ACCO Brands Bundle

Can ACCO Brands Thrive in Today's Cutthroat Market?

From its humble beginnings in the late 19th century, ACCO Brands has become a global force in office and school supplies. But how does this industry veteran stack up against its rivals in the ACCO Brands SWOT Analysis? With recent financial results showing a decline, a deep dive into the ACCO Brands competitive landscape is more crucial than ever.

This analysis will dissect the ACCO Brands competitive landscape, examining its ACCO Brands competitors and the ACCO Brands market analysis to understand its current standing. We'll explore the ACCO Brands industry dynamics, including ACCO Brands financial performance and the company's ACCO Brands business strategy, to assess its ability to adapt and succeed. By understanding the ACCO Brands competitive advantages and disadvantages, we can gain insight into its future prospects.

Where Does ACCO Brands’ Stand in the Current Market?

ACCO Brands operates primarily in the office and school supplies sector, offering a wide range of products. The company's core business revolves around three main categories: Business Essentials, Learning & Creative Products, and Technology Accessories. These product lines cater to diverse consumer needs, from office organization to educational and creative endeavors. ACCO Brands' business strategy focuses on maintaining a strong market presence and adapting to evolving consumer demands.

The value proposition of ACCO Brands lies in its extensive product portfolio and established brand recognition. The company provides essential supplies for businesses, educational institutions, and individual consumers. ACCO Brands aims to deliver high-quality products that meet the needs of a broad customer base. The company's commitment to innovation and adapting to market trends helps it maintain a competitive edge in the ACCO Brands competitive landscape.

ACCO Brands holds a significant market share in the Office Stationery Manufacturing, Art & Office Supply Manufacturing, and Office Supply Stores industries within the US. A detailed ACCO Brands market analysis reveals that the company's largest market share is in the Art & Office Supply Manufacturing industry, where it accounts for approximately 12.9% of total industry revenue. This strong market position is a key indicator of its success.

ACCO Brands has a strong presence in the Office Stationery Manufacturing, Art & Office Supply Manufacturing, and Office Supply Stores industries. Its market share in Art & Office Supply Manufacturing is particularly notable, at approximately 12.9%. Understanding the market share is important for evaluating ACCO Brands' competitive positioning.

ACCO Brands' product portfolio includes Business Essentials, Learning & Creative Products, and Technology Accessories. These segments contributed to 52%, 29%, and 19% of net sales in 2024, respectively. The diverse product range helps the company cater to various consumer needs and market segments.

ACCO Brands operates globally, with products sold in over 100 countries. North America accounts for 65% of revenue, followed by Europe at 28%, and Asia-Pacific at 7%. The geographic diversification helps mitigate risks and tap into diverse markets. The company's international presence is a key aspect of its business strategy.

In 2024, ACCO Brands reported net sales of $1.67 billion, a 9.1% decrease from 2023. The company also reported a net loss of $101.6 million, primarily due to non-cash impairment charges. Despite the challenges, the Return on Equity (ROE) of 3.37% in late 2024 indicates strong financial management. For more details, you can check out Owners & Shareholders of ACCO Brands.

ACCO Brands' financial performance in 2024 reflects both strengths and weaknesses. The company's net sales decreased, but its ROE remained strong, indicating efficient use of shareholder equity. The consolidated leverage ratio was 3.4x at the end of 2024, below its covenant limit of 4.0x.

