ACCO Brands Bundle

Can ACCO Brands Continue to Thrive in a Changing World?

From humble beginnings with a simple paper clip, ACCO Brands SWOT Analysis has evolved into a global powerhouse in consumer, school, and office products. Its story is one of innovation, strategic acquisitions, and adaptation to market demands. But what does the future hold for this established company in an era of digital transformation and evolving work environments?

This article delves into the ACCO Brands Company's growth strategy, examining its future prospects within the office supplies market and beyond. We'll explore the company's business model, analyze its financial performance, and assess the impact of remote work on its sales. Furthermore, we'll investigate ACCO Brands' strategic acquisitions and partnerships, providing a comprehensive market analysis to understand its competitive landscape and long-term investment potential, including its financial outlook and potential challenges and opportunities.

How Is ACCO Brands Expanding Its Reach?

The ACCO Brands Growth Strategy centers on several key expansion initiatives designed to fuel future growth. These include a focus on improving sales trends through new product development, strategic acquisitions, and enhanced brand building. The company also aims to enter new distribution channels and expand its product offerings into adjacent categories, demonstrating a proactive approach to market diversification.

Despite overall sales declines in 2024 and expected declines in 2025, the company has experienced growth in its technology accessories business. This growth is driven by increased demand, the introduction of new products, and geographic expansion. This highlights a strategic emphasis on this growing market segment, suggesting a shift towards areas with higher growth potential.

The company's approach includes targeted acquisitions to enhance its portfolio. For instance, in the first quarter of 2025, a small, strategic acquisition was completed in the ergonomics sector in Australia and New Zealand. This move demonstrates a commitment to expanding its presence in specific, high-growth areas through strategic investments. For a deeper understanding of the company's marketing approach, consider exploring the Marketing Strategy of ACCO Brands.

ACCO Brands is actively investing in new product development to meet evolving consumer needs and market trends. This includes innovations in existing product lines and expansion into new categories. The company aims to introduce products that align with current market demands, thereby driving sales and market share growth.

Strategic acquisitions play a crucial role in the ACCO Brands Growth Strategy. The company is focused on acquiring businesses that complement its existing portfolio and provide access to new markets or technologies. These acquisitions are intended to drive revenue growth and enhance the company's competitive position.

International expansion remains a key component of ACCO Brands' strategy. The company has a long-standing international presence, selling products in over 100 countries. This global footprint provides opportunities for further growth and market penetration.

ACCO Brands is implementing a multi-year cost reduction program to optimize its operational structure. This includes reducing the number of global locations and streamlining the supply chain. These efforts are designed to improve efficiency and provide a scalable structure for both organic and inorganic growth.

The company's expansion initiatives are multifaceted, focusing on both organic and inorganic growth strategies. These initiatives are designed to address challenges and capitalize on opportunities within the evolving market landscape.

- New Product Launches: Continuous introduction of innovative products to meet changing consumer demands.

- Strategic Acquisitions: Targeted acquisitions to expand the product portfolio and enter new markets.

- Geographic Expansion: Strengthening presence in existing international markets and exploring new regions.

- Operational Efficiency: Streamlining operations and reducing costs to improve profitability.

