ACCO Brands Bundle

How Does ACCO Brands Thrive in Today's Market?

ACCO Brands, a century-old giant, remains a dominant force in the office and school supplies sector. From iconic brands like Mead to innovative tech accessories, ACCO Brands's evolution is a testament to its adaptability. Understanding the inner workings of ACCO Brands SWOT Analysis is key to grasping its enduring success.

This exploration of the ACCO Brands business model will reveal how the company generates revenue and maintains its competitive edge. Whether you're interested in ACCO Brands stock, its product portfolio, or its financial performance, this analysis provides crucial insights. Discover how ACCO Brands, with its rich history, continues to navigate the ever-changing demands of the global market.

What Are the Key Operations Driving ACCO Brands’s Success?

The core of the ACCO Brands company lies in its ability to design, manufacture, and market a diverse array of office, school, and calendar products. This strategy is geared towards enhancing productivity, organization, and learning for a global customer base. ACCO Brands' operations are vertically integrated, involving in-house manufacturing and strategic sourcing, which allows for greater control over quality and cost.

ACCO Brands serves a broad spectrum of customers, from individual consumers and students to small businesses and large corporations. The company's product portfolio includes binding and laminating machines, shredders, notebooks, planners, folders, and computer accessories. This extensive range ensures that ACCO Brands can meet the diverse needs of its customers across various sectors.

The company's multi-channel distribution strategy is a key component of its success. ACCO Brands reaches customers through mass merchandise retailers, office superstores, independent dealers, e-commerce platforms, and direct-to-business sales. This wide-ranging network, combined with strong relationships with key retailers, ensures broad market penetration and accessibility for ACCO products.

ACCO Brands focuses on designing, manufacturing, and marketing office, school, and calendar products. They utilize in-house manufacturing and strategic sourcing. The company has a multi-channel distribution strategy to reach a wide customer base.

ACCO Brands offers reliable, high-quality products that meet everyday needs. They differentiate themselves through brand recognition and a comprehensive product offering. This simplifies purchasing decisions for consumers and businesses.

ACCO Brands uses mass merchandise retailers, office superstores, and e-commerce platforms. They also utilize independent dealers and direct-to-business sales. This ensures broad market penetration.

The portfolio includes binding and laminating machines, shredders, and notebooks. It also features planners, folders, and computer accessories. This caters to a diverse range of customer needs.

ACCO Brands' extensive portfolio of well-established and trusted brands fosters strong brand loyalty. Their global manufacturing and distribution footprint provides economies of scale. These factors translate into reliable, high-quality products and market differentiation.

- Brand Recognition: Strong brand loyalty allows for premium pricing.

- Global Presence: Manufacturing and distribution provide economies of scale.

- Comprehensive Offering: Simplifies purchasing decisions for consumers and businesses.

- Customer Benefits: Reliable, high-quality products meeting everyday needs.