- Net Sales: $1.67 billion in 2024

- Net Loss: $101.6 million in 2024

- ROE: 3.37% in late 2024

- Leverage Ratio: 3.4x at the end of 2024

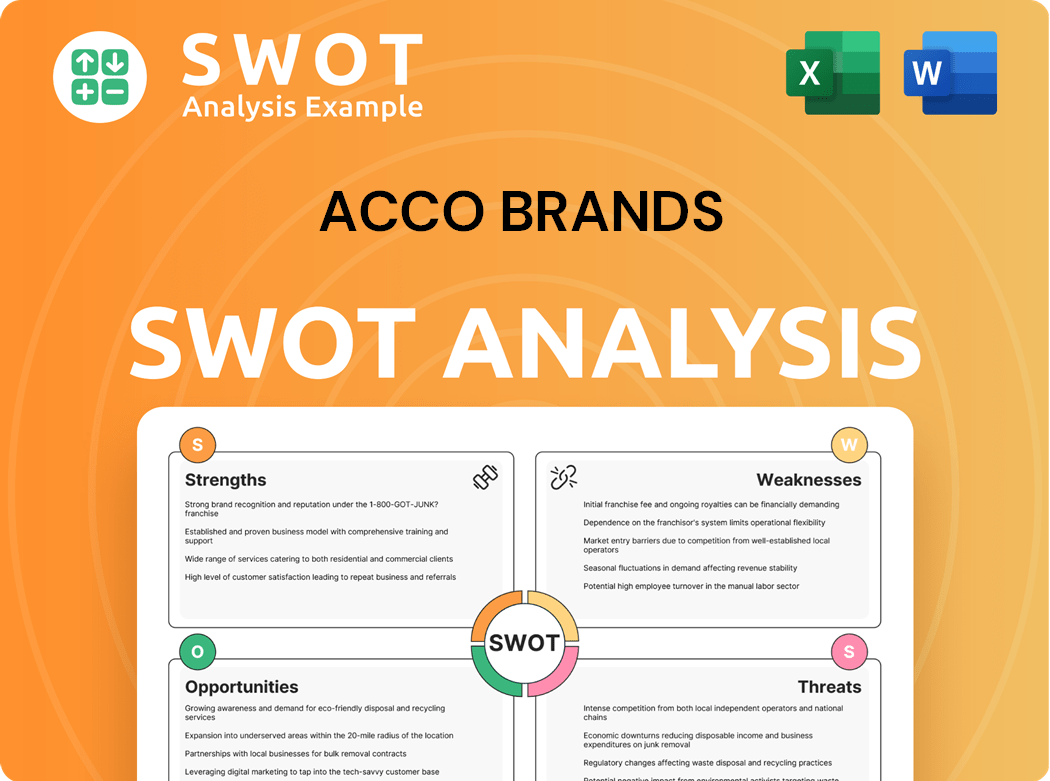

ACCO Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging ACCO Brands?

The ACCO Brands competitive landscape is characterized by a diverse array of rivals, spanning from large corporations to smaller, specialized businesses. These competitors vie for market share through various strategies, including pricing, product innovation, and distribution network optimization. Understanding the competitive dynamics is crucial for assessing ACCO Brands' market analysis and overall financial performance.

The company faces challenges from both established players and emerging competitors in the office supplies and related industries. The competitive environment necessitates continuous adaptation and strategic initiatives to maintain a strong market position. A deeper dive into ACCO Brands' business strategy reveals how it navigates this complex landscape.

Several key players directly compete with ACCO Brands, impacting its market share analysis. These competitors employ different approaches to attract and retain customers, influencing the overall dynamics of the office supplies market. The following sections will explore some of the major rivals and their strategies.

Staples Inc. is a major competitor, offering a wide range of office supplies and services. They compete with ACCO Brands on product offerings, pricing, and distribution capabilities. Staples' extensive retail presence and online platform make it a significant player in the ACCO Brands industry.

The ODP Corporation, formerly known as Office Depot, is another key competitor. ODP competes with ACCO Brands by providing a broad selection of office products, including private-label brands. Their focus on both retail and business services creates a multifaceted competitive environment.

Newell Brands competes with ACCO Brands in certain product categories, such as writing instruments and organizational tools. Newell's diverse portfolio of brands and strong distribution networks pose a competitive challenge. Their focus on innovation and brand recognition is a key aspect of their strategy.

Other competitors include Interface, MSA Safety, Exacompta Clairefontaine, Smead Manufacturing, LSC Communications, CCL Industries, Spiral Binding, Fellowes Brands, Corsair, and Targus. These companies compete with ACCO Brands in various segments of the office supplies and related industries.