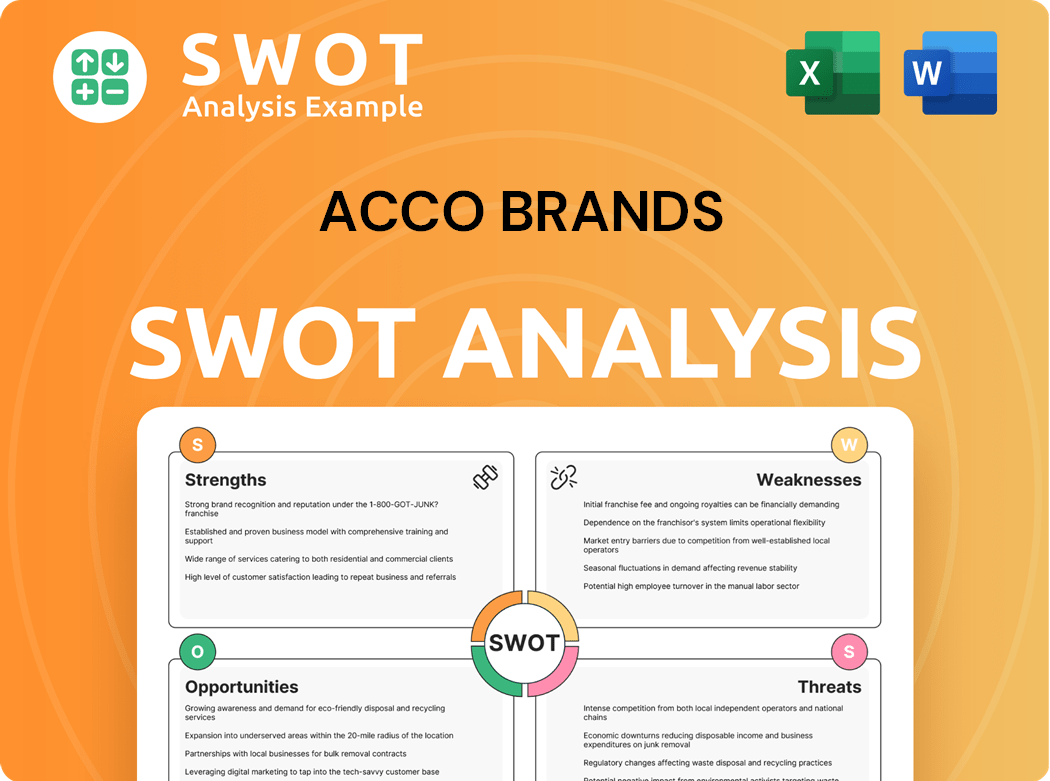

ACCO Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ACCO Brands Invest in Innovation?

The innovation and technology strategy of the ACCO Brands Company is a key driver for its sustained growth. The company focuses on developing new product solutions that meet the evolving needs of consumers in how they work, learn, and play. This emphasis on innovation is evident in their product launches, especially within the technology accessories segment, which has shown growth.

A core part of their strategy involves improving innovation and new product development processes. They are also extending product offerings into adjacent categories to expand their market reach. This approach is supported by significant investments in technology and operational efficiency, which are crucial for staying competitive in the market.

The ACCO Brands Company is undergoing a multi-year restructuring and cost-saving program. This includes streamlining operations, consolidating the supply chain, and reducing its global footprint. These actions, along with investments in automation, aim to create a leaner and more efficient organization. The company's focus on new product development and technology accessories suggests continued investment in these areas. For a deeper understanding of the company's structure, you can explore Owners & Shareholders of ACCO Brands.

The company focuses on creating new product solutions that meet the evolving needs of consumers. This includes product launches in the technology accessories segment. The goal is to stay relevant and competitive in the market.

The company is implementing a multi-year restructuring program. This includes streamlining operations and consolidating the supply chain. Investments in automation are also being made to improve efficiency.

The company has ESG goals, including improving energy efficiency. They are also increasing the percentage of revenue from products certified to environmental and social standards. This indicates an integration of sustainability into their strategy.

The technology accessories segment has shown growth due to innovation. This suggests the company's investment in this area is paying off. This sector is a key area for future growth.

The restructuring program aims to create a leaner organization. This involves streamlining operations and reducing the global footprint. These efforts are crucial for improving financial performance.

The company is extending its product offerings into adjacent categories. This strategy helps to broaden its market reach. This approach is a key part of the growth strategy.

The ACCO Brands Growth Strategy is centered on several key priorities. These include innovation, operational efficiency, and sustainability. These are critical for the company's future prospects.

- Improving innovation and new product development processes.

- Extending product offerings into adjacent categories.

- Streamlining operations and consolidating the supply chain.

- Reducing the global footprint to create a leaner organization.

- Investing in automation to improve efficiency.

- Enhancing energy efficiency of facilities.

- Increasing revenue from environmentally certified products.

