged with General Binding Corporation (GBC). This merger formed ACCO Brands Corporation as an independent, publicly traded company. This strategic move combined complementary businesses, significantly expanding the product portfolio and setting the stage for future growth.

In 2012, ACCO Brands merged with MeadWestvaco's Consumer & Office Products business, which brought in well-known brands such as Mead, Five Star, and AT-A-GLANCE. This acquisition significantly expanded ACCO Brands' product offerings and market reach. The integration of these brands helped to strengthen its position in the office supplies market.

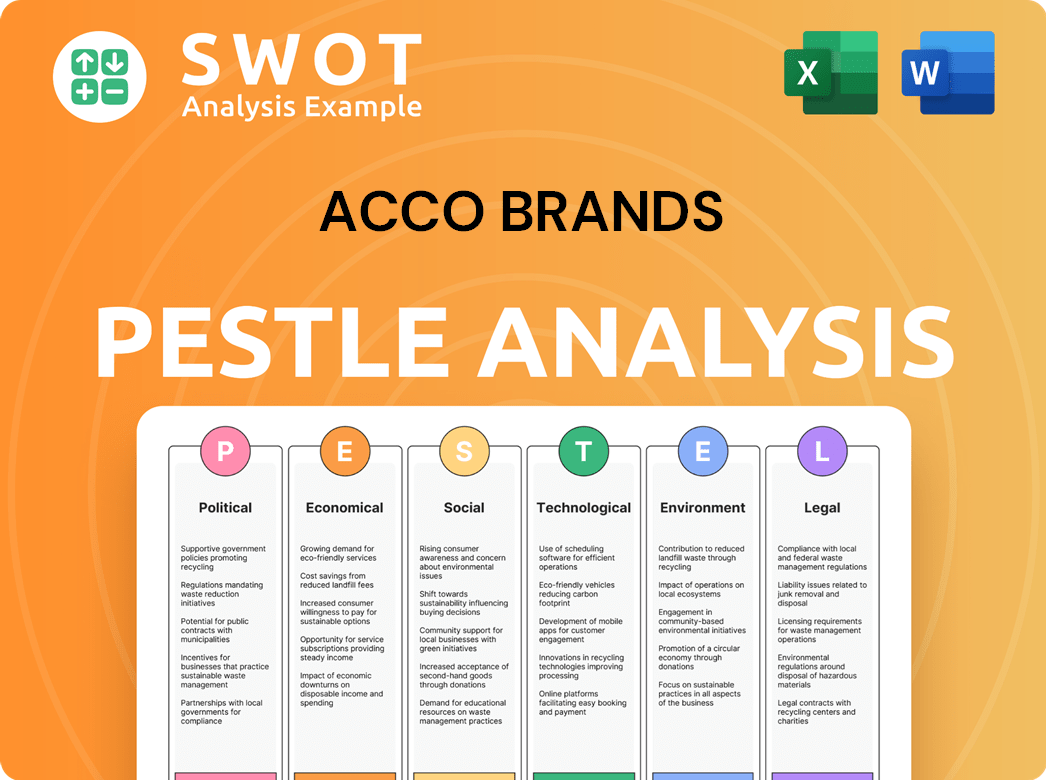

ACCO Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ACCO Brands history?

The ACCO Brands company has a rich history, marked by significant milestones in product innovation and strategic growth. The company's evolution includes foundational contributions to office supplies, such as the ring binder and stapler, which have fundamentally changed how people work.

| Year | Milestone |

|---|---|

| Early 1900s | Foundational entities introduced revolutionary products like the ring binder and paper clip, changing office work. |

| 1980s | Introduction of Kensington security products, expanding into technology accessories. |

| 2020 | Acquisition of PowerA, entering the video game accessory market. |

| 2024 | Implemented multi-year cost reduction programs, targeting $100 million in annualized savings by the end of 2026. |

ACCO Brands has consistently adapted its product range to meet the evolving needs of the market. This includes expanding into technology accessories and the video game accessory market.

ACCO Brands has consistently introduced innovative office supplies and business products. This includes items that have become staples in offices worldwide.

The company expanded its offerings to include technology accessories, such as Kensington security products. This diversification has helped ACCO Brands stay relevant in a changing market.

Strategic acquisitions, like PowerA, have allowed ACCO Brands to enter new markets. This strategy has been key to expanding its product line and market reach.

Despite its history of innovation and strategic acquisitions, ACCO Brands has faced challenges. These challenges include navigating competitive landscapes and adapting to technological disruptions.

ACCO Brands operates in a competitive market, requiring continuous innovation and strategic adjustments to maintain its market share. The company faces competition from both established players and emerging brands.

The company has to navigate market downturns and economic challenges. Recent financial results reflect some of these challenges, with a reported net loss of $101.6 million in 2024, primarily due to non-cash impairment charges.

Adapting to changing consumer preferences and technological advancements is crucial for ACCO Brands. The shift towards digital solutions and remote work models presents ongoing challenges.

ACCO Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ACCO Brands?

