ACCO Brands Bundle

Who Really Controls ACCO Brands?

Ever wondered who pulls the strings at a global powerhouse like ACCO Brands? Understanding ACCO Brands SWOT Analysis and its ownership structure is key to unlocking its strategic playbook. From its humble beginnings as the American Clip Company in 1903 to its current status, ACCO Brands' journey is a testament to how ownership shapes a company's destiny. Discover how the evolution of ACCO Brands ownership has influenced its market position and financial performance.

The dynamics of ACCO Brands ownership, which includes a mix of institutional investors and public shareholders, directly impacts everything from capital allocation to executive decisions. Examining 'Who owns ACCO Brands' is crucial for investors and stakeholders alike, as it offers a glimpse into the company's long-term vision and governance. This exploration will uncover the major shareholders, the impact of its history, and the significance of ACCO Brands' company structure.

Who Founded ACCO Brands?

The story of ACCO Brands begins in 1903 with the founding of the American Clip Company. The initial focus was on creating innovative office products, setting the stage for the company's future in the office and consumer products sector. While the exact details of the early ownership structure are not readily available in public records, the company's origins reflect an entrepreneurial spirit.

Early ownership likely involved a core group of founders and potentially local investors. These individuals shared a vision for the company's growth. The early years were crucial in establishing the foundation for what would become a major player in the industry. The company's evolution over time would naturally lead to a more complex ownership structure.

Over the years, the ACCO Brands company has seen significant changes. Information about early agreements, such as vesting schedules or buy-sell clauses from over a century ago, is typically not publicly disclosed for companies of this age. Similarly, details about initial ownership disputes or buyouts from that period are generally not part of contemporary public records.

The American Clip Company was founded in 1903, with a focus on innovative office products.

Early ownership likely involved founders and local investors. Details of the initial equity split are not readily available.

Over time, the company's ownership structure became more complex. Early agreements and disputes are not typically part of public records.

The early 1900s saw the birth of many companies. The financial information from this era is often not readily available.

As the company grew, its ownership structure naturally evolved. The initial focus was on office products.

Public records from over a century ago rarely contain detailed information about ownership structures.

Understanding the early history of ACCO Brands provides context for its later development. The company's origins highlight the importance of innovation and the evolution of ownership structures over time. For more insights, explore the Competitors Landscape of ACCO Brands.

- The American Clip Company was the foundation of what would become ACCO Brands.

- Early ownership details are not readily available in public records.

- The company's focus was on innovative office products.

- The ownership structure evolved as the company grew.