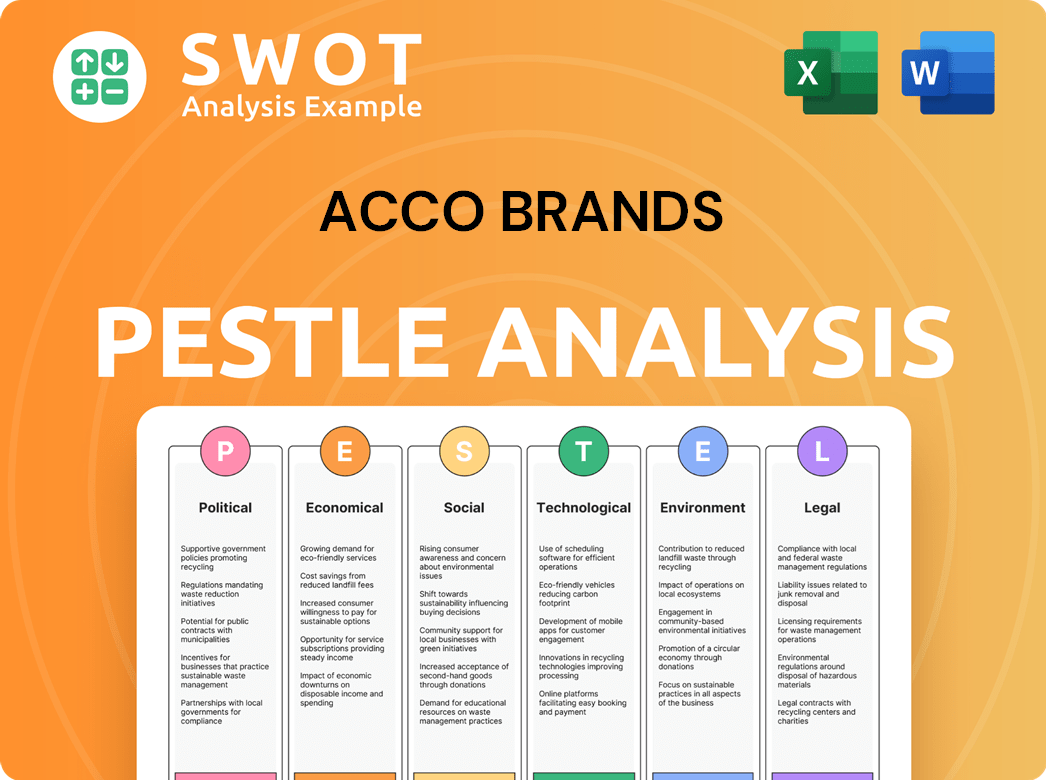

ACCO Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ACCO Brands’s Growth Forecast?

The financial outlook for ACCO Brands in 2025 indicates a strategic focus on navigating market challenges. The company anticipates a decline in comparable sales, projecting a decrease between 1.0% and 5.0% for the full year. This projection reflects the current economic environment and its impact on the office and consumer products sectors. Understanding the Brief History of ACCO Brands can provide context for its current market position.

Despite the anticipated sales decrease, ACCO Brands is prioritizing profitability through cost-saving measures. The company aims to mitigate the impact of reduced sales by implementing strategies to improve operational efficiency. These efforts are designed to maintain financial stability and support long-term growth initiatives.

The company's financial strategy also emphasizes strengthening the balance sheet and managing debt. ACCO Brands is committed to reducing its debt levels, which is expected to enhance its financial flexibility and support investments in future growth.

For 2025, ACCO Brands projects comparable sales to decrease between 1.0% and 5.0%. The adjusted EPS is expected to be in the range of $1.00 to $1.05, reflecting the company's efforts to manage profitability despite sales challenges. These projections are crucial for understanding the ACCO Brands Market Analysis.

ACCO Brands is implementing a multi-year cost-saving program. In 2024, the company achieved approximately $25 million in cost savings. The program targets a cumulative $100 million in savings by the end of 2026, which is a key component of its ACCO Brands Growth Strategy.

In 2024, ACCO Brands reduced its net debt by $94 million, resulting in a consolidated leverage ratio of 3.4x. The company's focus on debt reduction is part of its strategy to improve its financial health and flexibility. This is a key element of the ACCO Brands Financial Performance.

ACCO Brands anticipates free cash flow to be between $105 million and $115 million in 2025. This cash flow will support continued debt repayment and investments in the business. This is a critical aspect of the ACCO Brands Future Prospects.

The financial outlook for ACCO Brands is centered on managing sales declines while improving profitability and financial health. Key metrics include projected sales decreases, adjusted earnings per share, and free cash flow targets.

- Comparable Sales: Down 1.0% to 5.0% (2025)

- Adjusted EPS: $1.00 to $1.05 (2025)

- Free Cash Flow: $105 million to $115 million (2025)

- Net Debt Reduction: $94 million (2024)

ACCO Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ACCO Brands’s Growth?

The path forward for the ACCO Brands Company is not without its hurdles. Several factors could potentially impede the company's ability to achieve its growth targets, affecting its ACCO Brands Future Prospects. These challenges range from macroeconomic pressures to internal operational issues, requiring careful navigation and strategic planning.

One of the most significant challenges facing ACCO Brands Growth Strategy is the prevailing softness in global demand. This issue, combined with intense competition, particularly in the office products sector, puts pressure on profit margins. The company must also contend with uncertainties related to tariffs and supply chain adjustments, especially concerning operations in China.

Macroeconomic conditions, such as high interest rates and inflation, especially in the U.S. (its primary market), could further dampen consumer and business spending. Furthermore, exchange rate fluctuations pose a risk to reported sales and margins. Internal operational risks, including the execution of cost-saving programs, supply chain disruptions, and reliance on significant customers, also present challenges.

Weak consumer and business spending globally can significantly impact sales across many categories. This can lead to a decline in net sales, as seen in recent financial reports. The fluctuating global demand requires the company to adapt quickly to changing market conditions.