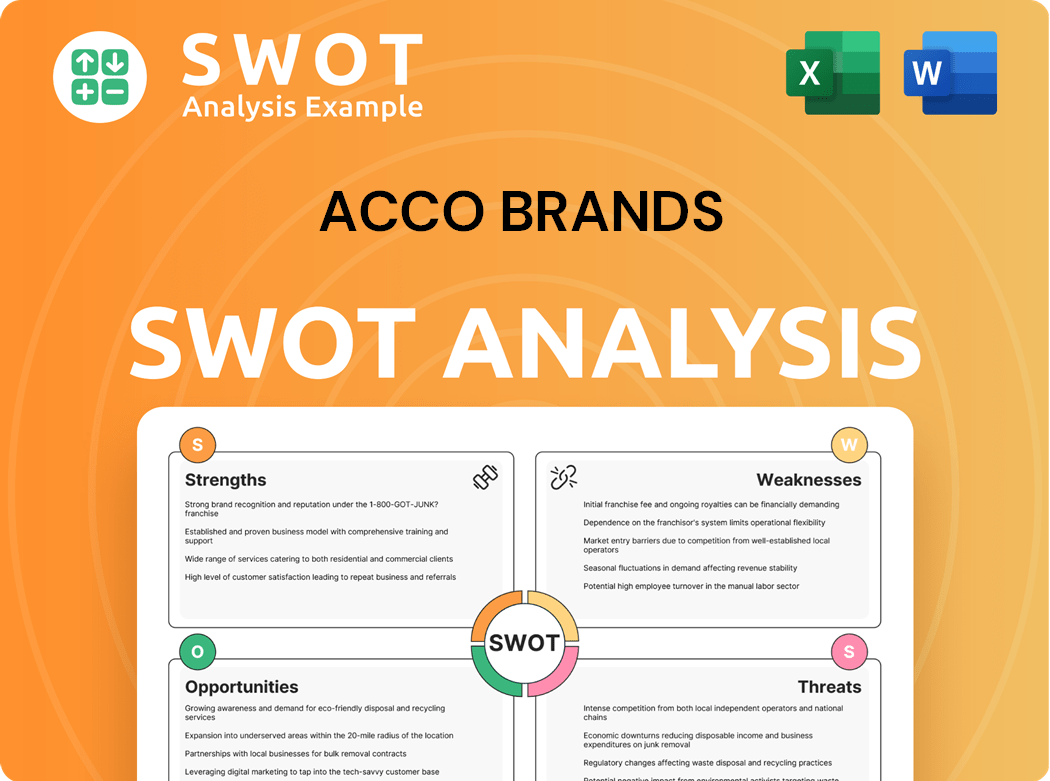

ACCO Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ACCO Brands Make Money?

The ACCO Brands company generates revenue primarily through the sale of its diverse range of office, school, and calendar products. This revenue model is heavily reliant on product sales across various segments, including Planning & Productivity, Computer Products, and Storage & Organization. Understanding the revenue streams and how the ACCO Brands business monetizes its offerings is crucial for investors and stakeholders.

The company's financial performance is largely driven by direct product sales. For instance, in fiscal year 2023, the net sales were reported at $1.89 billion, demonstrating the significant contribution of its core product offerings. The ability of ACCO Brands to maintain and grow its revenue is closely tied to its product sales strategy and market positioning.

Innovative monetization strategies are employed by ACCO Brands to maximize revenue. These include tiered pricing for certain product lines, especially in technology accessories under the Kensington brand, where premium features command higher prices. Bundling strategies are also utilized, offering complementary products together to increase the average transaction value.

While direct product sales form the core of ACCO Brands' revenue model, the company also explores other avenues to diversify its income streams. This includes licensing agreements for certain brands, which, while contributing to a smaller portion of overall revenue, still play a role in the company's financial strategy. The evolution of ACCO Brands' revenue sources reflects its efforts to adapt to changing consumer behaviors and market trends.

- Tiered Pricing: Premium features in products like Kensington technology accessories command higher prices.

- Bundling: Offering complementary products together to increase transaction values.

- Cross-selling: Leveraging broad distribution channels to expose customers to a wider range of ACCO products.

- Licensing Agreements: Generating revenue through brand licensing, diversifying income streams.