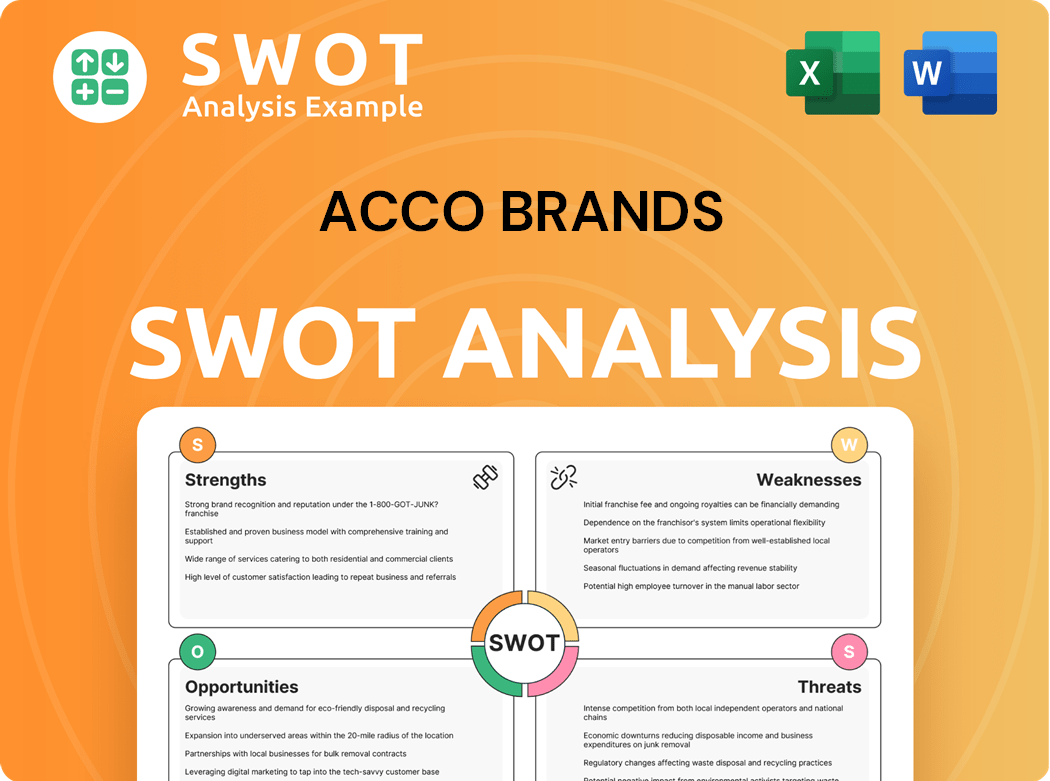

ACCO Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ACCO Brands’s Ownership Changed Over Time?

The ownership structure of ACCO Brands has evolved significantly since its spin-off from Fortune Brands in 2005, transforming it into an independent, publicly traded entity. This transition marked a pivotal moment, shifting the company’s ownership from a conglomerate structure to one distributed among a diverse group of shareholders. This change was crucial in shaping ACCO Brands' strategic direction and operational independence. Understanding the evolution of ACCO Brands ownership provides insights into its current market position and future prospects. For more details, you can read about the Brief History of ACCO Brands.

As a publicly traded company, ACCO Brands' ownership is primarily held by institutional investors. These institutional investors, including major investment management firms, collectively hold a substantial portion of the company's shares. This dispersed ownership structure influences the company's governance and strategic decisions, with the board of directors playing a critical role in representing the interests of various shareholders. The composition of these institutional holdings can fluctuate based on market conditions and the investment strategies of these firms, as reflected in their quarterly SEC filings.

| Ownership Aspect | Details | Impact |

|---|---|---|

| Initial Public Offering (IPO) | ACCO Brands became an independent public company. | Established a broad shareholder base, influenced by market dynamics. |

| Institutional Investors | Firms like The Vanguard Group and BlackRock Inc. hold significant stakes. | Shapes governance and strategic decisions, reflecting market sentiment. |

| SEC Filings | Quarterly 13F filings reveal changes in institutional holdings. | Indicate shifts in market sentiment and investment strategies. |

As of early 2024, major institutional shareholders of ACCO Brands include The Vanguard Group, BlackRock Inc., and State Street Global Advisors. These firms manage substantial assets and often hold significant positions in publicly traded companies, influencing market dynamics and corporate governance. The concentration of ownership among these institutions highlights the importance of understanding their investment strategies and the broader market trends that impact ACCO Brands' stock. The company's stock symbol is ACCO. The company's annual revenue was approximately $1.9 billion in 2023.

ACCO Brands' ownership structure is predominantly influenced by institutional investors.

- The Vanguard Group, BlackRock Inc., and State Street Global Advisors are among the major shareholders.

- The company's governance and strategy are shaped by this dispersed ownership.

- Changes in holdings are reported in SEC filings, reflecting market dynamics.

- Understanding the ownership structure is crucial for investors and stakeholders.