ACCO Brands faces competition from private-label brands, which can impact its market share in certain categories. These brands often offer lower prices, putting pressure on ACCO Brands' pricing strategies. This competitive pressure requires ACCO Brands to focus on product differentiation and brand value.

The office supplies market is dynamic, with new players and evolving market conditions. Mergers and alliances within the industry also impact the competitive landscape. The overall market is expected to grow at a CAGR of 2.1% from 2023 to 2030, indicating continued competition.

To better understand the competitive dynamics, it's important to consider ACCO Brands' competitive advantages and disadvantages. For more insights into ACCO Brands' strategies, you can read about the Marketing Strategy of ACCO Brands. This analysis provides a comprehensive overview of the company's approach to the market and its key initiatives.

The competitive landscape is shaped by various factors, including pricing, innovation, brand recognition, distribution, and technological advancements. ACCO Brands must continually adapt to these factors to maintain its competitive position.

- Pricing Strategies: Competitors use various pricing models to attract customers.

- Product Innovation: Continuous innovation in product offerings is crucial for staying competitive.

- Brand Recognition: Strong brand recognition helps build customer loyalty.

- Distribution Networks: Efficient distribution networks ensure product availability.

- Technological Advancements: Embracing technology can enhance product offerings and operational efficiency.

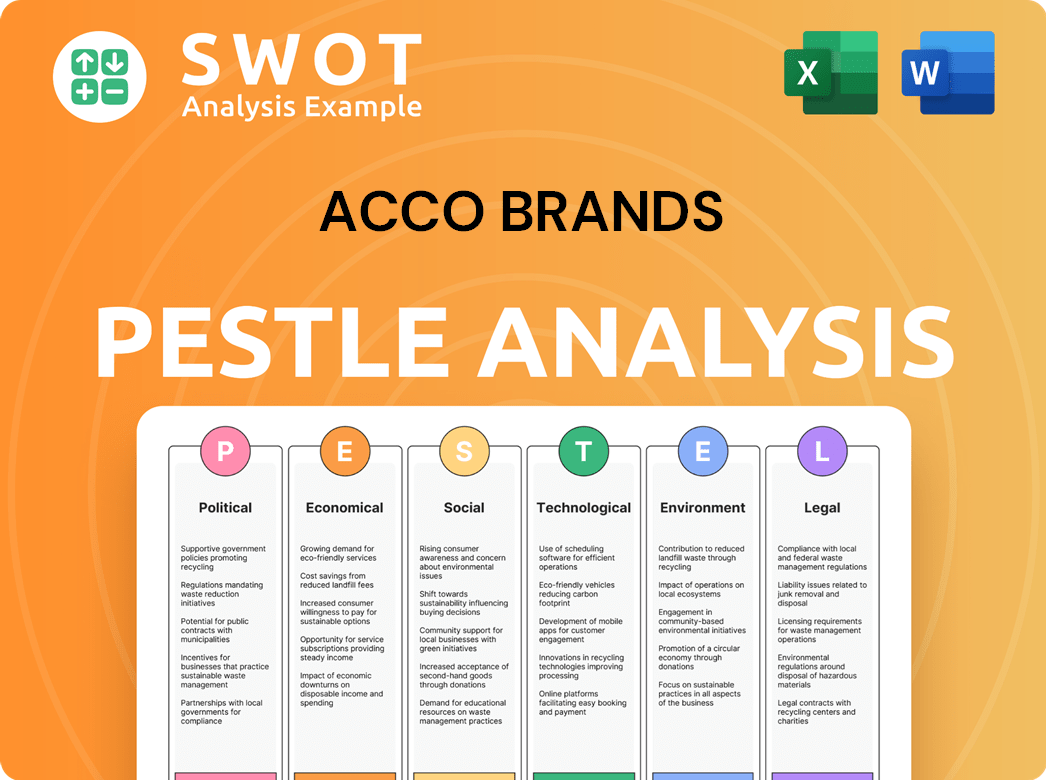

ACCO Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives ACCO Brands a Competitive Edge Over Its Rivals?