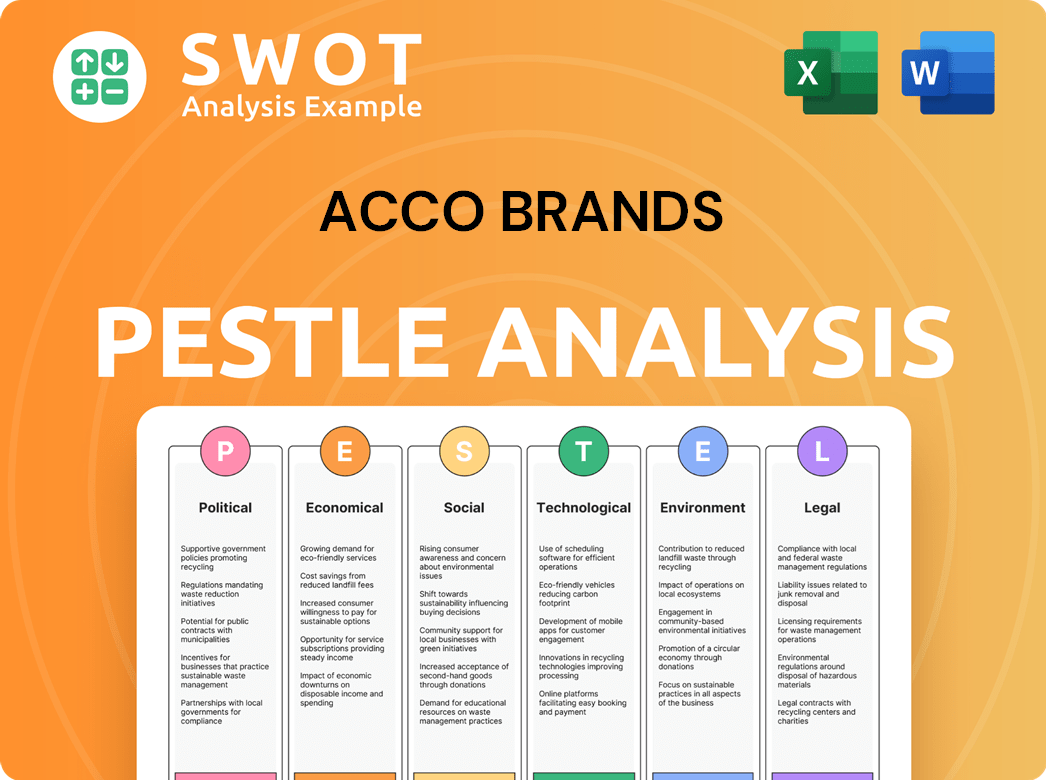

ACCO Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ACCO Brands’s Business Model?

The evolution of the ACCO Brands company has been marked by strategic acquisitions and operational adaptations. These moves have significantly shaped its market position and financial outcomes. Understanding these key milestones provides insights into the company's growth trajectory and its ability to navigate market dynamics.

ACCO Brands has strategically expanded its portfolio through acquisitions, enhancing its product offerings and geographic reach. These strategic moves have been crucial for the company's expansion. The company's ability to adapt to changing market conditions and consumer preferences is a key factor in its sustained success.

The ACCO Brands business model focuses on providing a wide range of office and school supplies. This approach has allowed the company to build a strong brand and maintain a competitive edge in the market. The company's focus on innovation and sustainability further strengthens its position.

The acquisition of MeadWestvaco’s Consumer & Office Products in 2012 was a pivotal move, adding iconic brands such as Mead and Five Star to its portfolio. The Esselte Group acquisition in 2017 further expanded its international presence and organizational solutions. These acquisitions have significantly expanded the ACCO Brands product portfolio.

ACCO Brands has adapted to supply chain disruptions by diversifying sourcing and optimizing logistics. The company has also focused on developing new product lines and enhancing its e-commerce presence. These strategic adjustments aim to maintain relevance in a changing market.

Strong brand recognition and loyalty across its diverse portfolio enable premium pricing and market share maintenance. Economies of scale from global manufacturing and distribution provide cost efficiencies. Extensive distribution networks and retailer relationships are also key advantages for the ACCO Brands company.

In 2023, ACCO Brands reported net sales of approximately $2.1 billion. The company's adjusted operating income was around $245 million. These figures reflect the company's ability to maintain financial stability. For more detailed financial information, you can consult the ACCO Brands annual report.

ACCO Brands continues to adapt to evolving market trends, including the growing demand for sustainable products and the shift towards hybrid work models. The company's focus on innovation and sustainability is expected to drive future growth. The company is also exploring opportunities to expand its e-commerce capabilities.

- The company's focus on sustainability includes initiatives to reduce its environmental impact.

- ACCO Brands is investing in product innovation to meet changing consumer needs.

- The company is expanding its e-commerce presence to enhance its market reach.

- ACCO Brands aims to maintain a strong market position through strategic initiatives.

ACCO Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ACCO Brands Positioning Itself for Continued Success?

The ACCO Brands company holds a strong industry position as a leading global provider of office, school, and consumer products. It competes with large multinational corporations and smaller, specialized manufacturers. The ACCO Brands business benefits from significant market share across various product categories, supported by high brand recognition and customer loyalty.

The company's global reach, with operations and sales in numerous countries, allows for diversified market exposure. However, ACCO Brands faces risks such as fluctuating raw material costs and changing consumer preferences, including the shift towards digital tools. Economic downturns and intense competition also pose challenges. For a deeper understanding of the competitive environment, consider exploring the Competitors Landscape of ACCO Brands.