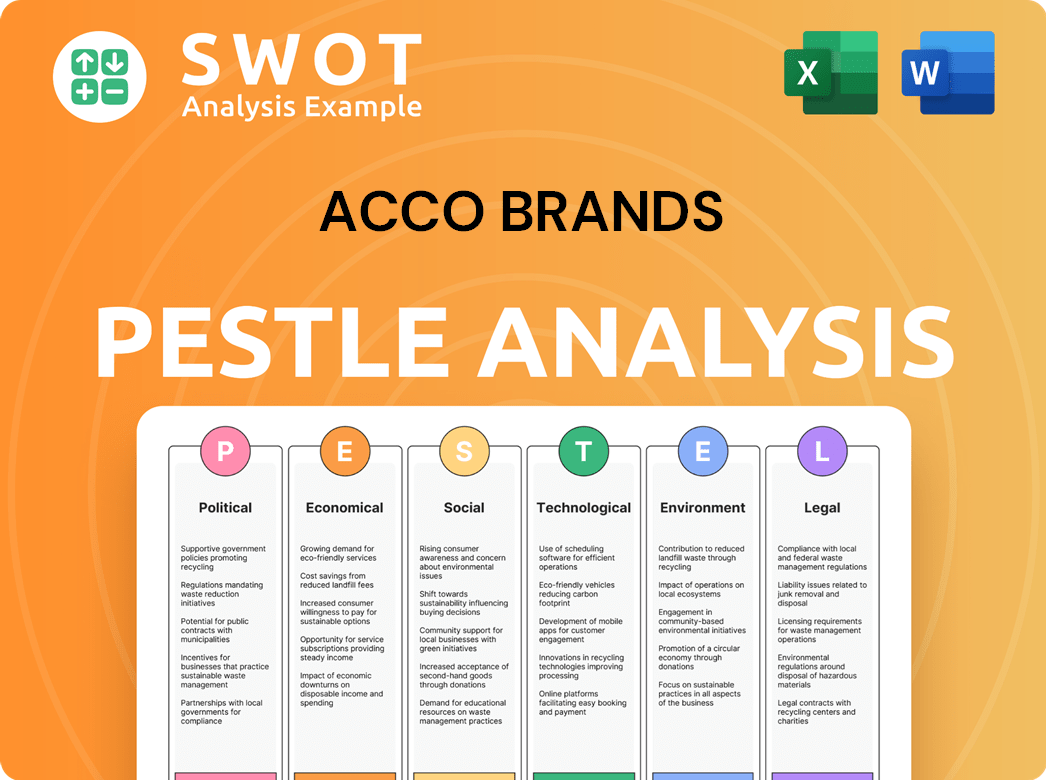

ACCO Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ACCO Brands’s Board?

The Board of Directors at ACCO Brands Corporation oversees the company's strategic direction and ensures proper governance, acting on behalf of the shareholders. The board is typically composed of both independent directors and executive directors. Some directors may represent significant institutional shareholders, although direct representation by major shareholders on the board isn't standard practice for publicly traded companies like ACCO Brands. Information on the current board members, their committee assignments, and any significant corporate governance matters can be found in recent proxy statements and annual reports, such as DEF 14A filings.

The voting structure for ACCO Brands generally follows a one-share-one-vote system. This means each share of common stock gives its holder one vote on shareholder matters, including electing directors and approving corporate actions. There's no indication of dual-class shares or similar arrangements that would give specific individuals or entities disproportionate voting power. While activist investor campaigns can occur, there haven't been any recent high-profile proxy battles or governance controversies that have significantly altered decision-making within ACCO Brands in a public manner.

| Director | Position | Other Affiliations |

|---|---|---|

| Boris Sekulić | Chairman of the Board | Former CEO of a global manufacturing company |

| Gary W. Baur | Director | Former CFO of a global consumer products company |

| Michelle M. Burns | Director | CEO of a global food company |

Understanding the composition of the board is crucial for investors looking into ACCO Brands ownership and the company's governance. The board's role is to ensure the long-term success of the company, making sure it aligns with shareholder interests. For those interested in the ACCO Brands stock, knowing the board's structure can help assess the company's strategic direction and risk management.

The Board of Directors at ACCO Brands company oversees the company's strategic direction and governance. Voting generally follows a one-share-one-vote system. For more details on ACCO Brands history and structure, you can explore this article: 0.

- The board includes independent and executive directors.

- Voting rights are typically one vote per share.

- Recent filings provide detailed board member information.

- No current indication of disproportionate voting power.

ACCO Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ACCO Brands’s Ownership Landscape?

Over the past few years, the ownership structure of ACCO Brands has seen continued evolution, reflecting broader trends in the market. While there haven't been major announcements regarding significant share buybacks or secondary offerings that drastically shifted the ownership, the company's shareholder base continues to be heavily influenced by institutional investors. This is a common pattern in the industry, as large asset managers grow and index investing becomes more prevalent. This typically leads to a distribution of ownership among a wider range of institutional funds. The company's strategic moves, such as the 2021 acquisition of PowerA, have played a role in shaping investor confidence and share performance, indirectly affecting ownership dynamics.