Understanding the ACCO Brands competitive landscape involves recognizing its key strengths. The company's success is underpinned by a strategic focus on cost management and a diverse portfolio of well-known brands. This approach, coupled with a robust distribution network, positions it favorably within the ACCO Brands industry.

ACCO Brands' business strategy emphasizes both brand strength and operational efficiency. The company's ability to navigate market dynamics is crucial for maintaining its competitive edge. Through strategic initiatives, such as cost reduction programs, ACCO aims to strengthen its financial performance and overall market position.

A deep dive into ACCO Brands market analysis reveals a company that is actively managing its resources to improve its competitive standing. The company's focus on cost savings and gross margin improvements are key factors in its strategy to enhance profitability and maintain its market share.

ACCO Brands benefits from a strong portfolio of brands, including AT-A-GLANCE, Five Star, Kensington, and Swingline. These brands have established customer loyalty. This diverse portfolio allows ACCO to cater to a wide range of customer needs.

ACCO Brands leverages a robust multi-channel distribution network. This network encompasses e-commerce platforms, retail stores, and wholesale channels. This extensive reach allows ACCO to access a broad customer base across different regions.

The company is actively implementing cost reduction initiatives. ACCO realized approximately $25 million in cost savings during 2024. The goal is to achieve a total of $100 million in annualized savings by the end of 2026.

Strategic management of the supplier base is another key advantage. This allows ACCO to respond quickly to trade dynamics. It potentially mitigates the impact of tariffs.

ACCO Brands' competitive advantages include a strong brand portfolio, a broad distribution network, and cost-saving initiatives. These factors contribute to its resilience in the market. The company's strategic focus on operational efficiency and brand strength supports its long-term growth.

- Diverse Brand Portfolio: A wide range of well-known brands caters to diverse customer preferences.

- Multi-Channel Distribution: Extensive reach through e-commerce, retail, and wholesale channels.

- Cost Management: Ongoing initiatives to reduce costs and improve financial performance.

- Strategic Supplier Management: Enables quick responses to changing market conditions.

ACCO Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping ACCO Brands’s Competitive Landscape?

The office and school supplies industry, where ACCO Brands operates, is undergoing significant shifts. Understanding the ACCO Brands competitive landscape requires an awareness of these changes, including the impact of technology and evolving consumer preferences. The ACCO Brands industry faces both challenges and opportunities, necessitating strategic adaptation for sustained success. This analysis will provide a detailed view of the industry trends, future challenges, and potential opportunities for the company.

The ACCO Brands market analysis reveals that the company must navigate economic uncertainties and changing consumer demands. To maintain its competitive position, ACCO Brands needs to focus on innovation, cost management, and strategic expansion. The future outlook hinges on the ability to capitalize on emerging trends and mitigate risks effectively. To understand the target audience, you can review the Target Market of ACCO Brands.

Technological advancements and digitalization are reshaping the demand for traditional office supplies. Hybrid work models and digital tools are influencing the market. The rise of sustainable products is also a significant trend, with consumers increasingly seeking eco-friendly options. The global green office supplies market is projected to grow.

Economic uncertainty, inflation, and foreign exchange fluctuations pose ongoing challenges. Stabilizing sales declines in core product categories is a key concern. Potential tariffs and geopolitical risks add to the complexity. Adapting to changing consumer behavior and preferences is crucial.

New product development and expansion into adjacent categories offer growth potential. Emerging markets, particularly in Asia-Pacific and Latin America, present significant opportunities. Strategic acquisitions can drive growth and expand market reach. Cost reduction programs and strong cash flow support financial flexibility.

The company focuses on new product development and expanding distribution channels. It pursues accretive acquisitions in adjacent categories. Efforts are made to capitalize on opportunities in emerging markets. Cost reduction programs and strong cash flow generation are leveraged to strengthen the balance sheet.