ACCO Brands is a key player in the office and school supplies sector, with a global footprint. Its market share is substantial, backed by well-known brands. The company's diverse product portfolio caters to various consumer needs across different regions.

Fluctuating raw material costs, like paper and plastics, impact profitability. Changing consumer habits towards digital tools pose a challenge. Economic downturns and competition from private label brands also present risks.

ACCO Brands is focused on sustainable growth through acquisitions and operational efficiencies. The company is investing in e-commerce and product innovation. Leadership aims to meet evolving workplace and educational needs.

ACCO Brands is expanding its technology accessories portfolio. It is optimizing its supply chain for greater resilience. The company is also focused on developing products for modern environments.

In recent financial reports, ACCO Brands has shown resilience in navigating market challenges. The company's revenue and profitability are closely monitored by investors. Strategic acquisitions and cost-saving measures influence the company's financial health.

- ACCO Brands reported net sales of approximately $1.2 billion for the third quarter of 2024.

- Gross margin for Q3 2024 was around 36.6%, reflecting the impact of cost management.

- The company's adjusted operating income for the same period was about $140 million.

- ACCO Brands continues to focus on returning capital to shareholders through dividends and share repurchases.

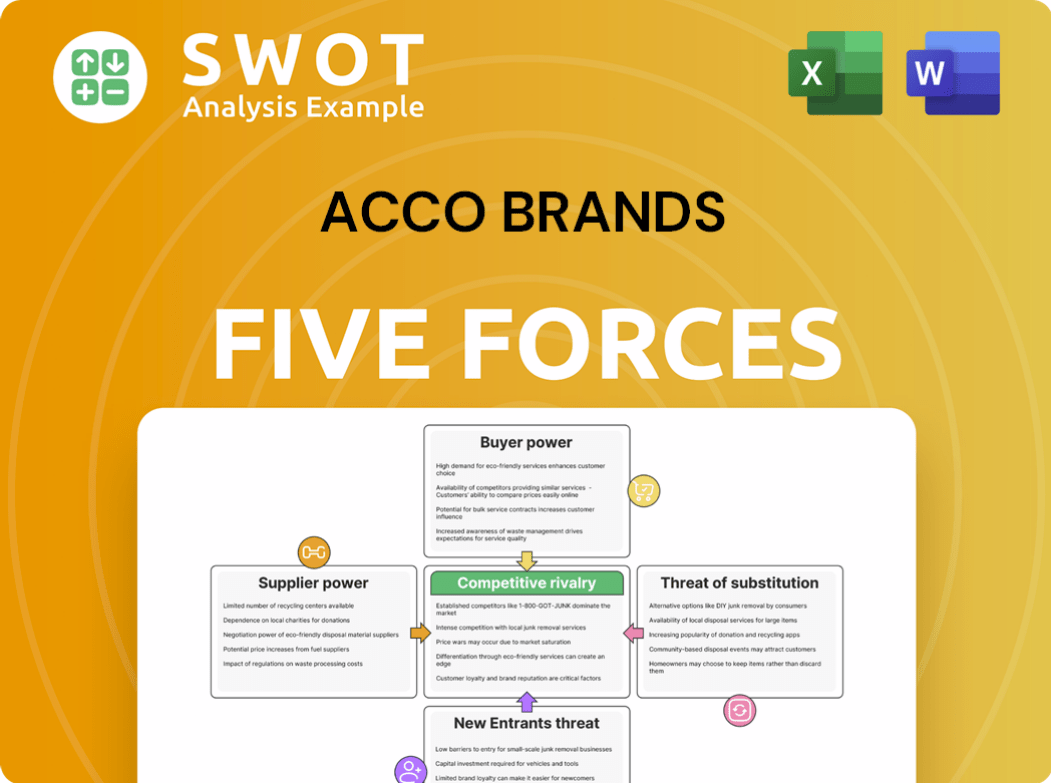

ACCO Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACCO Brands Company?

- What is Competitive Landscape of ACCO Brands Company?

- What is Growth Strategy and Future Prospects of ACCO Brands Company?

- What is Sales and Marketing Strategy of ACCO Brands Company?

- What is Brief History of ACCO Brands Company?

- Who Owns ACCO Brands Company?

- What is Customer Demographics and Target Market of ACCO Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.