Intense competition, mainly in the office products sector, can squeeze profit margins. Competitors constantly introduce new products and pricing strategies, requiring ACCO Brands Company to innovate and maintain a competitive edge. The competitive landscape is dynamic, demanding continuous adaptation.

Ongoing tariff uncertainties can affect cost structures and pricing strategies. Changes in trade policies and tariffs can increase the cost of goods sold and impact profitability. The company needs to monitor trade regulations and adjust its strategies accordingly.

Shifting supply chains out of China presents logistical challenges. This includes finding new suppliers, managing transportation, and ensuring timely delivery of goods. The complexity of supply chains requires careful planning and execution.

Sustained high interest rates and inflation can influence consumer and business spending. These factors can reduce demand for products and services. The company must be prepared for economic fluctuations and their effects on sales.

Fluctuations in foreign currency exchange rates can negatively impact reported sales and margins. The company must manage its currency exposure to mitigate these risks. This involves hedging strategies and careful financial planning.

Failure to implement the multi-year restructuring and cost savings program could adversely affect future results. Effective execution of these programs is critical for improving profitability and operational efficiency. Delays or failures can undermine financial goals.

Disruptions in the supply chain, including changes in the cost or availability of raw materials and labor, pose operational challenges. These disruptions can increase production costs and delay product delivery. The company needs robust supply chain management.

The company's reliance on a limited number of large customers presents a risk. Loss of a major customer can significantly impact sales and revenue. Diversifying the customer base is essential for mitigating this risk.

The potential for technological disruption to render some products obsolete is a risk. Rapid technological advancements can make existing products less relevant. Continuous innovation and adaptation are crucial for staying competitive.

For a deeper dive into the business model and revenue streams, consider reading about the Revenue Streams & Business Model of ACCO Brands.

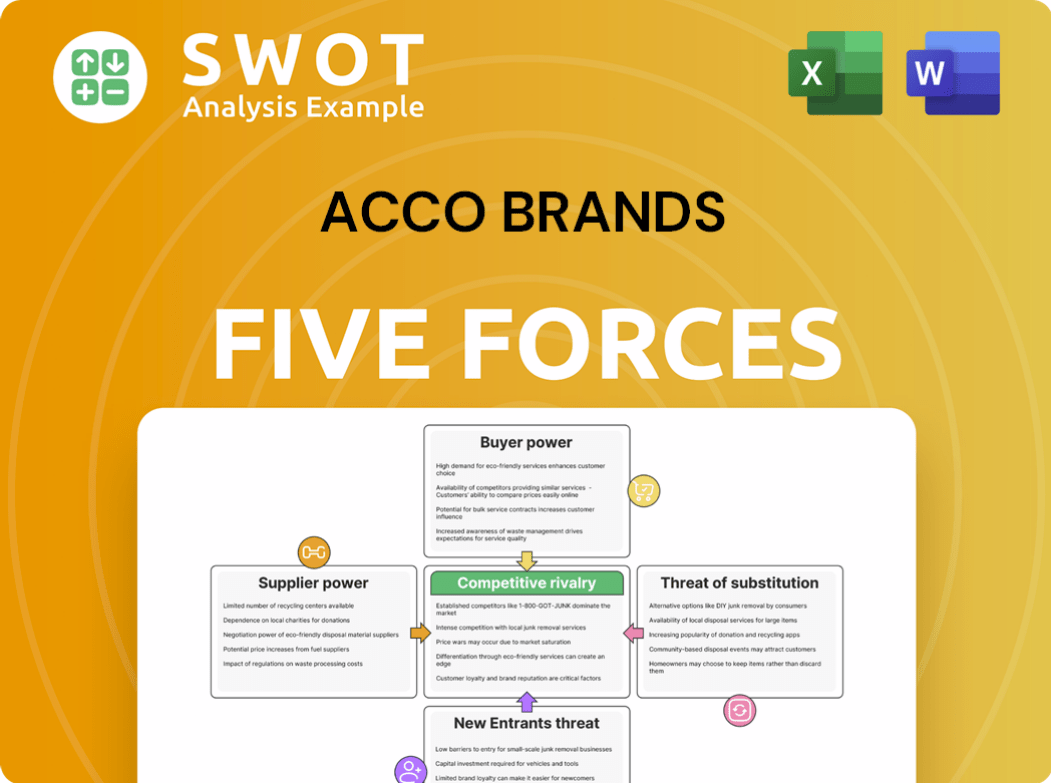

ACCO Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ACCO Brands Company?

- What is Competitive Landscape of ACCO Brands Company?

- How Does ACCO Brands Company Work?

- What is Sales and Marketing Strategy of ACCO Brands Company?

- What is Brief History of ACCO Brands Company?

- Who Owns ACCO Brands Company?

- What is Customer Demographics and Target Market of ACCO Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.