The ACCO Brands history is a journey through key moments that have shaped its identity in the business products sector. From its early days with the invention of the ring binder to its expansion through strategic acquisitions, the company has consistently adapted to market changes. Here's a look at the significant milestones that have defined the ACCO Brands company timeline.

| Year | Key Event |

|---|---|

| 1893 | Wilson Jones, a predecessor company and innovator of the ring binder, is founded, setting the stage for future developments. |

| 1903 | Fred J. Kline establishes the Clipper Manufacturing Company (later ACCO) in New York, initially producing paper clips, marking the company's official start. |

| 1925 | The Swingline Company, which would later become a crucial part of ACCO Brands, is founded, expanding its product offerings. |

| Mid-1920s | ACCO expands internationally by establishing offices in Canada and England, broadening its global presence. |

| 2005 | ACCO World merges with General Binding Corporation (GBC), forming ACCO Brands Corporation, a significant consolidation. |

| 2012 | ACCO Brands merges with MeadWestvaco's Consumer & Office Products business, integrating brands like Mead and Five Star. |

| 2017 | ACCO Brands acquires Esselte, a global office products manufacturer, strengthening its position in the industry. |

| 2020 | ACCO Brands enters the video game accessory market by acquiring PowerA, diversifying its portfolio. |

| 2024 | Reported net sales reach $1.67 billion, with a net loss of $101.6 million, reflecting current financial performance. |

ACCO Brands is focused on enhancing sales through new product development, strategic acquisitions, and brand building, indicating a proactive approach to market dynamics. The company is implementing a multi-year cost reduction program, aiming for $100 million in annualized savings by the end of 2026, which is crucial for operational efficiency.

The company is exploring opportunities in faster-growing categories like technology accessories, reflecting a commitment to adapting to evolving market demands. ACCO Brands aims to leverage its strong brands and operational efficiencies to drive future growth, continuing its long legacy in the industry, despite facing market uncertainties.

For 2025, the company anticipates comparable sales to be down 1% to 5%, and adjusted earnings per share (EPS) between $1.00 and $1.05, providing a clear financial outlook. These projections offer insights into the company's expected performance, helping stakeholders understand potential outcomes.

ACCO Brands is concentrating on initiatives that can drive future growth and deliver value to stakeholders. This strategic focus includes new product development, accretive acquisitions, and brand building to strengthen its market position. These efforts are designed to ensure sustained success.

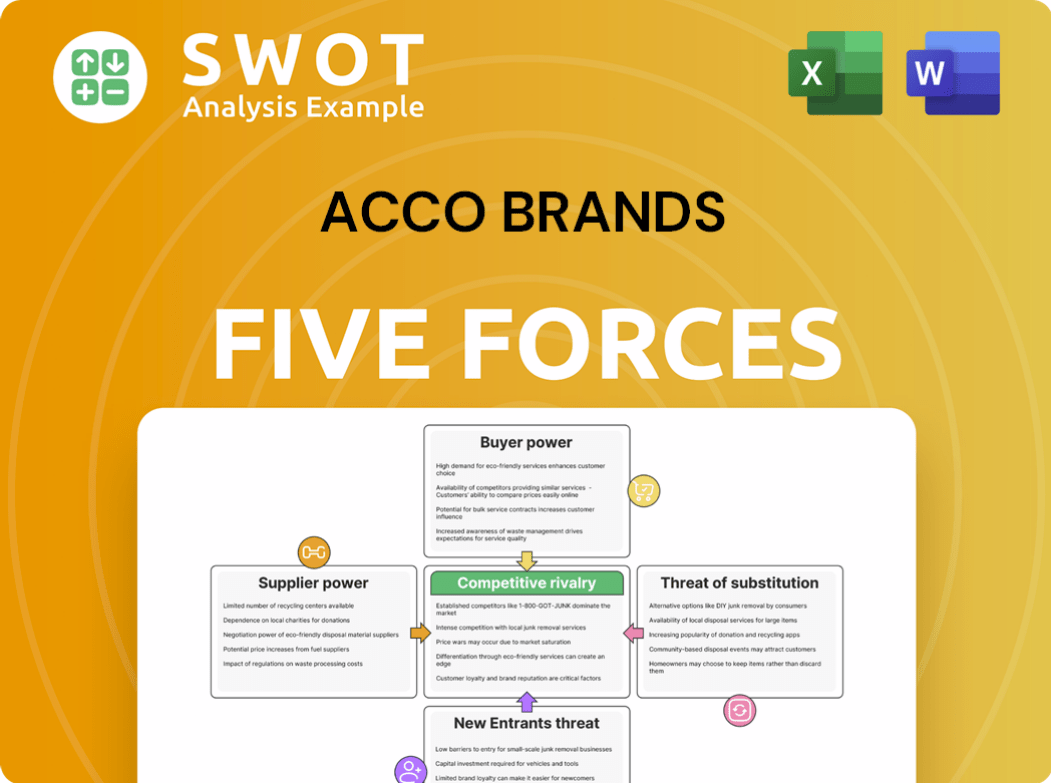

ACCO Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ACCO Brands Company?

- What is Growth Strategy and Future Prospects of ACCO Brands Company?

- How Does ACCO Brands Company Work?

- What is Sales and Marketing Strategy of ACCO Brands Company?

- What is Brief History of ACCO Brands Company?

- Who Owns ACCO Brands Company?

- What is Customer Demographics and Target Market of ACCO Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.