The evolution of ACCO Brands ownership also reflects the natural dilution of founder stakes over time, as the company has been publicly traded for an extended period. As a result, the initial ownership held by the founders has become a smaller percentage of the total outstanding shares due to subsequent stock issuances or secondary market sales. Public communications from the company and financial analysts tend to focus on performance, strategic initiatives, and market forecasts, rather than explicit ownership changes or potential privatization. This indicates a stable, publicly traded ownership structure in the near term. For more insights, you can check out the Marketing Strategy of ACCO Brands.

| Metric | Value | Year |

|---|---|---|

| Market Capitalization (approx.) | ~$600 million | 2024 |

| Institutional Ownership (approx.) | ~90% | 2024 |

| Revenue (approx.) | ~$2 billion | 2023 |

ACCO Brands company continues to be a publicly traded entity, and its ownership is primarily held by institutional investors. Understanding the dynamics of Who owns ACCO Brands is crucial for investors. The company's focus remains on financial performance and strategic growth initiatives. The ACCO Brands stock has seen fluctuations, reflecting its market position and strategic decisions.

The majority of ACCO Brands is held by institutional investors. The company's stock is publicly traded on the NYSE. The ownership structure reflects a stable, publicly traded company.

Major shareholders include large institutional investors. Individual holdings vary, but institutional ownership is dominant. Ownership structure is subject to change.

ACCO Brands has made strategic acquisitions, like PowerA in 2021. No significant changes in ownership have been reported recently. The company focuses on operational performance.

The company is expected to maintain its publicly traded status. ACCO Brands will likely continue to be of interest to institutional investors. Strategic initiatives will shape future performance.

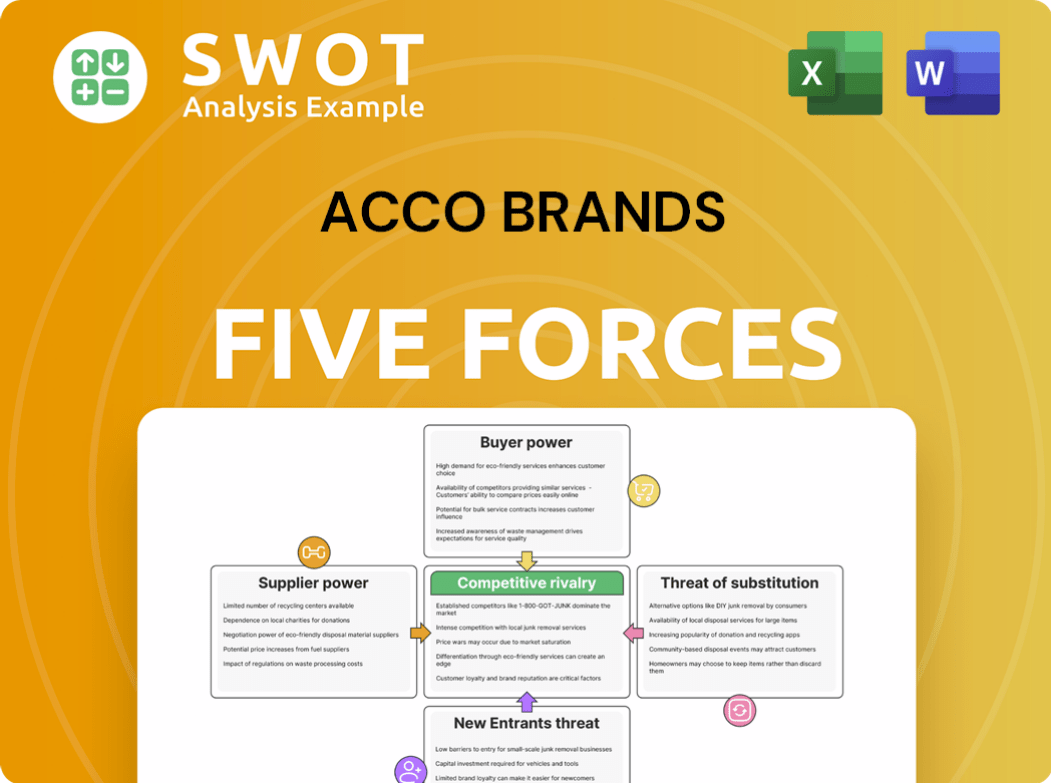

ACCO Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACCO Brands Company?

- What is Competitive Landscape of ACCO Brands Company?

- What is Growth Strategy and Future Prospects of ACCO Brands Company?

- How Does ACCO Brands Company Work?

- What is Sales and Marketing Strategy of ACCO Brands Company?

- What is Brief History of ACCO Brands Company?

- What is Customer Demographics and Target Market of ACCO Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.