ACCO Brands must navigate a complex landscape marked by both challenges and opportunities. The company's financial performance will depend on its ability to adapt to market trends and manage costs. Strategic initiatives, including new product development and market expansion, are critical for future success. The company's ability to adapt its product portfolio, manage costs effectively, and capitalize on opportunities in growing segments and emerging markets will be crucial for its competitive positioning and resilience in the future.

- ACCO Brands competitive advantages and disadvantages include its established brand portfolio and global presence, offset by the challenges of declining demand in traditional product categories.

- ACCO Brands growth strategies involve new product development, expanding into new distribution channels, and pursuing strategic acquisitions.

- ACCO Brands challenges and opportunities encompass adapting to digital trends, managing economic uncertainties, and capitalizing on growth in emerging markets.

- The company’s ability to innovate and adapt to evolving market dynamics will be critical for long-term success.

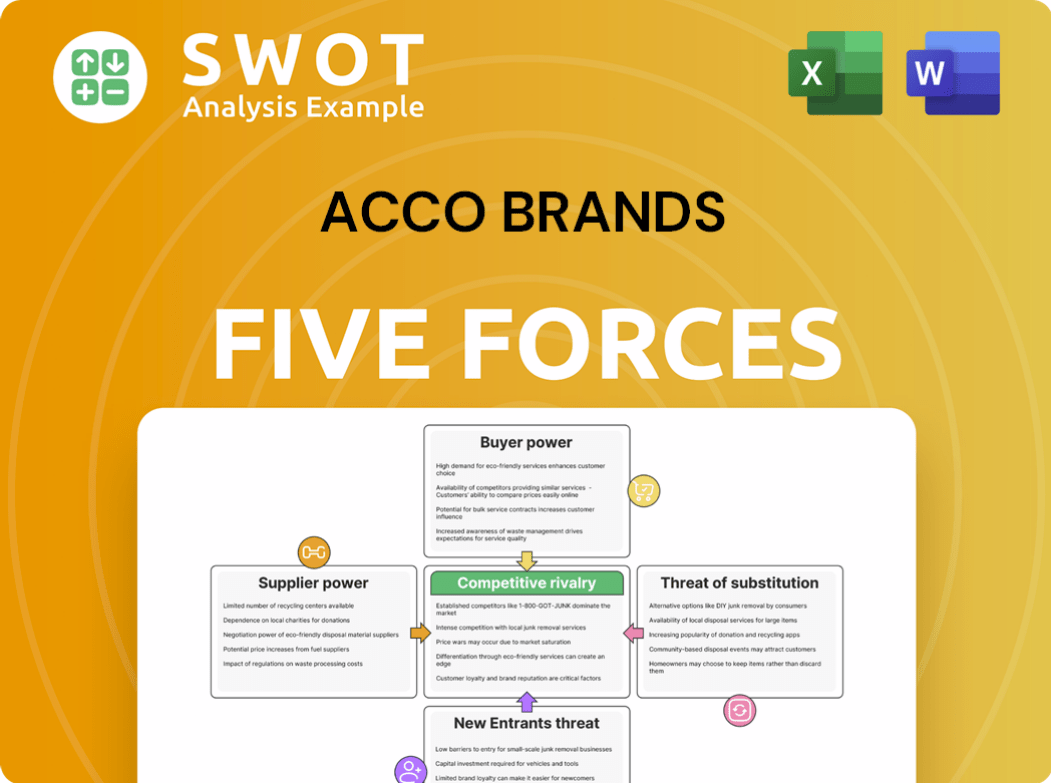

ACCO Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACCO Brands Company?

- What is Growth Strategy and Future Prospects of ACCO Brands Company?

- How Does ACCO Brands Company Work?

- What is Sales and Marketing Strategy of ACCO Brands Company?

- What is Brief History of ACCO Brands Company?

- Who Owns ACCO Brands Company?

- What is Customer Demographics and Target Market of ACCO Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.